Brazil based Vasta Platform Limited (NASDAQ: VSTA) is a high-growth education company providing end-to-end educational and digital solutions for private schools operating in the K-12 educational segment. Most of Vasta’s revenues are subscription based (and thus recurring) plus the Company will be offering its services to the public sector.

Note that Vasta Platform Limited will report second quarter 2023 financial results for the period ended June 30, 2023, after the market closes on Wednesday, August 9, 2023.

OVERVIEW:

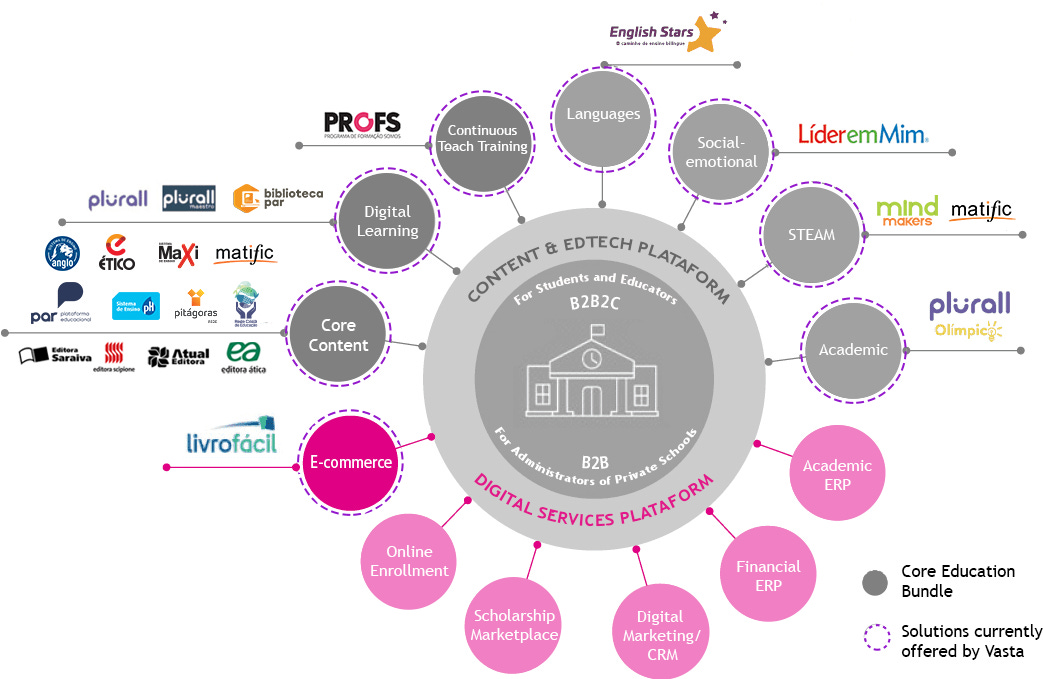

- Vasta is a leading, high-growth education company in Brazil powered by technology, providing end-to-end educational and digital solutions that cater to all needs of private schools operating in the K-12 educational segment, ultimately benefiting all of Vasta’s stakeholders, including students, parents, educators, administrators, and private school owners.

- Vasta’s mission is to help private K-12 schools to be better and more profitable, supporting their digital transformation. Vasta believes it is uniquely positioned to help schools in Brazil undergo the process of digital transformation and bring their education skill-set to the 21st century.

- Vasta promotes the unified use of technology in K-12 education with enhanced data and actionable insight for educators, increased collaboration among support staff and improvements in production, efficiency and quality.

- Vasta Educação is part of the Cogna Group or Cogna Educação (BVMF: COGN3 / OTCMKTS: COGNY), one of the most relevant educational organizations in the world. It provides services for the Postsecondary Education and K-12 segments, with solutions using B2B and B2C models.

- Somos Educação is part of the Vasta Educação group, with a wide portfolio of solutions for the B2B K-12 segment, gathering several brands which are quality references in the country. It includes core content solutions, complementary content solutions and digital services.

