In the wake of the Silicon Valley Bank and now the Credit Suisse debacles, many investors may not want to touch any kind of bank, insurance, financial services and related stock pick. However and as this meme I have already posted sums up, there are big differences between emerging market banks and their developed market counterparts:

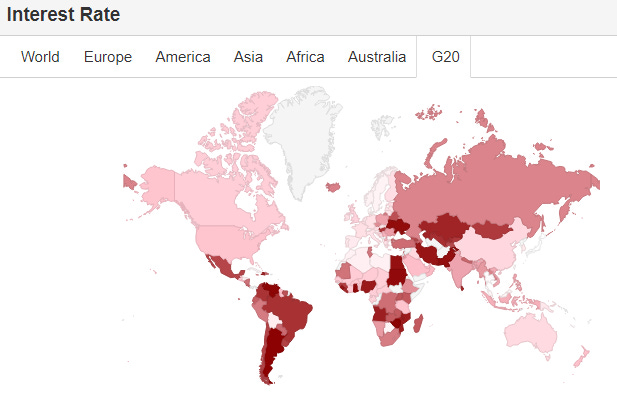

Outside the USA and EU, many countries are in different positions in their rate hike cycles. This means local banks and other financial services stocks may be poised to deliver much higher growth than in the past or compared to their developed market peers.

However, Indian financial stocks do seem to still come with rich valuations as you will see later in this post. On the other hand, Korean financial stocks in particular (the so-called “Korean Discount” on Korean stocks) along with South African ones tend to have low P/Es and high dividend yields at the moment.

Many emerging markets (India and Indonesia come to mind) also remain underpenetrated when it comes to offering consumer financial products e.g. consumer loans, insurance products, etc. The same can be said for wealth management products that offer savers something beyond gold, a bank deposit (inflation and currency risk), and property speculation (the developer goes bust…).

Nevertheless, one Fund looked at during the past quarter had commented how it’s getting harder to find what they consider high-quality companies in the financial sector due to their more commoditized and cyclical nature.

Fintech too has been all the rage and giving banks a run for their money. However, many emerging market banks have started to figure out or master fintech and digitization. As mentioned in February, this 40 minute podcast gives a good overview of fintech in emerging markets (or more specifically, Latin America): [Investor Stories] Jonathan Whittle (Quona) on why and when it pays to become a bank, parallels to previous bust… (Emerging Markets Enthusiast Podcast)

With that said, the stock picks in this post are organized (aside by region and country) first with a 10-year country interest rate chart from Trending Economics (you can click on the chart to take you to the site for a further discussion of local interest rate direction).

I will then give a one year (when possible) chart with the country’s current Deposit Interest Rate – the average rate paid by commercial banks to individuals or corporations on deposits.

NOTE: You might also find some of these other Trending Economics’ data or charts by country useful for evaluating a country’s banking or financial sector:

- Banks Balance Sheet

- Cash Reserve Ratio

- Central Bank Balance Sheet

- Foreign Exchange Reserves

- Interbank Rate

- Lending Rate

- Loan Growth

- Loans To Private Sector

In Saudi Arabia, depositors can now apparently lock in 5%+ rates on short-term bank deposits (higher than the average given by Trending Economics). IF you can get 5%+ guaranteed from a bank and the real rate of inflation for most consumer products you buy is low (e.g. energy exporter rather than importer), there is no need to be investing in the local stock market or speculating in property bubbles.

On the other hand, the average bank deposit rate in China is 35 basis points. Granted, you can get higher rates by locking in your money longer, but it’s still nothing to write home about and not enough to support your child’s education, any elderly parents, and yourself in retirement:

This means speculating in property bubbles or the stock market will beckon many savers.

Getting back to this post: I will then give the stock linked to it’s investor relations page, all the tickers for it’s various listings (linked to the respective financial charts), and talk a little about the stock. Where available (from Google Finance, Yahoo! Finance, Finviz, etc):

– P/E RATIO:

– DIVIDEND YIELD:

Keep in mind, the above figures might vary from source to source and can be harder to calculate or pin down for emerging market stocks.

Finally, I have a screenshot of the latest stock chart for the past year for the main ticker or listing. Many stocks mentioned do have secondary listings in London or Frankfurt.

Subscribe Now Via Substack

Similar Posts:

- Asian Banks Are Nibbling the Lunches of Global Banks (CCTV)

- Stop Worrying About Chinese Debt? (The Asset)

- Top Emerging Markets Hiking Interest Rates Last Week: Indonesia, UAE & More (Investing.com)

- EM Fund Stock Picks & Country Commentaries (March 21, 2023)

- EM Fund Stock Picks & Country Commentaries (May 16, 2023)

- Investing in Cyprus ADRs / Cyprus Stocks List

- EM Fund Stock Picks & Country Commentaries (February 4, 2024)

- EM Fund Stock Picks & Country Commentaries (August 22, 2023)

- EM Fund Stock Picks & Country Commentaries (October 10, 2023)

- EM Fund Stock Picks & Country Commentaries (November 22, 2023)

- The 40 Biggest Chinese Stocks Being Added to the MSCI Index (Fortune)

- EM Fund Stock Picks & Country Commentaries (May 23, 2023)

- EM Fund Stock Picks & Country Commentaries (August 15, 2023)

- EM Fund Stock Picks & Country Commentaries (June 27, 2023)

- Investing in Puerto Rico Stocks