The February 2015 issue of Fortune Magazine has a lengthy article about emerging markets and the BRICS before suggesting that investors take a look at seven other emerging stars to invest in: Colombia, India, Indonesia, Kenya, Malaysia, Mexico and Poland (Note: Links go to our ADR list pages for each respective country which will soon be followed by ETF list pages while a complete list of closed-end funds can be found here, for India here, for Mexico here and for Eastern Europe here. Likewise, click on the country names in the tag cloud on the right sidebar for more resources).

Regarding these markets, Fortune Magazine commented:

So where, now, should companies turn for their strategic investments? Well, that has everything to do with what they should look for: stability and resilience. And for that we found seven smart bets. In short, these are markets where it would seem good governance and sustainable growth are likely to go hand in hand.

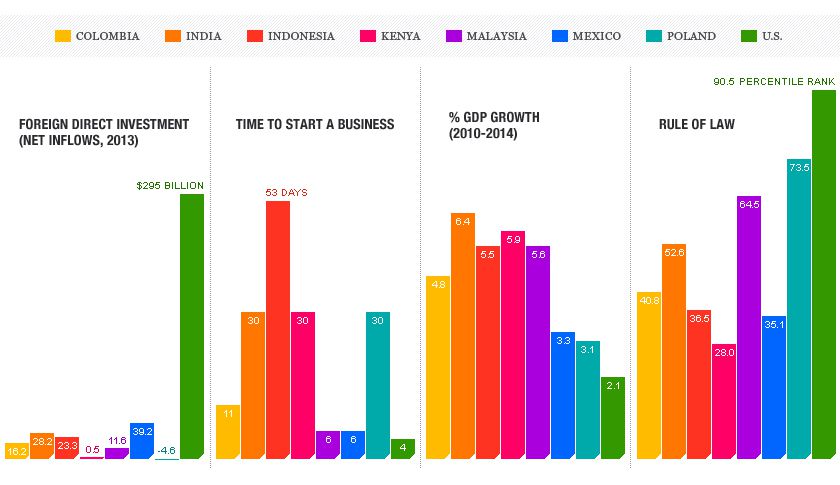

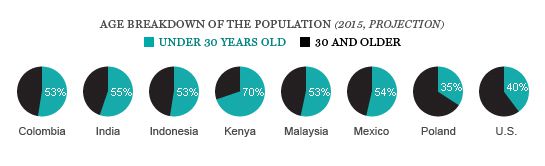

I am not so sure if “good governance” and “sustainable growth” are the best adjectives for some of these emerging markets (for example: See The Malay Dilemma: Is the Malaysia ETF a Safe Emerging Market Investment? and Malaysian Elections: Will The Malaysia ETF Rally or Sink?) but the Fortune Magazine article does give a decent if quick overview of why you might want to invest in each one. The article also came with these two useful graphics to back up their position:

To read the whole article, The new world of business, go to the website of Fortune Magazine.

Similar Posts:

- Fortune Magazine’s Best Emerging Markets to Invest in Now

- Invest in Poorer Performing Emerging Markets for Better Gains? (CNBC)

- 2017 Global Retail Development Index (ATKearney)

- Key Findings: Credit Suisse Emerging Markets Consumer Survey

- Emerging Market Investors: Drop a Bric and Pick Up a Bimchip (Financial Times)

- Which Emerging Markets Have the Most Leveraged Stocks? (Bloomberg)

- The Malay Dilemma: Is the Malaysia ETF a Safe Emerging Market Investment?

- Election Results in Some Fragile Five Emerging Markets Calm Investors (Reuters)

- “Fragile Five” Emerging Markets No Longer That “Fragile” (AP)

- Emerging Market Stocks Advance on Reform Themes & Central Bank Expectations (Bloomberg)

- Emerging Markets: Why Politics Matter in 2018 (Hermes)

- Analysts Favor Currencies Like the Mexican Peso, Won and Zloty (WSJ)

- Emerging Market Risk Ranking: Most Vulnerable to the Strongest (FT)

- Best Consumer Stocks for Emerging Market Investors (Morningstar)

- Emerging Market Companies & Governments Binge on US Dollar Debt (WSJ)