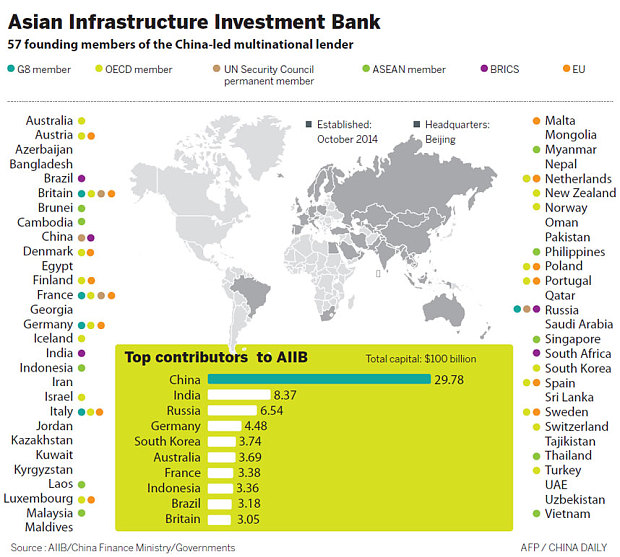

The China-backed Asian Infrastructure Investment Bank (AIIB), viewed as a rival to the World Bank and Asian Development Bank, was formally established on Friday, has recently been formally established and is expected to begin operations next year. The United States and Japan, the world’s largest and third-largest economies, respectively, have declined to join the bank, but other key US allies such as Australia, Britain, Germany, Italy, the Philippines and South Korea are taking part.

China will be by far the largest AIIB shareholder at about 30% with the bank initially to focus on financing projects in power, transportation and urban infrastructure in Asia.

To read the whole article, China establishes rival to World Bank, go to the website of The Telegraph.

Similar Posts:

- China’s Global Economic Footprint Via Chinese Financial Institutions (Eurasia Group)

- The 40 Biggest Chinese Stocks Being Added to the MSCI Index (Fortune)

- US-Chinese Business Partnerships Are Thriving (Kraneshares)

- Huawei Turns to Mobile Chip Rivals to Beat US Pressure (Nikkei Asian Review)

- Podcast: A Beginner’s Guide to Investing in China (KraneShares)

- Beijing’s Regulatory Crackdown Is Unlikely to End Any Time Soon (CIGI)

- China’s Investment Managers Abandon the Retail Market to Focus on Wealth Management Market (FT)

- World Bank Cuts China Growth Forecast as COVID-19, Real-estate Crunch Take Toll (WSJ via Fox Business)

- Russia, Kazakhstan and China are Buying Gold (The Diplomat)

- China Loses #2 Creditor Rank to Germany (Bloomberg)

- China and India to Overtake U.S. Economy This Century (Bloomberg)

- The Surprising Secrets of Growth in Emerging Markets (City Wire: The Funds Fanatic Show)

- China’s Mutual Funds Industry Now the Second Biggest in Asia (The Asset)

- China Investing in the Year of the Dog (GAM Investments)

- China’s Year of the Dog Bounds Into View (Allianz Global Investors)