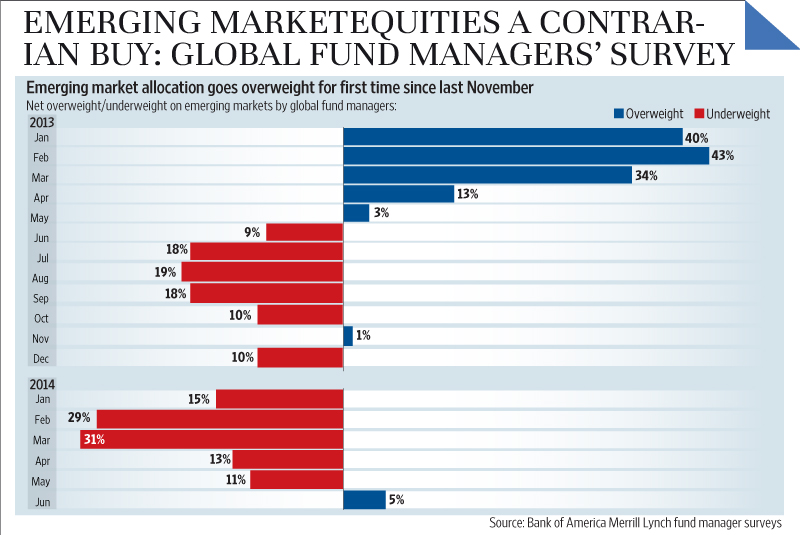

According to Live Mint, the latest Bank of America Merrill Lynch survey of global fund managers for June shows a net overweight for emerging market equities for the first time since November. Fund managers are also by far the most overweight on India among global emerging markets and that overweight has increased substantially in June as well.

To read the whole article, Emerging market equities a contrarian buy: global fund managers’ survey, go to the website of Live Mint.

Similar Posts:

- Fund Manager Allocations to Emerging Markets Hit 22-month High (Livemint)

- Hermes’ Greenberg: Overweight in India But Avoiding Modi Stocks (FE Trustnet)

- In Long Term Absolute Return Portfolio, I Have About 20 Stocks Which are Still Dominantly India: Chris Wood (The Economic Times)

- Experts: Tread Carefully With Emerging Market Investments (FE Trustnet)

- Investor Sentiment Survey: What Emerging Market Investors Think (Franklin Templeton)

- JPMorgan’s Mowat Talks About Iraq, EM Fund Flows and India (Economic Times)

- India Fund Managers Divided Over Whether Further Gains are Likely (FT)

- YPO CEO Survey: Asia CEO Confidence at 2-year Low (YPO)

- India Ranks Highest in Latest Nielsen Consumer Confidence Survey

- CLSA Equity Strategist Says India is the Best BRICs Investment Destination (LM)

- India to Offer More Investment Options Through ADRs (The Asset)

- Margetts’ Ricketts: Low Oil Prices Mean Asia and Emerging Market Funds Can Keep Rallying (FE Trustnet)

- moneycontrol India Stock of the Day (August 2023)

- Tech Sector Can Power Emerging Market Portfolios (FE Trustnet)

- Key Findings: Credit Suisse Emerging Markets Consumer Survey