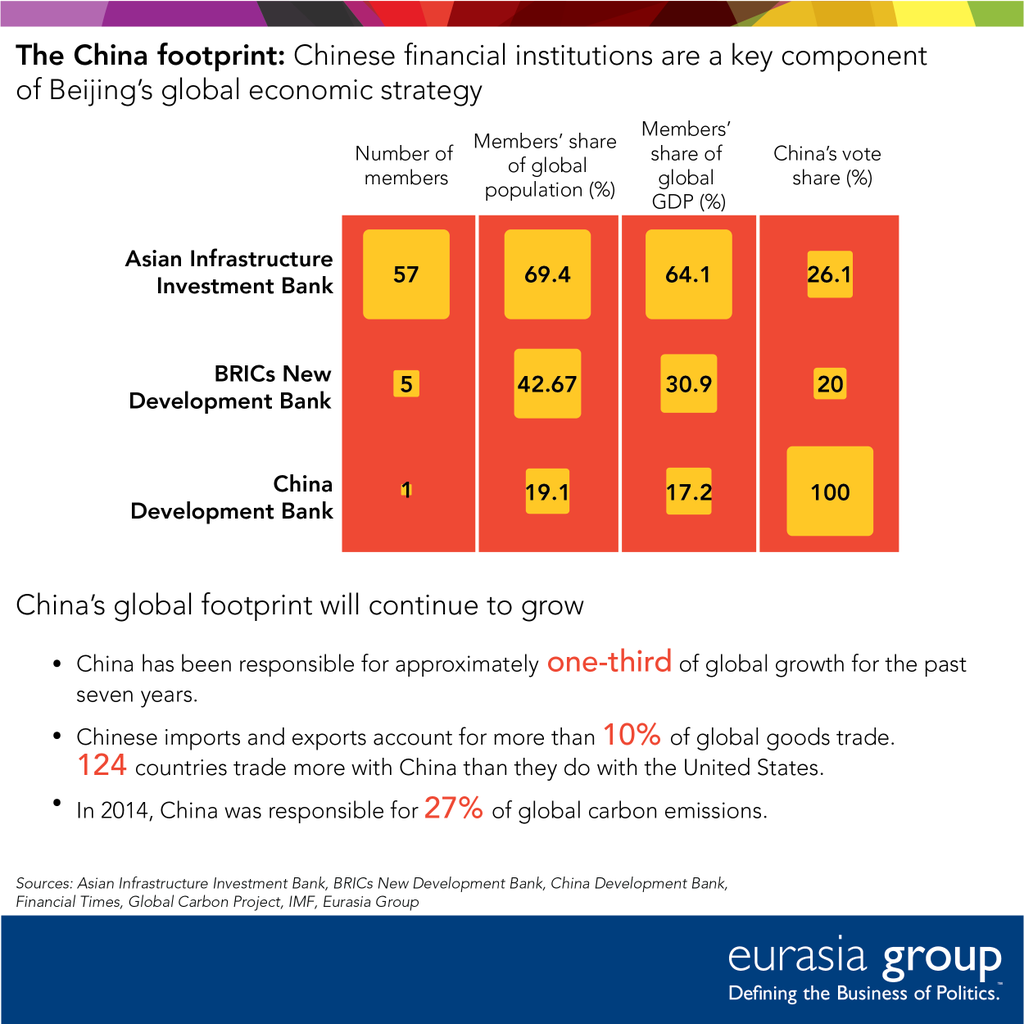

The Eurasia Group, the world’s largest political risk consultancy, recently tweeted this infographic showing how China’s global economic footprint is expanding via Chinese financial institutions. Those institutions would include the Asian Infrastructure Investment Bank (AIIB), (See: Asian Infrastructure Investment Bank (AIIB) Members Infographic (The Telegraph)), the New Development Bank BRICS (NDB BRICS) and the China Development Bank. Note that the United States has no say in any of these financial institutions while the AIIB has attracted a number of traditional US allies as members – despite lobbying or pressure from the US government not to join.

Similar Posts:

- Asian Infrastructure Investment Bank (AIIB) Members Infographic (The Telegraph)

- Top Risks 2019: Bad Seeds (Eurasia Group)

- All the Emperor’s Men: How Xi Jinping Became China’s Unrivalled Leader — and How he Plans to Expand His Power Base (Financial Times)

- The World in 2050 (PWC)

- Shanghai Putailai New Energy Tech (SHA: 603659): Financing Europe’s Biggest Anode Plant in Sweden for EV Batteries

- The Coming Eurasian Century: Russia and China are De-Dollarizing. Is “Pipelineistan” Coming?

- Norway’s Sovereign Wealth Fund Slows Emerging Market Investment (Bloomberg)

- The 40 Biggest Chinese Stocks Being Added to the MSCI Index (Fortune)

- China’s Investment Managers Abandon the Retail Market to Focus on Wealth Management Market (FT)

- Fidelity China Special Sits Trust: Four China Investment Themes (FE Trustnet)

- The Surprising Secrets of Growth in Emerging Markets (City Wire: The Funds Fanatic Show)

- Will the Russia-China Gas Deal Give Japan Energy Security? (Reuters)

- ‘Once-in-a-lifetime Opportunity’: How a Mass Lockdown at the World’s Biggest iPhone Factory is India’s Big Chance to Beat out China as Apple’s Favorite Supplier (Fortune)

- China Still Leads the BRICs in the Global Competitiveness Report

- China and India to Overtake U.S. Economy This Century (Bloomberg)