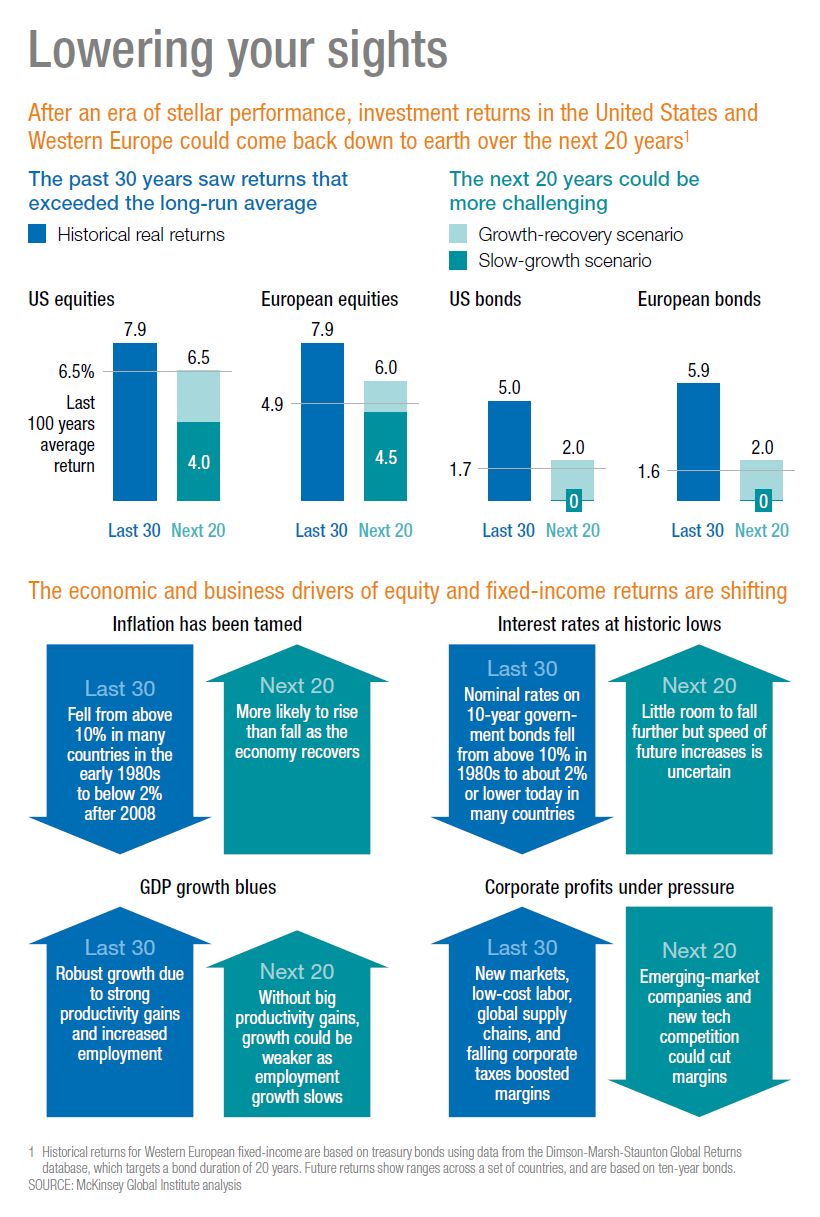

A new McKinsey Global Institute (MGI) report, Diminishing returns: Why investors may need to lower their expectations, finds that the forces that have driven exceptional returns are weakening, and in some cases reversing. The consulting company maintains that the last 30 years have been a “golden era” of exceptional inflation-adjusted returns thanks to a confluence of factors that won’t be repeated, including falling inflation and interest rates, swelling corporate profits and an expanding price-earnings ratio in the stock market.

Moreover, U.S. and European corporations will find it harder to boost profits in the face of stepped-up competition from Asian and other emerging market companies as well as from smaller businesses able to tap into the global market through the Internet.

This means that investors of all ages need to resign themselves to diminished gains.

The report includes a number of interesting charts, graphs and the following infographic:

Bloomberg also had the following segment with one of the study’s authors:

Bloomberg also had the following segment with one of the study’s authors:

For further reading, see End of Golden Era for Investors Spells Troubles for Millennials, and Why investors may need to lower their sights, on the websites of Bloomberg and McKinsey Global Institute, respectively.

Similar Posts:

- The “Next 15″ Will Drive 80% of Emerging Market Growth by 2025 (Luxury Daily)

- Five-Year Capital Market Outlook: Asia (Willis Towers Watson)

- UBS’s Raphael: A Hard Time For Emerging Markets Investing (Bloomberg)

- Miners From Emerging Markets Outperform Peers From Developed Countries (PwC)

- Why Tencent’s Golden Share Arrangements Could Be Worse for Investors Than Alibaba’s (China Tech Shorts)

- Asia Infrastructure Investment Returns Are Shrinking (FinanceAsia)

- Morgan Stanley: Emerging Market Pillars Seem to be Crumbling

- Brazil Slightly Lower in the Latest Global Competitiveness Report

- The Definition of Successful Investing to Affluent Chinese (The Asset)

- Asia Equities: Three Trends Driving Investor Optimism (PineBridge Investments)

- Ruchir Sharma’s Guiding Principles for Emerging Market Investing (Bloomberg)

- Structural Change in Emerging Markets: 4 Key Forces to Understand (Wellington Management)

- Taking the Lead: How China is Driving the Global Economy and Creating Opportunities (UBS)

- Infographic: Investors Shun Emerging Market Funds (WSJ)

- Frontier Market ETFs Have 72% Exposure to Oil-Dependent Countries (FT Adviser)