As mentioned late last week, I have found additional resources (free equity research reports, etc.) to cover in (mostly paywalled) monthly stock picks posts (and there might be enough material to make these posts more frequent). However, I have noticed more Substacks focused on international or non-USA stocks suddenly going quiet.

I guess this could be a natural shakeout as their writers either realize the difficulty of growing or monetizing a financial newsletter to warrant their time in continuing to keep one updated. On the other hand, some Substackers might also be putting everything behind paywalls and not bothering to send out any previews to free subscribers (thus becoming out of sight and out of mind…).

I had also noted some months ago, Seeking Alpha discontinued their free international stocks newsletter (basically links to their articles about non-USA stocks organized by country). Given the level of US stock valuations, I don’t know why they would do this plus I am sure their tagging or content management system could easily help put together a newsletter with minimal human effort.

If you know of other Substacks (or blogs hosted outside of this platform) that are more focused on international/emerging market or specific country or regional stocks (rather than just USA stocks), let me know in a comment:

Note that earnings and other types of slide presentations posted on Seeking Alpha are typically not behind their paywalls (and are a great way to learn about unfamiliar international stocks). Thus, I have started linking to them in these free Monday posts (their earnings call transcripts are typically paywalled)…

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🌐 Emerging Market Stock Picks (October 2025) Partially $

- 🤖 DeepSeek Analysis

- SE Asia

- 🇮🇩 Indonesia – PT GoTo Gojek Tokopedia Tbk, Sarana Menara Nusantara Tbk PT, Kalbe Farma Tbk PT, PT Bank Syariah Indonesia Tbk, Sinergi Inti Andalan Prima Tbk PT, Bank Jago Tbk PT, Indosat Ooredoo Hutchison, Unilever Indonesia Tbk PT, PT Dayamitra Telekomunikasi Tbk, Pakuwon Jati Tbk PT, AKR Corporindo Tbk PT, Bank Mandiri Tbk PT, Bank Tabungan Negara (Persero) Tbk PT, Bank Negara Indonesia (Persero) Tbk PT, Bumitama Agri Ltd, Bank Central Asia Tbk PT, Telkom Indonesia (Persero) Tbk PT, Jayamas Medica Industri Tbk PT, Sumber Alfaria Trijaya Tbk PT, Timah Tbk PT, Japfa Comfeed Indonesia Tbk PT, Bank Rakyat Indonesia Tbk PT, Autopedia Sukses Lestari Tbk PT, Astra International Tbk PT, Bank Jtrust Indonesia Tbk PT, Indonesia Kendaraan Terminal Tbk PT, Aneka Tambang Tbk PT & Blue Bird Tbk PT

- 🇲🇾 Malaysia – CNMC Goldmine Holdings Ltd

- 🇵🇭 Philippines

- 🇸🇬 Singapore – iFAST Corporation Ltd, CapitaLand Integrated Commercial Trust, Centurion Accommodation REIT, China Aviation Oil, HRNetGroup, Mapletree Logistics Trust, Keppel DC REIT, KSH Holdings Limited, Singapore Technologies Engineering Ltd, Sembcorp Industries, Suntec Real Estate Investment Trust, CDL Hospitality Trusts, OUE Real Estate Investment Trust, Mapletree Pan Asia Commercial Trust, Marco Polo Marine Ltd, Frasers Centrepoint Trust, COSCO Shipping International (Singapore) Co Ltd, Genting Singapore Ltd, Sanli Environmental Ltd, Digital Core REIT, First Resources Ltd, Sheng Siong Group Ltd, NetLink NBN Trust, Nanofilm Technologies, CSE Global Ltd, Oversea-Chinese Banking Corp (OCBC), Central Plaza Hotel PCL, Centurion Corporation Ltd, StarHub, GuocoLand Limited, Aztech Global Ltd, Grab Holdings Ltd, ComfortDelGro Corporation Ltd, Keppel Ltd, Soilbuild Construction Group Ltd, ASL Marine Holdings Ltd, Riverstone Holdings, 17LIVE Group, DBS Group, Seatrium Ltd, BRC Asia Limited, Keppel REIT, Wilmar International, UOL Group Ltd, Banyan Tree Holdings, Stoneweg European REIT, Lendlease Global Commercial REIT, CapitaLand Ascendas REIT, Tai Sin Electric Ltd, AEM Holdings Ltd & Aspial Lifestyle Ltd

- Singapore Broker’s Digest

- 🇹🇭 Thailand – WHA Corporation PCL, Central Retail Corporation PCL, Kasikornbank PCL, Indorama Ventures PCL, Central Pattana PCL, Bangkok Bank PCL, PTT Exploration & Production PCL, Siam Cement PCL, Bangkok Expressway and Metro PCL, Land and Houses PCL, Gulf Development PCL, SCG Packaging PCL, Osotspa PCL, Carabao Group PCL, Home Product Center PCL, Erawan Group PCL, BGrimm Power PCL, Muangthai Capital PCL, PTT Oil & Retail Business PCL, Thai Beverage PCL, Delta Electronics Thailand PCL, Global Power Synergy PCL, Bangchak Corporation PCL, Thai Oil PCL, Tidlor Holdings PCL, PTT Global Chemical PCL, Berli Jucker PCL, SCB X PCL, Krung Thai Bank PCL, IRPC PCL, Kiatnakin Phatra Bank PCL, CP ALL PCL, Bhiraj Office Leasehold REIT, Tisco Financial Group PCL, Charoen Pokphand Foods PCL, Aeon Thana Sinsap Thailand PCL, Bangkok Dusit Medical Services PCL, Bumrungrad Hospital PCL, Thai Union Group PCL & True Corporation PCL

- Africa

- Middle East

- 🇧🇭 Bahrain – Al Salam Bank

- 🇴🇲 Oman – Oq Exploration and Production CJSC

- 🇸🇦 Saudi Arabia – SABIC Agri-Nutrients Co, Bank Albilad SJSC, Etihad Etisalat Company SJSC, Arab National Bank, The Saudi Investment Bank SJSC, Alinma Bank, Riyad Bank, Banque Saudi Fransi SJSC, Al Rajhi Bank, Saudi National Bank SJSC, Jarir Marketing Company & Almarai Company

- 🇦🇪 United Arab Emirates (UAE) – Alef Education Holding PLC, Abu Dhabi Polymers Co Borouge LLC Ltd, Dubai Islamic Bank PJSC, United Arab Bank, ADNOC Drilling Company PJSC, Aldar Properties, Abu Dhabi Commercial Bank PJSC, Emirates Driving Company, National Bank of Ras Al Khaimah PSC, Emirates Integrated Telecommunications Co PJSC, Emirates NBD Bank PJSC, Commercial Bank of Dubai, Abu Dhabi Islamic Bank PJSC, Sharjah Islamic Bank & Investcorp Capital Plc

- Eastern Europe & Emerging Europe

- 🇭🇺 Hungary – PannErgy Nyrt & Opus Global Nyrt

- 🇵🇱 Poland – Fabrity SA, Ailleron SA, Enter Air SA, Bioceltix SA, Dadelo SA, Medicalgorithmics SA, Newag Sa, Cyber_Folks SA, Quercus TFI SA, ASBISc Enterprises Plc, Auto Partner SA, Vigo Photonics SA, Izostal SA, Lubelski Wegiel Bogdanka SA, Scope Fluidics SA, PA Nova SA, Atende SA, Ze Pak Sa & Makarony Polskie SA

- Latin America

- 🇲🇽 Mexico & Central America – FIBRA Prologis, GMexico Transportes, Alfa SAB de CV, Grupo Aeroportuario del Centro Norte or OMA, Fomento Economico Mexicano SAB de CV, CEMEX, Wal-Mart de Mexico SAB de CV, Coca-Cola Femsa SAB de CV, Arca Continental SAB de CV, La Comer SAB de CV, Fibra Monterrey SAPI de CV, Gentera SAB de CV, Grupo Aeroportuario del Sureste (ASUR), El Puerto de Liverpool SAB de CV, Grupo Comercial Chedraui SAB de CV, GCC SAB de CV, Alpek SAB de CV, Grupo Aeroportuario del Pacífico or GAP & America Movil SAB de CV

- EM Fund Stock Picks & Country Commentaries (November 9, 2025) Partially $

- Asia’s “platform” businesses, Alibaba’s involution fuelled comeback, cockroaches in the private credit market, international value outperforming growth, September/Q3 + October fund updates, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article (Note: Seeking Alpha earnings/conference etc. presentations are typically not paywalled) / ⛔ = Article archiving may not be working properly

🌏 Asia

🌏 Global investors pile into India commercial real estate (The Asset) 🗃️

- Asia-Pacific investment volumes rise 26% to US$39.5 billion in Q3 amid fragile recovery

- Asia-Pacific commercial real estate investment volumes reached US$39.5 billion in the third quarter of 2025, a 2% increase from the same period a year ago and a substantial 26% uptick from the previous three months, according to new data from global real estate consulting firm JLL.

- Year-to-date volumes rose 11% year-on-year to US$106.6 billion as markets navigate a fragile recovery amid evolving interest rate dynamics and persistent geopolitical headwinds.

🌏 Market realities pushing HNWIs to alternatives (The Asset) 🗃️

- Mass affluent holdings in asset class forecast to reach US$2-3 trillion in five years

- Market realities, particularly lingering inflation, stretched valuations, and the return of volatility to global markets, are pushing Asia’s high-net-worth individuals ( HNWIs ) to turn decisively towards alternatives to build resilience, diversification, and yield.

- Speaking at the J.P. Morgan Asset Management’s Asia-Pacific Media Summit 2025 in Seoul, Jed Laskowitz, global head of private markets and customized solutions, and James Burdis, head of global strategic relationships and private wealth, outlined how alternative assets ( private equity, private credit, real assets, hedge funds, etc. ), long the preserve of institutions, are entering the private wealth mainstream.

- While ultra-wealthy families in the region already hold over 20% of their portfolios in alternatives, J.P. Morgan estimates that the mass affluent segment, currently averaging just 2%, could grow to 8%-12% in the next few years. That represents roughly US$2-3 trillion in assets in motion.