What is Vasta’s addressable market?

- According to a report by Oliver Wyman that was commissioned by us, the total addressable market, or TAM, for our Content & EdTech Platform and Digital Platform for private schools in Brazil was R$25.3 billion as of 2018 and segregated between: (1) R$6.0 billion for core content; (2) R$6.4 billion for complementary education solutions; and (3) R$12.9 billion for digital platform. Oliver Wyman expects that our TAM will more than double by 2030, reaching R$54.0 billion, segregated between: (1) R$13.4 billion for core content; (2) R$14.0 billion for complementary education solutions; and (3) R$26.6 billion for digital platform. As of 2018, we estimate we captured approximately 12.1% of the TAM for core content and 0.4% of the TAM for complementary education solutions (which is included in our Content & EdTech Platform segment) and 0.5% of the TAM for our Digital Platform segment, which we believe represents significant growth opportunity.

#TradeTalks: Digital solutions for Brazilian K-12 private schools in Brazil. VSTA 0.00%↑ (YouTube) 14:26 Minutes (Nasdaq) September 2020

- Nasdaq –listed Vasta Platform CEO Mario Ghio joins Jill Malandrino on #TradeTalks to discuss digital solutions for Brazilian K-12 private schools in Brazil. VSTA 0.00%↑

RECENT FINANCIALS / NEWS:

Vasta Platform First Quarter 2023 Financial Results and 1Q23 Earnings Presentation May 11, 2023

- MESSAGE FROM MANAGEMENT: “With the 1Q23 results reached halfway through the 2023 cycle, we have delivered on our guidance for economic and financial results as anticipated in the previous quarter. In the 2023 cycle to date (4Q22 and 1Q23), net revenue increased 17% to R$908 million, and subscription revenue grew 18% (or 22%, excluding PAR). Complementary solutions continues to present the highest growth rate among our business segments with a 44% growth in the cycle to date compared to the same period of the previous year. The 2023 ACV was slightly less concentrated in the first two quarters (65.1%) than in the previous year (66.5%), due to the different seasonality and product mix.

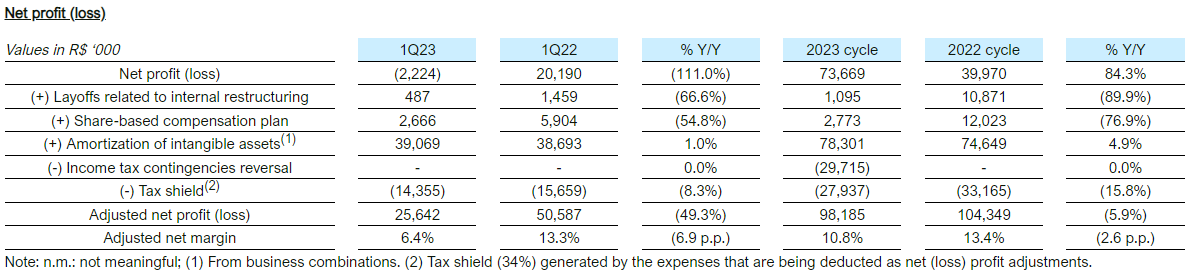

- Moreover, we continue to see the normalization of the company’s profitability and cash flow generation. In 1Q23, Adjusted EBITDA grew 10% to R$332 million, with a margin of 36.5%, a decrease of 220 bps compared to the same period in the previous year, as cycle margin was negatively impacted by 170bps due to provision for doubtful accounts (PDA) made in connection with a large retailer that entered bankruptcy proceeding in Brazil. Moreover, higher inventory cost caused by rising inflation on paper and production costs were partially offset by operating efficiency gains, cost savings and better mix due to subscription products growth. Free cash flow (FCF) totaled R$36 million in 1Q23, a 188% increase from R$13 million in 1Q22. In the 2023 cycle to date, FCF totaled negative R$7 million an 89% increase from negative R$65 million in 2022. The last twelve-month (LTM) FCF/Adjusted EBITDA conversion rate increased from negative 52% (2Q21-1Q22) to 31% (2Q22-1Q23).

