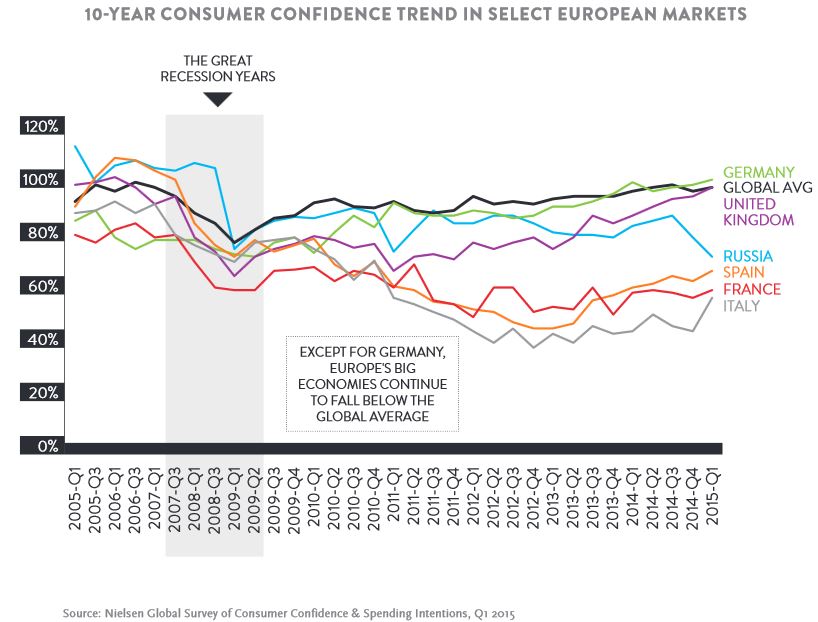

The ongoing geopolitical tensions between Russia and the Ukraine likely contributed to new confidence lows reported in those countries for the first quarter 2015 Nielsen Global Survey of Consumer Confidence and Spending Intentions. Specifically, Russia’s index fell for the second consecutive quarter to 72, a level lower than its confidence reading at the height of the Great Recession, while the Ukraine’s score dropped 11 points to 41.

Kriakos Kyriakou, the Regional Director for Nielsen Eastern Europe, commented:

“The normally resilient Russian consumer is under severe strain right now. The massive currency devaluation at the end of 2014 led to a flourish of consumer spending in an attempt to get ahead of inflation. Now, spiking inflation and negative wage growth are taking their toll. In the new market conditions, manufacturers and retailers will fight for a smaller share of shopper wallets as the majority of Russians have either switched into savings mode or have no spare cash to spend. Today, it’s more critical than ever to get the “price vs. volume” equation right in order to maintain market share. Cheaper products are likely to generate more sales volumes than ever — as long as quality is not compromised.”

To read the press release, Global Consumer Confidence Is More Upbeat in 2015, but Variation Exists Across Markets, or the full report, Q1 2015 Consumer Confidence Report, go to the website of Nielsen. In addition, check out our Russia ADRs list, Eastern Europe closed-end funds list, Russia closed-end funds list, Eastern Europe ETFs list and Russia ETFs list.

Similar Posts:

- Russia Ukraine War’s Global Impact (MetLife Investment Management)

- Emerging Market Hedge Fund Assets Rise to a Record Despite Russian Losses (PR)

- Russia Moves Up 11 Places in the Global Competitiveness Report (MT)

- Russia Troubles Hit Emerging Markets – Including Emerging Europe (Barron’s)

- Resolving the SE Ukraine Conflict Would be a “Massive Buy Signal” for Russia (CNBC)

- Jupiter’s Croft: If History Repeats Itself, Russian Stocks Could Double (FE Trustnet)

- Nielsen Global Survey of Consumer Confidence for Q1 2015

- Franklin Templeton’s $7.6bn Bond Bet on the Ukraine is 6X Bigger Than its Russian Bond Holdings (EM)

- Gazprombank GPB Hires Former Senators Lott and Breaux to Fight Russia Sanctions (CPI)

- Ukraine War Poses a Threat to EU Industry (RaboResearch)

- Russia, Ukraine and China (Franklin Templeton)

- How Canaccord Genuity’s Oliver is Hedging for Iraq & Ukraine Turmoil (FE Trustnet)

- Top Risks 2019: Bad Seeds (Eurasia Group)

- Russia Now Demands Rubles For Grain As World’s Largest Wheat Exporter (Zero Hedge)

- Infographic: Russia’s Sphere of Influence in Context (VOX)