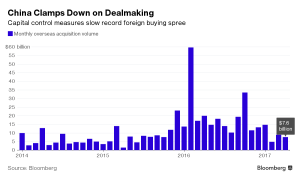

After a record $246 billion of announced outbound takeovers in 2016, Chinese M&A dealmakers are now struggling to cope with tighter capital controls and increasingly wary foreign counterparties who have been spooked by a string of canceled deals. In fact, cross-border purchases plunged 67% during the first four months of this year – the biggest drop for a comparable period since the depths of the global financial crisis in 2009 (according to data compiled by Bloomberg).

Nevertheless, the Chinese companies that are still doing overseas acquisitions are focusing on the consumer, energy and utilities sectors:

Nevertheless, the Chinese companies that are still doing overseas acquisitions are focusing on the consumer, energy and utilities sectors:

To get around China’s capital controls, some acquirers have tried to secure financing from the overseas branches of Chinese lenders by pledging their onshore assets as collateral, are pursuing smaller deals or are teaming up with offshore private-equity firms.

To get around China’s capital controls, some acquirers have tried to secure financing from the overseas branches of Chinese lenders by pledging their onshore assets as collateral, are pursuing smaller deals or are teaming up with offshore private-equity firms.

To read the whole article, China’s $246 Billion Foreign Buying Spree Is Unraveling, go to the website of Bloomberg. In addition, check out our China ETFs list and our China Closed-End Funds list.

Similar Posts:

- China Loses #2 Creditor Rank to Germany (Bloomberg)

- China M&A a Bright Spot Amid Regional Decline (The Asset)

- China Venture Capital Deals Shrink Amid Regulatory Concerns (Nikkei Asia)

- China is a Minefield for International Creditors (Washington Examiner)

- Lessons from Autohome Inc’s Battle With Foreign Shareholders (Bloomberg)

- EM Push & Pull: As China Rises, Competition for Capital Heats Up (Aviva Investors)

- China is Going After Foreign Car Makers (Fitch Ratings)

- India and China Emerging as Startup Hot Spots (Nikkei Asian Review)

- Understanding China’s Recent Moves in Its Capital Markets (Ray Dalio)

- US-Chinese Business Partnerships Are Thriving (Kraneshares)

- How China’s Middle Classes Move Their Money Abroad (SCMP)

- Accounting Fraud and Abuse Still Widespread Among Listed Chinese Stocks (CMN)

- China’s SGID to Become Major Player in Chilean Electricity Market (The Asset)

- Norway’s Sovereign Wealth Fund Slows Emerging Market Investment (Bloomberg)

- Five Misconceptions About China’s Stock Markets (KraneShares)