- The stronger US dollar, higher inflation, and tighter financial conditions weighed on emerging markets equities in the third quarter. Looking ahead, we are watching elections in Brazil and the National Communist Party Congress in China in October for signs of policy direction.

- We believe this is an attractive entry point for emerging markets equities: Valuations are attractive relative to history and to developed markets; profitability, free cash flow, and dividend yields have all moved higher; and earnings growth is expected to recover in 2023.

- Emerging markets debt suffered a fifth consecutive quarter of negative returns, and the blended asset class is now well into its worst-ever drawdown. However, bottom-up fundamentals are generally solid, valuations are attractive, and investor positioning is light.

- With recession warning signs flashing, we are currently positioned very conservatively in emerging markets debt. We have reduced US interest rate duration and moved up in credit quality as we await better entry points to increase risk. READ MORE

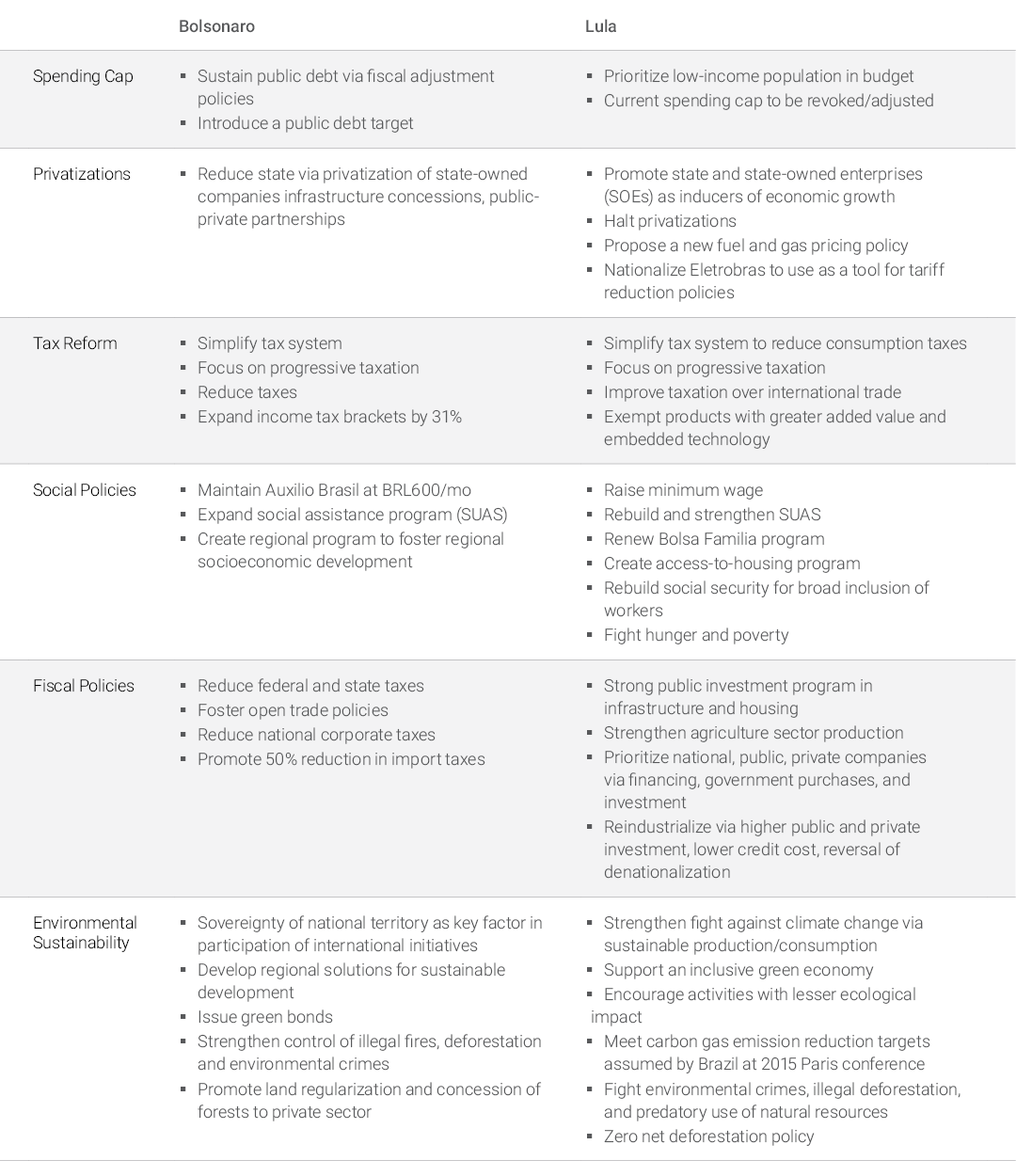

Exhibit 2: Bolsonaro vs. Lula: Policy Proposals Diverge, Especially on Fiscal Policy

Similar Posts:

- Secret to Enduring Stagflation Sends Traders to Emerging Markets (Bloomberg)

- S&W’s McGrath: Emerging Markets Are at the Perfect Entry Point (FE Trustnet)

- What Risks Do Emerging Markets Pose to US Economy? (Bloomberg)

- Outlook on Emerging Markets (Lazard AM)

- Morgan Creek Capital’s Yusko: “Killer Ds” Will Hurt the Developed World (CNBC)

- Disentangling EM Debt (AberdeenStandard Investments)

- Global Emerging Markets: Country Allocation Review, H1 2021 (Federated Hermes)

- China Still Leads the BRICs in the Global Competitiveness Report

- Brazil: Worth a Closer Look (Franklin Templeton)

- Which Emerging Markets Have the Most Leveraged Stocks? (Bloomberg)

- Emerging Market Companies & Governments Binge on US Dollar Debt (WSJ)

- Investors Look to Emerging Markets as Planets Align For End of U.S. Dollar Bull Market (The Globe & Mail)

- China: Navigating the Regulatory Landscape (UBS AM)

- PM Capital’s Bertoli: Now is an Attractive Entry Point for Asian Stocks (AFR)

- ING IM’s Ruijer: China and the Fed are the Biggest Risks to Frontier Markets (Citywire)