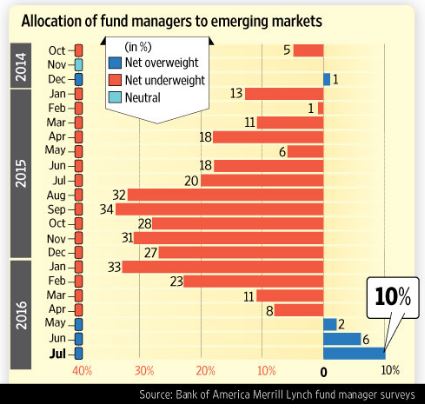

The July Bank of America Merrill Lynch survey of global fund managers, done between 8 and 14 July, shows that Brexit did change asset allocations away from euro zone stocks to US and emerging market stocks. Fund managers were also asked the following question:

Over the next twelve months, which region would you most like to overweight/underweight?

The answer: Long emerging markets/short UK.

In addition, cash holdings have risen to 5.8%, the highest level since November 2001, plus a record proportion of investors have hedged against a sharp fall in the equity markets in the next three months.

To read the whole article, Fund manager allocations to emerging markets at 22-month high, go to the website of Livemint.

To read the whole article, Fund manager allocations to emerging markets at 22-month high, go to the website of Livemint.

Similar Posts:

- Survey: Fund Managers Now Overweight on Emerging Market Equities (Live Mint)

- Changing Investor Attitudes About Emerging Markets (CNBC)

- Societe Generale Survey: Fund Managers Turning Bearish on Emerging Markets (CNBC)

- Carry Trade, Politics Boost Emerging Market Equities (Reuters)

- Allocation and Share of Institutional Investors in Emerging Market Funds (EM Equity)

- Investor Sentiment Survey: What Emerging Market Investors Think (Franklin Templeton)

- Emerging Markets Back in Favour Among European Investors (Citywire)

- Why Investing in Emerging Market Infrastructure Makes Sense (Wealth Daily)

- As Emerging Market Growth Slows, Moody’s Thinks Advance Economies Will Drive Global Growth

- Sovereign Wealth Funds Increase Investments in Emerging Markets (SCMP)

- Emerging Market Funds Hammer Developed Market Funds in July (Interactive Investor)

- Fund Managers Are Wary of “Cheap” Asian Stock Markets (FT Adviser)

- Diversifying Your Emerging-Markets Allocation (Aberdeen Standard)

- China’s Investment Managers Abandon the Retail Market to Focus on Wealth Management Market (FT)

- Obscure Stocks Make the Baron Emerging Markets Fund a Winner (Kiplinger)