The Chinese New Year holidays are mostly done while its a long weekend in the USA for Presidents’ Day (Washington’s Birthday). It remains to be seen whether the year of the Dragon will see government intervention and/or stabilization for the Chinese and Hong Kong stock markets.

Last week, Indonesia held elections. To avoid a runoff against his two rivals, Defense Minister Prabowo Subianto needs more than 50% of all votes cast and at least 20% in each of the country’s provinces. It looks like he will achieve that once all the votes are counted, but Western governments via Western corporate media are already telegraphing they don’t like the results:

- Once banned from the US, this fiery ex-army general is poised to lead Indonesia. What to expect (CNN)

- The Guardian view on Indonesia’s elections: Prabowo’s win is dismal news for democracy (The Guardian)

- Former Indonesian general linked to human rights abuses claims victory in presidential election (AP)

As briefly noted later in this post, the Edelman Trust Barometer 2023 found that 73% of Indonesians say they expect to be better off in five years (among the highest readings for any country). In contrast, only 36% of Americans and 23% of UK respondents said the same (decreases from the previous survey) – something CNN, AP and The Guardian might want to look into…

Meanwhile in South Africa, the CEO of a pork producer (Pork manufacturer Eskort is upbeat despite SA’s water, power crises) recently made this interesting observation increasingly applicable to developed countries:

“As you know, in this country the rules of the game have changed. If you don’t provide your own electricity, you don’t provide your own water, you’re going to have trouble. We spent R10m on this site to drill four boreholes and to put up a water purification plant. And that is money you lose on your bottom line. You get nothing for it when the government is supposed to supply you.”

Finally, the Emerging Market ETF Launches (3 for 2024) and Emerging Market ETF Closures/Liquidations (none) sections at the bottom of this post have been updated. I had also figured out why I could not save or publish new posts to my website (https://www.emergingmarketskeptic.com/ – some additional EM resources have been added to the front page) for the past few months and am almost finish publishing Substack posts there.

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🇰🇷 Mirae Asset Securities’ Korean Stock Picks (January 2024) Partially $

- Korean Air, Amorepacific Corp, LG Energy Solution, Daewoo Engineering & Construction, Samsung Engineering, SK Biopharmaceuticals, Lotte Data Communication, Kumho Petrochemical, Hotel Shilla, Hyundai Mobis, LG Innotek, Krafton, Aekyung Industrial, SK Hynix, LG Electronics, Korea Aerospace Industries, Hyundai Glovis, Samsung SDS, Hyundai Motor, Kia Corp, HanAll Biopharma, Lotte Rental, HD Hyundai Electric, Samsung Biologics, Jin Air, Lotte Data Communication, Hyundai Engineering & Construction, Hyundai AutoEver, Samsung SDS, NCSoft Corp, Wemade, SOCAR, Neowiz, Dio Corp, Joy City Corp, Hanmi Pharma, Chong Kun Dang Holdings, Cosmax Inc, Shinsegae Inc, Hyundai Department Store, KT Corp, BGF Retail, GS Retail, SK Telecom, LG Uplus, CJ Logistics, OCI Holdings, Lotte Chemical, Hanwha Solutions, DL E&C Co, Kakao, Shinsegae International, F&F Co, Samsung Electronics, Kolmar Korea & LX International

- EM Fund Stock Picks & Country Commentaries (February 18, 2024) $

- EM small cap stocks, HDFC Bank decline detracts from fund performances, the need to dig deep to find value in India, Alchip Technologies, Vivara Participacoes, Raia Drogasil, Coca-Cola Femsa, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 ZJLD Group (6979 HK): Fundamentals Intact; Share Price Wrongfully Punished (Smartkarma) $

See: ZJLD Group (HKG: 6979): IPO of the First Baijiu Maker to List Outside of China Flops

- Many China consumer stocks, including ZJLD Group (HKG: 6979), have been sold off heavily in the past 6 months, primarily driven by a fear of deflation and weak consumer sentiment.

- ZJLD Group is one of the exceptions, with fundamentals intact while share price heavily sold off.

- Shares look attractive vs. its high growth rate and strong management team, and especially with the return of Southbound connect post holidays.

🇨🇳 Autohome shifts into higher gear with NEVs and immersive tech (Bamboo Works)

- The Chinese car trading giant is expanding its network of high-tech showrooms where customers can check out various models in virtual reality

- Autohome (NYSE: ATHM)’s profits rose about 4% last year to 1.88 billion yuan

- The trading platform’s sales of new energy vehicles are soaring, jumping nearly 82% last year

🇨🇳 Cloopen closes the book on fraud case, looks to rebuild (Bamboo Works)

- The U.S. securities regulator charged the cloud services provider with fraud for falsifying revenue, but didn’t impose any fine due to the company’s cooperation in the investigation

- The SEC charged cloud services provider Cloopen Group Holding Ltd (OTCMKTS: RAASY) with falsifying revenue, but also praised it for cooperating with its investigation into the matter

- The company announced a major board overhaul in December, but faces a long road in its rebuilding effort due to stiff competition and China’s slowing economy

🇨🇳 Till death do us part: A multi-bagger in the funeral industry? (Atmos Invest – Hunting for 100-baggers)

- Fu Shou Yuan International Group (HKG: 1448 / OTCMKTS: FSHUF): the largest funeral operator in China.

- In 1994, it was one of the first death care companies that was created in China (most of them were run by the government).

- Can Fu Shou match the past performance of Service Corporation International (NYSE: SCI)? Let’s find out.

- We can see that the epicenter of the business is still in Shanghai where revenue has grown four-fold in 12 years. In 2010, Shanghai represented almost 70% of revenues, now it is still 50% of overall revenues for the company.

🇨🇳 China Sportswear (Anta, Li-Ning) – Part 1 (East Asia Stock Insights)

- China’s homegrown brands are the structural winners

- Part 1 of this report will examine the evolution of China’s sportswear industry and the relevant industry context. Importantly, we will discuss the key structural backdrops that underpin the compelling opportunities I see today in the Chinese sportswear companies.

- Part 2 will be a discussion on ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF) and Li Ning (HKG: 2331 / FRA: LNLB / FRA: LNL / OTCMKTS: LNNGY / LNNGF), delving into the company-specific factors. This part will also feature up-to-date insights from store visits that I conducted earlier this month in Beijing.

🇨🇳 Another Chinese Bubble Tea Chain Brews Hong Kong IPO (Caixin) $

- Chinese bubble tea chain Auntea Jenny has filed for a Hong Kong IPO, becoming the latest beverage brand to take advantage of a post-pandemic revival in consumer spending to spice up business.

- Auntea Jenny (Shanghai) Industrial Co. Ltd., the owner of the brand, plans to use the majority of the proceeds to boost digitalization and supply chain capabilities, as well as expand product offerings and upgrade equipment, according to its prospectus published by the Hong Kong Stock Exchange Wednesday.

🇨🇳 Tianjin Development Holdings (0882.HK) (Small Cap Value Investing with Phil)

Tianjin Development Holdings Ltd (HKG: 0882 / FRA: TJN / OTCMKTS: TJSCF)

- When your cash reserve is 3x your market capitalization, your projected P/E is below 2, and you operate within growing sectors in an expanding market

- The company operates in various sectors, including:

- Utilities (Tianjin TEDA Tsinlien Water Supply Co., Ltd, Tianjin TEDA Tsinlien Heat & Power Co., Ltd., Tanjin TEDA Electric Power Co., Ltd.)

- Pharmaceuticals (Tianjin Yiyao Printing Co., Ltd., Tianjin Lisheng Pharmaceutical Co., Ltd., Tianjin Institute of Pharmaceutical Research Co., Ltd.)

- Hospitality (Tsinlien Realty Limited which operates the Courtyard by Marriott Hong Kong)

- Electrical and Mechanical (Tianjin Tianfa Heavy Machinery & Hydro Power Equipment Manufacture Co., Ltd.)

🇭🇰 HSTECH Index Rebalance: Tongcheng (780 HK) In; GDS (9698 HK) Out; Round Trip Trade US$1bn (Smartkarma) $

- As expected, Tongcheng Travel Holdings (HKG: 0780) will replace GDS Holdings Ltd (NASDAQ: GDS) in the Hang Seng TECH Index (HSTECH INDEX) at the close on 1 March.

