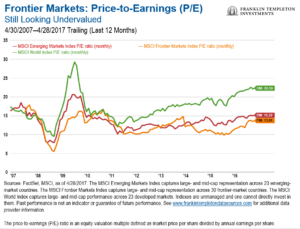

Carlos Hardenberg, senior vice president and director of frontier markets strategies at Templeton Emerging Markets Group, has noted that when we talk about the attractiveness of frontier market investing, the single most important factor for many investors tends to be valuations. Currently, frontier market stocks are trading at what they consider to be very cheap valuations compared with both developed and emerging market peers.

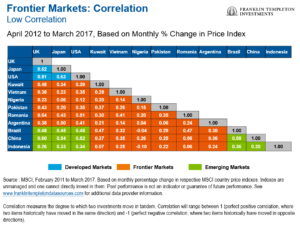

Hardenberg also noted that as an asset class, frontier markets have traditionally had very little correlation with emerging markets such as China, Brazil or Indonesia, or with developed markets including the United States, Japan or the United Kingdom.

Finally and as with emerging markets in general, Hardenberg says there may be a tendency among the uninitiated to lump all frontier markets under the same umbrella which would be a mistake as, for example, Vietnam is very different from the Ivory Coast.

Finally and as with emerging markets in general, Hardenberg says there may be a tendency among the uninitiated to lump all frontier markets under the same umbrella which would be a mistake as, for example, Vietnam is very different from the Ivory Coast.

To read the whole blog post, Busting the Frontier-Market Myths, go to the Mobius Blog. In addition, check out our list of Frontier Market ETFs.

Similar Posts:

- 8 of 10 Fastest Growing Markets are Frontier Markets (Mobius Blog)

- Busting Frontier Market Investing Myths (Mobius Blog)

- Emerging Market 2018 Outlook (Mobius Blog)

- Templeton’s Chow: “No Reason the Goat and the Bull Cannot be Friends” (Mobius Blog)

- October EM Market Recap and Outlook: A Sea of Opportunities (Franklin Templeton)

- Three Reasons We Remain Bullish on Emerging Markets Long Term (Franklin Templeton)

- Mark Mobius’s Favorite Emerging Markets: Indonesia, Russia, Brazil, Vietnam and South Africa (WSJ)

- Emerging Markets’ Foreign Exchange Reserves Have Dipped (Mobius Blog)

- South Africa Stocks “Expensive Within Emerging Markets” (Moneyweb.co.za)

- Local Investors Discover Brazilian Stocks (Franklin Templeton)

- Unlike Emerging Markets, Frontier Markets Are a Less Volatile Haven (FT)

- Today’s Emerging Markets Embrace Technological Innovation (Franklin Templeton Investments)

- Emerging Markets Experience a Volatile First Quarter (Franklin Templeton Investments)

- No Emerging Markets Crisis According to Mark Mobius (FE Trustnet)

- Why It’s Not Time to Squeeze the Brakes on Indian Equities (Franklin Templeton)