The World in 2050 report from PricewaterhouseCoopers sets out their latest long-term global growth projections to 2050 for 32 of the largest economies in the world who account for around 85% of world GDP. Key results include:

- The world economy could more than double in size by 2050, far outstripping population growth, due to continued technology-driven productivity improvements

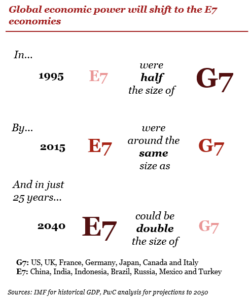

- Emerging markets (E7) could grow around twice as fast as advanced economies (G7) on average

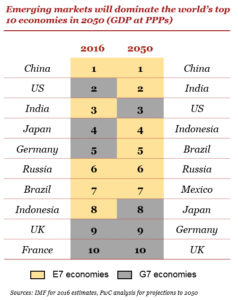

- As a result, six of the seven largest economies in the world are projected to be emerging economies in 2050 led by China (1st), India (2nd) and Indonesia (4th)

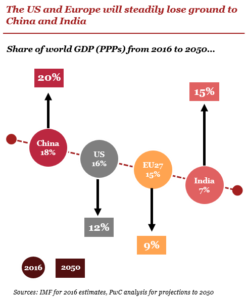

- The US could be down to third place in the global GDP rankings while the EU27’s share of world GDP could fall below 10% by 2050

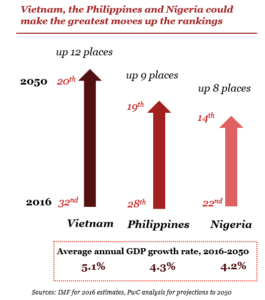

- UK could be down to 10th place by 2050, France out of the top 10 and Italy out of the top 20 as they are overtaken by faster growing emerging economies like Mexico, Turkey and Vietnam respectively

- But emerging economies need to enhance their institutions and their infrastructure significantly if they are to realise their long-term growth potential.

The report also considers opportunities for business:

- As emerging markets mature, they will become less attractive as low cost manufacturing bases but more attractive as consumer and business-to-business (B2B) markets

- But international companies need strategies that are flexible enough to adapt to local customer preferences and rapidly evolving local market dynamics

- Since emerging markets can be volatile, international investors also need to be patient enough to ride out the short-term economic and political cycles in these countries

To read the whole report, The World in 2050, go to the website of PWC.

Similar Posts:

- BlackRock’s Swann: Look at the China Slowdown in a Long Term Context (FE Trustnet)

- Asia is Home to 50% of World’s Fastest Growing Companies (Nikkei Asian Review)

- Economic Prospects in Several Emerging Asia Countries (Wells Fargo Securities)

- Global Emerging Markets: Country Allocation Review 2021 (Federated Hermes)

- “Fragile Five” Emerging Markets No Longer That “Fragile” (AP)

- Key Findings: Credit Suisse Emerging Markets Consumer Survey

- Which Emerging Markets Have the Most Leveraged Stocks? (Bloomberg)

- 2017 Global Retail Development Index (ATKearney)

- Global Emerging Markets: Country Allocation Review, H1 2021 (Federated Hermes)

- Invest in Poorer Performing Emerging Markets for Better Gains? (CNBC)

- Emerging Market Stocks Advance on Reform Themes & Central Bank Expectations (Bloomberg)

- China and India to Overtake U.S. Economy This Century (Bloomberg)

- YPO CEO Survey: Asia CEO Confidence at 2-year Low (YPO)

- The Spoils of Trade War: Asia’s Winners and Losers in US-China Clash (SCMP)

- Experts: Tread Carefully With Emerging Market Investments (FE Trustnet)