- Estimated one-way turnover is 3.9% leading to a round-trip trade of HK$7.74bn (US$988m). There is nearly 14x ADV to buy in Tongcheng Travel Holdings (HKG: 0780).

- Positioning in Tongcheng Travel Holdings (HKG: 0780) does not appear to be very high, while positioning in GDS Holdings Ltd (NASDAQ: GDS) is very high with a couple of deletions coming up.

🇲🇴 Macau Feb GGR might top US$2.5bln, solid CNY biz: CLSA, Macau nearly 900k tourists in first 5 days of CNY break & Macau welcomes 1.4mln visitors for 8-day CNY break: govt (GGRAsia)

See our Macau ADRs list.

- “Macau is poised to deliver solid performance during Chinese New Year as average visitations over 10 to 17 February track the Macao Government Tourism Office’s (MGTO) forecast of 120,000 per day,” wrote analysts Jeffrey Kiang and Leo Pan in a Tuesday note.

- Macau welcomed more than 898,000 visitors in the first five days of the Chinese New Year break, according to official data. The average number of visitor arrivals stood at about 179,700 a day, showed preliminary figures from the city’s Public Security Police.

🇲🇴 MGM China record 20pct Macau share in Jan: Hornbuckle (GGRAsia)

- “Macau is doing amazingly well. I know some of our competitors are wondering what we’re doing,” stated Bill Hornbuckle, chief executive and president of MGM Resorts International (NYSE: MGM) during the parent’s latest fourth-quarter earnings call.

- Analyst John DeCree of CBRE Equity Research, said of MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY) in a Wednesday note regarding the group results: “The company’s market share exceeded 16 percent in fourth-quarter 2023 and hit 20 percent in January 2024, likely due to some favourable hold.”

- Though he added: “Mid-to-high teens is the target market share for MGM with margins in the high-20 percent range, which points to meaningful EBITDA growth on the horizon.”

🇲🇴 Galaxy likely only Macau op with 2024 dividend: Jefferies (GGRAsia)

See: Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF): Macau’s Best Casino Stock Positioned for Growth

- Brokerage Jefferies says it expects Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF) to be the only one of Macau’s six casino operators to pay a dividend during 2024. Hong Kong-based analyst Andrew Lee cited as one element for such a view conversation with Galaxy Entertainment management at an event for investors in the United Kingdom’s capital, London.

- “Given their strong financial position, we expect Galaxy will remain the only [Macau] operator to pay dividend” in 2024, “and be in a position to possibly raise their payout ratio this year,” stated Mr Lee in a Wednesday memo.

🇲🇴 Galaxy Entertainment: VIP-To-Mass Transition Is A Work-In-Progress (Seeking Alpha) $

- I don’t anticipate that Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF)‘s actual Q4 2023 EBITDA will beat the market’s expectations, as it is still transitioning from the VIP segment to the mass segment.

- But investors are paid to wait out the VIP-to-mass transition process with expectations of growing dividend distributions for Galaxy Entertainment.

- I have a Hold rating for GXYEF stock, taking into account its near-term financial prospects and medium-term shareholder capital return outlook.

🇲🇴 SJM – time to dip into Macau? (Undervalued Shares)

- SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) is the oldest casino company in Macau.

- It embodies gambling in Macau in quite the same way as SBM (EPA: BAIN) does in Monte Carlo.

- Since its peak in 2014, the stock is down 90%.

- In fact, it’s now back to the same level when it first went public in 2008. Both SJM and Macau have since advanced by leaps and bounds.

- Will the stock of SJM ever return to its former glory?

🇹🇼 Asian Dividend Gems: Acter Co (Asian Dividend Stocks) $

- Based in Taiwan, Acter Group Corporation Limited (TPE: 5536) is capitalizing on its extensive experience of high-end cleanroom integration, recycling and regeneration systems, electromechanical engineering to generate consistent growth in earnings and cash flow. Semiconductor and electronics are two biggest customer segments of the company.

- Acter Co’s dividend yield averaged 8.2% from 2019 to 2022. Its annual dividend payout averaged 76% in the same period. Estimated dividend yield is 7% in 2023.

🇰🇷 Douzone Bizon: A Strong Turnaround Story in the Korean Software Industry (Smartkarma) $

- Douzone Bizon (KRX: 012510)‘s results turned around strongly in 2023. It had sales of 353.6 billion won (up 16.2% YoY) and operating profit of 68.4 billion won (up 50.4% YoY) in 2023.

- The company plans to release software platforms with artificial intelligence capable functions in 1Q 2024.

- The sharp increase in the share price and market cap of Douzone Bizon raises the probability of the company being included in the KOSPI 200 rebalance in 2024.

🇰🇷 Carlyle Group Selling More than 320 Billion Won Worth of KB Financial in a Block Deal Sale (Smartkarma) $

- After the market close on 14 February, KB Financial Group (NYSE: KB) announced that The Carlyle Group is trying to sell a 1.2% stake in the company through a block deal sale.

- The expected block deal price range is 64,608 won to 65,954 won per share, representing a 2 to 4% discount to the closing price of 67,300 won on 14 February.

- We would pass on this block deal sale. Despite excellent gains so far YTD, there is looming risk of many investors that may bail out of KB Financial post ex-dividend.

🇸🇬 Our thoughts on Qoo10’s acquisition of Wish (Momentum Works)

- ContextLogic (NASDAQ: WISH), Wish’s parent, will carry on as a listed entity to ‘monetise’ its US$2.7 billion net operating losses.

- Back to the deal. Qoo10 has raised significant amount of money but has been bleeding cash. Its accumulated losses by end of 2021 (the latest filing) was US$309 million. Southeast Asia will be too small a market for it to turn around, not to mention the fierce competition here;

- While it is almost impossible to fight a price war against Temu, US is too big a market that a differentiated, niche offering can still make a large, profitable ecommerce platform. Look at eBay and Etsy. It it is serious for a breakthrough, Qoo10 would need to find that niche.

🇸🇬 OUE REIT Undergoes a Rebranding as it Maintains DPU for 2H 2023: 5 Highlights from its Latest Earnings (The Smart Investor)

- The commercial and hospitality REIT announced a rebranding exercise late last month to change its name from “OUE Commercial REIT” to “OUE REIT (SGX: TS0U)” to better reflect its current focus on growth opportunities in the hospitality, office, and retail sectors.

- Here are five highlights from the REIT’s latest 2023 earnings.

- A resilient financial performance

- Prudent debt management

- Higher valuations with strong operating metrics

- A mixed performance for the Commercial segment

- A rebound for the Hospitality segment

🇸🇬 StarHub More Than Doubles its Net Profit and Hikes its Dividend by 34%: 5 Highlights from the Telco’s Latest Results (The Smart Investor)

- It has been more than two months since StarHub (SGX: CC3 / FRA: RYTB / OTCMKTS: SRHBY / SRHBF) announced its Investor Day objectives.

- The telco has ambitious plans to create an all-in-one app and execute an enterprise IT transformation.

- Here are five highlights from the group’s latest earnings report.

- A stellar set of earnings

- Low churn and higher ARPU for Mobile

- A mixed performance for Broadband and Entertainment divisions

- Cybersecurity takes centre stage for Enterprise division

- A positive outlook with a sharp jump in dividends

🇸🇬 Singapore Post’s Share Price Hits an All-Time Low: Can the Postal Group Manage a Turnaround? (The Smart Investor)

- The postal group’s share price is spiralling down to a new low. Can the group’s business pick up and do better in the future?

- Singapore Post Limited (SGX: S08 / FRA: SGR / OTCMKTS: SPSTY / SPSTF), or SingPost, used to be a dividend stalwart which investors relied on for steady, reliable dividends.

- Of late though, the postal service and e-commerce provider has performed poorly.

- Weak operating results

- Scaling up its network in Australia

- An ongoing strategic review

- Get Smart: Logistics is a profitable business

🇸🇬 Keppel DC REIT’s Unit Price is Hitting its 52-Week Low: Is the Data Centre REIT a Bargain? (The Smart Investor)

- We explore if the data centre REIT makes a compelling bargain after its unit price tumbled in the wake of a tenant problem.

- Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF) has not had an easy time.

