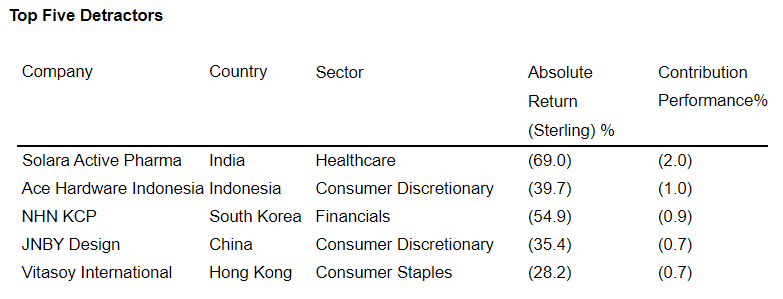

- Scottish Oriental continued its positive performance over the last 12 months. Its net asset value rose by 10% for the year ended 31 August 2022, compared to a decline of 0.9% for the MSCI AC Asia ex-Japan Small Cap Index and a decline of 7.1% for the MSCI AC Asia Ex Japan Index. The largest contributors to performance were the holdings in India and Indonesia. The biggest detractors from performance were the portfolio’s holdings in South Korea and the Philippines.

Similar Posts:

- Buying Stocks in Asia: The Ultimate Guide (InvestAsian)

- Asia at a Crossroads: Demographics, Economics & Investment (State Street)

- Southeast Asia Gains New Leverage as China and US Battle for Influence (Nikkei Asian Review)

- Platinum Asset Management: Asia ex-Japan Market Update

- What Makes Asia−Pacific’s Generation Z different? (McKinsey & Co)

- Korea, Japan Companies Expanding in Vietnam (The Asset)

- Economic Prospects in Several Emerging Asia Countries (Wells Fargo Securities)

- Looking Past the Hang-Ups for Asia’s Smartphone Industry (Franklin Templeton)

- Small But Mighty: Seizing Untapped Opportunities in Southeast Asia (Nielsen)

- Global Emerging Markets: Country Allocation Review, H1 2021 (Federated Hermes)

- 2017 Global Retail Development Index (ATKearney)

- The “Next Eleven” and the World Economy (The Asset)

- BlackRock’s Swann: Look at the China Slowdown in a Long Term Context (FE Trustnet)

- Sustained Growth Slowdown in China Would Spill Over to Asia-Pacific Region and Beyond (Moody’s Talk)

- As US-China Relations Worsen, Expect Supply Chain Chaos (Freight Waves)