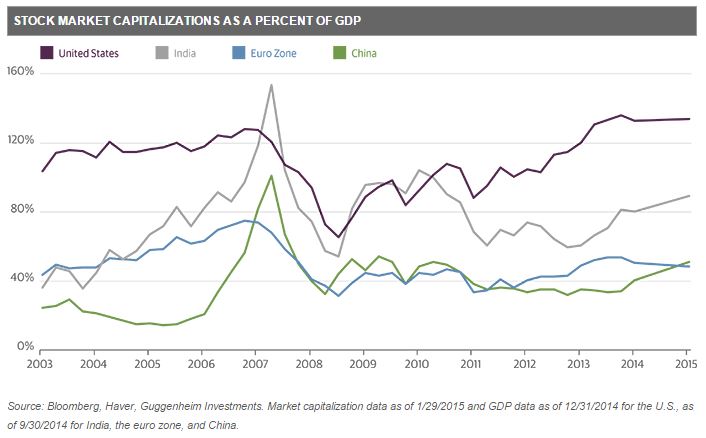

Guggenheim Investments’ Macro View for the end of January contained a great chart showing stock market capitalization as a percentage of GDP for the United States, India, the EuroZone and China. It was noted that US stock market capitalization as a percent of GDP is at its highest level since the third quarter of 2003, the year this global comparison data became available. The chart reveals that equity valuations in the euro zone, China and India appear much lower. However and as central banks in those countries implement policies to reflate their economies and structural reforms take hold, their stock markets could present more attractive opportunities over the longer term.

To read the whole accompanied article, Good Company, Bad Stock, go to the website of Guggenheim Investments.

Similar Posts:

- Chart: Chinese Margin Debt vs Other Stock Market Crashes (Guggenheim)

- Investor Sentiment Survey: What Emerging Market Investors Think (Franklin Templeton)

- How China has Dragged Down Investor Returns Over the Past Decade (Forbes India)

- Chart: Asia GDP Per Capita Has Risen Sharply Since 1960 (Aberdeen)

- Experts: Tread Carefully With Emerging Market Investments (FE Trustnet)

- No Improvement in Asia Pacific Corporate Payments in 2015 (Coface)

- India Is the ‘Best Bet’ in the Global Economy, Says Conglomerate Exec (CNBC)

- China Still Leads the BRICs in the Global Competitiveness Report

- Diageo’s emerging market problems deepen (FT)

- Foreign Investors Might Prefer China Soon as Indian Market Valuation Expensive (CNBC)

- Singapore’s GIC Bets on Emerging Market Technolgy Investments (Reuters)

- Sri Lanka’s Economy Has ‘Completely Collapsed’: PM (Zero Hedge)

- India Drops 11 Places to #71 in the Global Competitiveness Report

- ‘Once-in-a-lifetime Opportunity’: How a Mass Lockdown at the World’s Biggest iPhone Factory is India’s Big Chance to Beat out China as Apple’s Favorite Supplier (Fortune)

- Apple Plans to LEAVE China as COVID Protests Delay Production of Its Products: Tim Cook Could Move Factories to India and Vietnam After Brutal Lockdown at iPhone Plant Mean Key Deliveries Won’t Arrive in Time for Christmas (Daily Mail)