A recent post on the CFA Institute’s Enterprising Investor blog talked in detail about a book, Cracking the Emerging Markets Enigma, by Cornell University professor Andrew Karolyi who created an emerging market risk index composed of six dimensions mostly related to market institutions:

- Market capacity constraints

- Operational inefficiencies

- Foreign investability restrictions

- The quality of legal protections for minority investors

- Corporate governance

- Disclosure issues

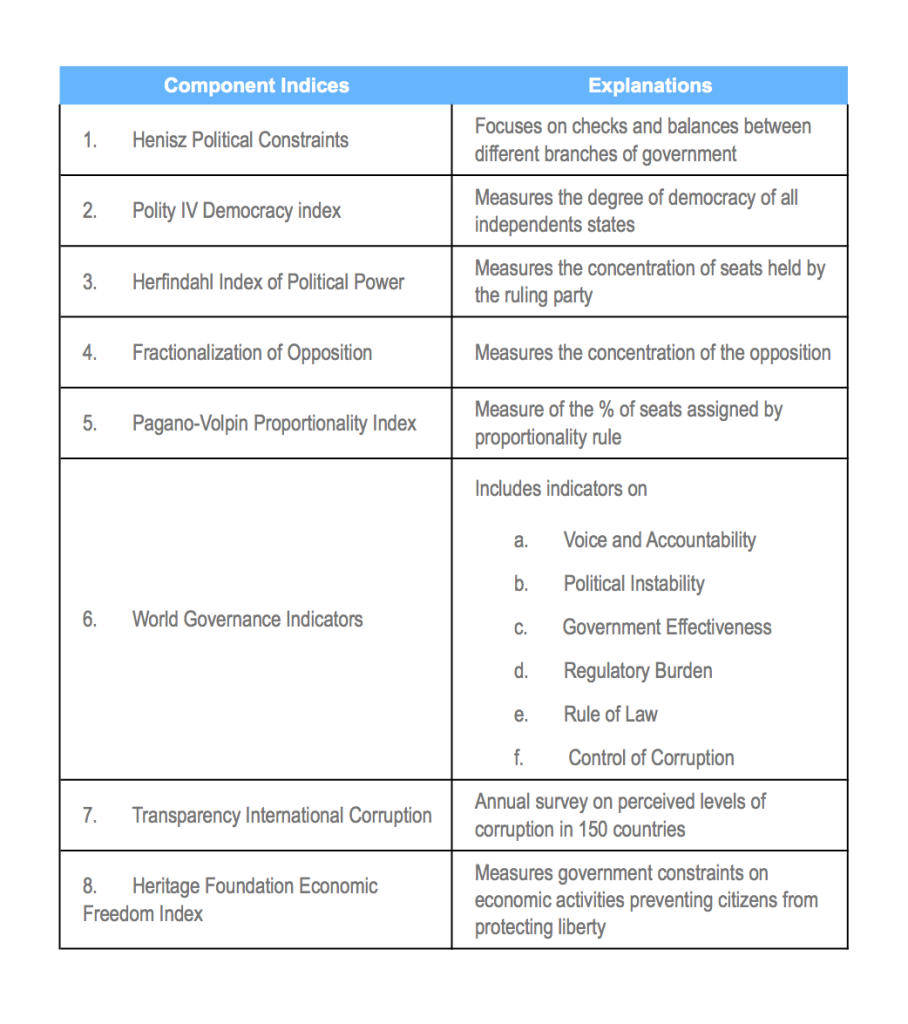

The following table details what contributes to political instability in Karolyi’s framework and the indices he uses to measure it:

Among Karolyi’s findings was that political instability has mattered both under “normal” stock market conditions over long periods of time and during crises. Moreover, those markets deemed less politically stable were underweighted more over the last decade and a higher percentage of capital exited them during the so-called taper tantrum.

To read the whole post, Where to Invest in Emerging Markets: Lessons from the Taper Tantrum, go to the Enterprising Investor blog on the website of the CFA Institute. In addition, Cracking the Emerging Markets Enigma is available from the Emerging Market Skeptic store.

Similar Posts:

- Emerging Market Risk Ranking: Most Vulnerable to the Strongest (FT)

- Frontier Markets: One of the Last low-Correlated Asset Classes? (Commerzbank)

- Seven Things to Consider Before Investing in Emerging Markets (AllianceBernstein)

- Unlike Emerging Markets, Frontier Markets Are a Less Volatile Haven (FT)

- Why Emerging Markets Are Back in Style for Investors (Breakout)

- Emerging Market Stocks Face Prospectus Scrutiny (Canadian Securities Law)

- The Link Between Soaring Food Prices and Political Instability (Statista)

- Lessons From When the USA was an Emerging Market (WSJ)

- Leave Emerging Markets to the Fund Manager Pros (Investors Chronicle)

- Argentina: Where Growth & Stock Market Returns Diverge (Mobius Blog)

- Election Results in Some Fragile Five Emerging Markets Calm Investors (Reuters)

- Are Peru’s Exports In Jeopardy As Social Unrest Worsens? (Zero Hedge)

- Busting Frontier Market Investing Myths (Mobius Blog)

- Emerging Markets: Where People Actually Use Google+ (GlobalWebIndex Blog)

- Are Investors Ignoring Growing Warning Signs for Emerging Market Debt? (RBA)