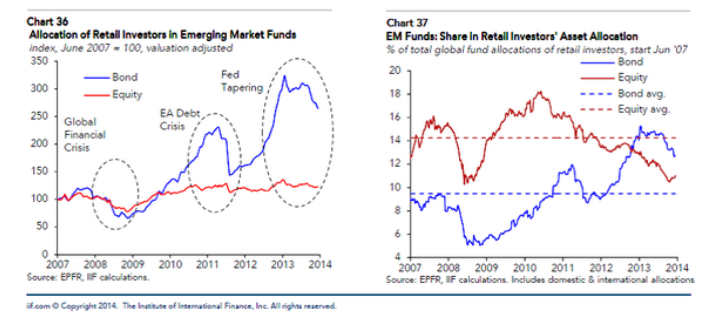

Emerging Market Equity recently tweeted two great emerging market retail investor graphics. The chart on the left shows that since 2009, retail investors have bought nearly three times more emerging market bond funds than equity funds while the chart on the right shows that since the global financial crisis, the average allocation in emerging market equity funds is around 14% and this allocation has fallen to almost 10% this year:

Similar Posts:

- Allocation and Share of Institutional Investors in Emerging Market Funds (EM Equity)

- Emerging Markets Back in Favour Among European Investors (Citywire)

- Emerging Market Small Caps: Hidden Gems in Plain Sight? (Wellington Management)

- Investor Sentiment Survey: What Emerging Market Investors Think (Franklin Templeton)

- Rplan Survey: Investors Have Been “Taken In” by Emerging Market Hype

- E Ink Holdings (TPE: 8069): Moving Beyond ePaper & the Amazon Kindle into Digital Retail Pricing Labels

- Why the MSCI Emerging Markets Index Has Some BIG Problems (WSJ)

- Private Equity Firms in Southeast Asia Are Cashing Out Faster (WSJ)

- 30 Years On From the Launch of the MSCI Emerging Markets Index (MSCI)

- Emerging Market Equity Closed-End Funds List (Multiple Regions / Countries)

- JPMorgan’s Mowat Talks About Iraq, EM Fund Flows and India (Economic Times)

- Lessons From a Decade of Chinese Stock Trading (WSJ)

- Emerging Market Equity & Fixed Income Closed-End Funds List (Multiple Regions / Countries)

- Emerging Market Stock Closed-End Funds List (All)

- Emerging Market Investors Need to Think Beyond Investing in the BRICs (II)