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 U.S. listings by Chinese firms face mounting challenges on both sides of Pacific (Bamboo Works)

- While new Nasdaq rules threaten to derail many smaller U.S. listings by Chinese companies, China’s securities regulator is also stepping up its scrutiny of such listings

- China’s securities regulator has been increasing its scrutiny of Chinese firms aiming to list in the U.S., asking questions on a growing number of topics

- The scrutiny comes as the Nasdaq prepares to implement new rules that would also place tough new requirements on Chinese firms applying to list on the exchange

🇨🇳 HSCEI Index Rebalance Preview: 3 Changes as Adds Go Up, Up & Away (Smartkarma) $

- There could be 3 changes for the Hang Seng China Enterprises Index (HSCEI INDEX) in December. Announcement is on 21 November with implementation at the close on 5 December.

- The forecast adds have moved higher over the last few months and handily outperformed the forecast deletes and the Hang Seng China Enterprises Index (HSCEI INDEX).

- There has been aggressive short covering in the forecast adds and there could be more in stocks where short interest is still a high percentage of float.

🇨🇳 Top Chinese PE Chief Unreachable Amid Corruption Crackdown (Caixin) $

- Shan Junbao, chairman of CICC Capital Operation Co. Ltd., has been unreachable for more than a week, the latest blow to the troubled private-equity arm of China International Capital Corp. Ltd. (CICC), one of the country’s top investment banks.

- Shan, around 58, has not responded to phone calls or messages, and his phone line is now disconnected. Two people with knowledge of the matter told Caixin that Shan was taken away by authorities last week. His disappearance follows a cascade of anti-corruption investigations that have rocked the firm in recent months, ensnaring many of its senior executives.

🇨🇳 China’s rare earth restrictions likely to hurt it most of all (The Asset) 🗃️

- Whereas the conventional wisdom holds that the US depends on Chinese rare earths, putting it at a severe geopolitical disadvantage, it is actually China that depends on the US (and others) for higher value-added rare earth compounds. Any Chinese restrictions on rare earth exports are thus likely to hurt China most of all

🇨🇳 Chifeng Gold chases new glitter in rare earths (Bamboo Works)

- The company currently gets 90% of its revenue from gold, but is expanding into copper and rare earths to tap anticipated future demand

- Chifeng Jilong Gold Mining Co Ltd (SHA: 600988 / HKG: 6693 / FRA: 5630)’s profit surged 141% in the third quarter, boosted by record gold prices

- The gold miner is expanding into rare earths, which could emerge as a significant second growth engine

🇨🇳 The Chinese Polysilicon Industry: Navigating overcapacity toward brighter horizons (Pyramids and Pagodas)

- Unpacking supply gluts, demand surges and Beijing’s anti-involution push

- While overcapacity narratives dominate Western views of Chinese solar stocks, often fueled by short-term politics and fear, the reality is more nuanced. Solar demand isn’t just growing; it’s exploding in unexpected places, outpacing even optimistic projections. There’s also a tendency to paint the whole industry with the same brush, but in reality each production stage comes with its own supply and demand dynamics.

- This piece challenges these narratives by focusing on the lynchpin: polysilicon, which is entering a phase of consolidation after a well-publicized supply glut.

- If you track the energy transition, you may have seen the fundamentals analysis of key polysilicon player Daqo New Energy (NYSE: DQ)(DQ.N; “Daqo”) from DeepValue Capital last year. Daqo currently boasts a market cap of ~USD 2.2 billion, and the piece sums up the the Company as an undervalued investment opportunity, emphasizing its rock-bottom costs, cash-rich balance sheet, and positioning to thrive as industry cycles turn upward amid bankruptcies of weaker players.

- Driven by the rebound in polysilicon prices and industry-wide “self-discipline”, the four major Chinese polysilicon producers showed marked sequential improvements in Q325, with profitability metrics initially turning positive across the board.

🇨🇳 How Alibaba’s Amap Beat Baidu Maps (The Great Wall Street)

- And why Alibaba (NYSE: BABA) is now using it to challenge Meituan (HKG: 3690 / 83690 / SGX: HMTD / FRA: 9MD / OTCMKTS: MPNGF / MPNGY)’s dominance in local commerce.

- Alibaba is now using Amap as a central weapon in its push into Meituan’s stronghold of instant retail and food delivery. It’s worth understanding how Amap fights and wins.

- By 2014, when Alibaba acquired Amap, the company was in deep trouble. Baidu (NASDAQ: BIDU) Maps was destroying them.

- The cycle repeats. Meituan has the lead, but the instant retail market is still growing. Alibaba appears to be executing the same playbook: grow the market, delay monetization, build the best product, and let the compounding effects of network and data take hold. Amap was once the underdog that overturned a dominant incumbent. Now, Alibaba is betting it can be the weapon to do it again. If it works is another question.

🇨🇳 Meituan’s Expansion Into Brazil Sets Up Showdown With Local Food Delivery Services (Caixin) $

- Meituan (HKG: 3690 / 83690 / SGX: HMTD / FRA: 9MD / OTCMKTS: MPNGF / MPNGY) has launched its food delivery brand Keeta in Brazil, marking its first foray into Latin America and setting the stage for a showdown with local market leaders iFood and DiDi Global (OTCMKTS: DIDIY)’s 99Food.

- Keeta went live at 11 a.m. local time on Oct. 30 in the cities of Santos and São Vicente, with plans to expand gradually across Brazil, entering the country’s largest city São Paulo by the end of the year, the company said.

🇨🇳 CES China Semiconductor Chips Index Rebalance Preview: One Change Likely in Dec (Smartkarma) $

- All Winner Technology Co Ltd (SHE: 300458) could replace StarPower Semiconductor Ltd (SHA: 603290) in the CES China Semiconductor Chips Index at the close of trading on 12 December.

- Cambricon Technologies Corp (SHA: 688256)‘s index weight is currently higher than 10% and the stock will be capped to limit its index weight.

- The forecast add has outperformed the forecast delete over the last year and recent market volatility (and valuations) has narrowed the gap.

🇨🇳 Zepp hits its stride with return to revenue growth (Bamboo Works)

- The maker of low-end wearable devices reported its revenue rose 78.5% in the third quarter, but forecast the rate would ease to about 40% in the current quarter

- Zepp Health Corp (NYSE: ZEPP) reported a second consecutive quarter of strong revenue growth in the three months to September, as it achieved breakeven on an adjusted operating basis

- The maker of fitness wearables is inching back towards profitability after ditching its former reliance on Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF) to develop its own Amazfit brand

🇨🇳 BYD (1211): Time to Sell (Smartkarma) $

- BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) has produced an enviable growth rate for the last 2 decades in the NEV sector.

- Berkshire Hathaway Inc Cl A (BRK/A US) has completed selling all its holding in BYD.

- The growth rate is no longer as high as before, and therefore demands a new way to evaluate the stock as its PEG increases.

🇨🇳 Pony.AI Hong Kong Public Offering Valuation Analysis (Douglas Research Insights) $

- Pony AI Inc (NASDAQ: PONY) has finalized the Hong Kong public offering price at HK$139 per share and it expects to raise HK$6.71 billion (US$860 million) from its planned secondary listing in Hong Kong.

- Our base case valuation of Pony.Ai is HK$178.2 per share over the next 6-12 months, which represents 28% higher than the Hong Kong public offering price.

- Given the solid upside, we have a Positive View of Pony.ai. Despite our Positive view, there have been increasing concerns about the overstretched valuations of major AI/tech related companies globally.

🇨🇳 Pony.ai and WeRide sink in Hong Kong trading debuts (The Asset) 🗃️

- Robotaxi firms to enhance technologies, expand into new markets

- Shares of Chinese autonomous driving start-ups Pony AI Inc (NASDAQ: PONY) and WeRide (NASDAQ: WRD) tumbled about 10% in their trading debuts in Hong Kong on Thursday ( November 6 ), reflecting the weak performance of their US-listed shares.

- Pony.ai ( stock code: 2026 ), which priced its shares at HK$139 each to raise HK$6.71 billion ( US$863 million ), ended the day 9.28% lower at HK$126.10. WeRide ( 800 ) set its price at HKD$27.10 per share to raise HK$2.39 billion, but fell 9.96% to close at HK$24.40.

- Some market watchers blamed the disappointing debuts on the surge of new listings in Hong Kong, which is the world’s largest market for initial public offerings this year, while others note that robotaxis have yet to make significant inroads into the transport sector. The Hang Seng Index closed 2.12% higher on Thursday, reversing a two-day slide.

🇨🇳 Seres Group H Share Listing (9927 HK): Trading Debut (Smartkarma) $

- [New-energy vehicle maker] Seres Group (SHA: 601127) priced its H Share at HK$131.50 to raise HK$14,283 million (US$1.8 billion) in gross proceeds. The H Share will be listed tomorrow.

- I discussed the H Share listing in Seres Group H Share Listing: The Investment Case and Seres Group H Share Listing (9927 HK): Valuation Insights.

- The price momentum is weak, and the international oversubscription rates were below the median of recent large AH listings. Nevertheless, Seres’ AH discount remains attractive.

