This week, we have some ideas for revaluating China exposure as Beijing’s regulatory crackdown and Xi’s bias for heavy industrial development will likely make it harder for private firms (without business plans in line with industrial policy) to obtain loans. Countries like India, Mexico, Vietnam, Cambodia and the Philippines are also seeking to lure manufacturing from China or become the next favoured nearshoring destination.

In Latin America, Brazil’s “Dutch Disease” has been worsened by the concurrent strong growth of the farming, mining, and oil sectors (leading to the loss of competitiveness for manufacturing which has collapsed when compared to Asian countries). Another interesting article looks at Argentina and what happens when people no longer trust banks and inflation hits 100% (“They can’t plan for the future, they have to live in an eternal present”) – perhaps a glimpse into the future of the West?

Finally, we have links to a few stock picking research articles – covering Pinduoduo (NASDAQ: PDD) (a very detailed research report), Singapore banks (now the 4th most widely held Bank exposure, behind US, Indian and Canadian Banks), Indian stocks (including renewable energy stocks), etc. In addition, there are several Chinese or Asia IPOs on US stock exchanges (the companies tend to be incorporated in the Cayman Islands) scheduled for this week (scroll towards the bottom of this post for the complete details).

Subscribe Now Via Substack

Suggested Reading

$ = behind a paywall

It’s Time for Investors to Reevaluate Their China Exposures (Investments & Wealth Monitor) PDF File

- First, investors can sell down their entire China exposure. As a practical matter, exiting publicly traded Chinese stocks or private investments, such as a factory or a private equity investment, will most certainly be protracted as sellers try to find reasonable prices in a challenged economic environment.

- A second option is for investors to write down the value of their Chinese investments but to still retain the assets on their (financial) books and records. The investor would not add any material new capital to grow or enhance the investments.Writing down an equity portfolio would lead to actual recorded market-to-market losses. Choosing to write down the value of the stocks rather than selling the position down to zero means the investor retains some optionality if the positions rebound.

- A third option is for an investor to both hold and grow its China exposure with new capital. In this case, an investor would look to capitalize on low valuations and market weakness to expand its presence in China.

Back on the ground in China: 8 anecdotes from our first post-Covid visit (Arisaug Partners)

NOTE: Arisaig Partners is based in Singapore and has a strict disclaimer at the bottom of this article…

Beijing’s Regulatory Crackdown Is Unlikely to End Any Time Soon (CIGI)

- China’s incomplete transition to a market economy means regulations often lag behind the demands of the market.

- This bias for heavy industrial development is reaffirmed by Xi’s party congress report, which emphasizes that the key focus of economic development should be the “real” economy, that is, only the industrial and agricultural sectors.

- As demonstrated by the recent prosecution of former China Merchant Bank (SHA: 600036) president Tian Huiyu, a major part of the investigation will concern problematic loans, especially those to private firms. This will make it even harder for private firms to obtain loans than before, unless such applications are backed up by business plans in line with China’s industrial policy.This is where China’s regulatory crackdown will kill two birds with one stone. It will both ensure the further dominance of SOEs, and force private firms to align their businesses with Xi’s vision of Chinese-style modernization: a Soviet-style industrialization plan focusing on heavy industrial development.

Countries Compete to Lure Manufacturers From China (WSJ) $

- At stake for the governments of low- and middle-income countries eager to help is the chance to turbocharge economic development and create millions of new jobs. Countries including India, Mexico, Vietnam, Cambodia and the Philippines are competing on subsidies, tax breaks and other perks to convince businesses that their country is the next best thing to the well-oiled manufacturing machine that China has honed over decades.

- Apple Inc. has shifted some smartphone production to India and is considering Vietnam, where Nike Inc. and Adidas AG already make sneakers, as a destination to make watches and earphones. Toy maker Mattel Inc., the maker of Barbie dolls, expanded its plant in Monterrey, Mexico, into its largest manufacturing facility worldwide between 2020 and 2022. Chinese electronics and appliance manufacturer Hisense Co. is developing an industrial park in the same city to make refrigerators, washing machines, air conditioners and kitchen appliances for the U.S. market.

- India has focused on low corporate tax rates and government subsidies to lure overseas businesses. In 2021, India announced close to $1 billion in incentives to persuade companies to make more computers and tablets in the country, an effort to repeat its success in fostering smartphone production, which had brought in billions of dollars of investment from companies including Samsung Electronics Co. and Foxconn Technology Group.New Delhi is also eyeing semiconductor manufacturing.

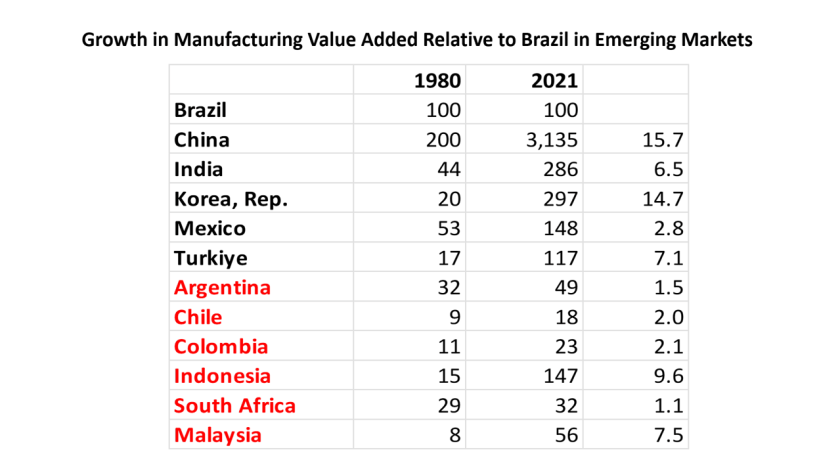

Brazil’s Grievous Manufacturing Collapse (The Emerging Markets Investor)

- Brazil’s “Dutch Disease” has been worsened by the concurrent strong growth of the farming, mining and oil sectors — all productive and capital intensive activities with a high degree of export competitiveness. The rapid growth of these sectors, and the discovery of the giant offshore pre-salt oil fields, has strengthened the current account and caused a structural appreciation of the Brazilian real. The loss of competitiveness of Brazil’s manufacturing sector has been more than compensated by the increased production and dollar revenues of the growth sectors. Unfortunately, these successful sectors generate scarce jobs and lack the significant multiplier effects of the manufacturing sector.

- Over this period, China’s manufacturing value added went from two times Brazil’s to 31.3x, a relative increase of 15.7x. India went from 44% of Brazil’s level to 2.9x. Every single country in the chart has gained relative to Brazil. This includes commodity producers (highlighted in red) which also may have suffered Dutch Disease. Most striking are Indonesia and Malaysia which went from 15% of Brazil to 150%, and 8% to 56%, respectively, a testament to the Asian commitment to currency stability and manufacturing exports.

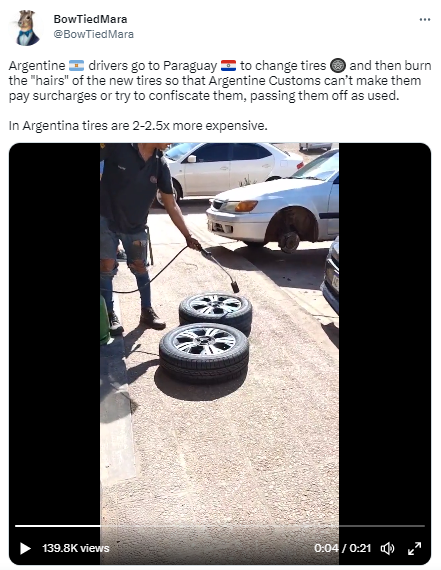

What it looks like when a country doesn’t trust its banks (VOX)

- I went to Argentina and the US did a bank run.

- “Since the ’60s and ’70s, Argentines’ confidence in their currency and their economic institutions has been eroding,” said Roy Hora, an Argentine historian. “What Argentines have done is to adapt to that scenario.”Hora compared it to boiled frog syndrome, where things get worse and worse but just slowly enough that in the day-to-day it’s rather imperceptible. Then, by the time the disaster has really set in, it’s too late. Argentina’s inflation rate just hit 100 percent annually. (In the US, it’s 6 percent.) Hora sent me a tweet about the country’s mega price increases. “Here’s a title for you,” he said, “Worse than expected, even for the biggest pessimists.”

