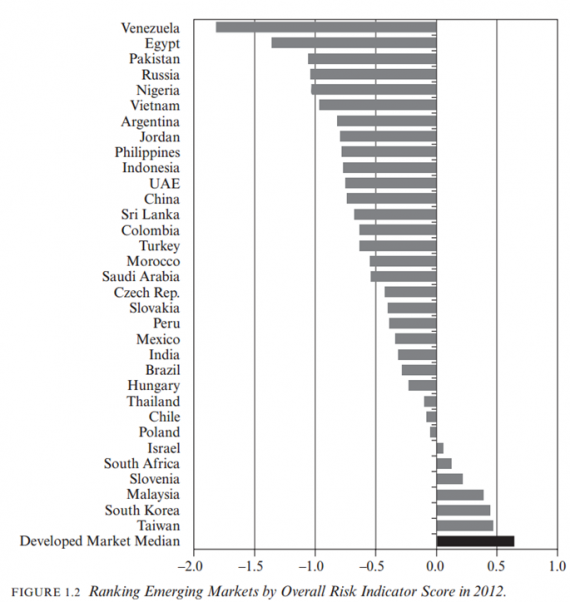

The beyondbrics blog notes that in the book “Cracking the Emerging Markets Enigma,” Andrew Karolyi, a professor of Emerging Market Finance at Cornell’s Johnson School, has come up with a matrix ranking 57 emerging markets and developed markets according to which is the most and least risky.

To come up with the emerging market risk ranking, each country is scored on over 70 variables spread out over 6 components. The components measure:

- Market capacity constraints e.g. capital markets (Taiwan comes out best, Venezuela is the worst)

- Operational inefficiencies e.g. trading systems (South Korea comes out best, Nigeria is the worst).

- Foreign accessibility restrictions e.g. foreign ownership limits, currency convertibility or repatriation etc (Poland comes out best, Pakistan is the worst).

- Corporate opacity e.g. the lack of disclosure requirements, the presence of voluntary reporting etc (South Korea comes out best, China is the worst).

- Limits to legal protections e.g. presence or absence of anti-director rights, anti-self dealing rules, judicial (in) efficiencies etc (Malaysia comes out best, Venezuela is the worst).

- Political instability e.g. lack of democratic institutions and regulatory burdens (Chile comes out best, Venezuela is the worst).

The results:

beyondbrics does point out some flaws in the analysis, namely the use of 2012 data to calculate the emerging market risk rankings and the fact that some of his components or variables are more concerns for long term investors while others might concern short term traders.

To read the whole blog post, Book review: Cracking The Emerging Markets Enigma, go to beyondbrics blog on the website of the Financial Times.

Similar Posts:

- Indices for Measuring Emerging Market Political Instability (Enterprising Investor)

- New Fragile Five Facing a Forex Crisis: Argentina, Brazil, South Africa, Ukraine & Venezuela (Institutional Investor)

- Emerging Market Companies & Governments Binge on US Dollar Debt (WSJ)

- The “Next Eleven” and the World Economy (The Asset)

- Hungary, Poland, Mexico and South Korea Poised to Handle a Pull Back in US Monetary Stimulus (WealthManagement.com)

- S&W’s McGrath: Emerging Markets Are at the Perfect Entry Point (FE Trustnet)

- Investors in Emerging Market ETFs Should ‘Look Under the Hood’ (Reuters Video)

- Bloomberg’s Misery Index’s Least Miserable Emerging Markets

- Asia at a Crossroads: Demographics, Economics & Investment (State Street)

- Which Emerging Markets Have the Most Leveraged Stocks? (Bloomberg)

- Fortune Magazine: Seven Emerging Markets to Invest in Now

- Escalating Tensions Have Not Unsettled Korean Markets (Moody’s)

- On Growth, Exports and Supply Chain Diversification: Making the Case for South Korean Equities (Franklin Templeton)

- Emerging Markets: Politics and Elections in 2021 (Wellington Management)

- Exchange Rate Predictability in Emerging Markets (Amundi AM)