- Distribution impacted by finance costs and a provision

- Grey skies for Bluesea

- Solid industry fundamentals

- Get Smart: Rough seas in the short-term

🇸🇬 4 Singapore Stocks Touching Their 52-Week Lows: Are They a Bargain? (The Smart Investor)

- One way to search for bargains is to look at stocks that are hitting their 52-week lows.

- Here are four Singapore stocks that recently hit their year-low and could end up on your buy watchlist.

- Wilmar International (SGX: F34 / FRA: RTHA / RTH / OTCMKTS: WLMIF / WLMIY) is a leading agribusiness group with business activities that include oil palm cultivation, processing, branding, and distribution of a wide range of edible foods and industrial products.

- Japan Foods (SGX: 5OI / TYO: 2599) is a leading Japanese restaurant chain in Singapore operating 78 outlets as of 31 December 2023 such as Ajisen Ramen, Osaka Ohsho, Menya Musashi, and Tokyo Shokudo.

- CapitaLand China Trust (SGX: AU8U / OTCMKTS: CLDHF), or CLCT, is a China-focused REIT with a portfolio of nine shopping malls, five business park properties, and four logistics park properties.

- Seatrium Limited (SGX: S51 / FRA: S8N / OTCMKTS: SMBMF) Seatrium provides engineering solutions to the global offshore, marine, and energy industries.

🇮🇳 India narrows gap with China in key MSCI index with weight hitting new high (Reuters) 🗃️

- MSCI added five Indian stocks to its Global Standard index and did not move any out. In contrast, the index provider removed 66 Chinese stocks while adding five.

- India’s state-owned lenders Punjab National Bank (NSE: PNB / BOM: 532461) and Union Bank of India (NSE: UNIONBANK / BOM: 532477) were added to the large-cap category, while Bharat Heavy Electricals (NSE: BHEL / BOM: 500103) and National Mineral Development Corporation or NMDC (NSE: NMDC / BOM: 526371) were included in the mid-cap category. GMR Airports Infrastructure (NSE: GMRINFRA / BOM: 532754) was moved to the mid-cap category from small-caps.

- About 27 small-cap stocks were added to the MSCI Domestic index, while six were either moved to other categories or removed.

- Tata Motors (NSE: TATAMOTORS / BOM: 500570 / LON: 0LDA) and Macrotech Developers (NSE: LODHA / BOM: 543287) were added to the domestic index under the large-cap category while Punjab National Bank, Canara Bank (NSE: CANBK / BOM: 532483) and Embassy Office Parks REIT (BOM: 542602) to the mid-caps.

- Bharat Heavy Electricals (NSE: BHEL / BOM: 500103), Persistent Systems (NSE: PERSISTENT / BOM: 533179), MRF Ltd (NSE: MRF / BOM: 500290), Suzlon Energy (NSE: SUZLON / BOM: 532667) and Cummins India (NSE: CUMMINSIND / BOM: 500480) were moved to the mid-cap index from small-caps.

🇮🇳 Initial Thoughts on Hyundai Motor India IPO (Smartkarma) $

- Hyundai Motor India has been taking initial steps for an IPO. We believe this IPO could be completed sometime in 4Q 2024.

- Hyundai Motor India Limited (HMIL) IPO offering size is estimated to be at least US$3 billion, which would be one of the largest in India and the world this year.

- If HMIL is valued at US$25 billion and HMC sells a 15% stake, its remaining 85% stake would be worth US$21 billion, representing 55% of HMC’s market cap.

🌍 Some Facts About Africa’s Listed Brewing Companies (Capital Markets Africa)

Note: The post contains a good table…

- there are FIVE listed African brewing businesses with market caps over half a billion US dollars?

- European brewing multinationals AB InBev, Heineken, Diageo, and Groupe Castel dominate the African market via a network of subsidiaries and significant shareholdings?

🇿🇦 Nampak progresses turnaround despite African currency headwinds (IOL)

- Nampak Ltd (JSE: NPK / FRA: NNZ0), Africa’s largest packaging group that is being restructured due to financial difficulties, needs to sell three key assets as its operations are not yet sufficient to put the group back on a sustainable growth trajectory, CEO Phildon Roux said yesterday.

- Roux was also asked what had caused “other players to eat Nampak’s lunch” considering that Nampak was the only beverage can maker in South Africa in 2018 and currently there were four manufacturers.

🇨🇿 CEZ: Earnings At Risk Amid Sharp Drop In Electricity Prices (Seeking Alpha) $

CEZ as (PSE: CEZ / WSE: CEZ / FRA: CEZ / OTCMKTS: CZAVF)

- The recent decline in electricity prices in Europe is anticipated to have a negative impact on earnings, leading to the likelihood of a dividend cut.

- Significant investment plans are posing an additional threat to the bottom line.

- The windfall tax implemented by the Czech government has resulted in a substantial reduction in profits, significantly impacting the company’s financial performance.

🇵🇱 Refining e-commerce with a Polish touch. (Active balance)

- Shoper SA (WSE: SHO / FRA: 8FF) is not only an e-commerce platform, but a whole ecosystem of services that supported online stores. The company specifically targets micro, small, and medium-sized enterprises with its offerings. Shoper is the leader in the Polish market of software for e-commerce in the SaaS model and had over 45% market share in terms of the number of customers served.

🇧🇷 Vale: Potential Value Trap Reliant On Weakening Chinese Iron Ore Demand (Seeking Alpha) $

- I previously issued a bear call on Vale (NYSE: VALE) in Jul-23, I am even more bearish now.

- Construction accounts for over 50% of Chinese steel demand, whereas new home sales have fallen by a third and new housing starts fallen by over 50% from their 2021 peak.

- I believe there is a significant risk China’s property market downturn will materially negatively impact steel demand, iron ore prices and Vale’s stock price beyond market expectations.

- Vale’s P/E of 6 and dividend yield of 6% comes with this underlying risk, which I believe to be significant. Dividend investors should be aware of and cautious about it.

🇧🇷 Vale: 9.16% Yield And A Sizeable Buyback Program But Earnings Approaching Fast (Seeking Alpha) $

🇧🇷 Atacadão: A Great Brazilian Cash And Carry Worth Monitoring (Seeking Alpha) $

- Atacadao (BVMF: CRFB3), a Brazilian cash and carry retailer owned by Carrefour S.A., operates throughout Brazil, offering a mix of food and non-food products, convenience stores, pharmacies, and gas stations.

- ATAAY faces challenges such as declining food inflation, high indebtedness, and intensified competition.

- Despite the conversion of BIG Group stores and synergy gains, high costs and delays in store maturation have pressured Atacadão’s margins, impacting its profitability.

- Looking ahead to 2024, Atacadão anticipates increased profitability driven by factors like Brazil’s food inflation recovery, lower interest rates, store maturation, and CapEx reduction.

- The Company’s valuation, while stretched compared to historical averages, is aligned with domestic peers and poised for profit growth, suggesting a potential convergence in profitability by 2024.

🇧🇷 Suzano: Net Prices Should Be Stable For Next Quarter, Cerrado Soon Finished (Seeking Alpha) $

- Suzano S.A. (NYSE: SUZ) is maintaining price levels despite the downturn in pulp prices, thanks (we think) to the nearing completion of the Cerrado project.

- The completion of the Cerrado project should have a substantial impact on overall volumes and increase profitability, given current pulp prices hold.

- Suzano’s Q4 should be relatively flat sequentially. All eyes should be on Cerrado, as the end of that CAPEX will restore FCFs and also resume deleveraging.

🇧🇷 Banco do Brasil: Q4 Earnings, A Few Issues, But Still Leading The Pack In Brazilian Banking (Seeking Alpha) $

- Banco do Brasil (BVMF: BBAS3 / FRA: BZLA / OTCMKTS: BDORY)‘s Q4 2023 results were robust, with adjusted net profit reaching R$9.4 billion, showing significant growth compared to the previous year.

- Despite challenges in credit quality and an increase in provisions for doubtful debts, the bank remains optimistic, maintaining its attractive dividend outlook for 2024.

- Banco do Brasil plans to increase its dividend payout from 40% to 45% and has provided bold profit growth guidance for 2024.

- The bank’s focus on maintaining and expanding its return on equity (ROE) above that of other private banks contributes to its positive investment thesis.

- Despite some negative points in the quarter, including a decline in coverage ratio and an increase in delinquency, Banco do Brasil continues to offer upside potential and an attractive dividend outlook through 2024.