- “Knowing that inflation has very negative consequences for the medium and long term, for most people, it takes away the opportunity to save,” Hora said. “They can’t plan for the future, they have to live in an eternal present.”

Credit Suisse: Saudi Arabia and Qatar set to lose big after UBS deal (Middle East Eye)

- Less than six months ago, the Saudi National Bank paid $1.5bn for a 9.9 percent stake in Credit Suisse. That stake is now worth about $280m, the website Market Watch reported, after UBS swooped in to acquire its embattled rival this weekend in a deal initially valued at about $3.25bn.Also left reeling is the Qatar Investment Authority, which has a 6.8 percent stake in Credit Suisse. Qatar’s sovereign wealth fund increased its stake as recently as January this year, becoming the Swiss bank’s second-largest shareholder after Saudi National Bank, which is the largest bank in Saudi Arabia.

Emerging Market Stock Picks / Stock Research

$ = behind a paywall

Pinduoduo Research Report (Hayden Capital) PDF File (37 Pages)

NOTE: Also see Why Chinese Apps Are the Favorites of Young Americans – “Seven-month-old Temu was the most downloaded app across U.S. app stores during the first three weeks of March.” And this Substack piece – “It’s “game over” for all Chinese tech companies in the US”

Nasdaq listed PDD Holdings (NASDAQ: PDD)is the multinational commerce group that owns and operates a portfolio of businesses, including Pinduoduo and Temu, an e-commerce marketplace in North America allowing Chinese vendors to sell their products directly to US consumers.

This valuation seems far too cheap, for a company who is growing current revenues at +65% y/y (as of Q3 2022), expected to grow top-line at ~24% y/y over the next three years, and where we expect operating income to 2 – 3x over the same timeframe.

It seems the basis of this opportunity, lies in the investment community’s broad aversion to Chinese equities (especially internet companies), in addition to several company specific concerns:

- The Recent Chinese Equity Sell-off is Due to Politics, Not Fundamentals

- Lack of Communication with Investors

- Growth Ceiling Concerns

- Fears that Strong Results are Temporary

In the immediate future, PDD’s core business is going to be driven by three primary tailwinds:

- Factories are over-supplied, and brands need to destock inventory.

- China’s economic growth is slowing, which will encourage consumers to seek out more value-for-money shopping opportunities.

- Lower-tier cities will exhibit stronger consumption growth going forward.

Singapore Banks: Breaking Out (Smart Karma) $

- A record 25.3% of Global funds have exposure to Singapore Banks, breaking out of a range of between 18% and 24% over the last decade.

- DBS Group (SGX: D05 / FRA: DEVL / OTCMKTS: DBSDY / OTCMKTS: DBSDF) favoured by investors, owned by 17.7% of funds compared to 11.2% in UOB(SGX: U11 / FRA: UOB) and 7% in OCBC (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY / OTCMKTS: OVCHF).

- After the recent rotation, Singapore Banks are now the 4th most widely held Bank exposure, behind US, Indian and Canadian Banks but ahead of fellow European and Asian peers.

Luckin Coffee is launching in Singapore, will it do well? (Momentum Asia)

NOTE: Like many overseas Chinese retail and beverage brands, Luckin (OTCMKTS: LKNCY) has chosen Singapore for international expansion.

- China’s Luckin Coffee has started to expand globally – with launches in Singapore expected over the coming weeks. According to local Chinese media, Luckin plans to open a total of 10 stores by the end of April.Luckin shares were delisted almost three years ago for financial fraud. Now the company has reemerged, restructured its debt, and settled with the SEC. According to their latest financial results released on March 2, total net revenue totaled US$1.93 billion in FY2022, making the first annual profit. It opened 2190 stores in 2022 and now has a total of 8214 stores – more than Starbucks, which counts about 6000 stores in China.

- Singapore has a rich coffee culture and its cafe market is crowded. It boasts several major players including Starbucks, Coffee Bean, Joe & Dough, Huggs (which interestingly uses Ant Group’s ordering and payment system), Dimbulah, Jamaica Blue, Zus Coffee from Malaysia, PPP Coffee, Tanamera from Indonesia, Dal.komm from Korea, (soon to enter) Tim Hortons and many others. Not to mention the abundance of chains offering local style coffee in Singapore such as Fun Toast, Toast box, Yakun, Wang, and Malaysian Oldtown White Coffee (which offers similar flavors). Also, there are numerous food courts with coffee stalls priced below US$1.5. Luckin, however, has its own advantages specifically for the Singapore market. Which are they and will Luckin be able to leverage them well?

India’s Opportunities: Impossible to Ignore (Van Eck)

- Reliance Industries Limited(NSE: RELIANCE / BOM: 500325) – Reliance Industries (4.82% of net assets*) is India’s most valuable company by most metrics. The conglomerate is at the forefront of transformation focusing on telecommunications, retail and renewable energy industries. More recently, Reliance has doubled down on its commitment to pursue these strategic ventures. In August 2022, Jio Platforms, the internet arm of Reliance Industries bid $11.5 billion for the 5G spectrum in India. Mukesh Ambani, the chairman of Reliance Industries, announced a $25 billion commitment to launch 5G in India. Ambani announced that Jio aims to provide 5G service to every district in the country by December 2023. Jio’s ambition is to become the world’s largest and most advanced 5G network, ahead of China and the United States. A dominant position in this space allows Reliance to build digital, scaled adjacent businesses in e-commerce, entertainment, education, etc.Reliance Industries has plans to usher in an era of renewable energy in India with $75 billion committed to its renewable energy endeavors…

- ReNew Energy Global (NASDAQ: RNW)- We believe ReNew (0.40% of net assets*) is going to be a likely beneficiary of India’s plan to boost renewable energy capacity to 500 GW by 2030…

- HDFC Bank (NYSE: HDB) – HDFC Bank Limited (4.60% of net assets*) is a private sector bank in India that caters to a range of banking services covering commercial and investment banking as well as transaction or retail banking. In scale, it could be conceptualized as the “J.P. Morgan Chase of India.”

- HDFC recently used its vast balance sheet to acquire HDFC Ltd, the country’s largest housing & mortgage lender. This acquisition brings new skills and customers, and, for shareholders, there are some valuable synergies to be exploited post-acquisition. We view HDFC as a high-quality bank that could offer a persistent high return of equity, per our estimates, up to 23% over the next 2-3 years…

- Delhivery Limited(NSE: DELHIVERY / BOM: 543529) – Delhivery (0.79% of net assets*) is India’s fastest-growing logistics operator by revenue. The company provides an ultra-low-cost, asset-light software platform for express parcel transportation, partial truckload, cross-border and supply chain services. Delhivery supports India’s leading e-commerce marketplaces, direct-to-consumer e-tailers, consumer brands and enterprises across diverse sectors. We met with the company’s CEO during our recent trip and collected on-the-ground observational data…

