Franklin Templeton’s Mark Mobius recently attended the Global International Islamic Finance Forum (GIFF) in Malaysia and has written a blog post about Malaysia and Islamic finance in emerging markets. At GIFF, Mobius noted that Bank of Malaysia Governor Datuk Muhammad bin Ibrahim had reported that by 2020, total assets in global Islamic finance are expected to reach more than US $3 trillion. He also said that in at least 10 jurisdictions, Islamic banking today represents more than 20% of total banking assets. Moreover and in many countries, Islamic banking services are offered in tandem with traditional types of financial services and products.

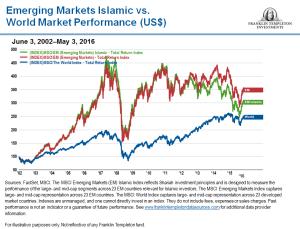

For investors, the MSCI Islamic Total Return Index has largely mirrored the performance of the MSCI Emerging Markets Total Return Index since 2002 with some slight variations, while generally outperforming the MSCI World Index:

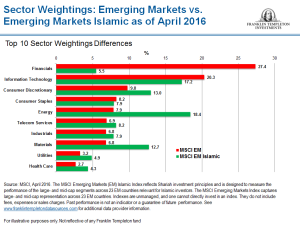

Mobius went on to note that if you look at the sector weightings of the MSCI Islamic Total Return Index versus the more general MSCI Emerging Markets Total Return Index, you will see significant differences. For example: Financials are much smaller in the Islamic Index, while consumer discretionary and energy are much higher for the same index. Country weightings also differ between the indexes:

Mobius went on to note that if you look at the sector weightings of the MSCI Islamic Total Return Index versus the more general MSCI Emerging Markets Total Return Index, you will see significant differences. For example: Financials are much smaller in the Islamic Index, while consumer discretionary and energy are much higher for the same index. Country weightings also differ between the indexes:

To read the whole blog post, Malaysia and Islamic Finance in Emerging Markets, go to the Investment Adventures in Emerging Markets – Notes from Mark Mobius blog.

To read the whole blog post, Malaysia and Islamic Finance in Emerging Markets, go to the Investment Adventures in Emerging Markets – Notes from Mark Mobius blog.

Similar Posts:

- The Malay Dilemma: Is the Malaysia ETF a Safe Emerging Market Investment?

- Malaysian Elections: Will The Malaysia ETF Rally or Sink?

- Are There Greater Opportunities In Asia’s Frontier Markets Than in China? (FT)

- The Emerging Asia Pacific Capital Markets: Malaysia (CFA Institute)

- Hibiscus Petroleum (KLSE: HIBISCS): Profitably Enhancing Production from Mature Assets

- Southeast Asia Set to Gain From Trade War Business Relocations (Nikkei Asian Review)

- Falling Oil Prices Puts a Spotlight on Malaysia’s Debt (Reuters)

- Emerging Market Risk Ranking: Most Vulnerable to the Strongest (FT)

- Mark Mobius’s Favorite Emerging Markets: Indonesia, Russia, Brazil, Vietnam and South Africa (WSJ)

- Bloomberg’s Misery Index’s Least Miserable Emerging Markets

- Malaysia Can Draw Up to $33b in Rare Earth Investment Over Next 10 Years (Straits Times)

- What Happens if Malaysia is Removed From the FTSE World Bond Index? (The Asset)

- Will Emerging Markets and Berjaya Corporation Save RadioShack?

- GST: Asia’s Most Important Economic (Election) Talking Point? (SCMP)

- UK Retail’s Most Valuable Shoppers Are From Asian Emerging Markets (Internet Retailing)