The Franklin Templeton 2015 Global Investor Sentiment Survey results were recently released with investors in the US and Canada showing the highest optimism for local stocks (64%) while Latin American investors are the least optimistic that the stock market will finish the year in the black (46%). In fact, the number of Latin American investors that believe the stock market will decline has doubled since last year, but they still see stocks as being among the top-performing asset classes this year (following real estate).

Some other key findings or insights from the fifth annual survey include the following:

- Emerging market investors are much more likely to make changes to their investment portfolio this year compared to their developed market peers as well as nearly twice as likely to increase their fixed income allocations.

- In spite of the fact that emerging markets countries posted better average stock market returns than developed markets in 2014, emerging market investors are more likely to follow a more conservative strategy this year.

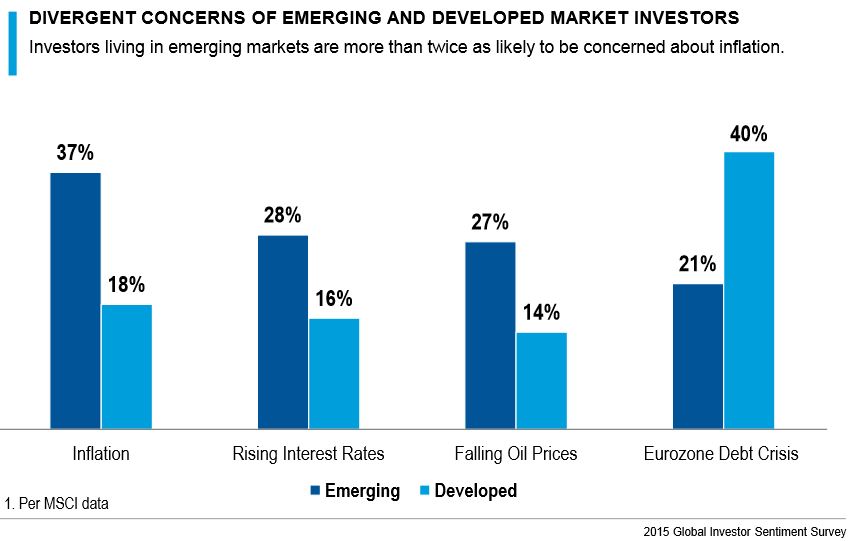

- Emerging market investor are more than twice as likely to be concerned about inflation plus nearly twice as likely to be concerned about rising interest rates and the effects of falling oil prices than developed market investors. On the other hand, developed market investors are nearly twice as likely to show concern over the fiscal situation in the Eurozone.

- Of the 22 countries included in the 2014 study, eight show higher levels of optimism and 14 either show no change or a decline in optimism since February of last year.

- Indian investors remain the most optimistic with 86% expecting their local stock market to rise and 97% either optimistic or very optimistic about the prospects of reaching their financial goals.

- Investors in China showed one of the most dramatic upward shifts in sentiment from last year with the survey showing a 12% jump in investor optimism.

- Investors in Brazil showed the most dramatic shift in sentiment to the downside among individual countries as the level of optimism there dropped 19% from last year’s survey.

- Emerging market investors along with those aged 25-34 years-old (aka the Millennial generation) show the highest appetite for foreign investments. Moreover, nearly seven in ten investors believe the best equity returns will be found outside their home countries this year with the largest portion looking at equity opportunities in the US and Canada.

To read a Mobius Blog summary, Investor Sentiment Around the World, or another summary with graphics entitled, What’s on the Minds of the World’s Investors?, or the report itself, 2015 Global Investor Sentiment Survey KEY INSIGHTS, go to the website of Franklin Templeton.

Similar Posts:

- Key Findings: Credit Suisse Emerging Markets Consumer Survey

- Emerging Market Investors Need to Think Beyond Investing in the BRICs (II)

- “Confidence Shaken:” US Firms In China Look Elsewhere As ‘Friendshoring’ Gathers Steam (Zero Hedge)

- India ETF Flows Touch $1.5 Billion, Highest Among its BRIC Peers (Economic Times)

- Artemis’ Edelsten: Emerging Markets are Expensive With the Exception of China (What Investment)

- Chart: Stock Market Capitalization as a Percent of GDP (Guggenheim Investments)

- New Fragile Five Facing a Forex Crisis: Argentina, Brazil, South Africa, Ukraine & Venezuela (Institutional Investor)

- Surviving the Pharma Drug Price Wars in Emerging Markets (PharmExec.com)

- Emerging Market Investors: Drop a Bric and Pick Up a Bimchip (Financial Times)

- Mark Mobius’s Emerging Markets Outlook (WSJ)

- Why Emerging Market Refrigerators Contain Cold Hard Economic Data (II)

- China Still Leads the BRICs in the Global Competitiveness Report

- Emerging Markets in the East Converging With Developed Markets in the West (Create Research)

- Emerging Market Stocks Advance on Reform Themes & Central Bank Expectations (Bloomberg)

- The Emerging Market Sand Trap: Financial Reports, Currency & Other Risks (Epoch Times)