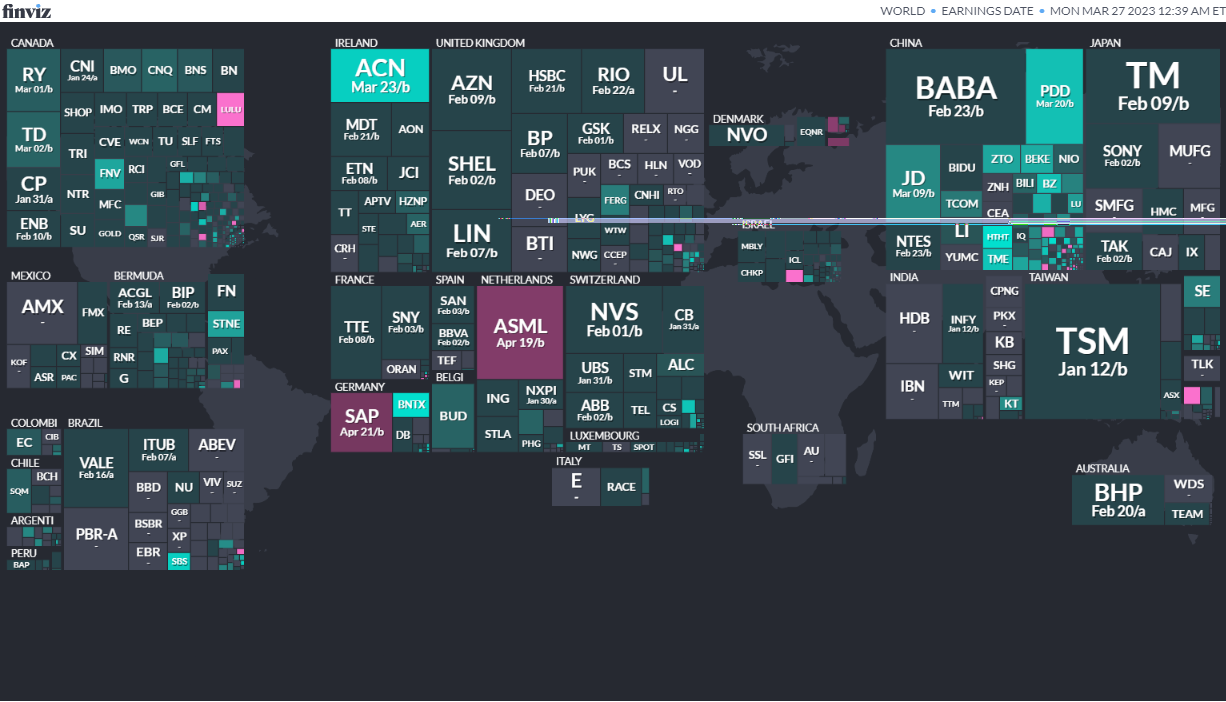

Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

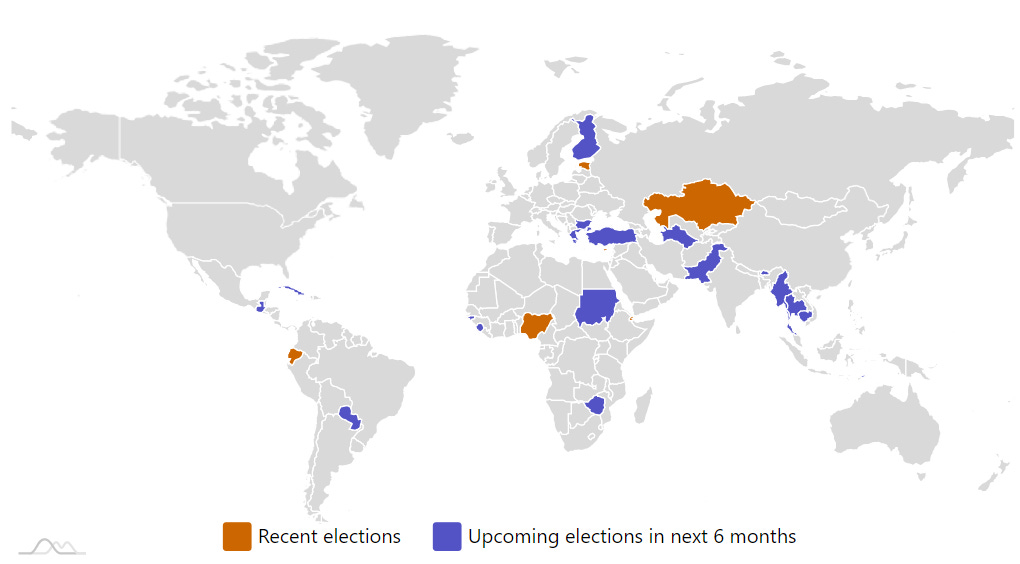

Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

KazakhstanKazakh House of RepresentativesMar 19, 2023 (d) Confirmed Jan 10, 2021- Turkmenistan Turkmen National Assembly Mar 31, 2023 (t) Date not confirmed Mar 25, 2018

- Bulgaria Bulgarian National Assembly Apr 2, 2023 (d) Confirmed Oct 2, 2022

- Paraguay Paraguayan Chamber of Senators Apr 30, 2023 (d) Confirmed Apr 22, 2018

- Paraguay Presidency of Paraguay Apr 30, 2023 (d) Confirmed Apr 22, 2018

- Paraguay Paraguayan Chamber of Deputies Apr 30, 2023 (d) Confirmed Apr 22, 2018

- Thailand Thai House of Representatives May 7, 2023 (t) Date not confirmed Mar 24, 2019

- Turkey Grand National Assembly of Turkey May 14, 2023 (d) Confirmed Jun 24, 2018

- Turkey Presidency of Turkey May 14, 2023 (d) Confirmed Jun 24, 2018

- Greece Greek Parliament Jun 8, 2023 (t) Date not confirmed Jul 7, 2019

- Cambodia Cambodian National Assembly Jul 23, 2023 (d) Confirmed Jul 29, 2018

- Pakistan Pakistani National Assembly Jul 31, 2023 (t) Date not confirmed Jul 25, 2018

- Zimbabwe Presidency of Zimbabwe Jul 31, 2023 (t) Date not confirmed Jul 30, 2018

- Zimbabwe Zimbabwean National Assembly Jul 31, 2023 (t) Date not confirmed Jul 30, 2018

Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Global Mofy Metaverse LimitedGMM, 1.2M Shares, $4.50-5.50, $6.0 mil, 3/27/2023 Week of

*Note: The shares in the IPO are being offered by the Cayman Islands- incorporated holding company.

We are a technology solutions provider engaged in virtual content production, digital marketing, and digital assets development for the metaverse industry. Utilizing our proprietary “Mofy Lab” technology platform which consists of cutting-edge three-dimensional (“3D”) rebuilt technology and artificial intelligence (“AI”) interactive technology, we are able to create 3D high definition virtual version of a wide range of physical world objects such as characters, objects and scenes which can be used in different applications. According to the industry datasheet generated by Frost & Sullivan, we believe we are one of the leading digital asset banks in China, which consists of more than 7,000 high precision 3D digital assets. High precision means 4K (4096*2160) resolution of movie precision. With our strong technology platform and industry track record, we are able to attract high-profile customers such as L’Oreal and Pepsi and earn repeat business. We primarily operate in three lines of business (i) virtual technology service, (ii) digital marketing, and (iii) digital asset development and others.

Virtual Technology Service

We provide comprehensive technology solution to assist customers in virtual content production, which can be used in a variety of settings such as movies, television series, animations advertising and gaming, etc. Leveraging our proprietary “Mofy Lab” technology platform, we are able to produce high-quality virtual content quickly and cost-effectively to meet highly differentiated customers’ needs. The virtual content production contracts are primarily quoted in fixed price, payable on a milestone basis, which requires us to perform services for visual effect design, content development, production and integration based on customers’ specific needs.

Digital Marketing

We provide advertisement production and promotion services to customers with integrated digital marketing services from content planning, technical services and content production assistance to omni-channel online placement. Technical services under advertisement production uses the same technologies with our virtual technology service. For content planning and content production, unlike focusing on the storyline under virtual technology service, we focus on the promotion products provided by the digital marketing customers under advertisement production. The advertisements are in different format, including but not limited to short video, landing pages and static materials. We consider that both of the advertisement production and promotion services are highly interrelated and not separately identifiable. It is not practical to quantify the portion of revenue from our advertisement production and revenue that derives from advertising placement/promotion services.

Digital Asset Development

Through our virtual content production business and opportunistic acquisition of certain digital assets, we are able to build a robust digital asset bank with more than 7,000 3D digital assets. We grant specific use right of these digital assets to customers who use them based on their specific needs across different applications such as movies, television series, AR/VR, animation, adverting and gaming. Our digital assets, which build up our digital asset bank, mainly consist of high precision 3D renders of scenes, characters, objects and, items that can be licensed for use in virtual environment. Depending on customers’ needs, these digital assets can be quickly deployed and integrated with minimal customization, thus reducing project costs and expediate completion time. With the rapid development of metaverse, we believe digital assets will be become increasingly valuable and have abundant use cases. We plan to actively expand our digital asset bank and build digital assets which we believe have more use case to serve this fast-growing market.