🇧🇷 Inter & Co’s Q4 Earnings: Defaults Taking A Dip, Bold Plan Gaining Ground (Seeking Alpha) $

- Inter & Co Inc (BVMF: INBR32 / NASDAQ: INTR) reported record growth in 2023, aligning with its ambitious growth plan to rival traditional banks in Brazil by 2027.

- The digital bank showcased robust growth in net profit, credit portfolio, and client expansion in Q4 2023.

- The decline in delinquencies suggests potential growth in new loan originations, driving operational growth in the future.

- Despite dilution concerns, the market has reacted positively to The Company’s capital increase.

- INTR’s trading below a 1.5x price-to-book ratio is appealing, considering its robust growth as a digital bank.

🇧🇷 Afya – LATAM Stocks Investment Analysis #23 (Latam Stocks)

- Afya (NASDAQ: AFYA) is the largest private medical education company in Brazil.

- On a personal note, my sister-in-law is in the process of applying to medical schools, so I thought I might learn something useful for my family by doing this analysis.

- Overall, I think Afya is a solid company, and their business should continue to do well. There are over 5 applicants for every available medical school seat in Brazil, so I expect continued demand for Afya’s products.

- However, the current valuation is quite expensive. Investors have been willing to pay a premium for the category leader. So I am not as confident that the company’s stock will perform as well as its business.

🇨🇱 Sociedad Química y Minera de Chile: Why Investors Should Get Back In The Ring (Seeking Alpha) $

- The risk-reward equation swings to Sociedad Química y Minera de Chile (NYSE: SQM)‘s favor after derisking with the LCE prices back to YE21 levels and the new concession term.

- The consensus has largely factored in a prolonged weak scenario and yet still finds upside.

- On US$11kg LCE price (forever) plus lower margins I arrive at a target price of US$48.

- Any rise in EV demand or restocking that moves LCE prices higher may trigger a sector and SQM resurgence.

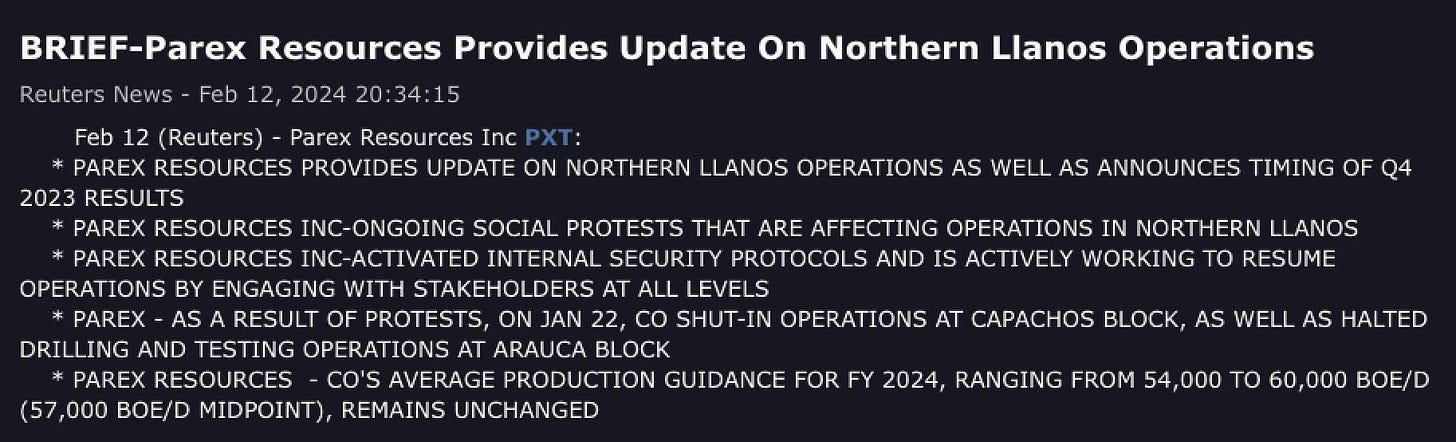

🇨🇴 Protests in Colombia & I bought the dip in Parex Resources (Calvin’s thoughts)

Also see: Global X MSCI Colombia ETF Holdings (September 2023)

- Over the past month, there have been protests in Colombia. This morning, Parex Resources (TSE: PXT / FRA: QPX / OTCMKTS: PARXF) dropped this headline, which has spooked its Canadian shareholder base yet again. The company said their current production is at 50k bpd, which is 4-10k bpd lower than annual guidance, but also said their previous guidance levels included expectation for situations like this, and left the annual production target unchanged.

🇨🇴 ¡Viva Colombia! A story of political unrest and shareholder returns (The Modern Investing Newsletter)

- GeoPark Ltd (NYSE: GPRK / LON: 0MDP / FRA: G6O) and Parex Resources (TSE: PXT / FRA: QPX / OTCMKTS: PARXF) are tremendously undervalued …

- All in all, the situation in Colombia appears to be not as dramatic as portrayed by the media. Several times in Colombia’s history, there have been protests and riots as a result of politics, and the country still exists. With one of the cheapest stock markets in the world, there are several interesting stocks. These are namely Geopark GPRK 0.00%↑, Parex Resources $PXT.TO, Ecopetrol SA (NYSE: EC) and Bancolombia (NYSE: CIB). My personal favorite is Geopark, as the independent oil & gas producer is deeply undervalued and has great capital allocation.

🇲🇽 Grupo Televisa SAB (NYSE: TV)

🇲🇽 Grupo México: For Long-Term Holders, A Correction May Be Coming (Seeking Alpha) $

- Grupo Mexico (BMV: GMEXICOB / FRA: 4GE / OTCMKTS: GMBXF) receives a “Hold” rating for its shares.

- There is potential for a bottom formation in the stock price cycle, offering a good return when shares are in an uptrend.

- Long-term prospects for robust copper demand support the investment in Grupo México.

🇲🇽 CEMEX: Volume Recovery And Strong Pricing To Drive Growth In 2024 (Seeking Alpha) $

- CEMEX (NYSE: CX) is experiencing strong volume recovery in its Mexican business across most of its products.

- The company’s margin profile has improved significantly, supported by the strong performance of its Urbanization Solutions business and pricing strategies.

- Cemex’s stock is trading at an attractive price point, offering a significant discount compared to its historical average and the sector median.

📰🔬 Further Suggested Reading

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Investors hope for catch-up rally as Chinese stocks reopen (FT) $ 🗃️

- Shanghai and Shenzhen exchanges tipped for gains after 10-day Lunar New Year holiday

🇨🇳 US companies may find China exposure a growing headache (FT) $ 🗃️

- But the picture is more mixed for big consumer brands

🇨🇳 US investors in emerging markets switch to ETFs that exclude China (FT) $ 🗃️

- Portfolios are being adjusted as tensions and state intervention weigh on Chinese stocks

🇨🇳 Chinese local governments reduce reliance on real estate in shift from old to new industries (Caixin) $

- Chinese local governments are pivoting from a reliance on property investment to developing hubs for cutting-edge industries after more than half of the Chinese mainland’s provincial-level regions missed their GDP targets for 2023.

- The world’s second-largest economy grew 5.2% last year, in line with Beijing’s target of “around 5%.” Performance at the local level, however, was a patchwork. Out of the 31 provincial-level governments on the mainland, 17 fell short of their objectives.

🇭🇰 It pains me to say Hong Kong is over (FT) $ 🗃️

- The stock market is likely to remain in the mire until we see convincing economic measures from Beijing

🇮🇩 Consider This: Indonesian elections 2024—what’s in it for investors? (Franklin Templeton)

- As Southeast Asia’s largest economy and third-largest democracy in the world, Indonesia’s elections are likely to have implications for global investors. Franklin Templeton Investment Institute Investment Strategist Kim Catechis weighs in.

🇮🇩 A popular anti-populist’s exit poses a challenge for Indonesia (FT) $ 🗃️

- After a decade of stability in a country not known for it, Joko Widodo will be a hard act to follow

- In a 2023 Edelman survey of leading developed and developing nations, 73 per cent of Indonesians said they expected to be better off in five years — among the highest readings for any country.