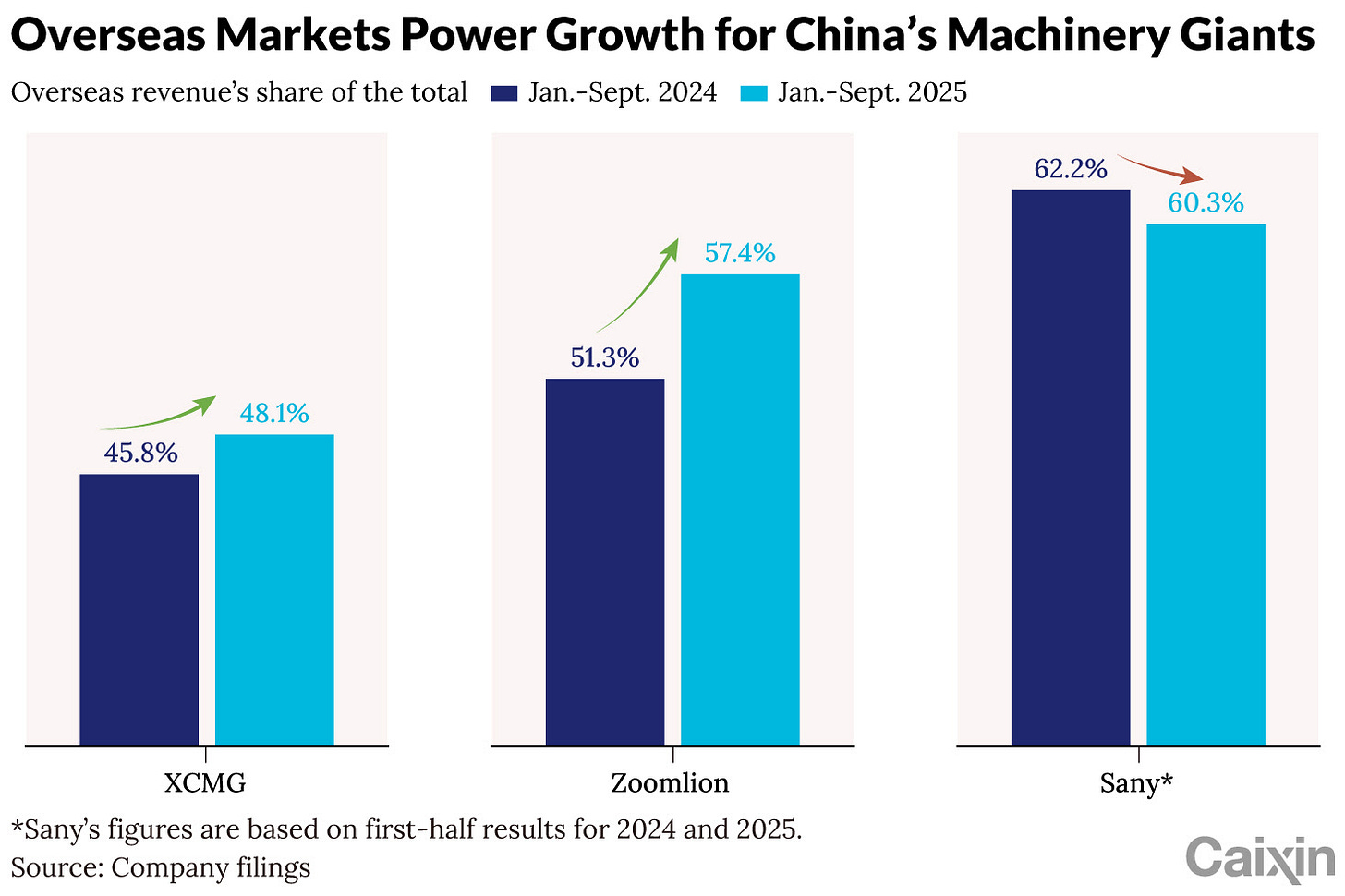

🇨🇳 Chart of the Day: China’s Construction Machinery Giants Unearth Growth Overseas (Caixin) $

- China’s three largest makers of construction machinery reported strong revenue and profit growth for the first three quarters of 2025, as they sharpened their focus overseas amid a protracted property downturn at home.

- In the nine months through September, Sany Heavy Industry (SHA: 600031) net profit attributable to shareholders shot up 46.6% year-on-year to 7.1 billion yuan ($998 million), according to its latest financial report released Friday. Its revenue was up 13.6% to 65.7 billion yuan.

🇨🇳 Afari tries to charm investors with AI story rife with question marks (Bamboo Works)

- The carmaker has applied to list in Hong Kong, led by a new chairman described as having over a decade of deep experience in AI, but with few additional details

- Chongqing Afari Technology Co Ltd (SHA: 601777) has applied to list in Hong Kong, reporting its revenue rose 40% in the first half of this year on rising NEV sales, as its gross margin fell into negative territory

- The carmaker counts Geely Automobile Holdings (HKG: 0175 / FRA: GRU / OTCMKTS: GELYY / GELYF) as a major partner, and recently signed a deal to sell 3% of its Shanghai-listed stock to Mercedes-Benz at a 25% discount

🇨🇳 Lens Technology approaches second ‘iPhone moment’ (Bamboo Works)

- The glass screen maker is betting big on AI glasses and embodied intelligence as its next major growth engines

- Lens Technology Co Ltd (SHE: 300433) reported its revenue reached 207 billion yuan in the third quarter, up 19.3% year-over-year

- The glass screen maker is investing heavily in AI wearables and embodied intelligence as fresh growth drivers

🇨🇳 Starbucks ducks for cover amid China’s coffee wars (FT) $ 🗃️

- Foreign companies can no longer rely on brand prestige alone in sectors in which Chinese rivals undercut prices

🇨🇳 Can a ship-shaped Shanghai shop put wind in China’s luxury sales? (FT) $ 🗃️

- Louis Vuitton’s cruise liner installation is drawing crowds, but a lasting sector recovery remains elusive

- Louis Vuitton has not disclosed the cost of its new ship, which has an exhibition, including a robotic arm testing the hinges on vintage Louis Vuitton suitcases, a café and a gift shop where small handbags are available for Rmb15,500 ($2,104).

- But the group’s owner LVMH Moët Hennessy Louis Vuitton (EPA: MC / OTCMKTS: LVMUY / LVMHF) said it had helped drive a 7 per cent year-on-year increase in China sales in the third quarter, albeit from a low base. In Shanghai, the brand says it has drawn in hundreds of thousands of visitors since it opened in June.

🇨🇳 Man Wah sets spin-off in motion for its sofa tech unit (Bamboo Works)

- The Chinese furniture giant is preparing to list its components subsidiary Remacro to raise the technology unit’s profile and open an independent funding channel

- After listing on China’s NEEQ market, Remacro will remain a subsidiary of Man Wah Holdings (HKG: 1999 / FRA: AAM / OTCMKTS: MAWHF / MAWHY), with the parent holding over 80% of its shares

- Revenues have been slipping at Man Wah and Remacro, hit by China’s property market woes and fragile consumer confidence

🇨🇳 Fenbi takes defensive action after steep share slide (Bamboo Works)

- The provider of exam preparation services is making a series of share buybacks in a bid to bolster confidence, as its business faces mounting competitive pressure

- The company outlined plans to buy back up to 10% of its equity capital over a six-month period

- Fenbi Ltd (HKG: 2469) executives increased their holdings and pledged to hold the shares for two years

🇨🇳 WuXi AppTec frees up money for Middle East push (Bamboo Works)

- The drugs services giant has stepped up sales of non-core Chinese assets to concentrate on its international expansion, with plans for a base in Saudi Arabia

- The company is partnering with Saudi authorities on a scheme to build a facility in the high-tech NEOM complex

- In a busy month of corporate news, WuXi AppTec Co (SHA: 603259 / HKG: 2359 / OTCMKTS: WUXAY) reported a jump in quarterly earnings, but investors were unsettled to hear that key stakeholders were selling down their holdings

🇭🇰 WH Group Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 WH Group Ltd (HKG: 0288 / FRA: 0WH / 0WHS / OTCMKTS: WHGLY / WHGRF) 🇰🇾 – Largest pork company in the world. Integrated pork business chain. 🇼 🏷️

🇭🇰 First Pacific Company Limited (FPAFY) Presents at Deutsche Bank ADR Virtual Investor Conference 2025 – Slideshow (Seeking Alpha)

- 🌏 First Pacific Co Ltd (HKG: 0142 / FRA: FPC / OTCMKTS: FPAFY / FPAFF) 🇧🇲 – Investment holding company in consumer food products, telecommunications, infrastructure, & natural resources. Indofood CBP Sukses Makmur (IDX: INDF), Indofood Sukses Makmur Tbk PT (IDX: INDF / FRA: ISM / OTCMKTS: PIFMF), PLDT (NYSE: PHI) & Metro Pacific Investments Corporation (“MPIC”). 🇼 🏷️

🇲🇴 Macau October GGR well above expectations, rebound not a ‘summer blip’: analysts (GGRAsia)

- Macau’s post-pandemic record of nearly MOP24.09 billion (US$3.01 billion) in casino gross gaming revenue (GGR) in October was “well above expectations”, rising 15.9 percent year-on-year, as high-end play outperformed market forecasts following the Golden Week holiday break, said Seaport Research Partners.

- This year’s October Golden Week – a major festive break for mainland China consumers and a peak trading period for Macau’s casinos – ran from October 1 to 8.

- “While Golden Week was softer than expected, strong demand in high-end play during the rest of the month drove October GGR growth well above expectations,” wrote Seaport’s senior analyst Vitaly Umansky in a Sunday memo.

🇲🇴 Melco Resorts & Entertainment Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇲🇴 🇵🇭 🇨🇾 Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) – Management & development of casino gaming & entertainment resort facilities. 🇼

🇲🇴 Melco to invest US$125mln in Countdown revamp, dividend likely by 2026-end, says management (GGRAsia)

- Global casino operator Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) plans to invest “about US$125 million” in the remodelling of the existing 330-room Countdown hotel at City of Dreams in the Cotai district.

- That is according to comments by Geoffrey Davis, Melco Resorts’ executive vice president and chief financial officer (CFO). He made the remarks in a Thursday conference call with investment analysts, following the firm’s announcement of its third-quarter 2025 results.

- Melco Resorts posted net income of nearly US$74.7 million for the three months to September 30, on operating revenues that rose 11.4 percent year-on-year, to nearly US$1.31 billion.

🇲🇴 Galaxy Ent 3Q EBITDA at US$430mln, as revenue up 14pct y-o-y (GGRAsia)

- Macau casino operator Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF) reported third-quarter adjusted earnings before interest, taxation, depreciation and amortisation (EBITDA) of just above HKD3.34 billion (US$429.7 million).

- The result was up 13.6 percent from a year earlier, showed unaudited performance highlights filed with the Hong Kong Stock Exchange on Thursday.

- Net revenue in the three months to September 30 rose 14.0 percent year-on-year, to HKD12.16 billion.

🇲🇴 Wynn Macau Ltd flags ‘impressive’ growth as 3Q EBITDAR hits US$308mln (GGRAsia)

- Macau casino operator Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) reported operating revenues of US$1.00 billion in the three months to September 30, a 14.8-percent increase from a year earlier, according to a Thursday filing from the parent, U.S.-based Wynn Resorts Ltd (NASDAQ: WYNN).

- Wynn Macau Ltd recorded third-quarter adjusted earnings before interest, taxation, depreciation, amortisation, and rent (EBITDAR) of nearly US$308.3 million, 17.3-percent higher than in the prior-year period.

- “Our third quarter results were marked by impressive EBITDA growth in Macau, and continued outperformance in Las Vegas,” said Craig Billings, the group’s chief executive, in prepared remarks.

