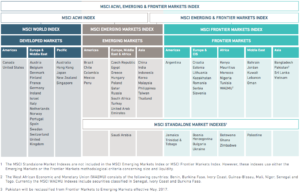

KraneShares recently had an article about MSCI’s Global Investable Market Indexes Methodology (GIMI) and why they believe investors should understand the way it dictates, or influences, how and which stocks are held by index funds, ETFs and even actively-managed mutual funds. MSCI takes a modular approach to defining the world which at the top level can be divided into two sections:

- The MSCI All Country World (ACWI) Index, and

- The MSCI Frontier Markets Index

The promotion from frontier market to emerging market status brings exposure to a much larger asset base as the MSCI Frontier Markets Index has relatively few assets benchmarked to it while the MSCI Emerging Markets Index has $1.6 trillion in benchmarked assets. Emerging market passive managers have no choice, but to buy the stocks once added to the index while active-managers generally must at least consider the stocks for purchase.

KraneShares goes on to note that once MSCI’s rules are defined, they must be monitored frequently and adjusted to adapt to global market conditions. The following chart summarizes MSCI’s modular approach to building and maintaining their indexes:

To read the whole article, Could this be the most influential publication in asset management?, go to the website of Kraneshares.

Similar Posts:

- MSCI Islamic Total Return Index vs. MSCI Emerging Markets Total Return Index (Mobius Blog)

- Saudi Arabia Inclusion and Emerging Markets (MSCI)

- Results of MSCI 2017 Market Classification Review (MSCI)

- History Says Investors Get Gored by MSCI Upgrades (Reuters)

- How the MSCI Emerging Markets Index Changes Will Impact Investors (P&I)

- Naspers’ Tencent Stake Drives the MSCI South Africa Index’s Returns (KraneShares)

- Why the MSCI Emerging Markets Index Has Some BIG Problems (WSJ)

- Frontier Markets: Small, Concentrated & Misunderstood (Financial Advisor)

- Will Frontier Markets Follow the Same Emerging Market Pattern? (The Telegraph)

- Macro Tailwinds That Could Propel China’s Internet Sector (KraneShares)

- Are Frontier Markets a Calculated Risk? (Bloomberg)

- Nigeria’s Forte Oil Plc and EcoBank Transnational Inc (ETI) Added to MSCI’s Frontier Market Index (AllAfrica.com)

- Frontier Market ETF List

- Emerging Market Technology ETF List

- Are There Greater Opportunities In Asia’s Frontier Markets Than in China? (FT)