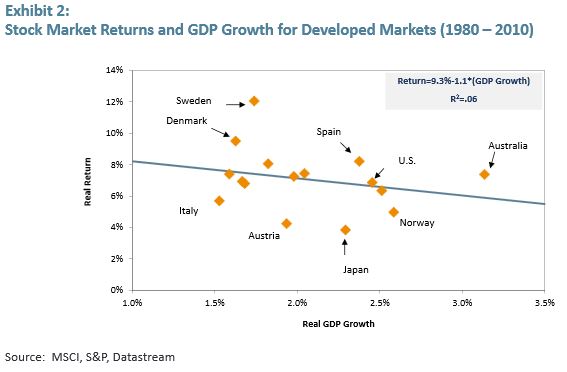

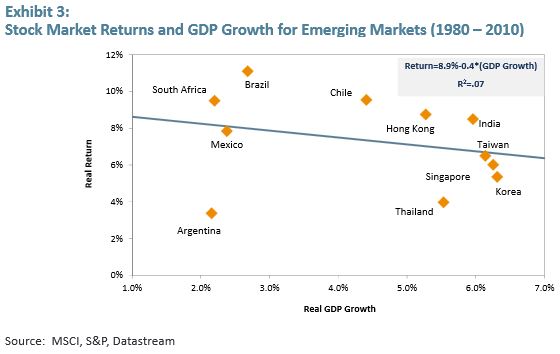

Investing in a country because you expect it to have strong GDP growth in the long term is a bad idea – even if your prediction is an accurate one. That’s according to an article in the latest quarterly report from global investment management firm GMO LLC.

Specifically, the article pointed out that in the 30 years from 1980-2010, developed countries that actually had the fastest GDP growth had a slight tendency to under perform those that had the slowest growth and this same pattern held true for emerging markets. For example:

The two developed countries with the strongest EPS growth between 1980 and 2010 were Sweden and Switzerland, which each had lower than average GDP growth. Canada and Australia, which saw the strongest GDP growth, showed very little aggregate EPS growth. Why? A big reason is dilution. Canada and Australia saw strong growth from their commodity producing sectors, but that growth came from massive investment, which was funded by diluting shareholders. Switzerland and Sweden did not invest as much and did not dilute their shareholders, leaving shareholders better off despite lower economic growth.

To read the whole article, GMO Quarterly Letter: Ditch the Good, Buy the Bad and the Ugly, go to the website of GMO LLC.

Similar Posts:

- Sustained Growth Slowdown in China Would Spill Over to Asia-Pacific Region and Beyond (Moody’s Talk)

- Aging will Reduce Economic Growth Worldwide in the Next Two Decades (Moody’s)

- Emerging Markets Strategy Feb 2018: Volatility Returns, Fundamentals Stay Strong (JP Morgan)

- Debunking Myths of Investing in Israel (Aberdeen Asset Management)

- EM Fund Stock Picks & Country Commentaries (June 30, 2024)

- Look at Stock Returns Rather Than GDP Growth Figures (II)

- China: Jan-Feb Data Better Than Expected (Pictet Wealth Management)

- Emerging Market Investing: Remember Demographics and Take a Selective Approach (ThinkAdvisor)

- Artemis’ Edelsten: Emerging Markets are Expensive With the Exception of China (What Investment)

- Why invest in Latin American Stocks? (Aberdeen)

- BNP Paribas’ Chi Lo: Patient Investors Should Build Up China Exposure Now (CMN)

- Terry Smith: Emerging Markets to Outperform Over the Long-term But Brace for Volatility (FE Trustnet)

- Ashmore Investment Management: Aggressive Western Foreign Policy Threatens Emerging Market Progress (funds europe)

- Mild Recession in the US may Aid Asian Markets Including India: Credit Suisse’s Dan Fineman (Money Control)

- Why Active Matters for Emerging Market Opportunities (MFS Investment Management)