Brazil based Arco Platform Limited (NASDAQ: ARCE) provides educational solutions that includes content, technology and services to over 5,400 schools – from kindergarten through high school. However, a potential offer to take the Company private at $11 a share has been increased to $13 a share just a few months ago. A group of shareholders said the first offer represented “a callous mistreatment of minority shareholders…”

OVERVIEW:

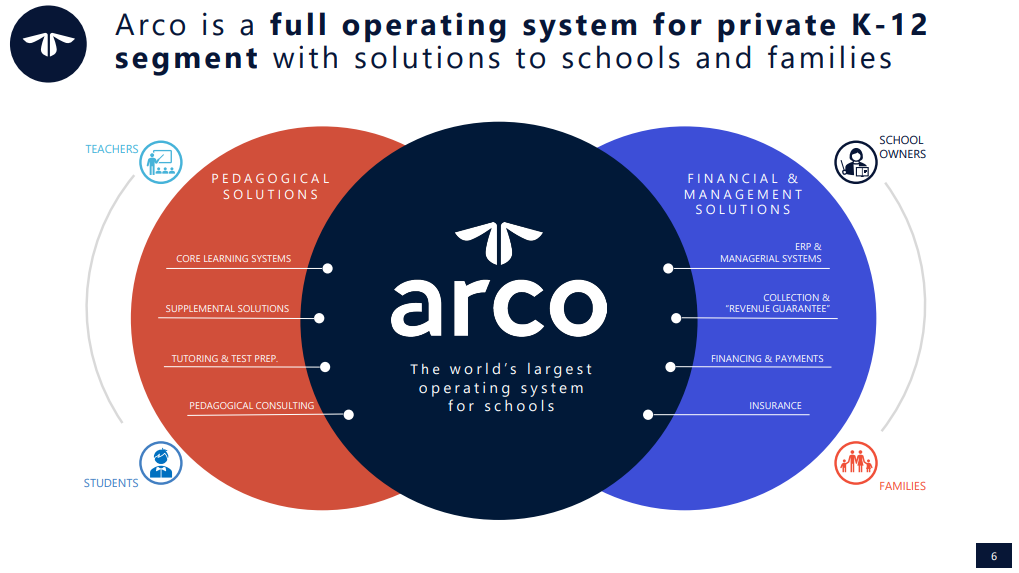

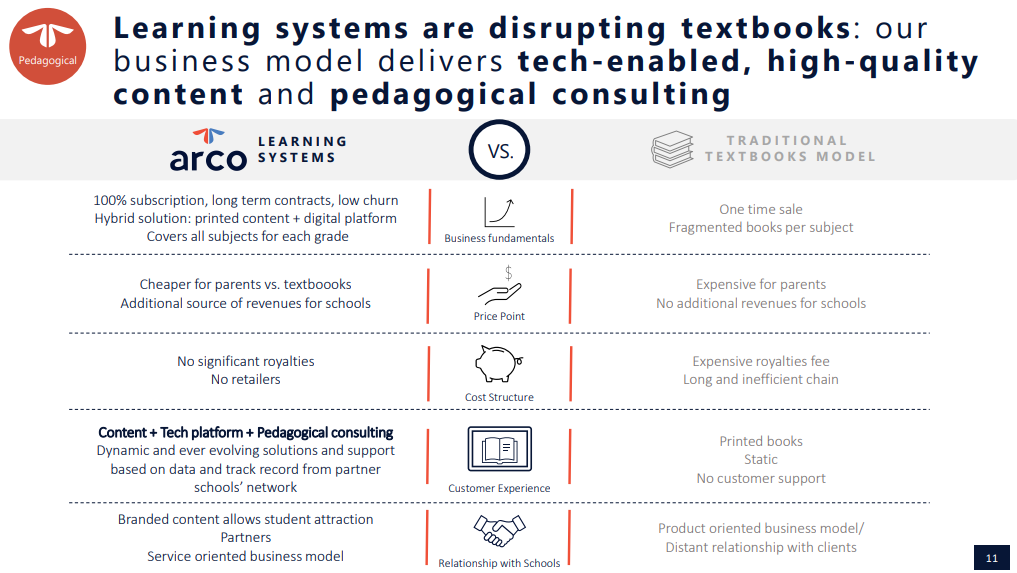

- Arco Platform Limited, a technology company in the education sector, provides a pedagogical system with technology-enabled features to deliver educational content to private schools in Brazil. The Company’s curriculum solutions provide educational content from basic to secondary education K-12 curriculum in printed and digital formats delivered through its platform. The Company’s activities also comprise editing, publishing, advertising, and sale of educational content for private schools. Arco Platform Limited was founded in 1941 and is headquartered in Sao Paulo, Brazil.

Arco – Meet Our Management (YouTube) 4:51 Minutes (Arco Educação) December 2021

RECENT FINANCIALS / NEWS:

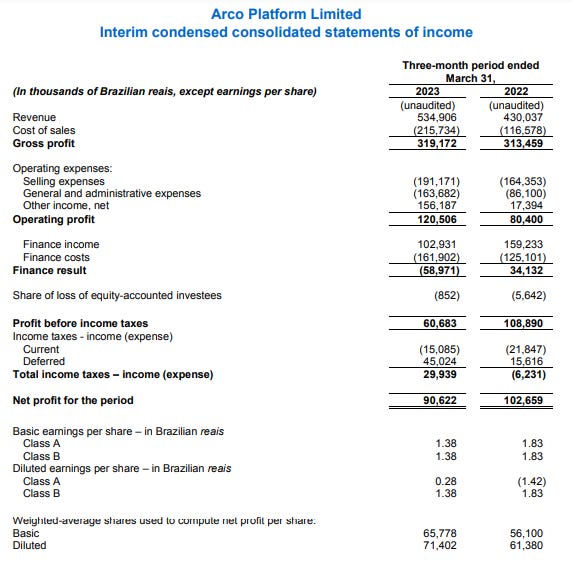

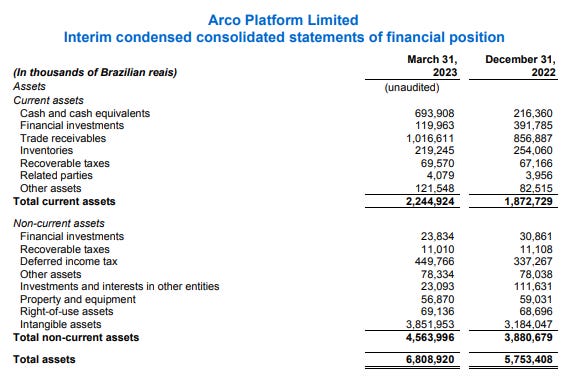

Arco Reports First Quarter 2023 Results and 1Q23 Earnings Presentation

Arco Provides Update Related to the Non-Binding Proposal May 2023

- Arco Platform Limited, or “Arco” or “Company” (Nasdaq: ARCE), today announced that the special committee of the board of directors (the “Special Committee”) received a revised non-binding proposal from General Atlantic L.P. (“General Atlantic”) and Dragoneer Investment Group, LLC (“Dragoneer”) to acquire all of the outstanding Class A common shares of the Company that are not held by such parties or Oto Brasil de Sá Cavalcante and Ari de Sá Cavalcante Neto or their respective affiliates at a price of $13.00 per share in cash. Based on recent discussions between the Special Committee and General Atlantic and Dragoneer, the Special Committee has agreed to negotiate definitive agreements with respect to a potential transaction. However, no agreement has been reached as to the terms of a potential transaction and there can be no assurance that a transaction will be approved at any time or as to the price or other terms of any such transaction.

Arco Minority Shareholders Urge Rejection of Takeover Bid (Bloomberg) December 2022

- A group of Arco Platform Ltd. shareholders sent a letter to directors urging them to reject a deal to take the company private, according to a copy of the communication reviewed by Bloomberg News.

- Arisaig Partners, Gavea Investimentos and Hix Capital, which say they represent a collective ownership stake of 13%, wrote that if Arco agrees to a proposed takeover by Dragoneer Investment Group and General Atlantic LLC, it would “represent a callous mistreatment of minority shareholders,” according to the letter.

Arco Announces Receipt of Non-Binding Going Private Proposal November 2022

- The proposal states that the Founders support the Proposed Transaction and will roll over 100% of their Class A common shares and Class B common shares in the Proposed Transaction, and that after the closing of the Proposed Transaction, the Founders will maintain the same economic and voting interest in the Company as they currently have. The purchase price proposed by General Atlantic and Dragoneer for each Class A common share is US$11.00 in cash, which represents an approximately 22% premium over today’s closing price of US$9.04 per Class A common share. A copy of the proposal letter is attached hereto as Exhibit A.

- The Company cautions its shareholders and others considering trading in its securities that no decisions have been made with respect to the Company’s response to the proposal. There can be no assurance that any definitive offer will be made, that any agreement will be executed or that this or any other transaction will be approved or consummated. The Company does not undertake any obligation to provide any updates with respect to this or any other transaction, except as required by applicable law.

KEY RATIOS:

- P/E (Google Finance): 246.19 / Forward P/E (Yahoo! Finance): 161.29

- Dividend Yield (Google Finance): N/A / Forward Dividend & Yield (Yahoo! Finance): N/A

1 YEAR CHART:

LONG TERM CHART:

ADDITIONAL RESOURCES:

- Website

- Investor Relations

- Company Presentation – June 2023

- Arco Reports First Quarter 2023 Results

- 1Q23 Earnings Presentation

- Arco Provides Update Related to the Non-Binding Proposal May 2023

- Arco Minority Shareholders Urge Rejection of Takeover Bid (Bloomberg) December 2022

- Arco Announces Receipt of Non-Binding Going Private Proposal November 2022

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Similar Posts:

- Vasta Platform Limited (NASDAQ: VSTA): A Brazilian Subscription Based High Growth Education Company

- Afya (NASDAQ: AFYA): Shares of Brazil’s Leading Medical Education Group Struggle to Breakout

- Cogna Educação (BVMF: COGN3 / OTCQX: COGNY): One of the World’s Largest Private Education Providers

- Vitru Limited (NASDAQ: VTRU): Positive Momentum for Brazil’s Leading Distance Learning Higher Education Provider

- Brazil: Setting the Stage for a Brighter Future? (Franklin Templeton)

- Economic Survey of Brazil: Towards a More Prosperous and Inclusive Brazil (OECD)

- Brazil’s Middle Class Feels Recession Pains (CNN Money)

- Active Managers’ Outperformance in Brazilian Bond Funds: Skill or Price Distortion? (S&P Dow Jones)

- Emerging Market CDS Volume Up 46% in 2014 (EMTA)

- Brazil and South Africa: Two Continental Giants with Feet of Clay (PGIM Fixed Income)

- Brazil’s Million Prostitutes are Preparing for the World Cup (The Independent)

- Brazil’s Americanas Could Face Up to $8 Billion Early Debt Charges After Accounting Scandal, Court Warns (Reuters)

- The S&P Indices Versus Active (SPIVA) Latin America Scorecard (S&P Dow Jones Indices)

- Latin American Stocks to Consider (Aberdeen)

- Outlook On Emerging Markets (Lazard AM)