🇹🇼 Taiwan

🇹🇼 Silicon Motion Technology Corporation 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Silicon Motion Technology Corporation (NASDAQ: SIMO) – Designs, develops, & markets NAND flash controllers for solid-state storage devices. 🇼

🇹🇼 Himax Technologies, Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Himax Technologies (NASDAQ: HIMX) 🇰🇾 – Fabless semiconductor company providing display imaging processing technologies. 🇼

🇹🇼 Chunghwa Telecom Co., Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇼 Chunghwa Telecom (TPE: 2412 / NYSE: CHT) – Largest integrated telecom service provider in Taiwan. Incumbent local exchange carrier of PSTN, Mobile, & broadband services. 🇼 🏷️

🇹🇼 TSMC: Time To Take Some Profits (Downgrade) (Seeking Alpha) $ 🗃️

- 🌐 Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) – World’s largest dedicated independent (pure-play) semiconductor foundry. 🇼 🏷️

🇰🇷 Korea

🇰🇷 NPS Could Raise Allocation of Korean Stocks = KOSPI to 5,000 Soon (Douglas Research Insights) $

- One of the biggest stories in the Korean stock market in the past several weeks has been the discussions about [National Pension Service] NPS potentially increasing the allocation of Korean stocks.

- If NPS announces a meaningful increase in the allocation of Korean stocks for its AUM, then there could certainly be an acceleration to KOSPI reaching 5,000.

- Based on what we have gathered so far, there is a higher probability (70-80%) that NPS meaningfully increases the allocation of Korean stocks in the next severalmonths.

🇰🇷 KOSDAQ150 Index Rebalance Preview: Large Number of Changes Likely in December; Huge Outperformance (SmartKarma) $

- With the review period for the December rebalance complete, we highlight 17 potential changes for the KOSDAQ 150 Index (KOSDQ150 INDEX).

- The estimated impact on the potential inclusions ranges from 0.1-3.2 days of ADV while the impact on the potential deletions varies from 0.7-11.2 days of ADV.

- The forecast adds have outperformed the forecast deletes over the last 6 months with a big move higher in the last couple of months. Trim positions into strength.

🇰🇷 Kangwon Land Inc’s 3Q net profit rose 24pct y-o-y to US$78 million (GGRAsia)

- Kangwon Land (KRX: 035250), operator of Kangwon Land (pictured), a South Korean resort with the only casino in the country open to locals, reported 24.1-percent year-on-year growth in its third-quarter net profit, to approximately KRW112.29 billion (US$78.1 million).

- Such figure for the three months to September 30 was recorded as the company saw a 167.6-percent year-on-year rise in “financial profit”, which stood at KRW73.4 billion for the period. The company said the increase was due to financial asset -related “gains from the disposal and fair value measurement”, without giving further details.

- Third-quarter net profit was up 83.5 percent on the second quarter’s.

🇰🇷 Paradise Co’s casino sales up y-o-y in Oct, GKL sees revenue decline (GGRAsia)

- Paradise Co Ltd (KOSDAQ: 034230), an operator in South Korea of foreigner-only gaming venues, said its casino sales in October rose 18.5 percent year-on-year, to KRW73.58 billion (US$51.2 million). Judged sequentially, such sales grew 16.7 percent, the firm stated in a Tuesday filing to the Korea Exchange.

- Paradise Co’s table-game sales in October were nearly KRW68.71 billion, up 19.2 percent from the prior-year period and an 18.3-percent increase from September.

- Machine-game sales last month rose 9.4 percent year-on-year to KRW4.87 billion. That tally was, however, down 2.9 percent sequentially.

- Rival foreigner-only casino operator Grand Korea Leisure Co Ltd (KRX: 114090) reported on Tuesday casino revenue of KRW28.56 billion for October, down 6.5 percent from a year earlier, and a 17.9-percent sequential decline.

🇰🇷 Korean Banks; Stick with Hana (086790 KS) On the Buy List (Smartkarma) $

- Hana Financial Group (KRX: 086790) remains our buy pick among Korean banks; it is close to the top our scorecard, it remains attractively valued and its returns are improving

- Hana is trading at a large PBV discount to KB Financial Group (NYSE: KB); this currently stands at a 30%+ discount which is over one standard deviation from the historical PBV discount mean

- Furthermore, we see that this relatively dovish phase of monetary policy, Hana appears to have more limited downside risk than its peers in terms of further interest spread erosion

🇰🇷 NAVER Corporation 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 NAVER (KRX: 035420 / OTCMKTS: NHNCF) – Global ICT company. Korea’s #1 search portal “NAVER” + LINE messenger, SNOW camera app, digital comics platform + R&D (AI, robotics, mobility & other future technology). 🇼 🏷️

🇰🇷 Magnachip Semiconductor Corporation 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Magnachip Semiconductor Corp (NYSE: MX) – Designer & manufacturer of analog/mixed-signal semiconductor platform solutions. 🏷️

🇰🇷 LG Display Co., Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 LG Display (NYSE: LPL) – Leading display company. Innovative displays & related products through differentiated technologies such as OLED & IPS. 🇼 🏷️

🇰🇷 POSCO Holdings Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 POSCO Holdings (NYSE: PKX) – Integrated steel producer. 6 segments: Steel, Trading, Construction, Logistics & Others, Green Materials & Energy & Others. 🇼 🏷️

🇰🇷 Total Net Asset Value of ETFs Based on FnGuide Indices Exceeds 30 Trillion Won (US$21 Billion) (Douglas Research Insights) $

- [Programs related to securities investment information and financial information] FnGuide Inc (KOSDAQ: 064850) is one of the key beneficiaries of the increased index investing in Korea.

- Total net assets of ETFs tracking FnGuide indices surged from about 14 trillion won at the end of 2024 to about 30 trillion won as of end of October 2025.

- There has been a sharp increase in foreign ownership of FnGuide from 0.4% at the end of 2023 to 14.5% as of 3 November 2025.

🇰🇷 Hanwha Aerospace: Best Ever Results in 3Q 2025 (Douglas Research Insights) $

- In 3Q25, Hanwha Aerospace (KRX: 012450) reported sales of 6.5 trillion won (up 146.5% YoY and 1.6% lower than consensus) and operating profit of 856.4 billion won (up 79.5% YoY).

- The company’s results in 3Q 2025 were its best ever in its history. The strong results were driven by its land defense business and its shipbuilding unit Hanwha Ocean (KRX: 042660).

- Given the company’s excellent growth in sales and profits in the past several years as well as its strong order backlog, its valuations remain attractive.

🇰🇷 EQT Partners Acquires a Controlling Stake in Douzone Bizon (Douglas Research Insights) $

- On 7 November, it was announced that EQT Partners is acquiring a controlling stake (34.85%) in Douzone Bizon (KRX: 012510) for about 1.3 trillion won (US$900 million).

- The acquisition price is 120,000 won per share (44.9% higher than the closing price on Friday).

- There was no other announcement regarding tender offer of the remaining minority shares and some investors are likely to have bailed out after this disappointment.

🇰🇷 D’Alba Global – End of Lockup Period For 10% of Outstanding Shares (Douglas Research Insights) $

- There is an end of a lock-up period for 1.3 million shares (10% of outstanding shares) for d’Alba Global Co Ltd (KRX: 483650) starting 22 November 2025.

- This could potentially result in additional selling by insiders which could negatively impact its share price in the coming weeks. We remain Bearish on d’Alba Global.

- The overall proportion of freely tradable shares, which was only 32.7% right after listing, will increase to 83.9% one year later.

🇰🇷 CMTX IPO Book Building Results Analysis (Douglas Research Insights) $

- [Ceramics & sapphire components for semiconductor etching processes + core consumable silicon components] CMTX finalized its IPO price at 60,500, the high end of the IPO price range. The book building process saw participation from 2,423 institutions. Demand ratio was 756.19 to 1.

- Our base case valuation of CMTX is implied market cap of 1.0 trillion won or 106,847 won per share (65% higher than the IPO price).

- Given the excellent upside, we have a Positive View of this IPO. The 71.8% shares that are under lock-up periods is high and this suggests a very bullish sign.

🇰🇷 SemiFive IPO Valuation Analysis (Douglas Research Insights) $

- Our base case valuation of SemiFive is implied market cap of 1.4 trillion won or target price of 42,349 won per share.

- This is 76% higher than the high end of the IPO price range (24,000 won per share). Given the excellent upside, we have a Positive View of this IPO.

- SemiFive is one of the global leaders in custom AI semiconductor (ASIC) design. Founded in 2019, SemiFive is a SoC platform company specializing in AI inference and high-performance computing (HPC) chip design.

🇰🇷 The Pinkfong Company IPO Book Building Analysis (Douglas Research Insights) $

- [Children’s content platforms] The Pinkfong Company successfully completed its IPO book building process. It finalized the IPO price at 38,000 won (high end of the IPO price range).

- A total of 2,300 domestic and international institutions participated in the book building process. The IPO competition ratio was 615.9 to 1.

- Our base case valuation of the Pinkfong Co is implied market cap of 671.4 billion won or target price of 46,369 won per share (over the next 6-12 months).

🌏 SE Asia

🇮🇩 PT Avia Avian Tbk 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇮🇩 Avia Avian Tbk PT (IDX: AVIA / FRA: P2C) – Manufactures & distributes paints and building materials. 2 segments: Architectural Solutions & Trading Goods. 🏷️

🇮🇩 PT Sarana Menara Nusantara Tbk. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇮🇩 Sarana Menara Nusantara Tbk PT (IDX: TOWR / OTCMKTS: SMNUF) – Telecommunication towers for wireless operators + other services. 🇼 🏷️

🇲🇾 Genting Bhd bid to acquire Genting Malaysia to proceed as parent’s shareholding now above 50pct (GGRAsia)

- Malaysia-based conglomerate Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) announced on Monday that its takeover offer for subsidiary Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF) has “become unconditional”, following the acquisition of Genting Malaysia’s shares on the open market.

- In mid-October, Genting Bhd made a circa US$1.59-billion bid to acquire all shares in Genting Malaysia that it didn’t already own, aiming to delist the unit from Bursa Malaysia.

- The parent said that – following the acquisition of some Genting Malaysia’s shares – it held a nearly 50.11-percent stake in its subsidiary as of 5pm on Monday.

