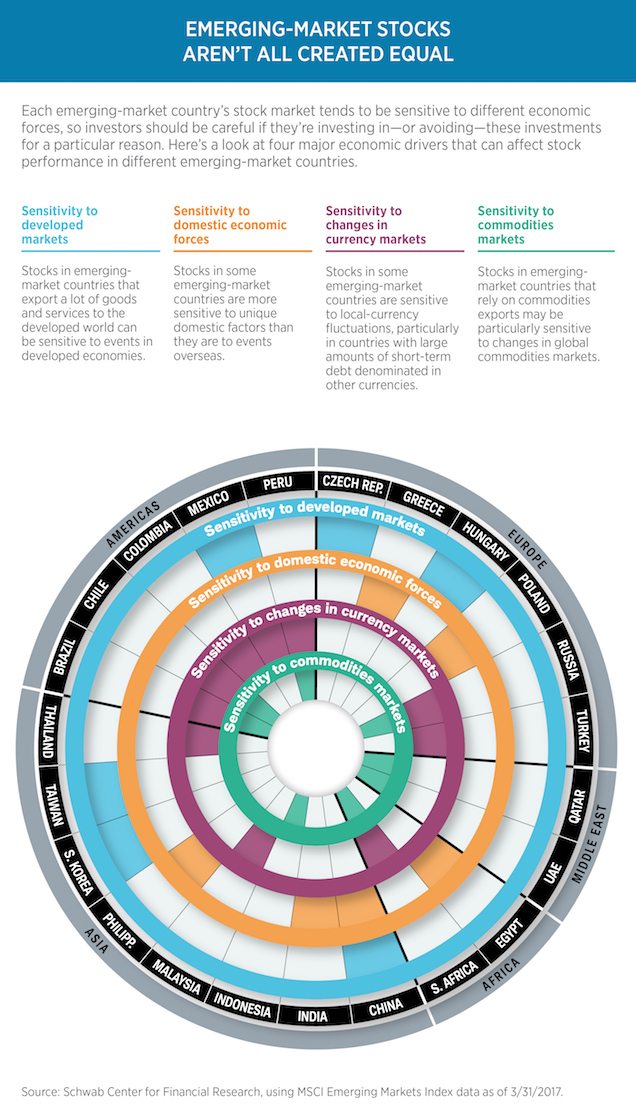

Charles Schwab’s Market Commentary blog recently looked at the countries in the MSCI Emerging Market Index, which measures EM stock market performance globally, and identified four big economic forces or areas where an emerging market country’s stock market tends to be sensitive:

- Sensitivity to developed markets

- Sensitivity to domestic economic forces

- Sensitivity to changes in currency markets

- Sensitivity to commodities markets.

To read the whole article, Different Drivers: Why Emerging Market Stocks Aren’t All the Same, go to the Market Commentary blog on the website of Charles Schwab.

Similar Posts:

- Emerging Market Large Cap ETF List

- MSCI Islamic Total Return Index vs. MSCI Emerging Markets Total Return Index (Mobius Blog)

- Why Emerging Markets are Increasingly Moving to Their Own Rhythms (AP)

- The Definition of Successful Investing to Affluent Chinese (The Asset)

- Why the MSCI Emerging Markets Index Has Some BIG Problems (WSJ)

- Naspers’ Tencent Stake Drives the MSCI South Africa Index’s Returns (KraneShares)

- Leave Emerging Markets to the Fund Manager Pros (Investors Chronicle)

- Argentina: Where Growth & Stock Market Returns Diverge (Mobius Blog)

- Structural Change in Emerging Markets: 4 Key Forces to Understand (Wellington Management)

- Fund Managers’ Opinions on the UAE and Qatar’s Emerging Markets Upgrade (The National)

- How MSCI’s Global Investable Market Indexes Methodology Influences Trillions of Dollars (Kraneshares)

- Understanding Four Forces of Structural Change in Emerging Markets (Wellington Management)

- Are There Greater Opportunities In Asia’s Frontier Markets Than in China? (FT)

- Unlike Emerging Markets, Frontier Markets Are a Less Volatile Haven (FT)

- Emerging Market Stocks Face Prospectus Scrutiny (Canadian Securities Law)