This post is a compilation of links and briefs for our short EM Stock Pick Tear Sheets (separate section) for the last two weeks with a focus on casino, hospitality and restaurant stock picks based in Indonesia, India, Poland, South Africa, and South Korea.

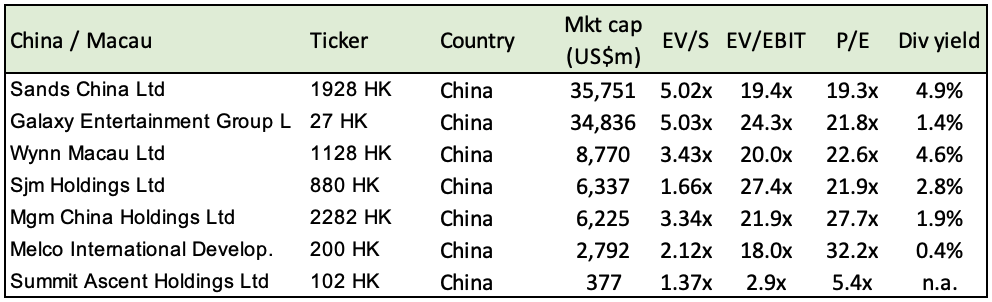

Michael Fritzell (Asian Century Stocks) recently published an article (Mapping Asia’s casino industry) with many good graphics, charts, tables or maps covering the Asian casino industry (a COVID reopening story or play…) with the most relevant tables for investors being:

We have already covered Galaxy Entertainment (Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF): Macau’s Best Casino Stock Positioned for Growth) which is said to be the best positioned Macau casino stock for the long-haul.

Both Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) and Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) have also come up in our Monday links and Tuesday fund posts. One of the Genting listings is trying to sell a valuable property in Miami (the latest deal apparently just fell through) and is bidding for a New York casino license.

We have also covered NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF) who has a long-life monopoly casino licence for the Cambodian capital, Phnom Penh, where it operates the NagaWorld resort complex. However and without the full return of Chinese tourists, they are having refinancing woes. And given just how much money casinos can rake in for governments, Thailand may decide to soon allow casino gambling of some kind which would further put pressure on Cambodian casinos (Two casino giants exploring Thailand).

Korea’s Kangwon Land (Kangwon Land (KRX: 035250): Shares Are Still Down Despite a Mass Gaming Revenue Recovery) is state-controlled (usually not a positive for a stock or business of any kind) as it’s a casino resort complex built in a former coal mining region to provide economic opportunities to the locals after the coal mines were closed down. It’s the only casino in Korea (there are a total of 17) where locals can gamble – meaning they are not dependent on waiting for Chinese (subject to geopolitical whims…) or Japanese tourists to return.

Likewise, there is talk of allowing more than just Pachinko to be played in Japan where casinos are controversial and public opinion is split (Japan approves first casino, hoping to create new tourism stream). This could further impact Korean casinos catering only to foreigners as I am reminded of what happened to Reno after California legalized gaming on Indian reservations and 66 casinos and almost as many card rooms opened. While Las Vegas continues to thrive as (like Macau) it caters to every type of tourist as an entertainment hub, Reno is nearly dead. Something similar could happen in both Korea and Cambodia.

Meanwhile, Africa is often overlooked as a casino gaming region and a COVID reopening play. Investment holding company Grand Parade Investments (Grand Parade Investments (JSE: GPL): A Horseracing Enthusiast Takes Control of a Solid Casino Gaming Platform Ready for Buildout) is now focused on gaming investments (including gaming technology) after years of restructuring and selling off unprofitable or non-core investments (e.g. Burger King). It was recently taken over by a South African who spent his investment banking career in the USA and returned home to hunt for deals (he has already done one deal to save a local horseracing track).

Grand Parade’s gaming portfolio (they started out as Sun International’s primary black economic empowerment partner and thus have minority stakes in some of their casino properties) offers him a solid platform from which to build out further gaming interests. However, what direction he will take the group remains to be seen, but he apparently plans to keep the listing.

Africa’s and South Africa’s other major casino players (covered in this post) are Tsogo Sun and Sun International while Southern Sun (once part of the same listing as Sun International) is Southern Africa’s leading hospitality group. While South Africa’s blackouts and uncertain economy that result from them are headwinds for local tourists and local discretionary spending, international tourists are slowly returning to the region.