🇮🇳 India opposition alliance fractures as support for Narendra Modi soars (FT) $ 🗃️

- Coalition seeking to unseat powerful prime minister hit by infighting, defections and arrests

🇿🇦 Pork manufacturer Eskort is upbeat despite SA’s water, power crises (IOL)

This was an interesting observation:

- “As you know, in this country the rules of the game have changed. If you don’t provide your own electricity, you don’t provide your own water, you’re going to have trouble. We spent R10m on this site to drill four boreholes and to put up a water purification plant. And that is money you lose on your bottom line. You get nothing for it when the government is supposed to supply you.”

🌐 The big opportunity in emerging market debt (FT) $ 🗃️

- The long-run trend of a rising dollar may be about to turn, boosting local currency bonds

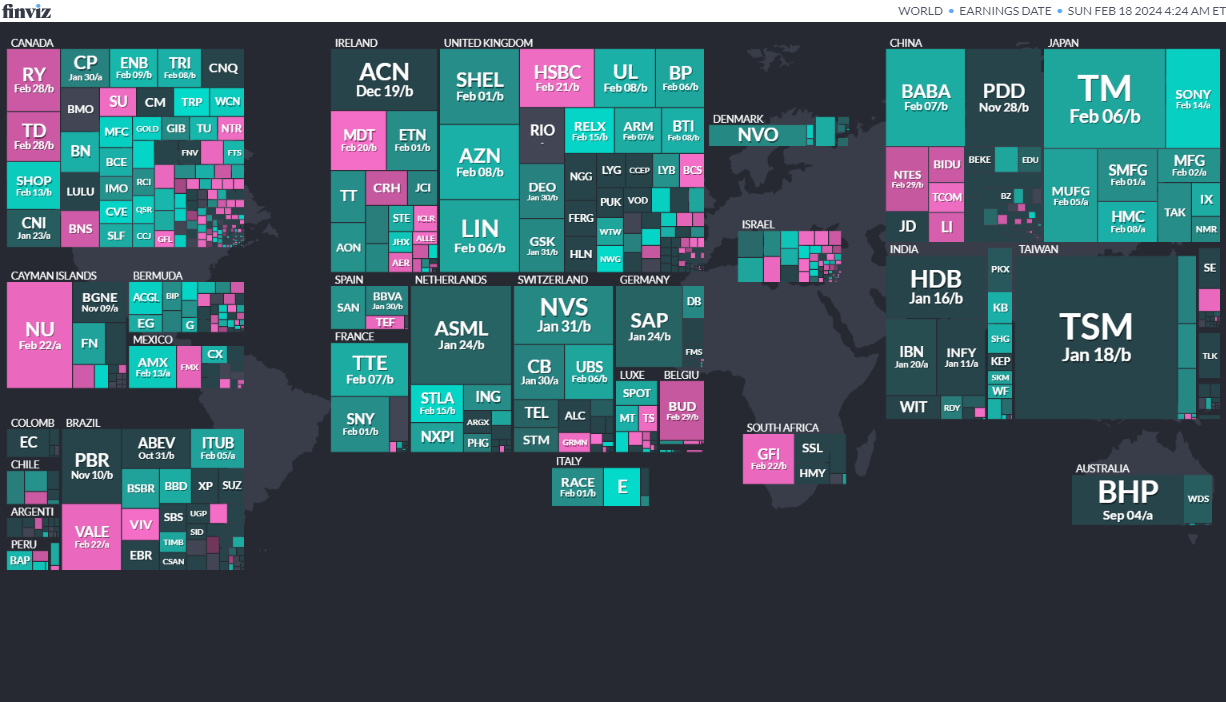

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

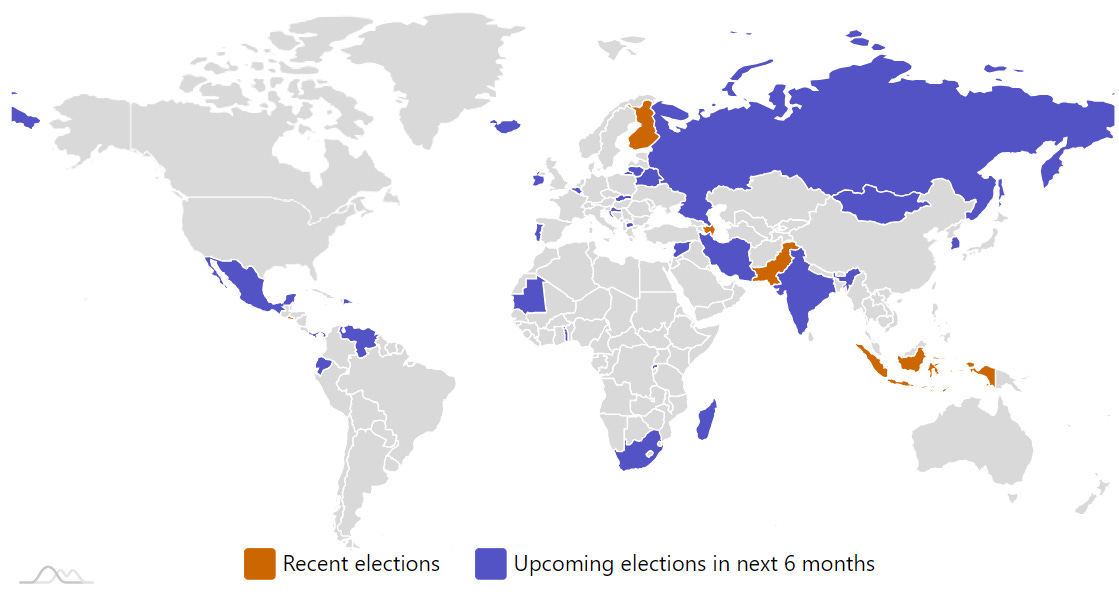

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

IndonesiaIndonesian Regional Representative CouncilFeb 14, 2024 (t) Confirmed Apr 17, 2019IndonesiaIndonesian PresidencyFeb 14, 2024 (t) Confirmed Apr 17, 2019IndonesiaIndonesian House of RepresentativesFeb 14, 2024 (t) Confirmed Apr 17, 2019- Russian Federation Russian Presidency Mar 17, 2024 (t) Confirmed Mar 18, 2018

- South Korea South Korean National Assembly Apr 10, 2024 (d) Confirmed Apr 15, 2020

- India Indian People’s Assembly Apr 30, 2024 (t) Date not confirmed Apr 11, 2019

- Panama Panamanian National Assembly May 5, 2024 (t) Confirmed May 5, 2019

- Panama Panamanian Presidency May 5, 2024 (t) Confirmed May 5, 2019

- Venezuela Venezuela Presidency May 31, 2024 (t) Date not confirmed May 20, 2018

- Mexico Mexican Senate Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

- Mexico Mexican Chamber of Deputies Jun 2, 2024 (t) Date not confirmed Jun 6, 2021

- Mexico Mexican Presidency Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

- Mongolia Mongolian State Great Hural Jun 28, 2024 (t) Tentative Jun 24, 2020

- Croatia Croatian Assembly Jun 30, 2024 (t) Date not confirmed Jul 5, 2020

- South Africa South African National Assembly Jun 30, 2024 (t) Date not confirmed May 8, 2019

- Sri Lanka Sri Lankan Presidency Sep 30, 2024 (t) Date not confirmed

- Czech Republic Czech Senate Sep 30, 2024 (t) Date not confirmed Sep 23, 2022

- Georgia Georgian Parliament Oct 26, 2024 (d) Confirmed Oct 31, 2020

- Uruguay Uruguayan Presidency Oct 27, 2024 (t) Date not confirmed

- Uruguay Uruguayan Chamber of Representatives Oct 27, 2024 (t) Date not confirmed

- Uruguay Uruguayan Chamber of Senators Oct 27, 2024 (t) Date not confirmed

- Georgia Georgian Presidency Nov 30, 2024 (t) Date not confirmed Nov 28, 2018

- Romania Romanian Presidency Nov 30, 2024 (t) Date not confirmed Nov 24, 2019

- Romania Romanian Chamber of Deputies Nov 30, 2024 (t) Date not confirmed Dec 6, 2020

- Romania Romanian Senate Nov 30, 2024 (t) Date not confirmed

- Namibia Namibian Presidency Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

- Namibia Namibian National Assembly Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

