According to the just released Smartphone MarketsTrends, Shares & Forecasts 2014-2019 report from mobile analyst firm Juniper Research, the number of smartphone shipments will approach 1.2 billion this year, an increase of 19% from 985 million in 2013, thanks to growth in emerging markets and the continued surge in sales and adoption of low-cost Economy ($75-$150) and Ultra-Economy (sub-$75) smartphones.

While Apple and Samsung continue to dominate the Ultra-Premium end of the market, both are facing significant pressure from local players in the emerging markets. For example: Chinese smartphone maker Xiaomi is witnessing tremendous success in China and India as a result of its aggressive price-point offerings. These new players are beginning to build market share and achieve larger economies of scale, which eventually will enable them to expand their offering and challenge other Smartphone sectors in the future.

Some of the key findings in the report are:

- Samsung accounted for 26% of all smartphone shipments globally in the second quarter — an estimated 75 million devices. Their market share declined both quarter-on-quarter and year-on-year.

- Apple also saw growth, shipping 35 million phones in the quarter – a figure up 13% year on year. A significant portion of iPhone sales came from emerging markets, with the company recording 55% y-o-y growth in the BRIC countries (Brazil, Russia, India and China).

- Huawei sold some 34.3 million smartphones in H1 2014, with the second quarter shipments reaching 20 million, a market share of nearly 7%. The company is expected to meet its full year target of 80 million smartphones.

- Lenovo is estimated to have shipped 15.6 million smartphones for the second quarter, a market share of 5.5%. LG meanwhile shipped a record 14.5 million smartphones in the second quarter, a 20% y-o-y growth and 5% market share.

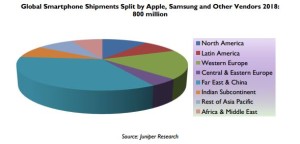

- The emerging nations in Far East & China, Indian Subcontinent, Latin America and Africa & Middle East will account for over 50% of the global smartphones shipped this year.

- Apple and Samsung will account for nearly 45% of the global smartphones shipped this year.

- The Average Selling Price of a smartphone will decline globally to reach $274 by 2019.

To read the whole press release, Press Release: Global Smartphone Shipments to Reach 1.2Bn this year as Economy Smartphone Sales Surge, finds Juniper Research, go to the website of Juniper Research. In addition, the free whitepaper, Smartphones ~ Emerging Push vs Maturing Pull, contains an extract from the report. Other articles about the report, include: Sub-$150 devices, emerging markets to drive continuing smartphone sales boom

To read the whole press release, Press Release: Global Smartphone Shipments to Reach 1.2Bn this year as Economy Smartphone Sales Surge, finds Juniper Research, go to the website of Juniper Research. In addition, the free whitepaper, Smartphones ~ Emerging Push vs Maturing Pull, contains an extract from the report. Other articles about the report, include: Sub-$150 devices, emerging markets to drive continuing smartphone sales boom

Similar Posts:

- ‘Once-in-a-lifetime Opportunity’: How a Mass Lockdown at the World’s Biggest iPhone Factory is India’s Big Chance to Beat out China as Apple’s Favorite Supplier (Fortune)

- How Big of a Threat is China’s Xiaomi to Apple? (Bloomberg)

- Microsoft Sees Asian Emerging Markets as a Way to Get Ahead of Rivals (Seattle Times)

- Both Apple and Android Use is Growing in Chinese Third-tier Cities (Tech in Asia)

- China Scrambles to Stem Manufacturing Exodus as 50 Companies Leave (Nikkei Asian Review)

- Meat Scandal Sees McDonald’s Sales Drop 7.2% in Emerging Markets (SCMP)

- What Goes Up: China’s Employment Crisis (J Capital Research)

- Emerging Markets Are Now Samsung Electronics – Not Samsung Heavy Industries (WSJ)

- Is This Divergence an Emerging Market Warning Sign? (BCA Research)

- Asia and Emerging Markets Had the Worst Dividend Growth Rates for 1Q2014 (FE Trustnet)

- Yale University Added $100M to the Vanguard FTSE Emerging Markets ETF (VWO) in 1Q2014 (P&I)

- Expedia Ramps Up in Asia (Nikkei Asian Review)

- Philippines Globe Telecom to Raise Funds, Expand (The Asset)

- Vietnam Economy Grows Nearly 7% on Trade War Tailwinds (Nikkei Asian Review)

- Russia Consumer Confidence Falls in Latest Nielsen Survey