As for restaurant stocks, we have covered two interesting restaurant stock picks in the past:

- Americana Restaurants International PLC (TADAWUL: 6015): Expansion Plans Include 250-300 New Restaurants a Year

- Famous Brands (JSE: FBR): Africa’s Leading Vertically Integrated Restaurant Operator With Rising Earnings

Indonesia’s Champ Resto (Champ Resto (IDX: ENAK): Indonesia’s Restaurant National Champion?) is interesting as instead of franchising foreign restaurant concepts, they have created seven of their own concepts from scratch.

Creating your own restaurant brand or concept is not easy (as I have done headhunting work in the restaurant operator space in SE Asia). But when you succeed at doing it, you control everything and don’t have to worry about franchise agreement renegotiations or a change in global strategy by the franchiser.

For example: Minor International in Thailand had operated Pizza Hut there until the contract was terminated. When that happened, Minor took the knowledge they had gained to start The Pizza Company which now operates in close to a dozen countries.

Although it’s not clear why (as the news was reported in Polish), Amrest (AmRest (WSE: EAT / FRA: 1QT / OTCMKTS: ARHOF): A Leading European Restaurant Operator Still Below Pre-COVID Highs) recently lost the development contract for Burger King in several Eastern European countries (but will apparently stay on as the operator). Since they operate a portfolio of international franchises in different markets plus have their own in-house concepts (including, interestingly enough, some virtual ones), this should not impact them too much.

In addition, I was told in the past that the business model for international fast food (and the like) franchisees might work like this: During a ten year period, you are contractually required to do two front of the house remodeling (as there is considerable wear and tear plus it seems like new digital ordering and payment kiosks are being installed everywhere now) every five years and one back of the house remodeling every ten years (as even fast food deep fryers and the like will change e.g. become more efficient, or need to be replaced).

So the business model is seven years of profits to cover three years of losses when the remodeling needs to be done. As you can imagine, any outside disruption to this business model (aka COVID lockdowns, minimum wage increases, etc.) can throw monkey wrenches at a franchisee’s financials. But by developing your own concepts, you can control things better.

Personally, I would have to question whether seven in-house concepts might be too much for Champ Resto to effectively manage, invest in, and expand. Again, it takes considerable capital to create a restaurant chain concept from scratch and to grow it. They also don’t have the benefit of learning best practices and operational efficiencies (including new technology) from a global restaurant operator.

Meanwhile, Devyani International (Devyani International (NSE: DEVYANI / BOM: 543330): Yum’s Largest Franchisee in India Hopes for a Rebound Amid Signs Inflation is Stabilizing) has an interesting business model as they are the largest franchisee for Yum! Brands (Pizza Hut and KFC) in India plus they operate Yum! concepts in Nigeria (just KFC) and Nepal. In addition, they operate Costa Coffee, have developed their own South Indian concept, and operate food courts (including ones in airports where margins are usually high). Finally, the parent company is a MNC conglomerate involved in beverages, fast-food restaurants, retail, ice-cream, dairy products, healthcare, and education.

From Yum and Costa Coffee, Devyani can learn global best practices that can be applied to their own homegrown brand. Managing food courts is also a great way to learn what concepts and products work with what demographics and what does not.

Of course, there is always the risk that Yum! Brands will become unhappy with them and takes away their development or operator contracts. Having a bigger portfolio mix of franchised and in-house concepts would take away some of those risks.

Finally, and as you can also see from post titles, Sapphire Foods (Sapphire Foods (NSE: SAPPHIRE / BOM: 543397): Institutional Shareholders Remain Bullish as They Buy More Shares) and Jubilant FoodWorks (Jubilant FoodWorks (NSE: JUBLFOOD / BOM: 533155): Inflation Bites as They Aggressively Expand Domino’s Pizza) are facing inflationary headwinds; but there are still reasons to be optimistic about or to take a closer look at both stocks.

Subscribe Now Via Substack

EM Stock Pick Tear Sheets Region/Country TAGS

Stock Pick Compilation Posts, Africa, Argentina, Chile, China, Colombia, Eastern Europe, Guyana, Hong Kong, India, Indonesia, Japan, Latin America, Macau, Malaysia, Mexico, Middle East, Nigeria, Poland, Singapore, South Africa, Southeast Asia, South Korea, Turkey & United Arab Emirates (UAE)