- “Accordingly, the acceptance condition has been fulfilled, and the offer has become unconditional on 3 November 2025,” stated Genting Bhd.

🇵🇭 International Container Terminal Services, Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 International Container Terminal Services (ICTSI) (PSE: ICT / OTCMKTS: ICTEF) – World’s largest, independent terminal operator across six continents and 20 countries. 🇼 🏷️

🇵🇭 Bank of the Philippine Islands 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇭 Bank of the Philippine Islands (PSE: BPI / OTCMKTS: BPHLF / BPHLY) – Oldest bank in the Philippines & SE Asia. 🇼

🇵🇭 Monde Nissin Corporation 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏 Monde Nissin Corp (PSE: MONDE / OTCMKTS: MNDDF) – Wide portfolio of branded food & beverages.

🇸🇬 GEN Singapore’s 3Q EBITDA up 34pct y-o-y, as revenue hits US$498mln (GGRAsia)

- Casino operator Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) reported aggregate revenue of SGD649.8 million (US$497.9 million) for the three months to September 30, up 15.6 percent from the prior-year period.

- The company posted a third-quarter net profit of SGD94.6 million, 19.2-percent higher than a year earlier, according to a Thursday announcement.

- The casino firm said in Thursday’s filing that the opening of the Singapore Oceanarium and the launch of a revamped retail area dubbed “WEAVE”, during the month of July, gave “new vibrancy” to Resorts World Sentosa, “attracting higher footfall and strengthening non-gaming revenue”.

🇸🇬 Genting Singapore’s earnings, gaming revenue likely to improve in 4Q: analysts (GGRAsia)

- Third-quarter results for casino operator Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) “were in line” with expectations, said Maybank Research Pte Ltd in a Friday note. “More poignantly, they were a meaningful recovery from the second quarter of 2025 trough, which was negatively impacted by RWS 2.0 construction works and closure of certain attractions,” wrote analyst Samuel Yin Shao Yang.

- Genting Singapore reported on Thursday revenue of SGD649.8 million (US$497.9 million) for the three months to September 30, up 15.6 percent from the prior-year period. The company posted a third-quarter net profit of SGD94.6 million, 19.2-percent higher than a year earlier.

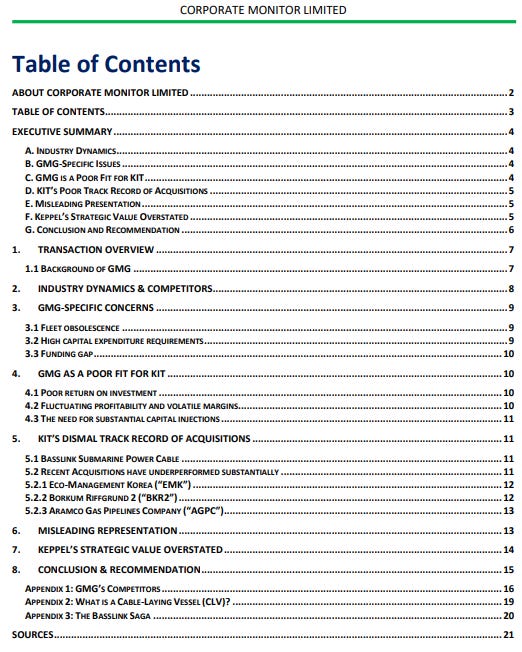

🇸🇬 Keppel Infrastructure Trust (KIT) – Global Marine Group Acquisition: A Case for Rejection (Corporate Monitor)

- 🌐 Keppel Infrastructure Trust (SGX: A7RU / OTCMKTS: KPLIF) – 3 core segments: Energy transition, environmental services & distribution & storage. 🏷️

🇸🇬 United Overseas Bank Limited (UOVEY) Q3 2025 Sales/ Trading Statement Call – Slideshow (Seeking Alpha)

- 🌐 United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF) – Global network of 500 branches & offices across 19 countries in Asia Pacific, Europe & North America. 🇼 🏷️

🇸🇬 Sea Limited: Premium Valuation Backed By Strong Execution And Global Diversification (Seeking Alpha)

🇸🇬 Sea Q3 Earnings Preview: Positive Outlook And Attractive Valuation (Seeking Alpha) $ 🗃️

- 🌏 Sea Limited (NYSE: SE) – 3 core businesses: Garena (global online games developer & publisher), Shopee (largest pan-regional e-commerce platform in SE Asia & Taiwan), SeaMoney (leading digital payments & financial services provider in SE Asia). 🇼 🏷️

🇸🇬 DBS Group Holdings Ltd 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏 DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) – Financial services group in Asia with a presence in 19 markets: Greater China, Southeast Asia & South Asia. 🇼 🏷️

🇸🇬 Grab Holdings Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏 Grab Holdings Limited (NASDAQ: GRAB) – Superapp in SE Asia for mobility, deliveries, & digital financial services to millions of Southeast Asians. 🇼 🏷️

🇸🇬 4 Singapore Dividend Stocks That Outperform Inflation (The Smart Investor)

- Meet four Singapore dividend stocks that consistently beat inflation and strengthen long-term income.

- Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) is a multi-asset exchange that provides listing, trading, and clearing services for securities and derivatives, operating equity, fixed income, currency, and commodity markets.

- Parkway Life Real Estate Investment Trust (SGX: C2PU) focuses on a well-diversified portfolio of healthcare and nursing home properties across Singapore, Japan, Malaysia and France.

- CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF) is Singapore’s largest retail and commercial REIT.

- Haw Par Corporation (SGX: H02 / OTCMKTS: HAWPF) is a conglomerate with four key divisions – healthcare, leisure, property, and investments.

🇸🇬 3 Beaten-Down Blue-Chip Stocks That Could See a Comeback (The Smart Investor)

- These three beaten-down blue-chip Stocks: Wilmar International Limited, SATS, and Thai Beverage have underperformed the index thus far. We take a look at why we believe they could be primed to outperform moving forward.

- SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF): The Market Is Not Giving Enough Credit to Its Turnaround

- Thai Beverage PCL (SGX: Y92 / OTCMKTS: TBVPF / TBVPY): Alcohol Giant Trading at Multi-Year Lows

- Wilmar International (SGX: F34 / FRA: RTHA / RTH / OTCMKTS: WLMIF / WLMIY): Strong Operating Performance Marred by Indonesia Cooking Oil Case

- What to Look for in a Comeback Blue-Chip

- What This Means for Investors

- Get Smart: Consider Owning These Quality Blue-Chip Stocks That Could Re-Rate Higher

🇸🇬 Beyond STI: 3 Singapore Stocks to Watch for November 2025 (The Smart Investor)

- Geo Energy Resources (SGX: RE4 / FRA: 7GE / OTCMKTS: GRYRF): Beyond Coal to Integrated Infrastructure

- The Indonesian coal producer delivered impressive operational performance in the first half of 2025 (1H2025), with revenue jumping 71% year on year (YoY) to US$289.5 million on the back of doubled coal sales volume to 6.3 million tonnes.

- Boustead Singapore (SGX: F9D / OTCMKTS: BSTGF): Unlocking Real Estate Value

- This multi-industry conglomerate delivered a paradoxical FY2025 performance.

- The Hour Glass (SGX: AGS): Weathering Luxury Headwinds

- Asia-Pacific’s luxury watch specialist delivered resilient top-line performance in FY2025, with revenue edging up 3% to S$1.16 billion despite moderating demand post-pandemic boom.

🇸🇬 OCBC Posts Flat 3Q 2025 Earnings on Record Non-Interest Income (The Smart Investor)

- Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY) posted flat 3Q earnings, supported by record non-interest income despite continued margin compression.

- While the headline number suggests stability, the underlying dynamics reveal a bank successfully navigating challenging rate conditions through its diversified revenue streams.

- The Interest Rate Headwind

- Non-Interest Income Saves the Day

- Bottom Line Resilience

- What This Means for Investors

- Get Smart: OCBC’s Diversification Strategy Proves Its Worth

🇸🇬 STI 10,000 by 2040: Which Companies Will Do the Heavy Lifting? (The Smart Investor)

- The path to STI 10,000 runs through just 10 stocks. Here’s what needs to happen.

- Breaking down the 10,000 target

- Singapore Banks: Holding Half the STI’s Fate

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF), Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY) or OCBC, and United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF) or UOB controlled a little over 50 per cent of the index at the end of September.

- Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel: The Optus Problem

- REITs: Beneficiaries of Lower Interest Rates

- CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF) or CICT, and CapitaLand Ascendas REIT (SGX: A17U / OTCMKTS: ACDSF) or CLAR together contribute close to six per cent of the index.

- SGX and STE: The Dividend Promise

- While REITs wait for interest rate relief, two companies are already making concrete promises: Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) or SGX and Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering or STE together account for 6.6 per cent of the index.

- Get Smart: Dividends While You Wait

- Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF) and Jardine Matheson (SGX: J36 / FRA: H4W / OTCMKTS: JARLF) control seven per cent of the index between them.

- Keppel is betting on transformation – becoming a global asset manager with S$200 billion under management. Jardine Matheson is playing the portfolio game through DFI Retail Group (SGX: D01 / FRA: DFA1 / OTCMKTS: DFIHY), Hongkong Land Holdings (SGX: H78 / LON: HKLJ / FRA: HLH / OTCMKTS: HKHGF / HNGKY), and Jardine Cycle & Carriage (SGX: C07 / FRA: CYC).

🇸🇬 UOB’s 3Q 2025 Earnings: 72% Profit Plunge Masks Strategic Balance Sheet Move (The Smart Investor)

- United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF)’s sharp 72% profit drop hides a proactive balance sheet move – with management assuring dividends remain intact despite higher allowances.

- Revenue Under Pressure from Margin Compression

- Fee Income Holds Up Reasonably Well

- Forward Guidance Points to Continued Margin Pressure

- Get Smart: Strategic Provisioning Protects Long-Term Dividend Capacity

🇸🇬 DBS Posts Record Q3 Profit Despite Rate Headwinds, Declares S$0.75 Dividend (The Smart Investor)

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF), Singapore’s largest bank, continues to demonstrate its resilience. Despite a softer interest rate environment, the bank delivered another record quarter, underscoring the strength of its diversified business model.

