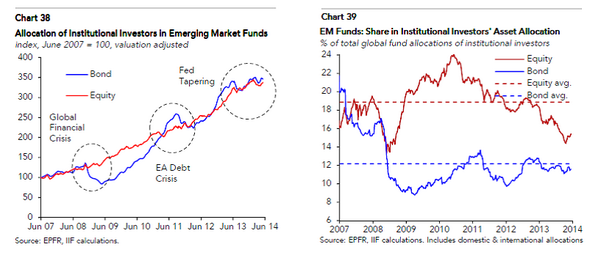

Emerging Market Equity has tweeted two great emerging market institutional investor graphics. The chart on the left shows the impact of the global financial crisis, the EA debt crisis and Fed tapering on institutional investor bond verses equity emerging market allocations while the chart on the right shows that since the end of the global financial crisis, the average institutional allocation to emerging market equity funds verses the total global fund allocation has fluctuated from a low of 14% to a high of around 24%:

Similar Posts:

- Allocation and Share of Retail Investors in Emerging Market Funds (EM Equity)

- Why a Financial Crisis is NOT Brewing in China (Institutional Investor)

- Emerging Markets Back in Favour Among European Investors (Citywire)

- Hungary, Poland, Mexico and South Korea Poised to Handle a Pull Back in US Monetary Stimulus (WealthManagement.com)

- The Impact of Emerging Market Currencies on Corporate America’s Earnings (Forbes)

- Emerging Market Investors Need to Think Beyond Investing in the BRICs (II)

- Emerging Market Small Caps: Hidden Gems in Plain Sight? (Wellington Management)

- The Impact of US Policy on Emerging Markets—Dollar Concerns “Overdone” (Franklin Templeton)

- How ETFs Amplify the Global Financial Cycle in Emerging Markets (Federal Reserve)

- New Fragile Five Facing a Forex Crisis: Argentina, Brazil, South Africa, Ukraine & Venezuela (Institutional Investor)

- Emerging Market Equity & Fixed Income Closed-End Funds List (Multiple Regions / Countries)

- Mark Mobius vs Passive Emerging Market Funds (CBS MoneyWatch)

- Why Fixed Income Investors Should Consider a Dedicated Allocation to Emerging Market Debt (PineBridge Investments)

- Emerging Market Bond ETF List

- Emerging Market Debt Outlook 2018: A Global Rebalancing is Due (Vontobel)