NOTE: Mobius Investment Trust plc (“MMIT”) is a closed-ended investment company listed on the London Stock Exchange (LSE: MMIT).

- ‘Although Turkey is suffering from inflation in excess of 80 per cent and its economy is in poor health,’ he says, ‘the same cannot be said of countries such as India and Vietnam. They are in pole position to benefit from the shift in world manufacturing away from China.’

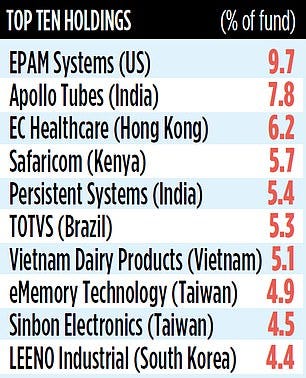

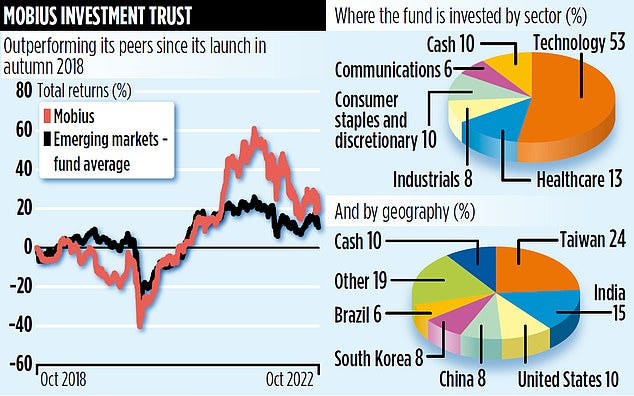

- ‘I believe that in the next four years, we will see a massive rerating in the shares of the 24 investments we hold,’ says Hardenberg confidently. ‘Also, our emphasis on high tech companies in the semi-conductor space will reap rewards.’ Taiwanese companies make up nearly a quarter of the trust’s portfolio… Although Taiwan is the trust’s biggest country stake, many of the Taiwanese companies it holds have production facilities all over the world.

Similar Posts:

- Fundsmith Unveils an Investment Trust Targeting Emerging Market Consumers (FT)

- The Emerging Market Sand Trap: Financial Reports, Currency & Other Risks (Epoch Times)

- Which Emerging Markets Have the Most Leveraged Stocks? (Bloomberg)

- Emerging Market Acronyms Like “Fragile Five” are Misleading and Unhelpful (SCMP)

- Mark Mobius Answers Readers’ Questions (Mobius Blog)

- Key Findings: Credit Suisse Emerging Markets Consumer Survey

- Income Ideas From Emerging Markets (Institutional Investor)

- “Friendshoring” Trend Sees Companies Moving Ops To Dodge Tensions And Trade Wars (Zero Hedge)

- The “Next Eleven” and the World Economy (The Asset)

- Global Emerging Markets: Country Allocation Review, H1 2021 (Federated Hermes)

- Emerging Market Companies & Governments Binge on US Dollar Debt (WSJ)

- “Confidence Shaken:” US Firms In China Look Elsewhere As ‘Friendshoring’ Gathers Steam (Zero Hedge)

- 2014 BCG Local Dynamos: 50 Emerging Market Consumer Companies to Watch (BCG)

- Turkey – Taking Stock in Times of Change (Undervalued Shares)

- New Fragile Five Facing a Forex Crisis: Argentina, Brazil, South Africa, Ukraine & Venezuela (Institutional Investor)