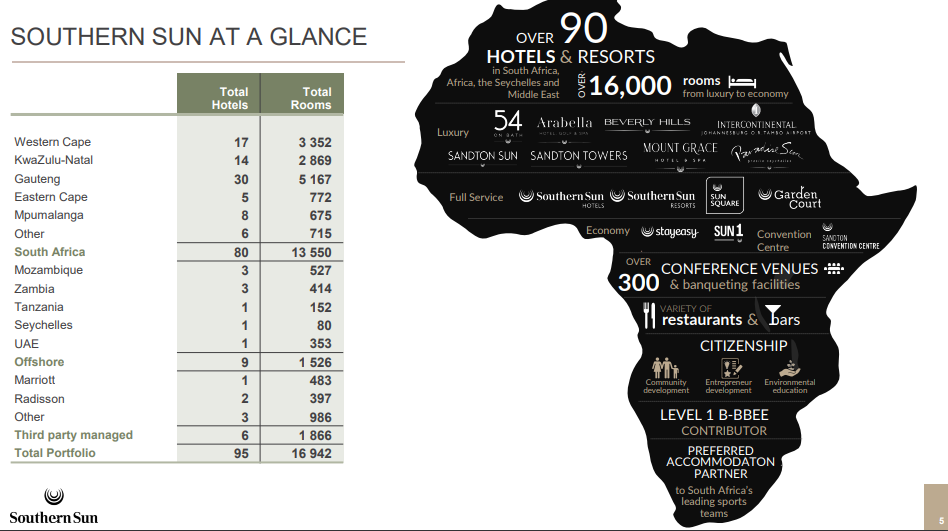

Southern Sun (JSE: SSU) is the leading hospitality company in southern Africa with 90 hotels across all sectors of the market in South Africa, Africa, the Seychelles and the Middle East. Almost all regions are back to pre-COVID levels albeit the Company is unsure what the impact of a winter with a severely constrained electricity system will be for the South African market.

OVERVIEW:

- Prior to 2011, Tsogo Sun Holdings owned and operated two divisions: Southern Sun Hotel Interests and Tsogo Sun. On 24 February 2011, Tsogo Sun Holdings concluded a merger with and reverse listing through Gold Reef Resorts. Since the unbundling of its business into separate hotels and gaming interests in June 2019, Southern Sun and Tsogo Sun Ltd (JSE: TSG / FRA: G5E) have been listed separately on the JSE (See: Tsogo Sun Ltd (JSE: TSG / FRA: G5E): Africa’s Biggest Casino Operator is Getting Bigger)

- Today, Southern Sun Limited is the leading hospitality company in southern Africa. Combining an established 50-year heritage with a professional and energised approach, the group proudly encompasses over 90 hotels across all sectors of the market in South Africa, Africa, the Seychelles and the Middle East.

- The Key shareholder is Hosken Consolidated Investments Limited (JSE: HCI / OTCMKTS: HKCIF), a JSE listed investment holding company. The Hosken Consolidated Investments (“HCI”) shareholding provides the bulk of the Broad-based Black Economic Empowerment (“B-BBEE”) ownership at group level.

- Tsogo Sun Corporate History Video (YouTube) 12:54 Minutes – Feb 2014

- A look back at the history of Southern Sun / Tsogo Sun.

RECENT FINANCIALS / NEWS:

- SOUTHERN SUN INVESTOR PRESENTATION May 2023

- Trading levels continued to recover, particularly in the second half of the financial year, as local and international travel patterns normalised and demand for conferencing and events increased. All regions performed well and exceeded FY20 (pre-Covid-19) levels except the Sandton node, reflecting the delayed recovery in corporate transient travel exacerbated by many companies in the node still operating a hybrid remote-working model.

- Notwithstanding the upward trend in trading and return to normalised travel patterns, the group remains heavily exposed to the South African economy which faces slow GDP growth, high unemployment and a lack of policy certainty and solutions to the country’s ongoing energy crisis from government – the continuous load shedding has a detrimental impact on consumer and corporate sentiment.

