According to the latest mining report (Mine 2014: Realigning expectations) from PricewaterhouseCoopers, emerging market mining companies contributed aggregate net profits of $24 billion in 2013, down from $39 billion in 2012, compared with those from developed economies which reported a $4 billion net loss, down from 2012’s $33 billion net profit.

Developed economy mining companies also paid $21 billion in dividends while emerging market mining companies paid $20 billion at a far superior yield. However:

“Companies from developed economies appear to have collectively fallen into a place where dividends must be paid despite diminished profitability, that they must at least equal last year and that surplus earnings be automatically returned to shareholders. In contrast companies from the developing markets still recognise that dividends are discretionary and must be closely aligned to profitability. At some point, if conditions remain poor, the market will need to be tested and the dividend tap turned off.”

In general though, last year was not a good year for mining companies because of:

- Decade-low profits, down 72%.

- Record $57 billion in impairments, gold worst.

- Costs up, revenues stagnate.

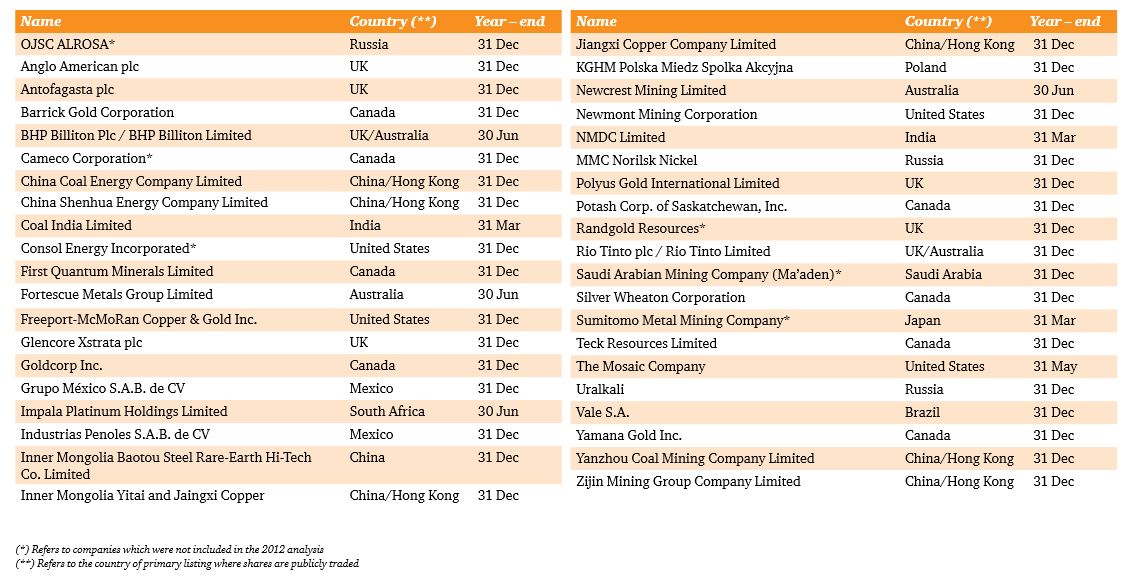

It should also be said that for the first time, the bulk (53%) of PwC’s Top-40 comprises of mining companies from emerging markets – another trend that’s expected to continue.

To read the whole article, Global Mine 2014: Top 40 Bite the Bullet, which summarizes the report, go to the website of PricewaterhouseCoopers Australia. In addition, the actual report (Mine 2014: Realigning expectations) can be downloaded here.

Similar Posts:

- Asia and Emerging Markets Had the Worst Dividend Growth Rates for 1Q2014 (FE Trustnet)

- The World in 2050 (PWC)

- South Africa’s Broken Mining Labor Model (BD)

- PwC Predicts South Africa’s Economic Rebound Could More Than Double GDP (Business Report)

- The Golden Era for Investing Could Be Ending (Bloomberg)

- With China on ‘Extended’ Path to Reopening, Emerging Market Equities Will Outperform Peers in Developed Economies, Record Double-digit Growth, Allspring Analyst Says (SCMP)

- What the HSBC Earnings Report Tells Us About Emerging Markets (Forbes)

- Iron Ore, Gold Rush Push South Africa’s Miners to 11-Year High (Bloomberg)

- Copper Mining Opportunities in Peru and Chile (Mobius Blog)

- Outlook on Emerging Markets (Lazard AM)

- What Explains Emerging Markets’ Relatively Low COVID-19 Fatality Rate? (LGIM)

- Emerging Markets Back in Favour Among European Investors (Citywire)

- China Offers Tax Incentives to Persuade U.S. Companies to Stay (NYT)

- Invest in Poorer Performing Emerging Markets for Better Gains? (CNBC)

- Private Equity Floods into Southeast Asia (Nikkei Asian Review)