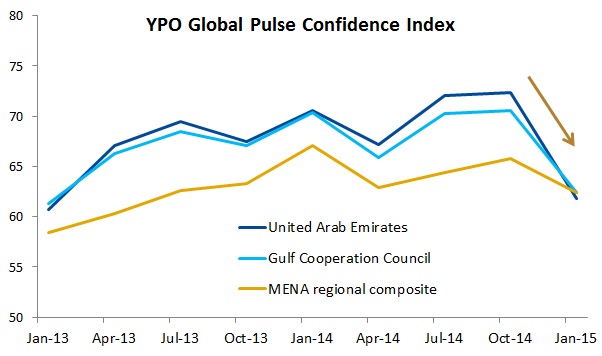

The latest YPO Global Pulse Confidence Index survey of UAE CEOs fell 10.5 points to 61.8 – its lowest level since January 2013 as the fall in oil prices contributed to a more cautious outlook among business leaders (Note: YPO or Young Presidents’ Organization is a not-for-profit, global network of young chief executives). Specifically and for the first time since April 2011, UAE CEOs were less optimistic about short-term business and economic prospects than their counterparts across the region.

Ali Tabbara, managing director of UTC International, commented:

“The sharp drop in oil prices is clearly impacting the business and economic outlook in the UAE. At the same time, CEO confidence remains firmly in optimistic territory, thanks to the diversity of the UAE economy and Expo 2020-related spending, which should help the country weather the reduction in oil revenues.”

The YPO Global Pulse Confidence Index for the Middle East and North Africa dropped 3.4 points to 62.4, but still recorded the second-highest level in the world, trailing just the United States.

Nevertheless, CEO confidence in Gulf Cooperation Council (GCC) member states plunged 8.1 points to 62.4 in January. However, confidence declines in oil exporting nations were partially offset by confidence improvements in Lebanon, which benefits from lower oil prices, and Saudi Arabia, where the government has committed to funding sweeping development projects.

To read the whole press release, YPO: UAE business confidence fades to lowest level in two years, go to the website of YPO.

Similar Posts:

- YPO CEO Survey: Africa CEO Confidence at 5-year Low (YPO)

- YPO CEO Survey: Asia CEO Confidence at 2-year Low (YPO)

- YPO CEO Survey: Brazil CEO Confidence Stagnates (YPO)

- Investing Beyond the Storm: A View from the MENA Region (Franklin Templeton)

- MENA Market Outlook: Managing the Economic Fallout (Franklin Templeton)

- The “Halo Effect” of Saudi Arabia’s Emerging Markets Arrival (Franklin Templeton)

- Podcast: A View on the Lebanese Investment Landscape (Union Bancaire Privée)

- What’s Ahead for the MENA Region? (Franklin Templeton)

- Nielsen Global Survey of Consumer Confidence for Q1 2015

- 2017 Global Retail Development Index (ATKearney)

- Brazil Consumer Confidence Falls in Latest Nielsen Survey

- MENA Equities: Five Key Themes and Reasons for Optimism (Franklin Templeton)

- What’s Next for Emerging Markets and the Dubai Stock Market? (Gulf Business)

- Fund Managers’ Opinions on the UAE and Qatar’s Emerging Markets Upgrade (The National)

- Spotlight on Saudi Arabia (Franklin Templeton)