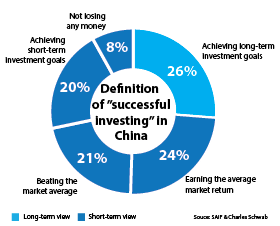

According to a report by Shanghai Advanced Institute of Finance (SAIF) and Charles Schwab, Chinese emerging affluent have varying definitions for “successful investing” with the majority (74%) polled in their survey taking a short-term view on investing. For them, “successful investing” means either “beating the market average” or “simply achieving their short-term goal:”

Many Chinese emerging affluent also have unrealistic expectations about what they can achieve through investing as Lisa Hunt, executive vice president, international services and special business development at Charles Schwab, was quoted in an article by The Asset about the study as saying:

Many Chinese emerging affluent also have unrealistic expectations about what they can achieve through investing as Lisa Hunt, executive vice president, international services and special business development at Charles Schwab, was quoted in an article by The Asset about the study as saying:

“In the US, for instance, if you have a well-balanced portfolio that is achieving about a 6.5% return on average, we think that is a great return. When you talk to a Chinese investor 6% return is not great. There really is a disconnect between realistic expectations and this notion of guaranteed investing.”

The Asset also noted a Boston Consulting Group study that predicts in 2020, there will be 280 million new affluent individuals in China – more than double the number recorded in 2012.

To read the whole article, Why gambling is second nature to China’s new rich, go to the website of The Asset. In addition, check out our China closed-end fund list and China ETF list pages.

Similar Posts:

- China’s New Rich Distrusts Financial Advisers (The Asset)

- The Chinese Property Market: The Most Important Industry Globally Which Few Understand (Platinum Asset Management)

- Why China is Gaining an Edge in Emerging Markets While the West Tries to ‘Impose Hegemony on a Shoestring’ (SCMP)

- The Great Chinese Exodus (WSJ)

- China’s Mutual Funds Industry Now the Second Biggest in Asia (The Asset)

- Lessons from Autohome Inc’s Battle With Foreign Shareholders (Bloomberg)

- Chinese Stocks: Cheap Long-term Play or Value Trap? (FE Trustnet)

- China M&A a Bright Spot Amid Regional Decline (The Asset)

- Don’t Believe All the Doom and Gloom Scenarios for China? (FT)

- The Incredible Rise of Pinduoduo, China’s Newest Force in eCommerce (TechCrunch)

- Infographic: Why Emerging Market Stocks Aren’t All the Same (Charles Schwab)

- What Hong Kong Dollar Bond Exposure Means to Investors (The Asset)

- S&W’s McGrath: Emerging Markets Are at the Perfect Entry Point (FE Trustnet)

- US Adds 36 Chinese Companies to Export Blacklist, Including Country’s Top Flash Memory Chip Maker (SCMP)

- The World in 2050 (PWC)