- Total Income Reaches a New High

- Net Interest Income Holds Steady Amid Rate Pressures

- Fee Income Powers Non-Interest Revenue Growth

- Bottom Line and Dividends

- Get Smart: Resilient Earnings, Reliable Dividends

🇸🇬 DBS Hovering at All-Time High: Should You Take Profits or Stay Invested? (The Smart Investor)

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) shares are near record highs after years of stellar growth. With interest rates likely to ease, some investors are wondering if it’s time to cash in. We look at whether the bank’s strong fundamentals still make it worth holding for the long haul.

- Why DBS Is at Record Levels

- The Case for Taking Profits

- The Case for Staying Invested

- What This Means for Investors

- Get Smart: Patience Still Pays

🇸🇬 Income Alert: Get Paid This Month with 3 Singapore Billionaire REITs (The Smart Investor)

- Three REITs deliver November distributions, but their latest results reveal different realities for income investors.

- Keppel REIT (SGX: K71U / OTCMKTS: KREVF): 25 November 2025

- Keppel REIT presents an interesting case where headline numbers obscure underlying strength.

- Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF): 28 November 2025

- Frasers Centrepoint Trust (FCT) is Singapore’s leading pure-play suburban retail REIT, owning nine suburban malls with approximately three million square feet of retail space.

- Suntec Real Estate Investment Trust (SGX: T82U / OTCMKTS: SURVF): 28 November 2025

- Like Keppel REIT, Suntec REIT is one of the five STI reserve stocks.

- Get Smart: Sustainability is key

🇸🇬 5 REITs That Are Still Yielding Over 6% Despite Market Highs (The Smart Investor)

- Markets may be near their highs, but these five REITs continue to reward investors with steady yields of over 6%.

- Elite UK REIT (SGX: MXNU)

- As the only Singapore-listed UK REIT, Elite UK REIT focuses predominantly on properties tenanted by the UK government and public-sector organizations.

- United Hampshire US REIT (SGX: ODBU / OTCMKTS: UNHRF)

- United Hampshire US REIT (UHREIT) invests primarily in grocery-anchored and necessity-based retail properties, and modern, climate-controlled self-storage facilities in the United States.

- AIMS APAC REIT (SGX: O5RU / OTCMKTS: ACIRF)

- AIMS APAC REIT invests in a diversified portfolio of industrial, logistics and business park real estate, located mainly in Singapore and Australia.

- Digital Core REIT(SGX: DCRU / OTCMKTS: DGTCF)

- Digital Core REIT is a leading pure-play data centre REIT with data centres across the US and Canada, serving blue-chip tenants.

- ESR-REIT (SGX: 9A4U / OTCMKTS: CGIUF)

- ESR-REIT holds interests in a diversified portfolio of logistics and industrial properties across the Asia-Pacific, with total assets of approximately S$5.9 billion.

- What This Means for Investors

- Get Smart: Yield Isn’t Everything

🇸🇬 Bargains or Busts? October 2025’s Biggest Blue-Chip Laggards (The Smart Investor)

- October delivered a harsh lesson for STI investors: impressive profits don’t guarantee stock performance — in the short term, that is.

- The trio booked negative returns for the month.

- What makes their underperformance puzzling is that all three reported improving results – yet the market yawned.

- Their October stumbles reveal a harsh truth: in today’s dividend-focused market, operational improvements mean little without improving dividend payouts.

- Seatrium Ltd (SGX: SE2 / FRA: S8N / OTCMKTS: SMBMF): Total Return -8.4% for October 2025

- Jardine Matheson (SGX: J36 / FRA: H4W / OTCMKTS: JARLF): Total Return -5.6% for October 2025

- Hongkong Land Holdings (SGX: H78 / LON: HKLJ / FRA: HLH / OTCMKTS: HKHGF / HNGKY): Total Return -2.7% for October 2025

🇸🇬 Top 3 Best Performing Singapore Blue-Chips for October 2025 (The Smart Investor)

- Three Singapore blue-chips are reinventing themselves — and the market may be starting to notice.

- Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF): Total Returns 12.7% for October 2025

- Forget the traditional conglomerate structure — Keppel (dubbed “New Keppel”) is gradually converting heavy assets into fee-generating assets under management (AUM).

- Wilmar International (SGX: F34 / FRA: RTHA / RTH / OTCMKTS: WLMIF / WLMIY): Total Returns 9.5% for October 2025

- On 25 September 2025, the commodities conglomerate was fined close to US$710 million after the Indonesian Supreme Court overturned an earlier decision to acquit three of its subsidiaries.

- Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF): Total Returns 8% for October 2025

- Get Smart: The Transformation Gain

🇸🇬 Hidden Gems: 3 Small-Cap Stocks That Beat the STI in October (The Smart Investor)

- Three small-cap stocks beat the STI in October, showing that hidden gems can outshine blue chips.

- Frencken Group Ltd (SGX: E28): Total Returns of 17.7% for October

- This technology solutions provider has been quietly serving big-name clients across semiconductors, aerospace, and healthcare for decades, producing everything from complex electro-mechanical assemblies to plastic components.

- CSE Global Ltd (SGX: 544 / FRA: XCC / OTCMKTS: CSYJY / CSYJF): Total Returns of 15.2% for October

- CSE Global has built a steady business providing the electrification, communications, and automation solutions that keep industries running.

- Digital Core REIT(SGX: DCRU / OTCMKTS: DGTCF): Total Returns of 9.5% for October

- Digital Core REIT owns what everyone wants right now: data centres powering the AI boom.

- Get Smart: Size Doesn’t Always Matter

🇹🇭 Advanced Info Service Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇭 Advanced Info Services PCL (BKK: ADVANC / SGX: TADD) – Operates Mobile Communication Service with 5G & 4G technology. 🇼 🏷️

🇹🇭 Thai Union Group Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Thai Union Group PCL (BKK: TU / TU-F / FRA: THYG / OTCMKTS: TUFBY / THFRF) – Frozen, chilled & canned seafood. 🇼 🏷️

🇹🇭 True Corporation Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇭 True Corporation PCL (BKK: TRUE / FRA: TAF1 / OTCMKTS: TCPFF) – Ultra-high-speed mobile & fixed broadband, Pay TV, etc. 🇼 🏷️

🇹🇭 PTT Exploration and Production Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇭🏛️ PTT Exploration & Production PCL (BKK: PTTEP / PTTEP-R / SGX: TPED / OTCMKTS: PEXNY) – Petroleum exploration, development & production, renewable energy, new forms of energy & advanced technology. 🇼 🏷️

🇹🇭 Delta Electronics (Thailand) Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇭 Delta Electronics Thailand PCL (BKK: DELTA / SGX: TDED) – Power & thermal management solutions & electronic component manufacturing. Subs. of Delta Electronics Taiwan (TPE: 2308). 🇼 🏷️

🇹🇭 The Siam Cement Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇭 Siam Cement PCL (BKK: SCC / SGX: TSCD) – Cement-Building Materials Business, Chemicals Business, Packaging Business & Investment Business. 🇼 🏷️

🇮🇳 India / South Asia / Central Asia

🇮🇳 Mahindra & Mahindra Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Mahindra & Mahindra Ltd (NSE: M&M / BOM: 500520 / FRA: MOM / OTCMKTS: MAHMF) – Automotive, farm equipment, financial services, real estate, hospitality & others segments. 🇼 🏷️

🇮🇳 Physicswallah IPO: Index Inclusion Possibilities & Timing (Smartkarma) $

- [Education company] Physicswallah Limited (2076103D IN) is looking to list on the exchanges by selling 319.26m shares via a primary and secondary offering to raise US$392m at a valuation of US$3.5bn.

- The price band has been set at INR 103-109/share, and the issue is likely to price at the top end of the range.

- The stock will be added to the AMFI Smallcap segment and inclusion in the Nifty Smallcap 250 index is likely in March. Global index inclusion could commence in June.

🇮🇳 Pinelabs IPO Review – Another Fintech IPO Exactly 4yrs After Paytm – Can It Buck the Trend? (Smartkarma) $

- Pine Labs is a fintech company supporting digitization of commerce through digital payments and issuing solutions for merchants, consumer brands and enterprises, and financial institutions.

- While the company has been growing in line with peers, its focus on enterprise customers and subscription pricing stands out, while peers have focused on merchants with a %-fee model.

- IPO priced at sharp discount to expectations ($2.5bn vs $6bn), which is fair given changing business/industry dynamics. Pending RBI investigation and potential selling from early investors are other near-term concerns.

🇮🇳 Pine Labs IPO – Building India’s Digital Checkout Future (Smartkarma) $

- India’s digital payments market is booming, expected to grow from Rs. 116.8 trillion in FY2025 to over Rs. 250 trillion by FY2029.

- Pine Labs targets India’s 80+ million small and mid-sized merchants with UPI-first devices and sector-specific affordability solutions.

- India’s largest issuer of gift cards, Pine Labs is also a leading player in checkout affordability and merchant payment solutions.

🇬🇪 TBC Bank Group PLC 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇬🇪 🇺🇿 Tbc Bank Group Plc (LON: TBCG / OTCMKTS: TBCCF) – The largest banking group in Georgia. 🇼

🌍 Middle East

🇮🇱 Teva Pharmaceutical Industries Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Teva Pharmaceutical Industries Ltd (NYSE: TEVA) – Branded-drugs, active pharmaceutical ingredients, contract manufacturing services & out-licensing platform. 🇼

🇮🇱 Teva: The Pivot to Growth delivers 11th consecutive quarter of growth ($TEVA) (Kontra Investments)

- Shift to becoming a Biopharma company is working

- Teva Pharmaceutical Industries Ltd (NYSE: TEVA)’s “Pivot to Growth” continues to show results. What began as a defensive restructuring has become a deliberate transformation into an innovation-led biopharma with a credible growth engine. The company now combines a stabilized generics powerhouse with a rapidly expanding portfolio of neuroscience and immunology assets, while maintaining rigorous financial discipline.

- Teva has quietly rebuilt itself into a credible growth story. The market is still anchored to its legacy image, but the financial data and strategic consistency suggest a new phase of compounding may be starting.

- Innovative medicines now account for over 20% of revenue, free cash flow is rising, and deleveraging continues. For long-term investors willing to look past the old headlines, Teva’s recovery is not a turnaround in progress — it’s a growth transition underway.

