A recent lengthy article in Financial Advisor noted the growing popularity of the frontier markets asset class but also pointed out that two key aspects of the space (measured or categorized by the MSCI Frontier Market Index) are often overlooked or not properly understood by investors:

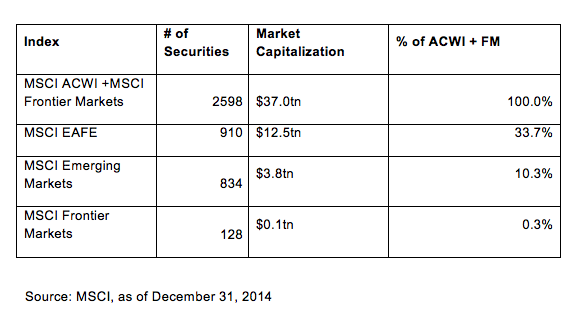

- The number of frontier market stocks is extremely limited, as is the amount of market capitalization available. In fact and while emerging markets make up more than 10% of the world’s stock markets, frontier market stocks make up just 0.3% or a mere 128 stocks with a median market cap of $424 million and just $100 billion in combined total market capitalization. On the other hand, the Russell 2000 Small Cap Index consists of 1,975 US securities with a total market cap of $1.8 trillion and a median market cap of $729 million at the end of last year.

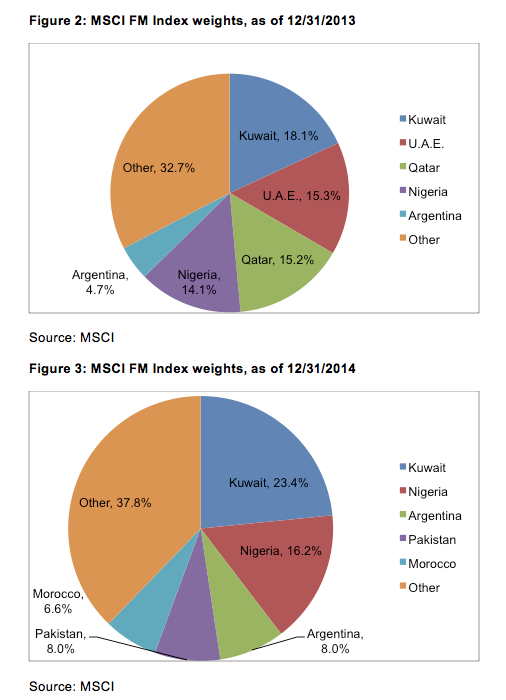

- The universe of assets has historically been very concentrated in a handful of countries. The recent migration of the United Arab Emirates and Qatar, two of the largest and best-performing countries (that are also oil dependent), out of the frontier markets category and into the emerging market group has exacerbated the concentration issue. Moreover, their removal changes the historical return patterns and liquidity characteristics of frontier markets to such an extent that there may now be a misleading picture of future prospects. Problems remain as the two largest countries have represented over one-third of the frontier markets index and the largest five countries have made up roughly two-thirds.

To read the whole article, Frontier Markets: Concentrated And Misunderstood, go to the website of Financial Advisor. In addition, see: Better Investing Strategy: Blend Emerging & Frontier Markets (Financial Advisor)

Similar Posts:

- How MSCI’s Removal of Qatar & UAE Impacts the Frontier Markets Landscape (MM)

- How the MSCI Emerging Markets Index Changes Will Impact Investors (P&I)

- Fund Managers’ Opinions on the UAE and Qatar’s Emerging Markets Upgrade (The National)

- Frontier Market ETFs Have 72% Exposure to Oil-Dependent Countries (FT Adviser)

- History Says Investors Get Gored by MSCI Upgrades (Reuters)

- The “Halo Effect” of Saudi Arabia’s Emerging Markets Arrival (Franklin Templeton)

- Better Investing Strategy: Blend Emerging & Frontier Markets (Financial Advisor)

- ING IM’s Ruijer: China and the Fed are the Biggest Risks to Frontier Markets (Citywire)

- What’s Next for Emerging Markets and the Dubai Stock Market? (Gulf Business)

- There is No Such Thing as a Typical Emerging Market (The Telegraph)

- Credit Suisse: Saudi Arabia and Qatar Set to Lose Big After UBS Deal (Middle East Eye)

- Investing Beyond the Storm: A View from the MENA Region (Franklin Templeton)

- MENA Market Outlook: Managing the Economic Fallout (Franklin Templeton)

- MENA Equities: Five Key Themes and Reasons for Optimism (Franklin Templeton)

- What’s Ahead for the MENA Region? (Franklin Templeton)