- Georgia Georgian Presidency Nov 30, 2024 (t) Date not confirmed Nov 28, 2018

- Uzbekistan Uzbekistani Legislative Chamber Dec 31, 2024 (t) Tentative Dec 22, 2019

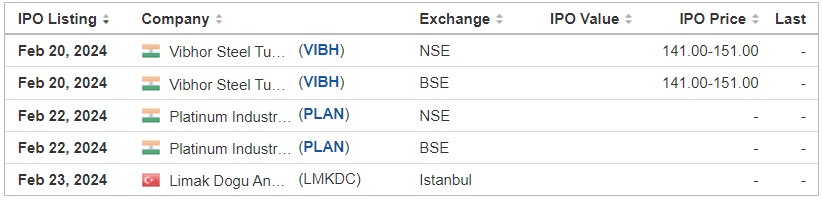

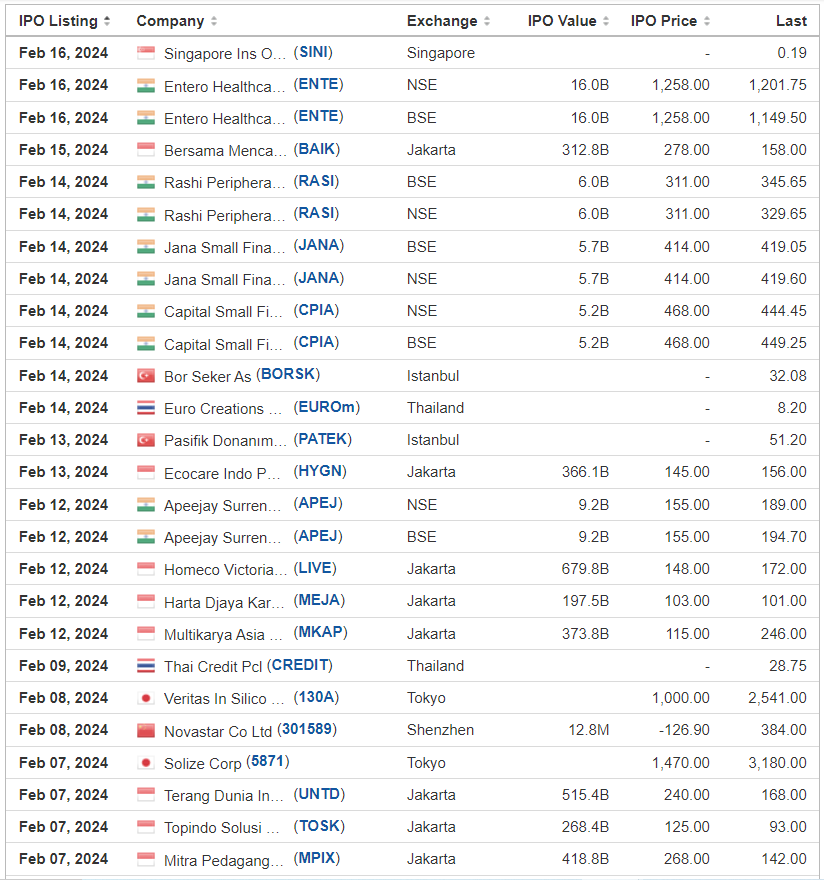

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Ryde Group Ltd. RYDE Maxim Group, 3.0M Shares, $4.00-5.00, $13.5 mil, 2/21/2024 Wednesday

We are a Singapore-based ride-hailing app. (Incorporated in the Cayman Islands)

Our vision is to become a “Super mobility app” where multiple mobility tools can be accessed and function seamlessly out of a single app, offering ultimate convenience and reliability for our customers. We currently operate in Singapore, with our core businesses in the following segments: (i) mobility, where we provide on-demand and scheduled carpooling and ride-hailing services, matching riders to our driver partners; and (ii) quick commerce, where we provide on-demand, scheduled, and multi-stop parcel delivery services.

Our mobility business segment includes carpooling and ride-hailing.

Carpooling refers to services that connect riders with driver partners who provide rides in a variety of vehicles, such as cars of different seating capacities. Carpooling is about sharing rides and is provided via our RydePOOL service in our mobile app. We launched carpooling through our RydePOOL service in Singapore. RydePOOL allows real-time, on-demand bookings as well as advance bookings via our Schedule Pickup function, and only allows seating capacity for one rider per request, while riders may have to share their ride with other riders.

Ride-hailing refers to services that connect riders with private-hire or taxi drivers, with the rider having the option to choose the type of ride from a variety of vehicles, such as cars of different seating capacities and make. We started off with only carpooling services, but ride-hailing services was a natural adjacency for us as we have the technology and the platform to enable it. Our ride-hailing services allow riders to determine the number of seats they require for the trip, and offers real-time, on-demand bookings as well as advance bookings and multi-stop options. We started to grow our offerings in this space and currently have the following different service offerings: RydeX, RydeXL, RydeLUXE, RydeFLASH, RydePET, RydeHIRE, and RydeTAXI services.

Quick Commerce is a package delivery booking service, which enables driver partners to accept bookings for package delivery services through our driver partner app. Our partners that fulfill deliveries range from driver partners, to motorcyclists and walkers as well. Consumers can arrange for instant deliveries and cater for different package sizes. E-commerce businesses, Food and Beverage businesses and social sellers can utilise our last mile delivery services to their customers as an option as well. We provide our quick commerce service through our RydeSEND offering, which comprises of real-time on-demand, scheduled, and multi-stop parcel delivery services.

Acquisition of Meili

On February 20, 2023, we completed the purchase of Meili Technologies Pte. Ltd. (“Meili”), a last-mile on-demand logistics service provider in Singapore, where we purchased the entire issued and paid-up share capital of Meili for a purchase consideration of S$450,000 which shall be satisfied through the issuance of exchangeable notes to the shareholders of Meili in an amount equal to the proportion of the purchase consideration (“Meili Acquisition”). The Meili Acquisition enables us to expand our business into the quick commerce industry, thereby increasing our revenue streams, acquire a new consumer and driver partner’s base as well as improve our operational efficiency. By leveraging on the existing technology and operational infrastructure of Meili, our operational costs have reduced. We believe that the Meili Acquisition helps us to stay competitive in the quick commerce market and potentially grow our business.

*Note: Net loss and revenue figures are in U.S. dollars for the 12 months that ended June 30, 2023.

(Note: Ryde Group Ltd. increased the size of its micro-cap IPO in an F-1/A filing dated Jan. 18, 2024, to 3.0 million shares – up from 2.25 million shares originally – and kept the price range the same at $4.00 to $5.00 to raise $13.5 million. Background: Ryde Group Ltd. disclosed terms for its IPO in an F-1/A filing dated Oct. 2, 2023: 2.25 million Class A ordinary shares at a price range of $4.00 to $5.00 to raise $10.13 million. Background: Ryde Group Ltd. filed its F-1 on Aug. 31, 2023, without disclosing terms for its IPO. The company submitted confidential IPO documents to the SEC in May 2023.)

Wetouch Technology WETH, WestPark Capital/Craft Capital/R.F. Lafferty & Co./ Orientert., 3.0M Shares, $5.00-7.00, $18.0 mil, 2/21/2024 Wednesday

(Note: This is NOT an IPO. This is a NASDAQ uplisting from the OTCQB market.)

Wetouch Technology makes and sells large-format touchscreens used in the financial, automotive, POS (point-of-sale), gaming, lottery, medical and other specialized industries. The company sells its touchscreens in the People’s Republic of China and internationally. (Incorporated in Nevada)

**Note: Net income and revenue figures are in U.S. dollars for the 12 months that ended Sept. 30, 2023.

(Note: Wetouch Technology cut the size of its NASDAQ uplisting/public offering on Feb. 13, 2024, to 3.0 million shares – down from 4.0 million shares – and kept the price range at $5.00 to $7.00 – to raise $18.0 million, according to an S-1/A filing dated Feb.13, 2024. Background: Wetouch Technology filed an S-1/A dated Nov. 17, 2023, in which it cut the price of its NASDAQ uplisting/public offering to a range of $5.00 to $7.00 – down from an assumed public offering price of US$11.20 – and kept the number of shares at 4.0 million – to raise $24.0 million. In that Nov. 17, 2023, SEC filing, Wetouch Technology updated its financial statements for the nine-month period through Sept. 30, 2023. Background: Wetouch Technology disclosed terms for its NASDAQ uplisting/public offering in an S-1/A filing dated Sept. 22, 2023: 4.0 million ordinary shares at an assumed public offering price of US$11.20 to raise $44.8 million. A 1-for-20 reverse stock split became effective on Sept. 12, 2023, according to the prospectus.)

