Vitru Limited (NASDAQ: VTRU) is one of Brazil’s largest higher education institutions focused on digital education. Shares plunged in April and this fall was said to have been “exacerbated” by the stock’s limited liquidity (Yahoo! Finance has the average volume at 14,622 shares – albeit it can be significantly lower on some trading days). However, President Lula da Silva has been vocal about expanding the country’s higher education financing fund which would benefit the sector. The Company is also largely done integrating a large acquisition.

Note that Vitru is set to release its quarterly earnings results on Thursday, August 10th.

OVERVIEW:

- VITRU is the leading pure-player in the private post-secondary digital education market in Brazil based on the number of enrolled undergraduate students, according to the most recent INEP census released by the Brazilian Ministry of Education (Ministério da Educação), in February 2022.

- Vitru has been listed on the Nasdaq stock exchange in the United States (ticker symbol: VTRU) since September 18, 2020, and its mission is to democratize access to education in Brazil through a digital ecosystem and empower every student to create their own successful story.

- Through its subsidiaries, Vitru provides a complete pedagogical ecosystem focused on a hybrid distance learning experience for undergraduate and continuing education students. All the academic content is delivered in multiple formats (videos, eBooks, podcasts and html text, among others) through its proprietary Virtual Learning Environment, or VLE. The pedagogical model also incorporates in-person weekly meetings hosted by dedicated tutors who are mostly local working professionals in the subject area they teach. The Company believes that this unique tutor-centric learning experience sets it apart, creating a stronger sense of community and belonging and contributing to higher engagement and retention rates of its student base.

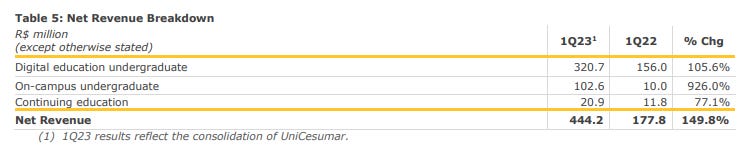

- The Company’s results are based on three operating segments:

- Digital education undergraduate courses. What differentiates Vitru’s digital education model are the higher quality and its hybrid methodology with synchronous learning, which consists of weekly in-person or online meetings with tutors for Uniasselvi, and weekly online classes for UniCesumar students, alongside the benefit of the virtual learning environment, where students are able to study where and when they prefer. The Company’s portfolio of courses is composed mainly of pedagogy, business administration, accounting, physical education, vocational, engineering, and health-related courses.

- On-campus undergraduate courses. Vitru (through Uniasselvi and UniCesumar) has several campuses that offer traditional on-campus undergraduate courses, including medical, engineering, law, and health-related courses. On-campus students experience a complete learning ecosystem, mixing theory with practical applications as well as access to sports activities and cultural events.

- Continuing education courses. Vitru (through Uniasselvi and UniCesumar) offers continuing education and graduate courses predominantly in pedagogy, finance, and business, but also in other subjects such as law, engineering, IT and health-related courses. Courses are offered in three different versions, consisting of (i) hybrid model, (ii) 100% online, and (iii) on-campus. This also includes technical courses and professional qualification courses.

- Vitru operates its hubs under the Uniasselvi and UniCesumar brands with 862.8 thousand students enrolled in digital education undergraduate and graduate courses, and 2,248 hubs distributed throughout Brazil (in each case as of March 31, 2023).

Behind the Bell: Vitru Educação (YouTube) 9:32 Minutes (Nasdaq) Sept 2020

- Brazilian distance learning education company Vitru Educação is now #NasdaqListed as $VTRU. CFO Carlos Freitas speaks with Bob McCooey, SVP of Global Head of Capital Markets about the journey to IPO day.

RECENT FINANCIALS / NEWS:

VITRU LIMITED announces First Quarter 2023 Financial Results and VITRU LIMITED Unaudited interim condensed consolidated financial statements March 31, 2023

- In August 2021, when Vitru announced the agreement for a business combination with Cesumar – Centro de Ensino Superior de Maringá Ltda or “UniCesumar”, it mentioned that the planning of the integration period would start, in which William Matos would occupy the position of co-CEO of Vitru, together with Pedro Graça, after the closing of said transaction, which took place in May 2022.

- The integration period brought together two executives with significant track-records in the Brazilian education sector and was key to benefit from the potential and best practices of both brands. Pedro Graça, with years of experience in the technology and distance learning sectors, joined Vitru in 2016 when Uniasselvi had approximately 80,000 students enrolled in the distance learning segment. William Matos is the mastermind behind UniCesumar’s approach to distance learning, which at the time of the business combination with Vitru, had over 300,000 students and had achieved high indicators of academic quality.

- The integration process turned Vitru – the parent company of Uniasselvi and UniCesumar – into a leading company in the distance learning higher education sector in Brazil, with 2,248 hubs across the country that serve around 800,000 digital education students (as of March 31, 2023), a consolidated Net Revenue of approximately R$1.6 billion and adjusted EBITDA of approximately R$570 million in the 12 months ended March 31, 2023, and an Adjusted EBITDA margin of 36% for the same period.

- The planned co-CEO structure accelerated the integration of the brands and now allows us to move into a new phase: Pedro Graça will leave his executive role in the Vitru group within the next six months and will have a seat on the Board of Directors. William Matos will take over as the sole CEO of the Company.

Vitru announces the beginning of the transition period of the co-CEO structure May 2023

- In August 2021, Vitru announced the business combination with Cesumar – Centro de Ensino Superior de Maringá Ltda, or “UniCesumar”, and the beginning of an integration period in which William Matos would hold the position of co-CEO of Vitru, alongside Pedro Graça, upon completion of the business combination, which took place in May 2022.

