A new Moody’s report entitled “Population Aging Will Dampen Economic Growth over the Next Two Decades” warns of a demographic tax that will slow economic growth over the next 20 years in both developed and emerging market economies as working-age populations shrink and household savings rates decline. Elena Duggar, a Moody’s Senior Vice President and one of the authors of the report, had this to say:

“Demographic transition, frequently considered a long-term problem, is upon us now and will significantly lower economic growth. Estimates show that aging will reduce aggregate annual economic growth by 0.4 percentage point in 2014-19 and by a much larger 0.9 percentage point in 2020-25.”

Madhavi Bokil, Assistant Vice President and another author of the report, said this:

“Policy reforms in the medium term which improve labor participations rates, streamline migration, and improve financial flows can partially mitigate the impact of aging on economic growth. Further, in the long term, innovation and technological progress that improves productivity have the potential to lessen the forecasted dampening effects of the rapid demographic changes.”

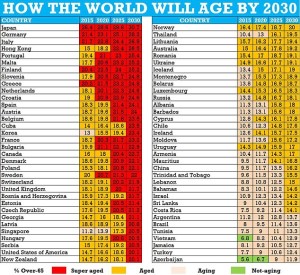

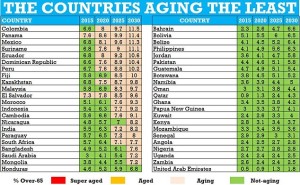

Aging is not just a developed-world problem as many emerging markets like Russia, Thailand, Chile and China have rapidly deteriorating demographics. Even relatively young countries such as Brazil and Turkey are aging. In fact, the pace of aging in some of these emerging market countries is more rapid than in developed economies.

The press release goes on to say:

Moody’s notes that by next year, over 60% of Moody’s-rated countries will be aging, with more than 7% of their population aged 65 or over. By 2020, super-aged societies (populations with more than 20% elderly) will increase to 13 globally from three today (i.e., Italy, Germany and Japan). By 2030, 34 countries will be super-aged.

Moody’s projects that growth in the working-age population of the world during 2015-30 will only be half that of the growth during the previous 15 years (i.e., 13.6% vs. 24.6%). All countries, except a handful in Africa, will face either a slower-growing or declining working-age population.

Worldwide aging will reduce economic growth via lower labor supply, and decline in savings rates that will reduce investment. It is estimated that a one percentage point rise in the old dependency ratio (i.e., the ratio of the population aged 65+ to the population aged 15-64), an indicator of aging, will lead to a 0.5-1.2 percentage points decline in the average savings rate which will affect investment adversely.

The Daily Mirror also published the following graphics presumably from the report:

To read the press release, Moody’s: Aging will reduce economic growth worldwide in the next two decades, go to the website of Moody’s. In addition, the Daily Mail has the following article: Super-aged Britain: One in five will be 65-plus in a decade…with dire economic impact, say experts

Similar Posts:

- Facing Demographic Doom, China’s Army Of Retirees Returns To Work In Post “Zero-Covid” Economic Wasteland (SCMP)

- Economic Prospects in Several Emerging Asia Countries (Wells Fargo Securities)

- Rapid Aging in Emerging Markets will Impact Consumer Spending (AllianceBernstein)

- Why China’s Marriage Crisis Is An Existential Threat To The Country (Epoch Times via Zero Hedge)

- As Emerging Market Growth Slows, Moody’s Thinks Advance Economies Will Drive Global Growth

- Investor Sentiment Survey: What Emerging Market Investors Think (Franklin Templeton)

- Ruchir Sharma’s Guiding Principles for Emerging Market Investing (Bloomberg)

- Emerging Asia Should Learn From Japan’s Demographic Experience (Nikkei Asian Review)

- IMF Warns of Emerging Markets Slowdown (FT)

- Emerging Market Investing: Remember Demographics and Take a Selective Approach (ThinkAdvisor)

- Why is Bangladesh Booming? (The Asset)

- FLASHBACK: Moody’s Downgrades Qatar Rating to Aa3 But Changes Outlook to Stable from Negative (Moody’s)

- Nielsen Global Survey of Consumer Confidence for Q1 2015

- Moody’s Downgrades Macao to Aa3 with Negative Outlook (Moody’s)

- Sustained Growth Slowdown in China Would Spill Over to Asia-Pacific Region and Beyond (Moody’s Talk)