Global Mofy China has its own technology platform, called “Mofy Lab”. Mofy Lab contains self-developed and optimized technologies, including 3D rebuilt technology and AI interactive technology, which can: (i) create 3D high definition virtual version of real world objects, or the digital assets; and (ii) provide a one-stop, low barrier, low-cost solution to assist metaverse companies in creating high quality virtual content.

**Note: Net loss and revenues are in U.S. dollars for the year ended Sept. 30, 2022.

(Note: Global Mofy Metaverse Limited slashed its IPO by 80 percent to 1.2 million shares – down from 6.0 million shares – and kept the price range at $4.50 to $5.50 – to raise $6.0 million, according to an F-1/A filing dated March 7, 2023. Global Mofy Metaverse Limited filed its F-1 on Nov. 23, 2022; it submitted confidential IPO documents to the SEC on March 4, 2022.) )

SAG Holdings LtdSAG, 3.8M Shares, $4.00-4.00, $15.0 mil, 3/27/2023 Week of

We are a holding company incorporated in the Cayman Islands. The ordinary shares offered in the IPO are being offered by the holding company.

We are a Singapore-based provider of high-quality OEM, third-party branded and in-house branded replacement parts for motor vehicles and for non-vehicle combustion engines serving a number of industries. We distribute spare parts through operations primarily based in Singapore and global sales primarily generated from the Middle East and Asia. Through our On-Highway Business, we supply a wide range of genuine OEM and aftermarket parts for use in passenger and commercial vehicles bearing either the manufacturer’s brands or our in-house brands through SP Zone. Through our Off-Highway Business, we supply a wide range of components and spare parts for internal combustion engines with strong focus on filtration products through Filtec. Our Off-Highway Business serves industrial sectors that include marine, energy, mining, construction, agriculture, and oil and gas industries. Our products are sourced from genuine OEM and global premium aftermarket brands to suit the diverse needs of our customers. Over the past several years, our revenues have been relatively evenly split between our On-Highway Business and our Off-Highway Business, and approximately 10% of our revenues are derived from sale of our in-house products.

Our Group’s business can be traced back to the early 1970s, when our late founder, KE Neo, set up Chop Kim Aik, a retail shop specializing in the supply of British-made truck spare parts. KE Neo leveraged his experience as the owner of a transportation business with a fleet of trucks serving the construction industry to building a small retail shop to a large-scale operation with a solid customer base and a recognizable brand.

In 1983, we diversified into the supply of Japanese made automotive spare parts to capitalize on the increase in demand for Japanese vehicles in Singapore. Riding on this global growth of Japanese automotive exports, CE Neo, with the support of his father KE Neo, set up its first automotive spare parts retail outlet in Singapore, naming it Soon Aik Auto Parts Trading Co (which became a private limited company, Soon Aik Auto Parts Trading Co. Pte Ltd in 1995, and is now known and hereinafter referred to as “SP Zone”) specializing in trading Japanese made automotive spare parts, primarily used in passenger and commercial vehicles.

In the late 1980s, SP Zone achieved a major milestone when it was appointed as an authorized dealer of UD Trucks Corporation (“Nissan UD”) automotive genuine spare parts in Singapore, expanding our business of selling authorized genuine spare parts, beyond our historical aftermarket spare parts business model. The business gradually expanded, and the outlet grew to supply automotive spare parts for trucks operating in Singapore sold by respected Japanese brands from the manufacturers such as Nissan UD, Mitsubishi Fuso Truck and Bus Corporation, Hino Motors Ltd and Isuzu Motors Ltd.

In 1993, Jimmy Neo and CK Neo, brothers to CE Neo and sons of KE Neo, joined SP Zone, to assist with the expanding business. In 1995, Jimmy Neo was instrumental in securing the dealership with Cummins Asia Pacific Pte. Ltd (“Cummins”) for Fleetguard filters, a product used in Cummins engines, pursuant to which SP Zone started distributing filters to the marine, energy, mining, agriculture, oil and gas, and construction industries (referred to as the “Off-Highway Business”) in addition to the automotive industry (referred to as the “On-Highway Business”).

In 1995, SP Zone became a private limited company and expanded its sales channels to include exports to ASEAN markets, capitalizing on unmet demand as there were few suppliers supplying automotive spare parts to those markets at that time. Another major milestone in 1995 occurred when Edward Neo, the third brother and son of KE Neo, joined our Group to manage the local wholesale and retail business, allowing CE Neo to focus on our Group’s newly expanded export business. At this point, the business had grown from a small retail operation to regional family business run by a father and his four sons with multiple areas of focus and utilizing the family member’s different areas of expertise.

In 1999, SP Zone secured another line of filtration products when it was appointed as a distributor for Parker Racor, a line of Parker Hannifin filtration products. Subsequently, we established Filtec as a separate Singapore subsidiary to carry out sales of Off-Highway Business dedicated to handling sales to our Off-Highway customers in the industrial sectors.

In the early 2000s, Edward Neo spearheaded an effort to develop in-house branded brake parts and lubricant products, namely, VETTO and REV-1 in SP Zone, to enhance our competitiveness in the automotive industry. Over the years, the product range of our in-house brands has greatly expanded to include the NUTEQ steering and suspension parts, GENTEQ pumps and cooling system components, ELITO cables and hoses, SUNBLADE wiper blades, FILTEQ filters, and ENERGEO batteries.

In 2010, we consolidated and shifted our business operations to larger headquarters and warehouse that facilitated greater efficiency in our operations and also allowed us to increase our product inventory offerings. Through our On-Highway Business, we entered the Malaysian market by first taking a 70% equity stake, and by 2017 a 100% stake, in Autozone (M), an established company that sells wholesale automotive spare parts as well as the sale of our in-house brands in Malaysia.

Since 2010, we have been selling to wholesale distributors based in Dubai as part of our strategy to expand our business. Like Singapore in Asia, Dubai is an important key trading hub in the Middle East serving customers not only in the Middle East, but also Central Asia, Africa and Europe. This business now represents an estimated 10.7% of our sales.

More recently, in 2019, our Off-Highway Business expanded to include the life science environmental industry, securing distribution and working in close collaboration with MANN+HUMMEL, a European-based multi-national company that provides a number of automotive and industrial commercial products, including filtration and related products with life science applications, for the distribution and promotion of their products in Singapore.

In 2022, we underwent a reorganization. On February 14, 2022, Celestial obtained a 4.9% shareholding interest in SAGI from Soon Aik. On September 29, 2022, Soon Aik transferred the entire issued share capital of our group of companies, consisting of Filtec, SP Zone, Autozone (S) and Autozone (M), to SAGI. Subsequently on September 29, 2022, Soon Aik and Celestial transferred their respective shares in SAGI to the Company in exchange for equivalent proportional percentages of Ordinary Shares of the Company. Upon completion of the group reorganization, Soon Aik owns 8,915,625 shares and Celestial owns 459,375 shares, and SAGI, Filtec, SP Zone, Autozone (S) and Autozone (M) are indirect subsidiaries.

**Note: Revenue and net income figures are for the year ended Dec. 31, 2021.

(Note: SAG Holdings Ltd filed its F-1 on Oct. 7, 2022: 3.75 million ordinary shares – no price range disclosed. Of those 3.75 million shares, selling stockholders are offering 625,000 shares. On Nov. 8, 2022, SAG Holdings Ltd. filed its F-1/A – same number of shares – but it did not disclose a price range. An F-1/A dated Nov. 16, 2022, was still mum on the price range.)

