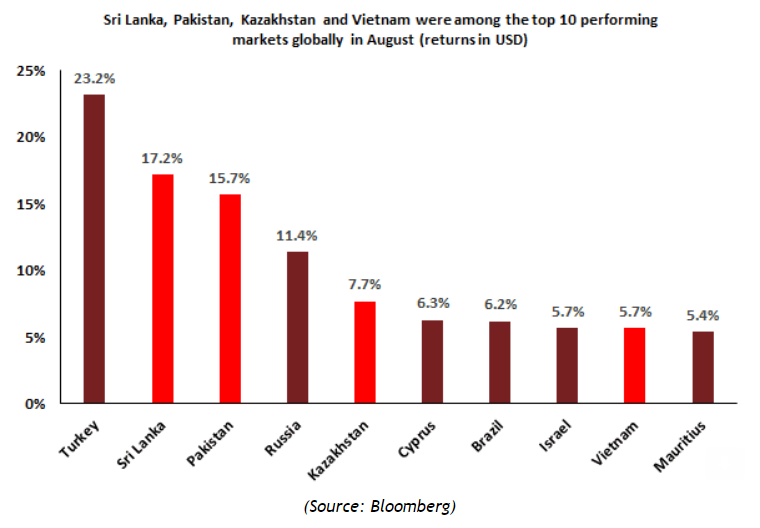

- Pakistan, Sri Lanka, Kazakhstan, and Vietnam were among the top-10 performing markets globally in August as domestic investors in these markets took advantage of extremely attractive valuations. We have made this point before: valuations in Asian frontier markets are at a considerable discount to the historical average (as the chart below shows) and any volatility in global markets would be a good entry point into Asian frontier markets with a 12–18-month view from here. READ MORE

Similar Posts:

- Frontier Market ETFs Have 72% Exposure to Oil-Dependent Countries (FT Adviser)

- May 2022 Update: Invest Through the Cycle to Generate Long Term Returns (Asia Frontier Capital)

- Webinar – Asian Frontier Markets Update on Friday, 28th October 2022

- AFC Asia Frontier Fund – Review 2022 and Outlook 2023 (AFC Asia Frontier Fund)

- AFC on the Road – Sri Lanka (Asia Frontier Capital)

- China Faces Pushback on Belt and Road Indebtedness (The Asset)

- China, IMF Bailouts for Poorer States Ease Bearish Sentiment Towards Emerging Markets (SCMP)

- 2017 Global Retail Development Index (ATKearney)

- Russell Frontier Markets Equity Fund’s Manager Sees Neglected Gems (WSJ)

- Is Pakistan About to Pop? (Petition Substack)

- Are There Greater Opportunities In Asia’s Frontier Markets Than in China? (FT)

- Turbulence Across Eurasia Will Not Slow Kazakhstan’s Progress (National Interest)

- The “Next Eleven” and the World Economy (The Asset)

- Vietnamese Verses Chinese Retail Investors (AFC)

- Pakistan: “More Gas in the Tank” (Asia Frontier Capital)