🇹🇷 Türk Hava Yollari Anonim Ortakligi 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Türk Hava Yolları (IST: THYAO) or Turkish Airlines – Passenger & air cargo. 🇼

🇹🇷 Anadolu Efes Biracilik ve Malt Sanayii Anonim Sirketi 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Anadolu Efes Biracilik ve Malt Sanayii AS (IST: AEFES / FRA: EF41 / OTCMKTS: AEBZY) – More than 2/3rds of its net sales in international markets & Europe’s 5th & world’s 9th largest brewer by production volume. Operations: Turkey + Belarus, Georgia, Kazakhstan, Moldova, Russia & Ukraine. 🇼 🏷️

🇹🇷 Türkiye Vakiflar Bankasi Türk Anonim Ortakligi 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Turkiye Vakiflar Bankasi TAO (IST: VAKBN / OTCMKTS: TKYVY) – Corporate, commercial, SME, agricultural, retail & private banking. 🇼

🇯🇴 International General Insurance Holdings Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 International General Insurance Holdings Ltd (NASDAQ: IGIC) 🇧🇲 – Specialty insurance & reinsurance solutions.

🌍 Africa

🇿🇦 Sappi Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Sappi (JSE: SAP / FRA: SPI / SPIA / OTCMKTS: SPPJY) – South African pulp & paper company with global operations. 🇼 🏷️

🇿🇦 The Foschini Group Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐🅿️ The Foschini Group (JSE: TFG / TFGP / OTCMKTS: FHHGF) or TFG Limited – Retail clothing group with 34 leading fashion lifestyle brands (clothing, footwear, jewelry, sportswear, mobile & tech & home & furniture offerings) with over 4 600+ outlets on 5 continents. 🇼 🏷️

🇿🇦 Harmony Gold: Strong Fundamentals In Gold And Copper, Weakness In Valuation (Seeking Alpha) $ 🗃️

- 🇿🇦 🇦🇺 🇵🇬 Harmony Gold Mining Company Limited (JSE: HAR / NYSE: HMY) – Global gold mining & exploration + significant copper footprint. 🇼

🇿🇦 Update On Platinum And Impala Platinum Holdings And My Strategy (Seeking Alpha) $ 🗃️

- 🌐 Impala Platinum Holdings (JSE: IMP / LON: 0S2J / FRA: IPHB / OTCMKTS: IMPUY / IMPUF) – South African holding company who is a leading producer of platinum group metals (PGMs), structured around 6 mining operations & Impala Refining Services, a toll refining business. 🇼 🏷️

🇿🇦 DRDGold Limited: Flying High On Gold’s Thin Air (Seeking Alpha) $ 🗃️

- 🇿🇦 DRD Gold (JSE: DRD / NYSE: DRD) – Gold mining company involved in the surface gold tailings retreatment business in South Africa. Exploration, extraction, processing & smelting activities. Sibanye Stillwater Ltd (JSE: SSW / NYSE: SBSW) controlled. 🇼 🏷️

🌍 Eastern Europe & Emerging Europe

🇬🇷 National Bank of Greece S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇬🇷 National Bank of Greece SA (ASE: NBGr / FRA: NAGF / OTCMKTS: NBGIF) – Greece’s first bank. 🇼

🇬🇷 Alpha Bank S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Alpha Services and Holdings (ASE: ALPHA / FRA: ACBB / ACBC / OTCMKTS: ALBKY / ALBKF) – Parent company of the Alpha Bank Group. Wide range of financial products & services. 🇼

🇬🇷 Piraeus Financial Holdings S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Piraeus Financial Holdings (ASE: BOPr / FRA: BKP / BKP0 / OTCMKTS: BPIRY / BPIRF) – Universal bank (Piraeus Bank) providing various banking services. 🇼

🇭🇺 MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság (BSE: MOL / FRA: MOGB / MOGG / OTCMKTS: MGYOY) – Leading integrated Central Eastern European oil & gas corp. Operations in 30+ countries. 🇼 🏷️

🇭🇺 OTP Bank Nyrt. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 OTP Bank (BUD: OTPB / FRA: OTP / OTCMKTS: OTPBF) – One of the fastest growing banking groups in Central & Eastern Europe. 12 countries of the CEE & Central Asian region. 🇼 🏷️

🇵🇱 Bank Polska Kasa Opieki 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇱🏛️ Pekao (WSE: PEO / FRA: BP1) or Bank Polska Kasa Opieki SA – One of the largest banks in Poland that was founded in 1929 to serve Poles living abroad. 🇼 🏷️

🇵🇱 InPost S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 InPost SA (AMS: INPST / LON: 0A6K / FRA: 669) – Specializes in parcel locker service + courier, package delivery & express mail service. 🇼 🏷️

🇷🇺 Eurasia Mining – 1,000% from selling Russian assets? (Undervalued Shares)

- Eurasia Mining PLC (LON: EUA / FRA: EUH) was a familiar name in British investor circles during the 2000s.

- Listed on London’s Alternative Investment Market (AIM) in 1996, the company raised money to explore for gold, platinum, and copper in Russia. Initially working in a joint venture with South Africa’s Anglo Platinum [Valterra Platinum Ltd (JSE: VAL / LON: VALT / FRA: RPHA / OTCMKTS: AGPPF / ANGPY)], it later took full control of several discoveries – some in the Ural mountains, others in the Kola peninsula in Russia’s far northwest.

- Progress was slow, and the 2010s brought a prolonged downturn in resource stocks. Between 2002-2012, Eurasia Mining’s share price lost 98% of its value, and then went sideways at below 1 pence for years – until suddenly rising 90-fold (!) in 2019-2020.

- The bear case argues that Eurasia Mining might remain unable to sell its assets for years, and operating them could prove challenging. Moreover, global stock exchanges already host plenty of heavily discounted resource plays without any Russian exposure.

- The bull case, however, notes that management reports growing interest in these assets, and is advancing toward ramping up production. Unlike many discounted resource projects, Eurasia Mining remains committed to selling its assets, which would free up cash for shareholders and close the discount gap.

🌎 Latin America

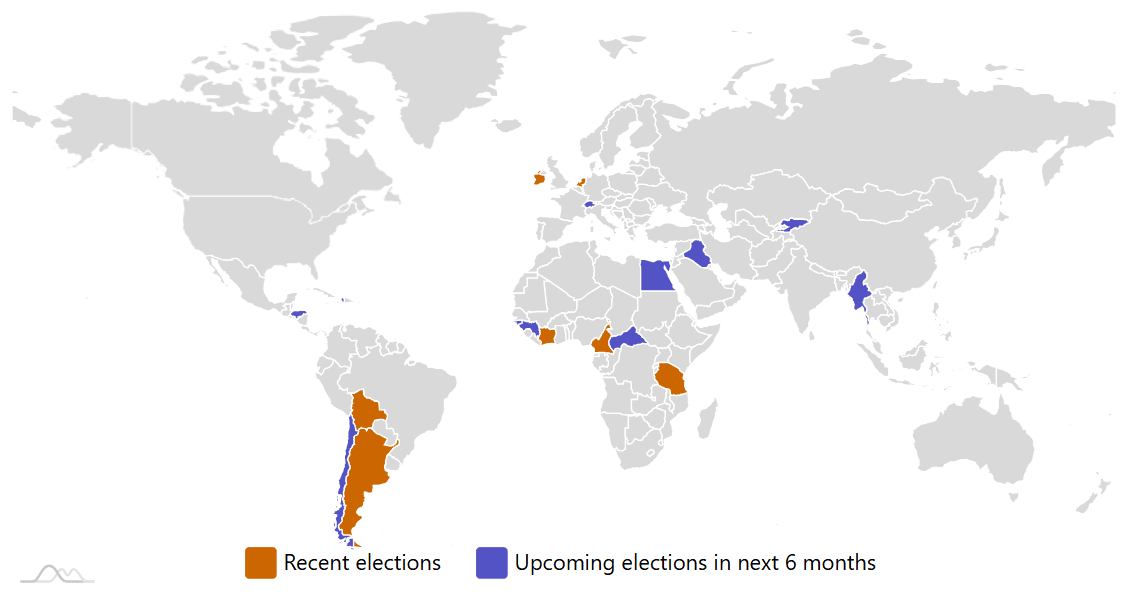

🌎 Long Chile and Short Maduro (TheOldEconomy Substack)

- November LatAm Report: The Venezuelan Edition

- Latin America never disappoints investors and analysts. Last month, Milei recorded a landslide victory in Argentina, Peru cut diplomatic relations with Mexico, and Bolivia shifted to the right.

- But there is more to come.

- On November 16, Chile will hold presidential elections. Meanwhile, Venezuela is back in the news with anticipated regime change.

- Despite the ingrained regional uncertainty—or, actually, because of it—LatAm equities are among the best performers globally.

- Global X Colombia ETF (NYSEARCA: COLO) is the top performer, followed by iShares MSCI Peru ETF (NYSEARCA: EPU) and the iShares LatAm 40 ETF (NYSEARCA: ILF). Argie equities gained traction after LLA’s success on the midterms.

- However, zooming out, Latin America is still one of the cheapest regions, especially compared to developed markets.

🌎 Random Thoughts on Offshore, Sanctions, and Payoffs (TheOldEconomy Substack)

- November Offshore Report: The Random Thoughts Edition

- Petrobras (NYSE: PBR / PBR-A / BCBA: PBR / PETR4) operates the largest pre-salt oil fields in the world. In this capacity, the company is one of the most important clients for the offshore industry. Petrobras needs everything from OSVs and PLSVs to drillships and FPSOs. As of late 2025, Brazil currently has 31 contracted floaters, six of which have yet to commence work. Petrobras needs approximately 200 OSVs under long-term contract by 2030 to support upcoming field developments, decommissioning, and offshore drilling operations.

- Yesterday, Petrobras announced extended contracts for three pipelay support vessels (PLSVs) via DOF Group and TechnipFMC (NYSE: FTI), adding roughly $100 million in backlog, and now maintains 17 contracted vessels with DOF for operations into the next decade.

- The Argentine offshore landscape is underdeveloped and still dominated by Ypf Sa (NYSE: YPF). However, the national oil giant is actively exiting its offshore exploration portfolio, comprising seven licenses (six offshore Argentina and one in Uruguay), to concentrate resources on Vaca Muerta. The company is negotiating with IOCs to divest controlling stakes in these blocks, potentially through competitive bidding processes, while retaining minority interests.