Jin Medical International Ltd.ZJYL, 1.3M Shares, $8.00-9.00, $10.6 mil, 3/28/2023 Tuesday

We are a holding company incorporated in the Cayman Islands. Our Ordinary Shares offered in this prospectus are shares of our Cayman Islands holding company. As a holding company with no material operations of our own, we conduct our operations through the VIE established in the PRC. We do not have any equity ownership of the VIE; instead, we control and receive the economic benefits of the VIE’s business operations through certain contractual arrangements, or “VIE Agreements”, which are used to provide contractual exposure to foreign investment in China-based companies where Chinese law prohibits direct foreign investment in the Chinese operating companies.

The China-based VIE, Changzhou Zhongjin, and its subsidiaries, design and manufacture wheelchairs and living aids products for people with disabilities, the elderly, and people recovering from injury. Our business focuses primarily on wheelchairs. For the six months ended March 31, 2022, and 2021, and fiscal years ended September 30, 2021, and 2020, sales of wheelchairs and wheelchair components represented approximately 97.3%, 99.7%, 99.7%, and 98.9%, respectively, of our revenue, while sales of living aids products such as oxygen concentrators and bathing machines represented approximately 2.7%, 0.3%, 0.3% and 1.1%, respectively, of our revenue. Currently, our living aids products are only sold to a few selected customers to test the markets for these products. The majority of our products are sold to dealers in Japan and China, while a small number of our products are also sold to dealers located in other regions, including the United States, Canada, Australia, Korea, Israel, Singapore, and others.

Since 2006, Changzhou Zhongjin has been designing and manufacturing wheelchairs. Almost all of its wheelchairs currently for sale are manual wheelchairs. Changzhou Zhongjin only started selling electric wheelchairs in 2018, and electric wheelchairs accounted for 0.5% and 1.0% of our revenues for the six months ended March 31, 2022, and 2021, respectively, and 1% of its revenues for the fiscal years ended Sept. 30, 2021, and 2020. The manual wheelchair product category has a wide range of products at various price points, consisting of more than thirty models. The mid to high-end wheelchairs and components are mostly geared towards customers in Japan, and the relatively lower-end wheelchairs and components are targeted for customers in China.

We believe the wheelchair markets in Japan and China are favorably exposed to multiple macro-economic growth driving factors such as rising spending power, growing popularity of outdoor and active lifestyles for the disabled population, and general needs for better mobility equipment. In addition, we believe demand for our products in Japan and China will increase over the next several decades due to the growing aging population. According to the Frost & Sullivan Report, as of early 2020, more than 25% of Japan’s population is over 65 years old, the highest proportion in the world, and by 2030, one in every three people will be 65 or older. Japanese demographers estimate that senior citizens will account for 40% of the population in Japan in 2060. Similarly, in China, according to the National Bureau of Statistics of China, the population aged 65 or above has grown at a Compound Annual Growth Rate (“CAGR”) of 6.1% from approximately 150.4 million to approximately 190.6 million from 2016 to 2020. We believe the expansion of the aging populations in Japan and China will continue in the near future, providing a real opportunity for us to grow our business.

**Note: Revenue and net income figures are in U.S. dollars for the 12 months that ended March 31, 2022.

(Note: Jin Medical’s IPO pricing date is still TBA, pending NASDAQ approval. Jin Medical International Ltd. cut its IPO in an F-1/A filing dated Dec. 20, 2022, to 1.25 million ordinary shares – down from 2.25 million shares previously – and kept the price range at $8.00 to $9.00 to raise $10.625 million. The revised terms cut the deal’s size by 44.4 percent. In the Dec. 20, filing, Jin Medical also updated its financial statements through the six months that ended March 31, 2022. Jin Medical International Ltd. cut its IPO by 30.5 percent in an F-1/A filing dated Nov. 17, 2022: 2.25 million shares, down from 5.0 million shares initially, at a price range of $8.00 to $9.00, up from the initial range of $5.00 to $6.00. Estimated IPO proceeds are now $19.13 million, down 30.5 percent from the initial estimated proceeds of $27.5 million. Jin Medical International Ltd. filed its F-1 on Sept. 24, 2021; it filed confidentially on Dec. 28, 2020.)

TMT Acquisition Corp.TMTCU, 6.0M Shares, $10.00-10.00, $60.0 mil, 3/28/2023 Tuesday

We intend to focus our search initially on target businesses operating in Asia (excluding China). We will not undertake our initial business combination with a target business with its principal business operations in China (including Hong Kong and Macau). (Incorporated in the Cayman Islands)

Our sponsor, 2TM Holding LP, a Delaware limited partnership, is based in the United States. Our sponsor’s daily ordinary course of operations, including its bank accounts, financial books and records, tax matters and investment activities, are handled primarily by Dahe Zhang, managing member of its general partner and a United States resident. In addition, a majority of our management team are United States citizens.

Mr. Linan Gong has served as our executive director and chairman since July 2021. Mr. Gong is a seasoned management and finance professional with over 10 years of experience in the financial industry. Since 2017, Mr. Gong has served as the executive director at Hong Kong Quasar Securities Co., Ltd. and Quasar Asset Management Co., Ltd. and as the executive director at Hong Kong Dragon Financial Holdings Co., Ltd. From 2008 to 2012, Mr. Gong served as the CEO of China Daqing M&H Petroleum Holdings Co., Ltd., which is primarily in the business of crude petroleum and natural gas. Mr. Gong is a citizen and resident of the People’s Republic of China (PRC).

(Note: TMT Acquisition Corp. filed its S-1 on Sept. 29, 2021. This is a SPAC IPO of 6.0 million units at $10.00 each to raise $60.0 million. Each unit consists of one ordinary share and one right. Each right entitles the holder to receive two-tenths (2/10) of one ordinary share upon consummation of our initial business combination, so an investor must hold rights in multiples of 5 in order to receive shares for all of his or her rights upon closing of a business combination.)

YanGuFang International Group Co., Ltd.YGF, 2.5M Shares, $4.00-6.00, $12.5 mil, 3/28/2023 Tuesday

We are a holding company incorporated as an exempted company on May 28, 2020, under the laws of the Cayman Islands. As a holding company with no material operations of our own, we conduct substantially all of our operations through our PRC (People’s Republic of China) subsidiary and VIEs in China.

We are primarily engaged in the production, research and development, and sales of oat and grain products through our own sales team and distribution network. We are driven by a creative and experienced management team, led by Junguo He, our chairman and CEO, with a focus on the healthy food industry and a fresh take on our mission, building from our deep understanding of and commitment to oat-based food science.

Our mission is to build a new type of healthy food company with core values of safety, health, nutrition and sustainability, supported by our advocates of scientific diet structure and different approaches to our brand and commercial strategy.

In 2014, we produced a new kind of oat germ groats in the form of whole grains through our patented equipment, which brought healthier oat products to the daily diets of the consumers.

Our commitment to oats has resulted in core technical advancements that enable us to unlock the breadth of our product portfolio, which is broadly categorized into oat series products (including, but not limited to, oat germ groats, oatmeal, oat flour, oat bran, some of which are organic or green food series) and oat nutrient and health series products (including, but not limited to, oat peptide series, dietary fiber powder, oat biscuits, oil series, oat hand cream and soap, and oat toothpaste). Based on our vision and understanding of oats, we also source products from third party suppliers that complement our product portfolio.

We seek to build our market position both in the PRC and internationally. In the PRC market, our business operations cover many provinces and cities of China, including but not limited to, Beijing, Shanghai, Jiangsu, Zhejiang, Fujian, Guangdong, Inner Mongolia, and Anhui.

We also seek to establish our presence internationally and currently sell our products through a distributor in Thailand. As part of our plan to expand our international footprint, we expect to commence sales of our products in the United States during the second half of 2022.

**Note: Revenue and net income are for the fiscal year that ended June 30, 2022.

(Note: YanGuFang International Group, Inc. cut its IPO again – to 2.5 million shares, down from 3.5 million shares – and cut the price range to $4.00 to $6.00 – to raise $12.5 million – according to an F-1/A filing dated March 1, 2023. The new terms represent a 35 percent in the IPO’s size.

