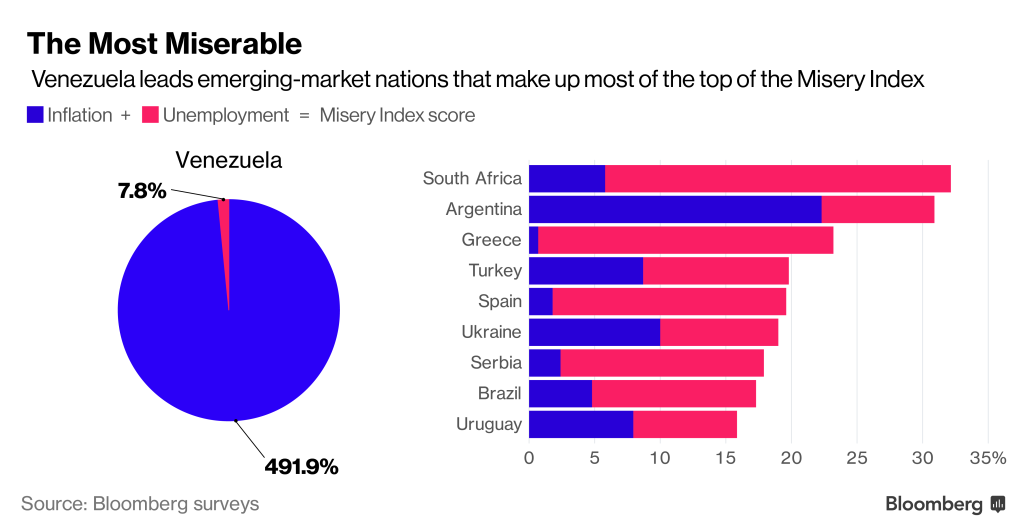

Bloomberg’s Misery Index, which combines countries’ 2017 inflation and unemployment outlooks, ranks Venezuela number one for the third year in a row followed by a number of usual and mostly emerging market suspects: South Africa, Argentina, Greece, Turkey, Spain, the Ukraine, Serbia, Brazil and Uruguay.

Other noteworthy emerging market moves toward being more miserable included:

- Poland, which experienced the biggest negative move in the rankings, came in at No. 28 among this year’s 65 economies, from a rank of 45 last year. Though it’s seen a steady decline in its unemployment rate since the financial crisis, inflation rose to 1.8% in January after Poland’s longest period of deflation on record. Similar price increases were seen in Romania, Estonia, Latvia and Slovakia which drove large jumps in those countries’ Misery Index rankings.

- Misery also deepened in Mexico. After finishing 2016 at No. 38, it’s slated to rise to 31st place as inflation balloons to a forecast of 5% in 2017 from an average 2.8% last year. A combination of the end of government fuel subsidies and the peso’s 11% decline against the dollar since Trump’s election is pressuring prices.

To read the whole article, These Economies Are Getting More Miserable This Year, go to the website of Bloomberg.

Similar Posts:

- The 15 Most Miserable Emerging Market Economies (Bloomberg)

- Bloomberg’s Misery Index’s Least Miserable Emerging Markets

- New Fragile Five Facing a Forex Crisis: Argentina, Brazil, South Africa, Ukraine & Venezuela (Institutional Investor)

- 2017 Global Retail Development Index (ATKearney)

- Which Emerging Markets Have the Most Leveraged Stocks? (Bloomberg)

- Invest in Poorer Performing Emerging Markets for Better Gains? (CNBC)

- How ECB QE Could Impact Emerging Markets (FT)

- Key Findings: Credit Suisse Emerging Markets Consumer Survey

- Turkey: Looming Challenges (Union Bancaire Privée)

- Global Emerging Markets: Country Allocation Review, H1 2021 (Federated Hermes)

- Emerging Market Risk Ranking: Most Vulnerable to the Strongest (FT)

- Quarterly Frontier Markets Recap 1Q21 (FitchRatings)

- “Fragile Five” Emerging Markets No Longer That “Fragile” (AP)

- S&W’s McGrath: Emerging Markets Are at the Perfect Entry Point (FE Trustnet)

- Emerging Market Companies & Governments Binge on US Dollar Debt (WSJ)