Tassos Stassopoulos, a senior vice president and manager of the emerging consumer portfolio, as well as the global growth and thematic portfolio at AllianceBernstein in London, has written an interesting article for Institutional Investor about how what is inside refrigerators shows economic progression in emerging markets. Stassopoulos first explained that their field research has found shacks in Ghana crammed full of consumer electronics owned by people otherwise considered poor by any other measure, but kitchens actually offer a more honest reflection of household wealth.

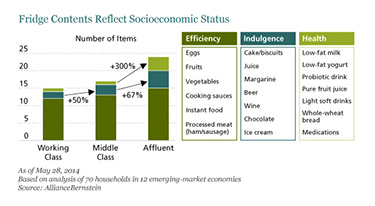

However, their analysis of 70 refrigerators in rural and urban homes in 12 emerging markets from Chile to China revealed key differences between consumers in each country and between social classes:

Their research suggests that Chinese consumers are in the indulgence phase where companies producing products like beer, butter and chocolates stand to benefit from rising incomes while Indian consumers are still filling their friges with efficiency items like milk, yogurt and ready-made sauces. Meanwhile, Brazilian consumers have shifted towards health mode that should benefit high-end food producers.

To read the whole article, Refrigerators in Emerging Markets Contain Cold, Hard Economic Data, go to the website of Institutional Investor.

Similar Posts:

- Emerging Market Investors Need to Think Beyond Investing in the BRICs (II)

- Best Consumer Stocks for Emerging Market Investors (Morningstar)

- Key Findings: Credit Suisse Emerging Markets Consumer Survey

- Investor Sentiment Survey: What Emerging Market Investors Think (Franklin Templeton)

- India ETF Flows Touch $1.5 Billion, Highest Among its BRIC Peers (Economic Times)

- Artemis’ Edelsten: Emerging Markets are Expensive With the Exception of China (What Investment)

- Emerging Market Stocks Advance on Reform Themes & Central Bank Expectations (Bloomberg)

- New Fragile Five Facing a Forex Crisis: Argentina, Brazil, South Africa, Ukraine & Venezuela (Institutional Investor)

- Margetts’ Ricketts: Low Oil Prices Mean Asia and Emerging Market Funds Can Keep Rallying (FE Trustnet)

- Surviving the Pharma Drug Price Wars in Emerging Markets (PharmExec.com)

- Kiplinger’s Personal: Don’t Give Up on Developing Markets (Kiplinger’s Personal Finance)

- GAM’s Love: Emerging Markets Might Double Your Money Over Four Years (FE Trustnet)

- “Confidence Shaken:” US Firms In China Look Elsewhere As ‘Friendshoring’ Gathers Steam (Zero Hedge)

- China Still Leads the BRICs in the Global Competitiveness Report

- Mark Mobius’s Emerging Markets Outlook (WSJ)