A recent Wall Street Journal’s Intelligent Investor blog post began by noting:

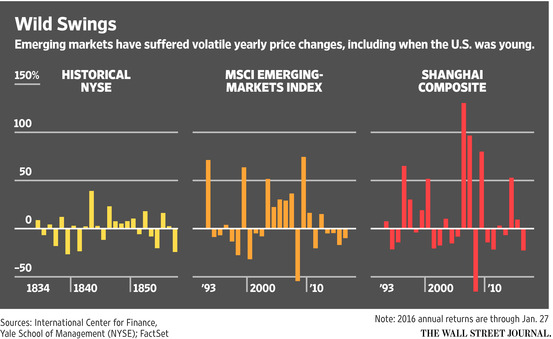

The government massively overinvested in transportation and land development. The banking system was inefficient and corrupt. State governments gorged on debt, then defaulted on it with aplomb. The stock market was crooked, rife with cronyism and insider trading. Stocks shot up and down like yo-yos.

The blog post is not referencing China, but the United States back in the 19th century when British investors learned some hard lessons about investing in emerging markets. A generation-long decline of UK bond yields from about 5.5% in 1816 to less than 3% in 1845, and again from roughly 4% in 1866 to 2% in 1897 had sent British investors looking for better returns in the much more risky US emerging market.

Stocks gained an average of 6.7% annually after inflation between 1802 and 1870, when the US was an emerging market, but they’ve returned 6.9% on that basis since 1926. 19th century returns might also be overstated by at least a percentage point annually given the difficulties of measuring the performance of the thousands of stocks that disappeared without a trace in those days.

With that in mind, the blog post noted some key takeaways from when the US was an emerging market would include:

- Emerging markets don’t offer higher returns merely because they are growing faster and they aren’t lucrative investments just because they are “emerging.” They deliver higher returns only after they have been battered, as China is being battered now.

- China’s evolution as an emerging market has thus far followed a similar path followed by the US in the 19th century.

To read the whole article, Market Crashes, Stock Scandals: Lessons From the U.S. Frontier, go to the website of the Wall Street Journal.

Similar Posts:

- Be Wary of the MSCI China Inclusion Hype (WSJ)

- Portfolio Money Flows Back Into the Philippines (WSJ)

- Infographic: Investors Shun Emerging Market Funds (WSJ)

- Lessons From a Decade of Chinese Stock Trading (WSJ)

- Emerging Market Bond Funds Continue to See Inflows (WSJ)

- Emerging Markets Are Now Samsung Electronics – Not Samsung Heavy Industries (WSJ)

- Indices for Measuring Emerging Market Political Instability (Enterprising Investor)

- Nigeria, Argentina and Vietnam Top the Frontier Markets Sentiment Index (WSJ)

- Emerging Market Private Equity Beats Listed Stocks (Asian Investor)

- Prudent Ways to Invest in Frontier Markets (WSJ)

- Oppenheimer’s Leverenz Blames “Radical Collapse” in FX Markets for Poor Performance (WSJ)

- Mark Mobius’s Favorite Emerging Markets: Indonesia, Russia, Brazil, Vietnam and South Africa (WSJ)

- Infographic: Emerging Market Bond Issuance is Up (WSJ)

- 3 Successful Frontier Market Investing Strategies (DraculaCapital.com)

- Mark Mobius’s Emerging Markets Outlook (WSJ)