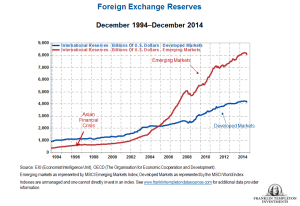

The Mobius Blog recently had a post about how total currency reserves in emerging markets have fallen and what this could mean. Specifically, the IMF has reported that foreign reserves in emerging markets in aggregate fell $114.5 billion on a year-over-year basis to $7.74 trillion in 2014 – down from their peak of just over $8 trillion in the second quarter 2014.

However, the Mobius Blog noted that the reduction in foreign exchange reserves seen in 2014 is relatively insignificant in the context of the huge reserve increase that has taken place since the Asian Financial Crisis in the late 1990s.

However, the Mobius Blog noted that the reduction in foreign exchange reserves seen in 2014 is relatively insignificant in the context of the huge reserve increase that has taken place since the Asian Financial Crisis in the late 1990s.

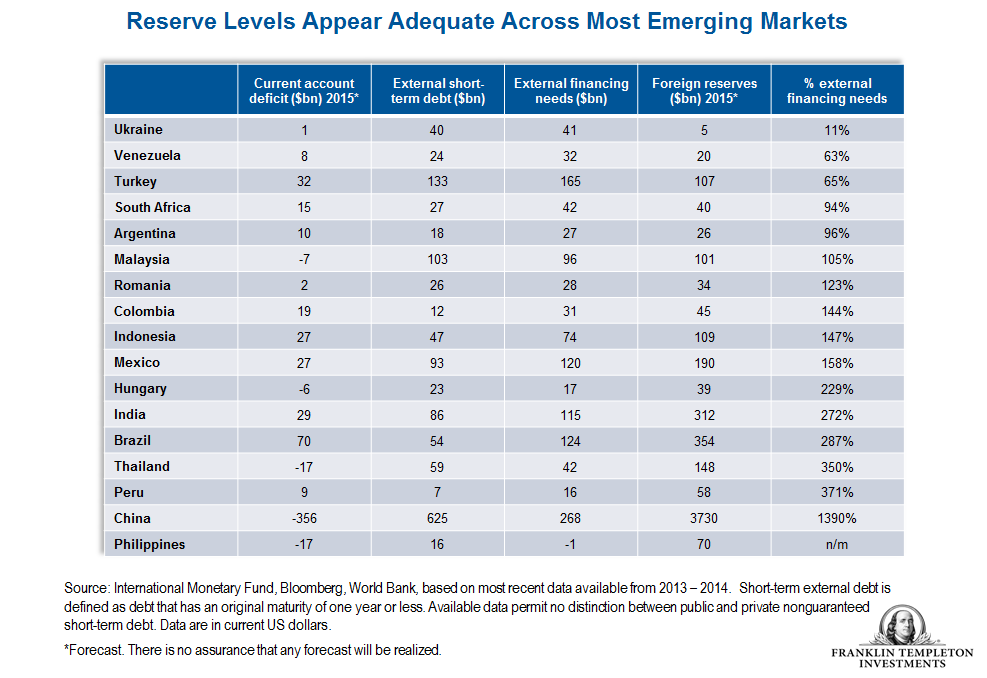

Today, emerging market reserves remain high and are still more than four times as high as they were in 2004; but with few exceptions, these reserves appear more than sufficient to service short-term financing requirements:

…we should not be too much concerned about the decline in the level of reserves by itself. Countries have become more independent in the way they can conduct their monetary policy and most no longer peg the domestic currency to the US dollar, giving them more freedom to set domestic interest rates… Declining reserves could be highlighting another issue which is the decline in the attractiveness of emerging market countries in the short term either because they cannot produce the current account surpluses they delivered in the past (on the back of declining commodity prices for commodity producers) or they no longer attract capital inflows to finance attractive investment opportunities.

To read the whole blog post, Significant Slip—or Just a Blip—in Emerging Markets’ Foreign Exchange Reserves?, go to the Mobius Blog on the website of Franklin Templeton.

Similar Posts:

- MSCI Islamic Total Return Index vs. MSCI Emerging Markets Total Return Index (Mobius Blog)

- Rapid Aging in Emerging Markets will Impact Consumer Spending (AllianceBernstein)

- Emerging Market Companies & Governments Binge on US Dollar Debt (WSJ)

- 8 of 10 Fastest Growing Markets are Frontier Markets (Mobius Blog)

- Busting Frontier Market Investing Myths (Mobius Blog)

- Table: Emerging Market Bull vs Bear Market Dates (Mobius Blog)

- Infographic: Why Emerging Market Stocks Aren’t All the Same (Charles Schwab)

- Argentina: Where Growth & Stock Market Returns Diverge (Mobius Blog)

- Mark Mobius’s Favorite Emerging Markets: Indonesia, Russia, Brazil, Vietnam and South Africa (WSJ)

- Templeton’s Chow: “No Reason the Goat and the Bull Cannot be Friends” (Mobius Blog)

- Frontier Markets: Attractive Valuations with Limited Correlation (Mobius Blog)

- Lira and Rand Among the Latest “Hot” Emerging Market Currency Bets (WSJ)

- Leave Emerging Markets to the Fund Manager Pros (Investors Chronicle)

- Emerging Market Stocks Face Prospectus Scrutiny (Canadian Securities Law)

- Three Reasons Why Investors Should Buy Frontier Market Stocks (The BlackRock Blog)