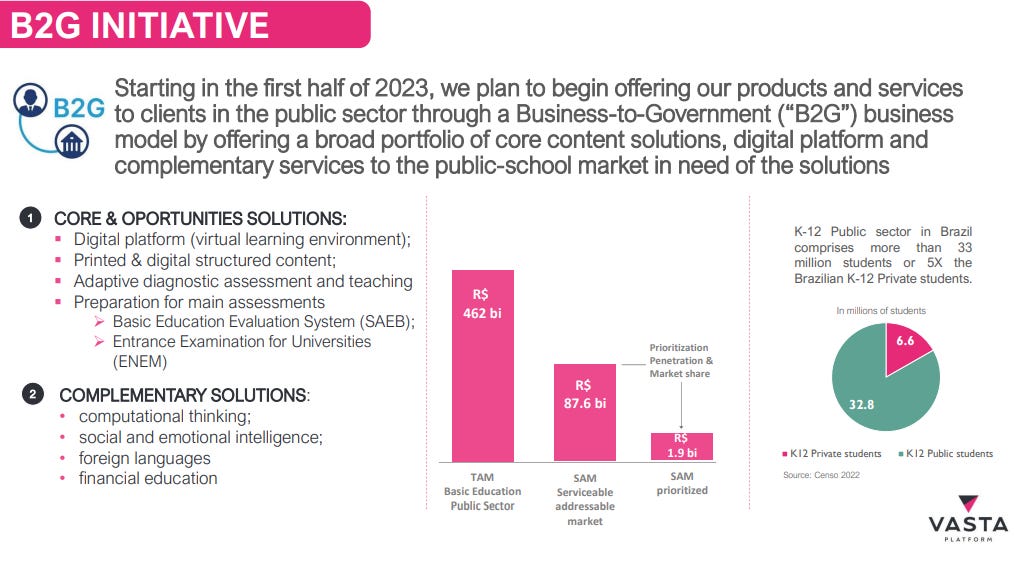

- Another highlight of 2023 is that starting in the first semester, we plan to begin offering our products and services to clients in the public sector (B2G), in addition to our existing private school client base. Our broad portfolio of core content solutions, digital platform and complementary services will allow us to access a public-school market in need of the solutions we have developed over decades for private sector. Accordingly, we have taken certain steps to (i) create what we believe to be an attractive portfolio of products and services, focused on state secretariats for education; (ii) allocate managerial and financial resources for this new business initiative; (iii) implement certain business-generating and marketing strategies for the public sector and (iv) establish a robust governance process to guarantee the highest compliance standard. The K-12 Public sector in Brazil comprises more than 32 million students, 5X the Brazilian K-12 Private students.

- Start-Anglo, a key pillar of our growth agenda, Start-Anglo continues to grow. In the first quarter of 2023 we acquired a 51% stake of Escola Start Ltda. (“Start-Anglo”), a flagship school focused on promoting bilingual education with high performance in order to respond to an increasingly strong demand from families and students for academic excellence, bilingual education, and innovation. This will be a model-institution for the franchise project that we are launching this year at Bett Brasil, the biggest education event in Latin America that reaches its 28th edition in 2023.

- But more important than the improvement in our operating results is the success of our students. According to the results released in early 2023, Vasta’s brands maintained the leadership in the number of approvals in the admission tests of Brazil’s best universities (according to SISU). The performance of our premium brands was particularly highlighted in Medicine, the most competitive career in the country. Our top-of-mind brand Anglo expanded its leadership in admissions for Medicine at the University of São Paulo (USP), with an increase of 13% in admitted students compared to 2022. The top performance at Brazil’s best universities is among the key attributes considered by K-12 schools when choosing a content partner.”

