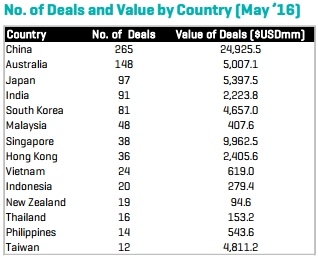

Asia-Pacific M&A deals amounted to US$302 billion in the first five months of this year for a 22% decline from a year ago. However, China still remained a bright spot with a 31% increase in M&A deals.

The Asset quoted Michael DeFranco, global head of M&A at Baker & McKenzie, as saying:

“Chinese investors were extremely active in Q1 as they looked beyond their own borders for growth opportunities, supported by government-led initiatives to diversify the economy. This was after a record year for Chinese investment into the US and EU in 2015.”

To read the whole article, China M&A is one bright spot amid regional decline, go to the website of The Asset. In addition, check out our China closed-end fund list and China ETF list pages.

To read the whole article, China M&A is one bright spot amid regional decline, go to the website of The Asset. In addition, check out our China closed-end fund list and China ETF list pages.

Similar Posts:

- China’s Mutual Funds Industry Now the Second Biggest in Asia (The Asset)

- China’s $246B Foreign M&A Buying Spree Is Slowing (Bloomberg)

- Fund Managers Are Wary of “Cheap” Asian Stock Markets (FT Adviser)

- Aberdeen Asset Management’s China Update

- Macau Visitor Numbers Will Keep Growing (GGRAsia)

- China Investing in the Year of the Dog (GAM Investments)

- Will the Russia-China Gas Deal Give Japan Energy Security? (Reuters)

- China Loses #2 Creditor Rank to Germany (Bloomberg)

- Barclays: China Fears Being Overplayed (FT Adviser)

- The Definition of Successful Investing to Affluent Chinese (The Asset)

- Korea & Taiwan Use Renminbi for Majority of Payments with China & Hong Kong (The Asset)

- China beyond Evergrande: Contagion or containment? (PineBridge Investments)

- No Improvement in Asia Pacific Corporate Payments in 2015 (Coface)

- Asia300 Power Performers: Tech’s Wild Ride (Nikkei Asian Review)

- Nikko AM’s Sartori: Best Buying Opportunities in Asia in My Career (AFR)