(Background: Wetouch Technology resurrected its plans for a NASDAQ uplisting and a public offering in a blank S-1 filing dated March 21, 2023; the transaction was estimated at $46 million. In a letter dated March 8, 2023, the SEC deemed that Wetouch Technology’s previous NASDAQ uplisting and public offering from 2021 had been abandoned; that previous NASDAQ uplisting/public offering began with an S-1 in September 2021, when the transaction was estimated at about $62 million.)

CDT Environmental Technology Investment Holdings Limited CDTG, WestPark Capital, 2.0M Shares, $4.00-5.00, $9.0 mil, 3/4/2024 Week of

We are a waste treatment company that generates revenue through design, development, manufacture, sales, installation, operation and maintenance of sewage treatment systems and by providing sewage treatment services. We primarily engage in two business lines: sewage treatment systems and sewage treatment services in both urban and rural areas. Sewage treatment systems are sometimes also referred to herein as rural sewage treatment, and sewage treatment services are sometimes also referred to herein as septic tank treatment.

For sewage treatment systems, we sell complete sewage treatment systems, construct rural sewage treatment plants, install the systems, and provide on-going operation and maintenance services for such systems and plants in China for municipalities and enterprise clients. We provide decentralized rural sewage treatment services with our integrated and proprietary system using our advanced quick separation technology. Our quick separation technology uses a biochemical process for economically and sufficiently treating rural sewage. In addition, our integrated equipment generally has a lifespan of over 10 years without replacement of the core components. Due to our quick separation technology and our technological expertise and experience, our integrated rural sewage treatment system produces a high quality of outflowing water, with high degrees of automation, efficient construction and start up, and low operational costs. In addition, our equipment is typically able to process abrupt increases of sewage inflows and high contamination. Our integrated equipment consists of a compact structure and is buried underground in order to minimize changes to the surrounding environment.

**Note: Net income and revenue figures are in U.S. dollars for the 12 months that ended June 30, 2023.

(Note: CDT Environmental Technology Investment Holding Limited updated its financial statements for the six-month period that ended June 30, 2023, in an F-1/A filing dated Nov. 20, 2023.)

(Note: CDT Environmental Technology Investment Holding Limited cut its IPO’s size by about 35 percent to 2.0 million shares – down from 3.07 million shares – and increased the price to a range of $4.00 to $5.00 – up from an assumed IPO price of $4.00 – to raise $9.0 million, according to an F-1/A filing dated March 27, 2023. CDT Environmental Technology Investment Holdings Limited updated its financial statements in an F-1/A dated Feb. 24, 2023. The company changed its sole book-runner to WestPark Capital from ViewTrade Securities in an F-1/A filing in June 2021. The F-1 was filed on Jan. 15, 2021. The company submitted confidential IPO documents to the SEC on Nov. 15, 2019.)

Intelligent Group Limited INTJ, WestPark Capital, 2.0M Shares, $4.00-5.00, $9.0 mil, 3/4/2024 Week of

(Incorporated in the British Virgin Islands)

We are a professional services provider in Hong Kong that engages in the business of providing Financial PR services. Our Financial PR services include arranging press conferences and interviews, participating in the preparation of news releases and shareholders’ meetings, monitoring news publications, identifying shareholders, targeting potential investors, organizing corporate events, and implementing crisis management policies and procedures.

We aim to build an effective channel for the exchange of information between the public, investors and our clients. We provide information about our clients to the public and investors in a manner designed to enable them to understand our clients’ operations more easily. We also provide training to our clients so as to allow them to understand public relations tactics and practice. The objective is to create a positive market image of our clients to the public.

Our Industry

Hong Kong, which occupies a unique geographic position, continues to achieve remarkable expansion in its role as a regional financial leader. As one of the financial centers in the Asia-Pacific region, Hong Kong attracts a number of public relations firms to provide services in Hong Kong, mainly in Financial PR, corporate public relations and consumer marketing services. According to the website of the HK Stock Exchange — Annual Market Statistics (As of December 30, 2022) (source: https://www.hkex.com.hk/-/media/HKEX-Market/Market-Data/Statistics/Consolidated-Reports/Annual-Market-Statistics/e_2022-Market-Statistics.pdf and https://www.hkex.com.hk/-/media/HKEX-Market/Market-Data/Statistics/Consolidated-Reports/Annual-Market-Statistics/2021-Market-Statistics_e.pdf), Hong Kong has ranked number four and four in the world in 2021 and 2022, respectively, in terms of the amount of funds raised through IPOs. According to the market statistics published by the HK Stock Exchange, the total funds raised through IPOs on the HK Stock Exchange in 2021 and 2022 were approximately HK$328.9 billion and HK$99.1 billion, respectively. The total post-IPO funds raised by listed companies on the HK Stock Exchange in 2022 amounted to HK$147.3 billion and, together with funds raised by IPOs, the total funds raised on the Main Board (“Main Board”) and GEM Board of the Hong Kong Stock Exchange, amounted to approximately HK$251.9 billion. Despite the decrease in the total funds raised in 2022 due to the impact of resurgences of the COVID-19 outbreak, the capital market and fund-raising activities are expected to rebound in 2023.The demand for Financial PR services is expected to correlatively rebound.

Competitive Strengths

We believe the following competitive strengths differentiate us from our competitors:

• We provide comprehensive Financial PR services to our clients;

• We provide extensive coverage in media monitoring and promotion services for our clients;

• We have a strong client base; and

• We have experienced and competent management and professional staff.

Our Strategy

We intend to pursue the following strategies to further expand our business:

• Further strengthening our Financial PR business in Hong Kong;

• Expanding our market presence in other international capital markets, in particular the U.S.; and

• Enhancing the automation and establishment of our virtual Financial PR services.

(Intelligent Group Limited filed an F-1/A dated Nov. 21, 2023. The terms of its IPO: 2 million ordinary shares at $4.00 to $5.00 to raise $9.0 million. )

SKK Holdings Limited SKK, Bancroft Capital LLC, 2.5M Shares, $4.00-5.00, $11.3 mil, 3/11/2024 Week of

We are a civil engineering service provider that specializes in subsurface utility works in Singapore and have participated in numerous public utility projects, including but not limited to power and telecommunication cable laying works, water pipeline works and sewer rehabilitation works. (Incorporated in the Cayman Islands)

We were founded in 2013 by Mr. Sze, our Chief Executive Officer, together with, among others, Mr. Ng, one of our Executive Directors and our Chief Operating Officer. Our Executive Officers including Mr. Sze, Mr. Ng, Mr. Wong and Mr. Tang have over 28, 26, 18 and 15 years of experience in the field, respectively.

As of the date of this prospectus, we were equipped with a fleet of five HDD rigs, 18 excavators and 36 vehicles and a staff over 140. We are one of the five major contractors in Singapore for horizontal directional drilling, or HDD works.

*Note: Net income and revenue are for the 12 months that ended June 30, 2023 (in U.S. dollars converted from Singapore dollars)

(Note: SKK Holdings Limited filed its F-1 on Jan. 29, 2024, and disclosed terms for its IPO: 2.5 million ordinary shares at a price range of $4.00 to $5.00 to raise $11.25 million. Of the 2.5 million ordinary shares in the IPO, the company is offering 1.75 million shares and selling stockholders are offering 750,000 shares. The company will not receive any proceeds from the sale of the selling stockholders’ shares. Background: SKK Holdings filed confidential IPO documents with the SEC on Sept. 20, 2023.)