Vasta announces CEO transition plan March 2023

- After 36 years dedicated to education as a teacher, entrepreneur and executive, Mr. Mario Ghio has chosen to step down from his executive role with the Company. After Mr. Ghio’s departure on April 30, 2023, Mr. Guilherme Mélega, the Company’s current chief operating officer, will assume the CEO role.

- Mr. Mélega will assume the CEO position at a time of strong growth for the Company following the recovery from the challenges posed by the COVID-19 pandemic. Mr. Mélega has been with the Company for almost 10 years. Between 2015 and 2017, he served as the CEO of Red Balloon, one of the Company’s proprietary language schools and a leader among Brazilian language schools for children. Mr. Mélega has also served in an executive capacity in other companies in the education and other sectors, such as Abril Educação, Braskem and Whirlpool.

IPO Preview: Vasta Platform Files For U.S. IPO (The Street) July 2020

- Vasta Platform Limited (VSTP) intends to raise $100 million in an IPO of its Class A common shares, according to an F-1 registration statement.

- The firm has restructured its go-to-market approach by increasing its consulting sales force, improving training, and launching new collections or educational content.

- General & Administrative expenses as a percentage of total revenue have been dropping as revenues have increased.

- According to a 2018 market research report by LEK Consulting, private education in Brazil accounted for less than 20% of the overall market, compared to 30% in other emerging economies such as India.

- Class A common shareholders will be entitled to one vote per share and Class B shareholders will receive ten votes per share.

- The S&P 500 Index no longer admits firms with multiple classes of shares into its index.

KEY RATIOS:

- P/E (Google Finance): N/A / Forward P/E (Yahoo! Finance): 11.27

- Dividend Yield (Google Finance): N/A / Forward Dividend & Yield (Yahoo! Finance): N/A

1 YEAR CHART:

LONG TERM CHART:

ADDITIONAL RESOURCES:

- Website

- Investor Relations

- #TradeTalks: Digital solutions for Brazilian K-12 private schools in Brazil. VSTA 0.00%↑ (YouTube) 14:26 Minutes (Nasdaq) September 2020

- Vasta Platform First Quarter 2023 Financial Results

- 1Q23 Earnings Presentation May 11, 2023

- Vasta announces CEO transition plan March 2023

- IPO Preview: Vasta Platform Files For U.S. IPO (The Street) July 2020

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Similar Posts:

- Cogna Educação (BVMF: COGN3 / OTCQX: COGNY): One of the World’s Largest Private Education Providers

- Arco Platform Limited (NASDAQ: ARCE): Minority Shareholder Are Wary of this Brazil Education Stock

- Afya (NASDAQ: AFYA): Shares of Brazil’s Leading Medical Education Group Struggle to Breakout

- Vitru Limited (NASDAQ: VTRU): Positive Momentum for Brazil’s Leading Distance Learning Higher Education Provider

- YDUQS Participações (BVMF: YDUQ3): Digital Learning Investments Pay Off as Growth Continues

- Emerging Market CDS Volume Up 46% in 2014 (EMTA)

- Active Managers’ Outperformance in Brazilian Bond Funds: Skill or Price Distortion? (S&P Dow Jones)

- Brazil Small Cap ETF Stock Picks (September 2023)

- Brazil: Setting the Stage for a Brighter Future? (Franklin Templeton)

- Brazil Readies $18.5B Public Spending Plan (Valor Econômico)

- Invesco Manager: Brazil a “Sinkhole of Corruption Still Searching for a Bottom” (Forbes)

- Lowe’s Companies Said to be Looking for Acquisitions in Brazil (Bloomberg)

- Is There Progress Fighting Latin American Corruption? (Economist)

- Latin American Stocks to Consider (Aberdeen)

- Brazil: What’s Gone Wrong Plus Four Scenarios (Miami Herald)