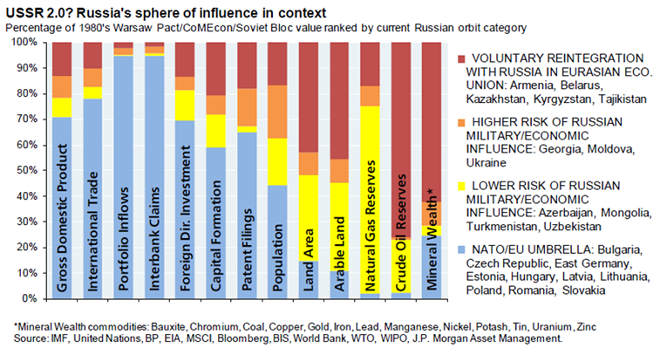

Michael Cembalest, J.P. Morgan’s Chairman of Market and Investment Strategy, has put together the following infographic to show that the bulk of economic power in the former communist bloc now isn’t Putin’s to command – and that power is often aligned against him:

Source: Michael Cembalest/JP Morgan

Basically, Russia and hence Putin still has some degree of influence over much of the resource wealth and arable land that it did in the Soviet Union era, but other important economic assets like trade, banking, intellectual property and pure GDP have since shifted to Western alliances.

On the other hand and before you count Putin out, Russian deliveries account for 34% of the natural gas supplies to the EU with the following breakdown according to a blog post from the Soufan Group:

- Germany: 40% (and likely to increase with completion of the Nord Stream pipeline. Like other Western European countries, Germany pays “full price” to Gazprom, Russia’s gas monopoly)

- Hungary: 50%

- Ukraine: 51%

- Austria: 52%

- Greece: 55%

- Poland: 54%

- Czech Republic: 80%

- Latvia: 100%

- Lithuania: 100%

- Estonia: 100%

- Sweden: 100%

They predicted the EU will work to increase non-Russian gas supplies, but will find all options nearly prohibitive in terms of geological machinations and financial costs. Likewise and due to its reliance on on energy exports, Russia is unlikely to disrupt natural gas supplies to Western European countries such as Germany, which pays a higher price without risk of default or delay.

To read the whole articles, Why Putin’s Russia is weaker than the USSR, in one chart and TSG IntelBrief: The Gas Bloc: Russia’s Sphere of Energy Influence, go to the websites of VOX and TSG respectively. In addition, check out the following article: Despite Centuries of Dire Predictions, Why Russia Isn’t Going Away (NI)

Similar Posts:

- Gazprombank GPB Hires Former Senators Lott and Breaux to Fight Russia Sanctions (CPI)

- Investment Implications of the Russian Invasion (Franklin Templeton)

- Do You Need to Putin-proof Your Portfolio? (FE Trustnet)

- Ukraine War Poses a Threat to EU Industry (RaboResearch)

- Russia Ukraine War’s Global Impact (MetLife Investment Management)

- Resolving the SE Ukraine Conflict Would be a “Massive Buy Signal” for Russia (CNBC)

- EU Slowly Weening Off Russian Crude Gives Moscow Time To Divert Flows To Asia (Zero Hedge)

- The Economic Impact of a Boycott on Russian Fossil Fuels (RaboResearch)

- Russia Pivoted East to Asia 800 Years Before Obama (MT)

- Russia, Ukraine and China (Franklin Templeton)

- Russia Troubles Hit Emerging Markets – Including Emerging Europe (Barron’s)

- Russia Consumer Confidence Falls in Latest Nielsen Survey

- Jupiter’s Croft: If History Repeats Itself, Russian Stocks Could Double (FE Trustnet)

- Russia Moves Up 11 Places in the Global Competitiveness Report (MT)

- Emerging Market Hedge Fund Assets Rise to a Record Despite Russian Losses (PR)