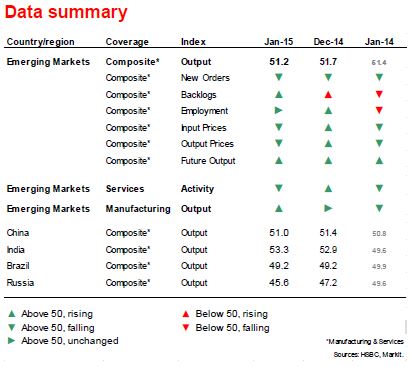

The HSBC Emerging Markets Index (EMI), a monthly indicator derived from the Purchasing Managers’ Index (PMI) surveys conducted by HSBC and Markit, fell back from December’s three-month high of 51.7 to 51.2, the joint-lowest since last May. The overall slowdown was driven by the weakest expansion in services activity in eight months. However, manufacturing output growth picked up to the fastest since August.

To read the whole report, HSBC Emerging Markets Index: Emerging markets start 2015 in low gear, go to the website of HSBC.

Similar Posts:

- HSBC Emerging Markets Index: EM Lose Pace in July Despite Manufacturing Pick-up (HSBC)

- What the HSBC Earnings Report Tells Us About Emerging Markets (Forbes)

- Hawksmoor Investment Management Manager Cutting Emerging Market Exposure (FE Trustnet)

- Societe Generale Survey: Fund Managers Turning Bearish on Emerging Markets (CNBC)

- Fund Manager Allocations to Emerging Markets Hit 22-month High (Livemint)

- Fund Managers’ Opinions on the UAE and Qatar’s Emerging Markets Upgrade (The National)

- Searching for Alpha Consistency in Emerging Market Equities (State Street)

- Brazil Consumer Confidence Falls in Latest Nielsen Survey

- British Investment Managers Increase Their Emerging Market Bets (Reuters)

- Renminbi’s Share of Global Payments Falls (The Asset)

- 49% of UK Investment Professionals Think Developed Country Equities are Overvalued (funds europe)

- Southeast Asia Set to Gain From Trade War Business Relocations (Nikkei Asian Review)

- Wealth Managers Struggle to Tap the Wealthy in Emerging Markets (II)

- How the MSCI Emerging Markets Index Changes Will Impact Investors (P&I)

- YPO CEO Survey: UAE Business Confidence Declines Significantly (YPO)