(Previously: YanGuFang International Group revived its IPO with an F-1/A filing dated Jan. 10, 2023, in which it downsized the deal by cutting the number of shares to 3.5 million – down from 5.0 million shares – and cutting the bottom of the price range to $4.00 – down from $5.00 – so the new price range is $4.00 to $7.00. Estimated IPO proceeds are now $19.25 million – down from $30.0 million – a reduction of 35.8 percent. YanGuFang also updated its financial statements with figures for the fiscal year that ended June 30, 2022, in its F-1/A filing dated Jan. 10, 2023. )

(Background: YanGuFang International Group temporarily postponed its IPO pricing in late September 2022 while NASDAQ finalized its review; the pricing date, initially Sept. 25, 2022, was expected to be updated as soon as possible. YanGuFang International Group disclosed its IPO terms in an S-1/A filing dated Sept. 2, 2022: 5.0 million shares at $5.00 to $7.00 to raise $30 million. YanGuFang filed its S-1 on Aug. 5, 2022; the company submitted confidential IPO documents to the SEC on March 9, 2022.)

ARB IOT GROUP LIMITEDARBB, 1.3M Shares, $4.00-6.00, $6.5 mil, 3/29/2023 Wednesday

We are a provider of complete solutions to our clients for the integration of Internet of Things (“IoT”) systems and devices from designing to project deployment. (Incorporated in the Cayman Islands)

Our mission is to become a leading player in the IoT landscape in the ASEAN region. We offer a wide range of IoT systems as well as provide customers a substantial range of services such as system integration and system support service. We deliver holistic solutions with full turnkey deployment from designing, installation, testing, pre-commissioning, and commissioning of various IoT systems and devices as well as integration of automated systems, including installation of wire and wireless and mechatronic works.

Recent new technology trends such as artificial intelligence (AI), cloud computing, 5G, robotic process automation (RPA), IoT and hyper-connectivity continue to transform businesses and drive companies to seek digital changes to meet evolving demands of customers. We have built up an IoT development ecosystem to help our customers address the challenges and opportunities brought by new digital technologies, offering an array of design and development system software, application software and other software in providing digital solutions for various processes, sub-processes, transactions and activities.

Currently, we have organized our operations into four business lines: 1. IoT Smart Home & Building; 2. IoT Smart Agriculture; 3. IoT System Development and 4. IoT Gadget Distribution.

We have benefited from ARB Berhad’s experience, reputation and network in Malaysian information technology (“IT”) industry. As an operating segment of a seasoned Malaysian public company, we have gained from established business processes and a veteran leadership team, allowing us to focus our attention on growing and developing our IoT business. While our history with ARB Berhad has provided us with certain competitive advantages, we believe that the separation and this offering will promote clearer segregation of business responsibilities and operations for the IoT segment, thereby enabling efficient allocation of resources to accelerate the growth of our IoT business, and allow us to have direct access to a globally recognized stock exchange, which would increase our financial flexibility to explore expansion and growth prospects and enhance our corporate reputation and recognition. See “Corporate History and Structure” and “Related Party Transactions—Historical Relationship with ARB Berhad.”

Our business has grown rapidly as demonstrated by the increase in revenue from approximately RM50.3 million ($11.4 million) for the fiscal year ended June 30, 2021 to approximately RM443.0 million ($100.6 million) for the fiscal year ended June 30, 2022, an increase of RM392.7 million ($89.1 million), or 780.7%, and in profit from approximately RM18.9 million ($4.3 million) for the fiscal year ended June 30, 2021 to approximately RM73.4 million ($16.7 million) for the fiscal year ended June 30, 2022, an increase of 289.0%. For additional information regarding our financial performance, see “Summary Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

**Note: Revenue and net income are in U.S. dollars for the 12 months that ended June 30, 2022.

(Note: ARB IOT Group Limited increased the size of its IPO to 1.3 million shares, up from 1.2 million shares, and kept the price range at $4.00 to $6.00 – to raise $6.5 million – in an F-1/A filing dated Dec. 5, 2022. ARB IOT Group Limited filed its F-1 on Sept. 30, 2022, following submission of confidential IPO documents on June 24, 2022.)

Chanson International HoldingCHSN, 3.8M Shares, $4.00-6.00, $18.8 mil, 3/29/2023 Wednesday

We are a holding company incorporated in the Cayman Islands and not a Chinese operating company. As a holding company with no material operations of our own, we conduct our operations through our subsidiaries in China and the U.S. and the VIEs in China.

Note: “Unless otherwise indicated, all share amounts and per share amounts in this prospectus have been presented giving effect to a forward split of our ordinary shares at a ratio of 1,000-for-1 share and additional share issuances to our existing shareholders approved by our shareholders and board of directors on March 27, 2021.”

The PRC Stores and the U.S. Stores manufacture and sell a wide selection of bakery products, seasonal products (i.e. products sold during particular holiday seasons), and beverage products; some of these stores also offer eat-in services. The PRC Stores and the U.S. Stores currently focus their business in Xinjiang of the PRC and New York City, respectively, and plan to expand to other regions of the PRC and the U.S., with a goal of opening three to five new stores in China annually and eight new stores in the U.S. during the next five years. The PRC Stores and the U.S. Stores aim to make healthy, nutritious, and ready-to-eat food through advanced facilities and industry research and to create a comfortable, yet distinguishable store environment in which customers can enjoy their products.

The PRC Stores are a bakery chain consisting of 32 stores operated by Xinjiang United Family and the VIEs under the “George●Chanson” brand in Xinjiang, and the U.S. Stores sell their products in New York City. Chanson 3rd Ave and Chanson Broadway are currently renovating spaces for the opening of two new stores in New York City. Selling through directly-operated stores, instead of franchise stores, allows the operating entities to run their entire operation more efficiently and to exercise greater control over the quality of products and the presentation of their brand, and to better manage customer experience in the stores. The PRC Stores and the U.S. Stores also sell their products on their digital platforms and through third-party online food ordering platforms. The current customer base of the PRC Stores and the U.S. Stores consists of both individual and corporate customers. To expand their customer base, the PRC Stores and the U.S. Stores have developed a variety of marketing and sale strategies, such as increasing their presence on social media platforms, devising pricing and discounting programs, and improving customer in-store experience.

The PRC Stores manufacture the majority of bakery products in their central factory located in Urumqi, Xinjiang, prepare beverage products within the stores, and contract third-party manufacturers to produce seasonal products. the U.S. Stores bake bakery products, prepare breakfast, lunch and all-day brunch, bar food, and other light meals for eat in, and make beverage products all within the kitchen in the stores. To ensure the quality and safety of their products, the PRC Stores and the U.S. Stores procure raw materials, including flour, eggs, and milk, from renowned suppliers with a record of consistently supplying high-quality raw materials over decades in the food industry. In addition, the PRC Stores and the U.S. Stores have implemented a rigorous quality control system covering their entire operation process and mandated internal training to improve their employees’ awareness and knowledge of food safety.

The PRC Stores and the U.S. Stores have dedicated and highly experienced product development teams that constantly create new products that reflect market trends and are designed to meet customer demand. As of November 2022, the PRC Stores had more than 697 types of bakery products and seasonal products on sale, including over 135 types of new products introduced to the market since 2021, and the U.S. Stores had 123 types of eat-in menu items and bakery products on sale, including 26 types of new products introduced to the market since 2021. The PRC Stores and the U.S. Stores also offer a large number of beverage products and update their drink menus seasonally and in response to ever changing customer demand. By continuously offering new products and refining their product formulas to enhance existing products, we believe that the PRC Stores and the U.S. Stores are able to steadily bring in new customers and increase the frequency of their existing customers’ visits to their stores, digital platforms, and store page on third-party platforms.

**Note: Revenue and net income figures are for the 12 months that ended June 30, 2022.

(Note: Chanson International Holding filed an F-1/A dated March 20, 2023, in which it increased the size of its IPO to 3.75 million shares and kept the price range at $4.00 to $6.00 to raise $18.75 million. In February, Chanson switched its sole book-runner to EF Hutton – from Univest Securities – according to an F-1/A filing dated Feb. 6, 2023.)