EM Stock Pick Tear Sheets Sector TAGS

Stock Pick Compilation Posts, Alcohol Stocks, AI Stocks, Auto Stocks, Bank Stocks, Battery Stocks, Biotech Stocks, Casino Stocks, Consumer Stocks, Financial Services Stocks, Fintech Stocks, Food & Beverage Stocks, Gaming Stocks, Health Care Stocks, Hospitality Stocks, Industrial Stocks, Insurance Stocks, Internet Stocks, Investment Holding Company Stocks, IT Services Stocks, Meme Stocks, Oil Stocks, Property Developer Stocks, Real Estate Stocks, REITs, Restaurant Stocks, Retail Stocks, Semiconductor Stocks, Tech Stocks & Telco Stocks

PAYWALLED

- Grand Parade Investments (JSE: GPL): A Horseracing Enthusiast Takes Control of a Solid Casino Gaming Platform Ready for Buildout $

- moneycontrol India Stock of the Day (May 2023) Partly $

- Includes: Indraprastha Gas (IGL), Star Health & Allied Insurance, Aditya Birla Capital, Amber Enterprises, Apcotex Industries, Coromandel International, CEAT Ltd, Karur Vysya Bank, Godrej Consumer Products, Devyani International, Sona BLW Precision Forgings, Home First Finance, KEC International, Crompton Greaves, CMS Info Systems, PI Industries, CSB Bank, IndusInd Bank, Laurus Labs & Tata Consumer Products

- Kangwon Land (KRX: 035250): Shares Are Still Down Despite a Mass Gaming Revenue Recovery $

- Champ Resto (IDX: ENAK): Indonesia’s Restaurant National Champion? $

- AmRest (WSE: EAT / FRA: 1QT / OTCMKTS: ARHOF): A Leading European Restaurant Operator Still Below Pre-COVID Highs $

NON-PAYWALLED

(NOTE: Forward P/Es, dividend yields, and charts are from June 30th):

Sun International (JSE: SUI / FRA: RY1B): On a Roll as Casino Gamblers Return Plus New Market Expansion Plans

Sun International South Africa (Pty) Ltd (JSE: SUI / FRA: RY1B) is a South African resort company who pioneered casino gaming in Southern Africa and owns the iconic Palace of The Lost City at Sun City. With COVID out of the way, gamblers have returned plus the Company is expanding into new markets e.g. they have online sports betting and casino licenses to operate in other African markets.

- P/E (Google Finance): 15.48 / Trailing P/E (Yahoo! Finance): 15.69 (no trailing P/E)

- Dividend Yield (Google Finance): 6.94% / Forward Dividend & Yield (Yahoo! Finance): 14.04%

Southern Sun (JSE: SSU): Almost Normalcy for Southern Africa’s Leading Hospitality Stock

Southern Sun (JSE: SSU) is the leading hospitality company in southern Africa with 90 hotels across all sectors of the market in South Africa, Africa, the Seychelles and the Middle East. Almost all regions are back to pre-COVID levels albeit the Company is unsure what the impact of a winter with a severely constrained electricity system will be for the South African market.

Prior to 2011, Tsogo Sun Holdings owned and operated two divisions: Southern Sun Hotel Interests and Tsogo Sun. On 24 February 2011, Tsogo Sun Holdings concluded a merger with and reverse listing through Gold Reef Resorts. Since the unbundling of its business into separate hotels and gaming interests in June 2019, Southern Sun and Tsogo Sun Ltd (JSE: TSG / FRA: G5E) have been listed separately on the JSE (See: Tsogo Sun Ltd (JSE: TSG / FRA: G5E): Africa’s Biggest Casino Operator is Getting Bigger)

- P/E (Google Finance): 8.12 / Trailing P/E (Yahoo! Finance): 17.76 (no forward P/E)

- Dividend Yield (Google Finance): N/A / Forward Dividend & Yield (Yahoo! Finance): N/A

Tsogo Sun Ltd (JSE: TSG / FRA: G5E): Africa’s Biggest Casino Operator is Getting Bigger

Tsogo Sun Ltd (JSE: TSG / FRA: G5E) is South Africa’s largest hospitality company, the only casino, hotel and entertainment group in the top 100 companies of the JSE, and it’s Africa’s biggest casino operator. Despite loadshedding (blackouts), the Company recently reported higher earnings and a bumper dividend as it expands its hotel footprint.