- Luxury hotel guests have proven more resilient to prevailing economic pressures such as inflation and rising interest rates, being influenced more by location and personal preference rather than price.

- We are encouraged by trading levels over the last six months which have continued into April and May 2023.

- The impact of a winter with a severely constrained electricity system is unknown.

- Having successfully strengthened the group’s balance sheet over the past year, we are able to withstand short-term trading volatility but will continue to maintain the discipline of managing liquidity and capital allocation prudently.

- The group’s strategy is to continue reducing debt levels and making the most of the properties we have in our portfolio, many of which are irreplaceable, and to focus on our customer delivery.

- Commentary (REVIEWED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2023)

- The directors considered it prudent to retain cash resources to ensure that the group can meet its obligations until trading and occupancies normalise and the threat of increased load shedding during winter subsides. Accordingly, the directors have not declared a final cash dividend for the year ended 31 March 2023.

- Watch: Southern Sun swings to profit (YouTube) 6:52 Minutes (Business Day) May 2023

- Southern Sun is back in the black. The hotel group has delivered annual profit of over R1 billion from a loss of R156 million previously, as it benefitted from a recovery in the travel and tourism industry. Business Day TV unpacked the performance with CEO Marcel von Aulock.

- WATCH: Stock Picks – Southern Sun, City Lodge and Sun International (Youtube) 14:45 Minutes (Business Day) May 2023

- Watch: Southern Sun says trading levels have been encouraging (YouTube) 6:39 Minutes (Business Day) November 2022

- Hotels group Southern Sun says trading levels during its first half have been encouraging with occupancy increasing to 46% from 22% in the prior comparative period. The group has also returned to profitability with adjusted headline earnings of R17m. Business Day TV unpacked the results in detail with Southern Sun CEO, Marcel von Aulock.

KEY RATIOS:

- P/E (Google Finance): 8.92 / Trailing P/E (Yahoo! Finance): 19.60 (no forward P/E)

- Dividend Yield (Google Finance): N/A / Forward Dividend & Yield (Yahoo! Finance): N/A

1 YEAR CHART:

LONG TERM CHART:

ADDITIONAL RESOURCES:

- Website

- Investor Relations

- Wikipedia

- Tsogo Sun Corporate History Video (YouTube) 12:54 Minutes – Feb 2014

- SOUTHERN SUN INVESTOR PRESENTATION May 2023

- Commentary (REVIEWED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2023)

- Watch: Southern Sun swings to profit (YouTube) 6:52 Minutes (Business Day) May 2023

- WATCH: Stock Picks – Southern Sun, City Lodge and Sun International (Youtube) 14:45 Minutes (Business Day) May 2023

- Watch: Southern Sun says trading levels have been encouraging (YouTube) 6:39 Minutes (Business Day) November 2022

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Similar Posts:

- Tsogo Sun Ltd (JSE: TSG / FRA: G5E): Africa’s Biggest Casino Operator is Getting Bigger

- Sun International (JSE: SUI / FRA: RY1B): On a Roll as Casino Gamblers Return Plus New Market Expansion Plans

- Business Day TV Daily Stock Picks (September 2023)

- Spur Corporation Ltd (JSE: SUR): Owns South Africa’s “Official Restaurant” and Has Produced Sizzling Results

- Pick ‘n Pay (JSE: PIK / FRA: PIK): Value Stock Characteristics as South Africa Continues to Deteriorate

- Famous Brands (JSE: FBR): Africa’s Leading Vertically Integrated Restaurant Operator With Rising Earnings

- South Africa Business Confidence Hits a 9-year Low (BusinessReport)

- Business Day TV Daily Stock Picks (June 2023)

- Pick n Pay Plans to go Big in Africa (Business Report)

- Business Day TV Daily Stock Picks (August 2023)

- Business Day TV Daily Stock Picks (July 2023)

- Business Day TV Daily Stock Picks (October 2023)

- Curro Holdings (JSE: COH / FRA: 24P): Performing Significantly Better After Expanding Too Quickly

- South Africa’s Economic and Potential Downgrade Woes (Bloomberg)

- YPO CEO Survey: Africa CEO Confidence at 5-year Low (YPO)