(Chanson International Holding filed its F-1 on March 31, 2021, and disclosed terms for its IPO: 3 million shares at $4.00 to $6.00 to raise $15.0 million. )

(Note: On Dec.1, 2022, Chanson International Holding filed an F-1/A with updated financial statements for the six months through June 30, 2022.)

Millennium Group International Holdings LimitedMGIH, 1.3M Shares, $4.00-4.00, $5.0 mil, 3/30/2023 Thursday

Millennium Group International Holdings Limited, or Millennium, is a holding company incorporated in the Cayman Islands. As a holding company with no material operations, it conducts a substantial majority of its operations through the subsidiaries established in Hong Kong, the People’s Republic of China, or the PRC or China, and Vietnam.

Founded in 1978, we are a long-established paper-based packaging solutions supplier. We are headquartered in Hong Kong with operations in the PRC and Vietnam. We operate two production facilities in Guangdong Province of the PRC. We also operate a supply chain management business to service our global clients who source their packaging needs from Vietnam and other Association of Southeast Asian Nations (“ASEAN”) countries. We have also established offices in Hong Kong and Vietnam to service our customers outside the PRC.

We are a third-generation family-owned business and our history can be traced back to 1978 when Mr. Yee Cheong Lai, our founder, who engaged in the sale of Corrugated Paper in Hong Kong and developed a vision to becoming a one-stop integrated services provider for paper related products. Since our inception, through the continued efforts of our founder, the second generation and third generation of the family, we have diversified our business segments beyond the sale of Corrugated Paper to production and sale of packaging products and corrugated products with deliveries to, among others, PRC, Hong Kong, Vietnam, Myanmar, Australia, Indonesia, Cambodia, Taiwan, Thailand, United States, India and Germany. Throughout our years of dealings, we have developed and accumulated extensive industry experience and capabilities in relation to design and production of packaging products and corrugated products, packaging costing management, and print quality consistency control. We plan on further expanding our business in packaging products supply chain management solution to assist our global customers who source their supplies from regions in Southeast Asia.

We offer paper-based inner and outer packaging products which can be broadly categorized into packaging products and corrugated products.

Note: Revenue and net income figures are for the year ended June 30, 2022.

(Note: Millennium Group International Holdings Limited cut the size of its IPO by 38 percent to 1.25 million shares – down from 2.0 million shares – and kept the assumed IPO price at $4.00 – to raise $5.0 million, according to an F-1/A filing dated March 15, 2023.)

(Note: Millennium Group International Holdings Limited changed underwriters and cut its IPO by 60 percent in an F-1/A filing dated March 3, 2023. Revere Securities and R.F. Lafferty & Co. are the new joint book-runners, replacing Network 1 Financial Securities, according to the March 3, 2023, SEC filing. Millennium Group slashed its IPO to 2.0 million shares – down from 5.0 million shares – and set the assumed IPO price at $4.00 – the bottom of its $4.00 to $5.00 price range – to raise $8.0 million. The IPO will now raise 64 percent less than the $22.5 million in estimated IPO proceeds under the previous terms. Millennium Group filed its F-1 on Oct. 28, 2022, and disclosed terms for its IPO: 5.0 million shares at $4.00 to $5.00 each to raise $22.5 million. The company submitted confidential IPO paperwork to the SEC on Jan. 31, 2022.)

U Power Ltd.UCAR, 2.5M Shares, $6.00-8.00, $17.5 mil, 4/7/2023 Friday

We are an electric vehicle (EV) battery-swapping technology company. (Holding company incorporated in the Cayman Islands)

We are a vehicle sourcing service provider in China, with a vision to becoming an EV market player primarily focused on our proprietary battery-swapping technology, or UOTTA technology, which is an intelligent modular battery-swapping technology designed to provide a comprehensive battery power solution for EVs.

Since our commencement of operations in 2013, we have principally engaged in the provision of vehicle sourcing services. We broker sales of vehicles between automobile wholesalers and buyers, including small and medium sized vehicle dealers (“SME dealers”) and individual customers primarily located in the lower-tier cities in China, which are smaller and less developed than the tier-1 or tier-2 cities. To that end, we have focused on building business relationships with our sourcing partners and have developed a vehicle sourcing network. As of the date of this prospectus, our vehicle sourcing network consisted of approximately 100 wholesalers and 30 SME dealers located in lower-tier cities in China.

Beginning in 2020, we gradually shifted our focus from the vehicle sourcing business to the development of our proprietary battery-swapping technology, or UOTTA technology. According to Frost & Sullivan, the PRC government will focus on promoting the electrification of commercial vehicles in the next few years, and it is expected that the sales volume of electric commercial vehicles will grow from 164.7 thousand units in 2021 to 431.0 thousand units in 2026 at a CAGR of 21.2% in China, and with the increasing penetration rates of electric commercial vehicles and the expanding battery-swapping infrastructure network, the market size by revenue of battery swapping solutions for electric commercial vehicle is expected to increase from approximately RMB8,661.5 million in 2021 to RMB176,615.1 million in 2026, representing a CAGR of 82.8%. In order to capture the opportunities arising from such growth, our plan is to develop a comprehensive EV battery power solution based on UOTTA technology, which mainly consists of: (i) vehicle-mounted supervisory control units that monitor the real-time status of an EV’s battery packs; (ii) customized vehicle control units (“VCUs”), which upload real-time data of the electric vehicle, such as its battery status, real-time location and safety status, to our data platform, using Bluetooth and/or Wi-Fi technologies; and (iii) our data management platform, which collects and synchronizes real-time information of the EVs uploaded by their respective VCUs, as well as information on the availability and locations of compatible UOTTA battery-swapping stations that assist drivers in locating the nearest compatible UOTTA battery-swapping station(s) available when the EV’s battery is determined to be lower than a certain level; and (iv) UOTTA battery-swapping stations designed for precise positioning, rapid disassembly, compact integration and flexible deployment of battery swapping for compatible EVs.

We have established in-house capabilities in the innovation of EV battery-swapping technology. Through our research and development efforts, we are developing an intellectual property portfolio. As of the date of this prospectus, we had 14 issued patents and 24 pending patent applications in China. Our research and development team is committed to technology innovation. As of the date of the prospectus, our research and development team consisted of 34 personnel and is led by Mr. Rui Wang and Mr. Zhanduo Hao, each of whom has experience of over 20 years in the electric power sector.

In 2021, leveraging years of automobile industry experience, we started cooperating with major automobile manufactures to jointly develop UOTTA-powered EVs, by adapting selected EV models with our UOTTA technology. According to Frost & Sullivan, compared with passenger EV drivers, drivers of commercial-use EVs experience more range anxiety and are more motivated to shorten, or even eliminate, time spent on recharging EVs, therefore, we intend to primarily focus on developing commercial-use UOTTA-powered EVs, such as ride-hailing passenger EVs, small logistics EVs, light electric trucks, and heavy electric trucks, and their compatible UOTTA battery-swapping stations. As of the date of this prospectus, we have entered into cooperating agreements with two major Chinese automobile manufacturers, FAW Jiefang Qingdao Automotive Co., Ltd, and HUBEI TRI-RING Motor Co., Ltd, to jointly develop UOTTA-powered electric trucks. We also have engaged with two battery-swapping station manufactures to jointly develop and manufacture UOTTA battery-swapping stations that are compatible with UOTTA-powered EVs. Our UOTTA battery-swapping stations are designed for precise positioning, rapid disassembly, compact integration and flexible deployment, allowing battery replacement within several minutes. As of the date of this prospectus, we realized sales of five battery-swapping stations. In August 2021, we completed the construction of our own battery-swapping station factory in Zibo City, Shandong Province (the “Zibo Factory”), which commenced manufacturing UOTTA battery-swapping stations in January 2022. We are also in the process of constructing another factory in Wuhu city, Anhui province (the “Wuhu Factory”), which is expected to commence production in 2023. In order to provide a comprehensive battery power solution based on UOTTA technology, we are in the process of developing a data management platform that connects UOTTA-powered EVs and stations, and assists the UOTTA-powered EV drivers in locating the closest compatible UOTTA swapping-stations on their routes. In January 2022, we started operating a battery-swapping station, pursuant to our station cooperation agreement with Quanzhou Xinao Transportation Energy Development Co., Ltd (“Quanzhou Xinao”), a local gas station operator in Quanzhou City, Fujian Province. Although we have made significant progress in entering into the EV market, there is no assurance that we will be able to execute our business plan to expand into the EV market as we have planned.