- P/E (Google Finance): 7.55 / Trailing P/E (Yahoo! Finance): 7.51 (no forward P/E)

- Dividend Yield (Google Finance): 6.92% / Forward Dividend & Yield (Yahoo! Finance): 8.43%

Devyani International (NSE: DEVYANI / BOM: 543330): Yum’s Largest Franchisee in India Hopes for a Rebound Amid Signs Inflation is Stabilizing

Devyani International (NSE: DEVYANI / BOM: 543330) is Yum! Brands’ largest (on a non-exclusive basis) franchisee for KFC & Pizza Hut in India, plus they operate Costa Coffee, have developed their own South Indian concept, and operate food courts. They have also expanded operations to Nepal and Nigeria (only KFC).

For the financial year ended March 2023, Devyani International reported record revenues, the highest-ever margins and record profits. However, Q1 results were more nuanced with net profit down 20%, but revenue was up 28%.

- P/E (Google Finance): 87.34 / Trailing P/E (Yahoo! Finance): 86.69 (no forward P/E)

- Dividend Yield (Google Finance): N/A / Forward Dividend & Yield (Yahoo! Finance): N/A

Sapphire Foods (NSE: SAPPHIRE / BOM: 543397): Institutional Shareholders Remain Bullish as They Buy More Shares

Sapphire Foods (NSE: SAPPHIRE / BOM: 543397) is one of the largest franchisees of Yum! Brands in the subcontinent, operating more than 700 KFC, Pizza Hut and Taco Bell restaurants across India, Sri Lanka (where it’s the largest international QSR chain) and the Maldives.

Demand softness leads to weaker same-store-sales growth for the latest reported quarter. However, this week’s block purchases of shares by 14 institutional investors and funds such as Goldman Sachs and Nomura have improved sentiment for the stock.

- P/E (Google Finance): 37.89 / Trailing P/E (Yahoo! Finance): 38.86 (no forward P/E)

- Dividend Yield (Google Finance): N/A / Forward Dividend & Yield (Yahoo! Finance): N/A

Jubilant FoodWorks (NSE: JUBLFOOD / BOM: 533155): Inflation Bites as They Aggressively Expand Domino’s Pizza

Jubilant FoodWorks (NSE: JUBLFOOD / BOM: 533155) is India’s largest foodservice company and holds the exclusive master franchise rights from Domino’s Pizza Inc. to develop and operate the Domino’s Pizza brand in India, Sri Lanka, Bangladesh and Nepal. The Company also has exclusive rights to develop and operate Dunkin’ restaurants in India and Popeyes restaurants in India, Bangladesh, Nepal and Bhutan; plus has created it’s own Chinese concept.

In the most recent earnings report, Jubilant Foodworks reported a near-71% slump in quarterly profit as the Domino’s Pizza’s Indian franchisee incurred higher expenses and inflation-hit consumers cut back on discretionary spending. Nevertheless, the Company is expanding aggressively to new cities – opening 250 new stores for Domino’s during fiscal 2023.

- P/E (Google Finance): 93.30 / Forward P/E (Yahoo! Finance): 56.50

- Dividend Yield (Google Finance): 0.24% / Forward Dividend & Yield (Yahoo! Finance): 0.24%

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Stock Pick Tear Sheets (June 19-30, 2023) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Emerging Market Stock Pick Tear Sheets (May 1-14, 2023)

- Sun International (JSE: SUI / FRA: RY1B): On a Roll as Casino Gamblers Return Plus New Market Expansion Plans

- Emerging Market Stock Pick Tear Sheets (July 1-15, 2023)

- Restaurant Brands Asia Ltd (NSE: RBA / BOM: 543248): Inflation Pains as Expansion Continues in India and Indonesia

- Tsogo Sun Ltd (JSE: TSG / FRA: G5E): Africa’s Biggest Casino Operator is Getting Bigger

- Southern Sun (JSE: SSU): Almost Normalcy for Southern Africa’s Leading Hospitality Stock

- Business Day TV Daily Stock Picks (September 2023)

- Emerging Market Stock Pick Tear Sheets (May 15-28, 2023)

- Business Day TV Daily Stock Picks (June 2023)

- Business Day TV Daily Stock Picks (July 2023)

- Emerging Market Stock Pick Tear Sheets (April 2023)

- Emerging Market Stock Pick Tear Sheets (June 1-18, 2023)

- Business Day TV Daily Stock Picks (August 2023)

- Sapphire Foods (NSE: SAPPHIRE / BOM: 543397): Institutional Shareholders Remain Bullish as They Buy More Shares

- Devyani International (NSE: DEVYANI / BOM: 543330): Yum! Brands’ Largest Franchisee in India Hopes for a Rebound Amid Signs Inflation is Stabilizing