🌎 Millicom International Cellular S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎 Millicom (NASDAQ: TIGO) – Fixed & mobile, telecommunications services, cable & satellite TV, mobile financial services & local content such as music & sports in Latin America. 🇼 🏷️

🌎 MercadoLibre: A 20% Pullback That Looks Like A Buying Opportunity (Seeking Alpha) $ 🗃️

- 🌎 MercadoLibre (NASDAQ: MELI) – Uruguay HQ’d. The largest online commerce & payments ecosystem in Latin America. 🇼 🏷️

🌎 Mercado Libre Q3 2025 (Expanse Stocks)

- Pressing the “Meli” Advantage

- MercadoLibre (NASDAQ: MELI) reported its third-quarter 2025 results this week, and the quarter perfectly illustrates the company’s aggressive, long-term mindset and why exceptional businesses can justify short-term margin compression.

- Once again, short-term-focused investors fixated on the Direct Contribution margin decline as the company continues to sacrifice near-term margins in its largest market, Brazil.

- The result? Re-acceleration of user growth and a clear signal that Mercado Libre is pressing its advantage to solidify its dominance for the decade ahead.

🌎 dLocal (DLO): DCF Valuation (HatedMoats)

- If This Isn’t Undervalued, What Is? – DCFriday #003

- Date of Analysis: November 5-7, 2025

- Verdict: Undervalued

- Current Price Target (Base Case): $22.49

- Price at the Time of Analysing: $13.38

- Dlocal (NASDAQ: DLO) operates as a critical, technology-first payments platform, providing the financial infrastructure that connects global enterprise merchants with billions of consumers in fragmented and complex emerging markets. The fundamental driver of its economic value is a capital-light business model that enables the company to generate exceptionally high returns on invested capital by solving intractable local payment, regulatory, and foreign exchange challenges for its clients.

🇦🇷 Argentina Has the World’s Weirdest Tax. Can Milei Scrap it? (WSJ) $ 🗃️

- Argentina’s export tax hurts its critical agricultural industry. Milei has yet to follow through on a promise to end it.

- Most countries promote, even subsidize, exports. Argentina does the opposite, imposing a tax on its most important exports, including soybeans, wheat, beef and corn. The tax helps explain Argentina’s stunted export sector, perpetual shortage of foreign reserves and recurrent currency crises.

🇦🇷 The $18 Billion Argentina-YPF-Burford Mess (Triple S Special Situations Investing)

- What yesterday’s hearing tells us

- If you’ve been following the Argentina-Ypf Sa (NYSE: YPF) saga (and if you’re into litigation finance or investing, you absolutely should be), Wednesday’s Second Circuit oral arguments were must-see TV.

- For those not familiar, this is Burford Capital Limited (NYSE: BUR)’s crown jewel investment, where they bought distressed litigation claims from bankrupt Petersen Energía for what amounts to pocket change (reportedly around €15 million) and stood to collect a 37,000% return. That’s not a typo. Thirty-seven thousand percent.

- But after Wednesday’s hearing, Burford’s stock tanked 15% because the three-judge panel signaled some serious skepticism about whether this case ever belonged in a U.S. court in the first place.

🇦🇷 Pampa Energía S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇦🇷 Pampa Energia: An Excellent Bet For Argentine Growth (Seeking Alpha) $ 🗃️

- 🇦🇷 Pampa Energia Sa (NYSE: PAM) – Participates in power generation & transmission. 🇼 🏷️

🇦🇷 Loma Negra Compañía Industrial Argentina Sociedad Anónima 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇦🇷 Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE: LOMA) – Production & commercialization of cement in Argentina. 🇼 🏷️

🇧🇷 Klabin S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷🅿️ Klabin (BVMF: KLBN3 / KLBN4 / KLBN11 / OTCMKTS: KLBAY) – Packaging paper & sustainable paper packaging solutions. 🇼

🇧🇷 Raia Drogasil S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Raia Drogasil (BVMF: RADL3 / OTCMKTS: RADLY) – Largest pharmacy chain in Brazil + one of the 10 largest digital retail platforms in the country. 🇼 🏷️

🇧🇷 Companhia Siderúrgica Nacional 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Companhia Siderurgica Nacional SA (NYSE: SID) – Fully integrated steel producer. 5 segments: Steel industry, mining, logistics, energy & cement. 🇼

🇧🇷 Companhia Brasileira De Distribuicao 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Companhia Brasileira de Distribuicao SA (BVMF: PCAR3 / OTCMKTS: CBDBY) or GPA – Multiformat & multichannel business model + eCommerce. Casino Group company (reduced stake) present all over Brazil. Formerly NYSE (CBD) listed. 🇼 🏷️

🇧🇷 TOTVS S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 TOTVS (BVMF: TOTS3 / OTCMKTS: TTVSY) – Delivers productivity by the digitalization of businesses + systems & platforms for business management. 🇼 🏷️

🇧🇷 Smartfit Escola de Ginástica e Dança S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎 Smartfit Escola de Ginastica e Danca Sa (BVMF: SMFT3 / OTCMKTS: SFEGY) – Market leader in fitness/health clubs across Latin America, the world’s 4th largest chain in membership & the largest club outside the USA. 🏷️

🇧🇷 BrasilAgro – Companhia Brasileira de Propriedades Agrícolas 2026 Q1 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Brasilagro – Co Brasileira De Proprieda (NYSE: LND / BVMF: AGRO3 / FRA: 52BA) – One of Brazil’s largest companies in terms of arable land. Acquisition, development, operation & sale of rural properties suitable for agricultural activities. IRSA (NYSE: IRS) has a stake. 🏷️

🇧🇷 SLC Agrícola S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 SLC Agricola SA (BVMF: SLCE3 / FRA: GJ9 / OTCMKTS: SLCJY) – One of the world’s largest grain & fiber producers (cotton, soybean and corn + cattle raising, integrating crop-livestock). 🇼 🏷️

🇧🇷 Lojas Renner S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 🇦🇷 🇺🇾 Lojas Renner SA (BVMF: LREN3 / OTCMKTS: LRENY) – Department store clothing company. 🇼 🏷️

🇧🇷 Sendas Distribuidora S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Sendas Distribuidora SA (BVMF: ASAI3 / OTCMKTS: ASAIY) or Assaí Atacadista – Self-service wholesale company (Cash & Carry). 🇼 🇼 🏷️

🇧🇷 Vasta Platform Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Vasta Platform Limited (NASDAQ: VSTA) – High-growth education company providing end-to-end educational and digital solutions for private schools operating in the K-12 educational segment. 🏷️

🇧🇷 Suzano S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇧🇷 Engie Brasil Energia S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Engie Brasil Energia SA (BVMF: EGIE3 / FRA: 7TE1 / OTCMKTS: EGIEY) – Electric utility (hydroelectric power + natural gas). Formerly Tractebel Energia. Subs. Engie SA (EPA: ENGI / OTCMKTS: ENGIY / ENGQF). 🇼

🇧🇷 Minerva S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎 Minerva Sa (BVMF: BEEF3) – 32 industrial units strategically located near the main export ports, domestic markets & its broad supplier base. 3 are protein processing plants. 🇼 🏷️

🇧🇷 Nu Holdings: 30%+ Compounded Returns Through 2030 Appear Likely (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings Q3 Preview: Margin Expansion Could Drive The Next Re-Rating (Seeking Alpha) $ 🗃️

- 🌎 Nu Holdings (NYSE: NU) – Digital banking platform / fintech. 🇼

🇧🇷 Prio S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇧🇷 BB Seguridade Participações S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷🏛️ BB Seguridade (BVMF: BBSE3 / OTCMKTS: BBSEY) – Insurance, pension plans & bonds. Subs. of Banco do Brasil (BVMF: BBAS3 / FRA: BZLA / OTCMKTS: BDORY).

🇧🇷 TIM S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇧🇷 Multiplan Empreendimentos Imobiliários S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Multiplan Empreendimentos Imobiliaris SA (BVMF: MULT3 / OTCMKTS: MLTTY) – Full-service company that plans, develops, owns & manages one of the country’s largest & highest-quality commercial property portfolios. 🏷️

🇧🇷 Patria Investments Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇧🇷 Patria: Latam’s Premier Asset Manager Logs $50bn In AUM (Seeking Alpha) $ 🗃️

- 🌎🇰🇾 Patria Investments Limited (NASDAQ: PAX) – Asset management services to investors focusing on private equity, infrastructure development, co-investments, constructivist equity & real estate & credit funds. 🏷️

🇧🇷 StoneCo Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 StoneCo Ltd (NASDAQ: STNE) 🇰🇾 – Fintech. Financial technology & software solutions to merchants for eCommerce.

🇨🇱 Banco de Chile 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎 Banco de Chile (NYSE: BCH) – Range of financial services. 🇼

🇨🇱 Banco Santander-Chile 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇨🇱 Banco Santander-Chile (NYSE: BSAC) – Part of the Santander group & majority controlled by Santander Spain. The largest bank in Chile by loans & the second largest by deposits. 🇼 🏷️

🇨🇱 Enel Chile S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇨🇱 Enel Chile (NYSE: ENIC) – Develops, operates, generates, distributes, transforms and/or sells energy. 🇼

🇨🇴 Grupo Cibest S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎🅿️ Grupo Cibest SA (NYSE: CIB / BVC: PFBCOLOM) fmr. Bancolombia – First Colombian financial institution listed on the NYSE. It provides banking products & services in Colombia, Panama, Puerto Rico, El Salvador, Bermuda & Guatemala. 🇼 🏷️

🇨🇴 Mineros S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎 Mineros SA (TSE: MSA / OTCMKTS: MNSAF) – Gold exploration & production in Colombia & Nicaragua + 20% interest in a property in Chile. Colombia HQ.

🇲🇽 Grupo Aeroportuario del Pacifico: Q3 Confirms Quality, Yield, And Stability (Seeking Alpha) $ 🗃️

🇲🇽 Grupo Aeroportuario del Pacífico, S.A.B. de C.V. (PAC) Discusses Integration of Cross Border Xpress and Internalization of Technical Assistance Agreement – Slideshow (Seeking Alpha)

- 🇲🇽 Grupo Aeroportuario del Pacífico or GAP (NYSE: PAC / BMV: GAPB) – Operates 12 airports in the Pacific region of Mexico. 🇼 🏷️

🇲🇽 Grupo Financiero Banorte, S.A.B. de C.V. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)