🏁 Emerging Market ETF Launches

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- 02/07/2024 – Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares XXCH – Equity, leveraged

- 01/11/2024 – Matthews Emerging Markets Discovery Active ETF MEMS – Active, equity, small caps

- 01/10/2024 – Matthews China Discovery Active ETF MCHS – Active, equity, small caps

- 11/07/2023 – Global X MSCI Emerging Markets Covered Call ETF EMCC – Equity, leverage

- 11/07/2023 – Avantis Emerging Markets Small Cap Equity ETF AVEE – Active, equity, small caps

- 09/22/2023 – Matthews Asia Dividend Active ETF ADVE – Active, equity, Asia

- 09/22/2023 – Matthews Pacific Tiger Active ETF ASIA – Active, equity, Asia

- 09/22/2023 – Matthews Emerging Markets Sustainable Future Active ETF EMSF – Active, equity, ESG

- 09/22/2023 – Matthews India Active ETF INDE – Active, equity, India

- 09/22/2023 – Matthews Japan Active ETF JPAN – Active, equity, Japan

- 09/22/2023 – Matthews Asia Dividend Active ETF ADVE – Active, equity, Asia

- 08/25/2023 – KraneShares Dynamic Emerging Markets Strategy ETF KEM – Active, equity, emerging markets

- 08/18/2023 – Global X India Active ETF NDIA – Active, equity, India

- 08/18/2023 – Global X Brazil Active ETF BRAZ – Active, equity, Brazil

- 07/17/2023 – Matthews Korea Active ETF MKOR – Active, equity, South Korea

- 05/18/2023 – Putnam Emerging Markets ex-China ETF PEMX – Active, value, growth stocks

- 05/11/2023 – JPMorgan BetaBuilders Emerging Markets Equity ETF BBEM – Passive, large + midcap stocks

- 03/16/2023 – JPMorgan Active China ETF JCHI – Active, equity, China

- 03/03/2023 – First Trust Bloomberg Emerging Market Democracies ETF EMDM – Principles-based

- 1/31/2023 – Strive Emerging Markets Ex-China ETF STX – Passive, equity, emerging markets

- 1/20/2023 – Putnam PanAgora ESG Emerging Markets Equity ETF PPEM – Active, equity, ESG, emerging markets

- 1/12/2023 – KraneShares China Internet and Covered Call Strategy ETF KLIP – Active, equity, China, options overlay, thematic

- 1/11/2023 – Matthews Emerging Markets ex China Active ETF MEMX – Active, equity, emerging markets

- 12/13/2022 – GraniteShares 1.75x Long BABA Daily ETF BABX – Active, equity, leveraged, single stock

- 12/13/2022 – Virtus Stone Harbor Emerging Markets High Yield Bond ETF VEMY – Active, fixed income, junk bond, emerging markets

- 9/22/2022 – WisdomTree Emerging Markets ex-China Fund XC – Passive, equity, emerging markets

- 9/15/2022 – KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV – Passive, equity, Asia, dividend strategy

- 9/15/2022 – OneAscent Emerging Markets ETF OAEM – Active, Equity, emerging markets, ESG

- 9/9/2022 – Emerge EMPWR Sustainable Select Growth Equity ETF EMGC – Active, equity, emerging markets

- 9/9/2022 – Emerge EMPWR Unified Sustainable Equity ETF EMPW – Active, equity, emerging markets

- 9/8/2022 – Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH – Active, equity, emerging markets, ESG

- 7/14/2022 – Matthews China Active ETF MCH – Active, equity, China

- 7/14/2022 – Matthews Emerging Markets Equity Active ETF MEM – Active, equity, emerging markets

- 7/14/2022 – Matthews Asia Innovators Active ETF MINV – Active, equity, Asia

- 6/30/2022 – BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD – Passive, fixed income, emerging markets

- 5/2/2022 – AXS Short CSI China Internet ETF SWEB – Active, inverse, thematic

- 4/27/2022 – Dimensional Emerging Markets High Profitability ETF DEHP – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Core Equity 2 ETF DFEM – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Value ETF DFEV – Active, equity, emerging markets

- 4/27/2022 – iShares Emergent Food and AgTech Multisector ETF IVEG – Passive, equity, thematic [Mostly developed markets]

- 4/21/2022 – FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM – Passive, equity, ESG

- 4/6/2022 – India Internet & Ecommerce ETF INQQ – Passive, equity, thematic

- 2/17/2022 – VanEck Digital India ETF DGIN – Passive, India market, thematic

- 2/17/2022 – Goldman Sachs Access Emerging Markets USD Bond ETF GEMD – Passive, fixed income, emerging markets

- 1/27/2022 – iShares MSCI China Multisector Tech ETF TCHI – Passive, China, technology

- 1/11/2022 – Simplify Emerging Markets PLUS Downside Convexity ETF EMGD – Active, equity, options strategy

- 1/11/2022 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG – Passive, equity, ESG

🚽 Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

- 11/11/2023 – Global X China Innovation ETF – KEJI

- 11/11/2023 – Global X Emerging Markets Internet & E-commerce ETF – EWEB

- 11/09/2023 – Franklin FTSE South Africa ETF – FLZA

- 10/27/2023 – Simplify Emerging Markets Equity PLUS Downside Convexity – EMGD

- 10/20/2023 – WisdomTree India ex-State-Owned Enterprises Fund – IXSE

- 10/20/2023 – WisdomTree Chinese Yuan Strategy Fund – CYB

- 10/20/2023 – Loncar China BioPharma ETF – CHNA

- 10/18/2023 – KraneShares Emerging Markets Healthcare Index ETF – KMED

- 10/18/2023 – KraneShares MSCI China ESG Leaders Index ETF – KSEG

- 10/18/2023 – KraneShares CICC China Leaders 100 Index ETF – KFYP

- 10/16/2023 – Strategy Shares Halt Climate Change ETF – NZRO

- 09/20/2023 – VanEck China Growth Leaders ETF – GLCN

- 08/28/2023 – Asian Growth Cubs ETF – CUBS

- 08/01/2023 – VanEck Russia ETF – RSX

- 07/07/2023 – Emerge EMPWR Sustainable Emerging Markets Equity ETF – EMCH

- 06/23/2023 – Invesco PureBeta FTSE Emerging Markets ETF – PBEE

- 06/16/2023 – AXS Short China Internet ETF – SWEB

- 04/11/2023 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF – REMG

- 3/30/2023 – Invesco BLDRS Emerging Markets 50 ADR Index Fund – ADRE

- 3/30/2023 – Invesco BulletShares 2023 USD Emerging Markets Debt ETF – BSCE

- 3/30/2023 – Invesco BulletShares 2024 USD Emerging Markets Debt ETF – BSDE

- 3/30/2023 – Invesco RAFI Strategic Emerging Markets ETF – ISEM

- 2/17/2023 – Direxion Daily CSI 300 China A Share Bear 1X Shares – CHAD

- 1/13/2023 – First Trust Chindia ETF – FNI

- 12/28/2022 – Franklin FTSE Russia ETF – FLRU

- 12/22/2022 – VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

- 8/22/2022 – iShares MSCI Argentina and Global Exposure ETF AGT

- 8/22/2022 – iShares MSCI Colombia ETFI COL

- 6/10/2022 – Infusive Compounding Global Equities ETF JOYY

- 5/3/2022 – ProShares Short Term USD Emerging Markets Bond ETF EMSH

- 4/7/2022 – DeltaShares S&P EM 100 & Managed Risk ETF DMRE

- 3/11/2022 – Direxion Daily Russia Bull 2X Shares RUSL

- 1/27/2022 – Legg Mason Global Infrastructure ETF INFR

- 1/14/2022 – Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (February 19, 2024) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Emerging Market Links + The Week Ahead (January 16, 2023)

- Emerging Market Links + The Week Ahead (January 23, 2023)

- Emerging Market Links + The Week Ahead (February 13, 2023)

- Emerging Market Links + The Week Ahead (February 20, 2023)

- Emerging Market Links + The Week Ahead (February 6, 2023)

- Emerging Market Links + The Week Ahead (May 29, 2023)

- Tech Sector Can Power Emerging Market Portfolios (FE Trustnet)

- Emerging Market Links + The Week Ahead (February 27, 2023)

- Best Consumer Stocks for Emerging Market Investors (Morningstar)

- Emerging Market Links + The Week Ahead (May 8, 2023)

- Global Smartphone Shipments to Reach 1.2Bn This Year on Emerging Market Strength (Juniper Research)

- Emerging Market Links + The Week Ahead (January 30, 2023)

- Emerging Market Links + The Week Ahead (August 1, 2022)

- Emerging Market Links + The Week Ahead (March 13, 2023)

- Yale University Added $100M to the Vanguard FTSE Emerging Markets ETF (VWO) in 1Q2014 (P&I)