**Note: U Power Ltd. reported a net loss of $6.84 million on revenue of $1.75 million for the 12 months that ended June 30, 2022.

(Note: U Power Ltd. disclosed terms for its IPO on March 8, 2023, n an F-1/A filing: 2.5 million shares at $6.00 to $8.00 to raise $17.5 million. U Power Ltd. filed its F-1 on Dec. 22, 2022, and updated the filing with an F-1/A on Feb. 14, 2023 – without disclosing terms for its IPO.)

CDT Environmental Technology Investment Holdings LimitedCDTG, 3.1M Shares, $4.00-4.00, $12.3 mil, 4/10/2023 Week of

We are a waste treatment company that generates revenue through design, development, manufacture, sales, installation, operation and maintenance of sewage treatment systems and by providing sewage treatment services. We primarily engage in two business lines: sewage treatment systems and sewage treatment services in both urban and rural areas. Sewage treatment systems are sometimes also referred to herein as rural sewage treatment, and sewage treatment services are sometimes also referred to herein as septic tank treatment.

For sewage treatment systems, we sell complete sewage treatment systems, construct rural sewage treatment plants, install the systems, and provide on-going operation and maintenance services for such systems and plants in China for municipalities and enterprise clients. We provide decentralized rural sewage treatment services with our integrated and proprietary system using our advanced quick separation technology. Our quick separation technology uses a biochemical process for economically and sufficiently treating rural sewage. In addition, our integrated equipment generally has a lifespan of over 10 years without replacement of the core components. Due to our quick separation technology and our technological expertise and experience, our integrated rural sewage treatment system produces a high quality of outflowing water, with high degrees of automation, efficient construction and start up, and low operational costs. In addition, our equipment is typically able to process abrupt increases of sewage inflows and high contamination. Our integrated equipment consists of a compact structure and is buried underground in order to minimize changes to the surrounding environment.

**Note: Revenue and net income figures are in U.S. dollars for the 12 months that ended June 30, 2022.

(Note: CDT Environmental Technology Investment Holdings Limited updated its financial statements in an F-1/A dated Feb. 24, 2023. The company changed its sole book-runner to WestPark Capital from ViewTrade Securities in an F-1/A filing in June 2021. The F-1 was filed on Jan. 15, 2021.)

Emerging Market ETF Launches

Climate change and ESG are clearly the latest flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- 1/31/2023 – Strive Emerging Markets Ex-China ETF STX – Passive, equity, emerging markets

- 1/20/2023 – Putnam PanAgora ESG Emerging Markets Equity ETF PPEM – Active, equity, ESG, emerging markets

- 1/12/2023 – KraneShares China Internet and Covered Call Strategy ETF KLIP – Active, equity, China, options overlay, thematic

- 1/11/2023 – Matthews Emerging Markets ex China Active ETF MEMX – Active, equity, emerging markets

- 12/13/2022 – GraniteShares 1.75x Long BABA Daily ETF BABX – Active, equity, leveraged, single stock

- 12/13/2022 – Virtus Stone Harbor Emerging Markets High Yield Bond ETF VEMY – Active, fixed income, junk bond, emerging markets

- 9/22/2022 – WisdomTree Emerging Markets ex-China Fund XC – Passive, equity, emerging markets

- 9/15/2022 – KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV – Passive, equity, Asia, dividend strategy

- 9/15/2022 – OneAscent Emerging Markets ETF OAEM – Active, Equity, emerging markets, ESG

- 9/9/2022 – Emerge EMPWR Sustainable Select Growth Equity ETF EMGC – Active, equity, emerging markets

- 9/9/2022 – Emerge EMPWR Unified Sustainable Equity ETF EMPW – Active, equity, emerging markets

- 9/8/2022 – Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH – Active, equity, emerging markets, ESG

- 7/14/2022 – Matthews China Active ETF MCH – Active, equity, China

- 7/14/2022 – Matthews Emerging Markets Equity Active ETF MEM – Active, equity, emerging markets

- 7/14/2022 – Matthews Asia Innovators Active ETF MINV – Active, equity, Asia

- 6/30/2022 – BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD – Passive, fixed income, emerging markets

- 5/2/2022 – AXS Short CSI China Internet ETF SWEB – Active, inverse, thematic

- 4/27/2022 – Dimensional Emerging Markets High Profitability ETF DEHP – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Core Equity 2 ETF DFEM – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Value ETF DFEV – Active, equity, emerging markets

- 4/27/2022 – iShares Emergent Food and AgTech Multisector ETF IVEG – Passive, equity, thematic [Mostly developed markets]

- 4/21/2022 – FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM – Passive, equity, ESG

- 4/6/2022 – India Internet & Ecommerce ETF INQQ – Passive, equity, thematic

- 2/17/2022 – VanEck Digital India ETF DGIN – Passive, India market, thematic

- 2/17/2022 – Goldman Sachs Access Emerging Markets USD Bond ETF GEMD – Passive, fixed income, emerging markets

- 1/27/2022 – iShares MSCI China Multisector Tech ETF TCHI – Passive, China, technology

- 1/11/2022 – Simplify Emerging Markets PLUS Downside Convexity ETF EMGD – Active, equity, options strategy

- 1/11/2022 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG – Passive, equity, ESG

Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

- 3/30/2023 – Invesco BLDRS Emerging Markets 50 ADR Index Fund – ADRE

- 3/30/2023 – Invesco BulletShares 2023 USD Emerging Markets Debt ETF – BSCE

- 3/30/2023 – Invesco BulletShares 2024 USD Emerging Markets Debt ETF – BSDE

- 3/30/2023 – Invesco PureBeta FTSE Emerging Markets ETF – PBEE

- 3/30/2023 – Invesco RAFI Strategic Emerging Markets ETF – ISEM

- 2/17/2023 – Direxion Daily CSI 300 China A Share Bear 1X Shares – CHAD

- 1/13/2023 – First Trust Chindia ETF – FNI

- 12/28/2022 – Franklin FTSE Russia ETF – FLRU

- 12/22/2022 – VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

- 8/22/2022 – iShares MSCI Argentina and Global Exposure ETF AGT

- 8/22/2022 – iShares MSCI Colombia ETFI COL

- 6/10/2022 – Infusive Compounding Global Equities ETF JOYY

- 5/3/2022 – ProShares Short Term USD Emerging Markets Bond ETF EMSH

- 4/7/2022 – DeltaShares S&P EM 100 & Managed Risk ETF DMRE

- 3/11/2022 – Direxion Daily Russia Bull 2X Shares RUSL

- 1/27/2022 – Legg Mason Global Infrastructure ETF INFR

- 1/14/2022 – Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as some ETF lists are still being updated as of Summer 2022).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (March 27, 2023) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Luckin Coffee is Launching in Singapore, Will it Do Well? (Momentum Asia)

- The Emerging Asia Pacific Capital Markets: Malaysia (CFA Institute)

- Yale University Added $100M to the Vanguard FTSE Emerging Markets ETF (VWO) in 1Q2014 (P&I)

- Emerging Market Links + The Week Ahead (March 13, 2023)

- Emerging Market Links + The Week Ahead (May 16, 2022)

- Tech Sector Can Power Emerging Market Portfolios (FE Trustnet)

- Emerging Market Links + The Week Ahead (March 20, 2023)

- Emerging Market Links + The Week Ahead (March 6, 2023)

- Emerging Market Links + The Week Ahead (February 27, 2023)

- Emerging Market Links + The Week Ahead (July 17, 2023)

- Emerging Market Links + The Week Ahead (January 23, 2023)

- Emerging Market Links + The Week Ahead (November 7, 2022)

- Singapore Closed-End Funds List

- Emerging Market Links + The Week Ahead (February 6, 2023)

- Emerging Market Links + The Week Ahead (September 12, 2022)