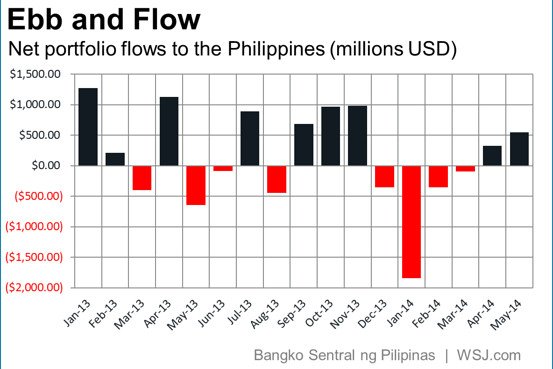

The Wall Street Journal’s Real Time Economics blog has posted the following chart showing how portfolio money is once again flowing into the Philippines as emerging markets come back into fashion:

As of earlier this week, the PSE Composite Index is up more than 5% since the end of March and 15% year-to-date. However and for the year, the Philippines has still seen a net outflow of $1.42 billion, according to their central bank.

To read the whole article, With Emerging Markets Back in Favor, Money Flows to the Philippines, go to the Real Time Economics blog on the website of the Wall Street Journal.

Similar Posts:

- The Philippines: More Two Steps Forward And One Step Back?

- Emerging Market Companies & Governments Binge on US Dollar Debt (WSJ)

- Why Emerging Markets Are Back in Style for Investors (Breakout)

- A Damaged Culture No More? Investing in the Philippines

- China is building an island on the disputed Mabini Reef (Timelapsed Pictures)

- Eat, Pray, Shop: Philippines Embraces Mall Worshiping (INQ)

- Ayala: Duterte’s China Pivot Transforms Philippines’ Oldest Conglomerate (Nikkei Asian Review)

- Are There Greater Opportunities In Asia’s Frontier Markets Than in China? (FT)

- Economic Prospects in Several Emerging Asia Countries (Wells Fargo Securities)

- Mark Mobius’s Favorite Emerging Markets: Indonesia, Russia, Brazil, Vietnam and South Africa (WSJ)

- Meet Myanmar’s New Rich One Percent (WSJ)

- Nigeria, Argentina and Vietnam Top the Frontier Markets Sentiment Index (WSJ)

- Top Emerging Markets Hiking Interest Rates Last Week: Indonesia, UAE & More (Investing.com)

- Can a Barbecue Baron Kick off a Big Year for Philippine IPOs? (Nikkei Asia)

- Jollibee’s Quest for Global Dominance Derailed by Virus (Nikkei Asian Review)