Vitru Announces Share Buyback Program May 2023

- Board of Directors has approved a share buyback program to purchase up to 500,000 of its common shares until the earlier of the completion of the buybacks and May 15, 2024.

This little-known education stock from Brazil can surge 70%, Morgan Stanley says (CNBC) May 2023 (Archived Article)

- Shares of the Brazil-based digital education company have plunged 44% since March, as of Friday’s closing price. However, Morgan Stanley thinks the decline wasn’t due to the company’s fundamentals, but rather was “exacerbated” by the stock’s limited liquidity.

- Brazil’s new government under President Luiz Inácio Lula da Silva has been vocal about expanding the country’s higher education financing fund known as Fundo de Financiamento ao Estudante do Ensino Superior, according to the analyst.

Vitru Limited Enters into a Definitive Agreement for the Business Combination with Unicesumar August 2023

- Unicesumar is a leading and fast-growing higher education institution in Brazil focused on the distance learning market, founded 30 years ago in Maringá/PR and led by the Matos Family since then. As of March 31, 2021, it had 760 hubs and 331 thousand students, including 314 thousand in digital education. According to the latest INEP higher education census released in Sept. 2020 by the Brazilian Ministry of Education (Ministério da Educação), or MEC, Uniasselvi and Unicesumar were respectively the #1 and #2 fastest-growing institutions in the Brazilian private digital education market. Unicesumar also enjoys a sizeable presence in health-related on-campus courses, particularly Medicine, with more than 1,600 students in 348 current medical seats1 that are still ramping-up (with potential for 50 additional seats in the near future).

- At the closing date, 62.9% of the equity value will be paid in cash and 19.4% will be paid through the issuance of new Vitru shares. As a result, the current Unicesumar shareholders will hold a 23.6% stake in Vitru. The remaining 17.7% of the equity value will be paid in cash 12 months after closing, adjusted by the Brazilian consumer price index (IPCA). Vitru has secured a firm credit line from leading Brazilian banks in an aggregate amount of R$1.95 billion (five-year financing) for the transaction, to be disbursed at closing. We believe that the strong cash flow profile of both companies will allow a smooth deleveraging over time.

- The agreement also provides for additional payments as follows: (i) a potential payment of R$ 1.0 million per seat in connection with 50 additional medical seats subject to approval of MEC, within 36 months from closing; (ii) R$180 million in connection with non-compete obligations entered into by and among Vitru and certain executives of the Matos Family; and (iii) an earn-out of up to R$ 50 million related to certain achievements as defined in the business combination, for two years after the closing date.

IPO Launch: Vitru Limited Seeks $258 Million U.S. IPO – IPOs On TheStreet – U.S. IPO Research & Opinion (The Street) September 2020

- Vitru Limited (VTRU) intends to raise $258 million in an IPO of its common shares, according to an F-1 registration statement.

- Management is headed by Chairman Mr. Bruno Zaremba, who has been with the firm since 2020 and was previously a director at BK Brasil Operacao e Assessoria a Restaurantes S.A., an owner and operator of Burger King and related brands in Brazil.

- Vitru has received at least $104 million from investors including Mundi Holdings I and II, Vinci Capital Partners II, Agresti Investments, Botticelli Investments, Caravaggio Investments, Raffaello Investments and NB Verrocchio.’

- According to a 2015 market research report by Ken Research, the total education market in Brazil is expected to exceed $350 billion by the end of 2020, with the K-12 segment accounting for the highest percentage of the total market at about 2/3 of the total.

- Existing shareholders intend to sell 5.23 million shares and Vitru will offer 6.0 million shares.

KEY RATIOS:

- P/E (Google Finance): 19.87 / Forward P/E (Yahoo! Finance): 18.52

- Dividend Yield (Google Finance): N/A / Forward Dividend & Yield (Yahoo! Finance): N/A

1 YEAR CHART:

LONG TERM CHART:

ADDITIONAL RESOURCES:

- Website

- Investor Relations

- Institutional Presentation July 2023

- VITRU LIMITED announces First Quarter 2023 Financial Results

- VITRU LIMITED Unaudited interim condensed consolidated financial statements March 31, 2023

- Vitru announces the beginning of the transition period of the co-CEO structure May 2023

- Vitru Announces Share Buyback Program May 2023

- This little-known education stock from Brazil can surge 70%, Morgan Stanley says (CNBC) May 2023 (Archived Article)

- Vitru Limited Enters into a Definitive Agreement for the Business Combination with Unicesumar August 2023

- IPO Launch: Vitru Limited Seeks $258 Million U.S. IPO – IPOs On TheStreet – U.S. IPO Research & Opinion (The Street) September 2020

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Similar Posts:

- YDUQS Participações (BVMF: YDUQ3): Digital Learning Investments Pay Off as Growth Continues

- Afya (NASDAQ: AFYA): Shares of Brazil’s Leading Medical Education Group Struggle to Breakout

- Cogna Educação (BVMF: COGN3 / OTCQX: COGNY): One of the World’s Largest Private Education Providers

- Vasta Platform Limited (NASDAQ: VSTA): A Brazilian Subscription Based High Growth Education Company

- Arco Platform Limited (NASDAQ: ARCE): Minority Shareholder Are Wary of this Brazil Education Stock

- Brazil Small Cap ETF Stock Picks (September 2023)

- Brazil: Worth a Closer Look (Franklin Templeton)

- YPO CEO Survey: Brazil CEO Confidence Stagnates (YPO)

- South American Rumbles: Argentina and Brazil Developments (Pictet)

- Relaxed Financial Markets Look at Lula’s Comeback (Amundi)

- Active Managers’ Outperformance in Brazilian Bond Funds: Skill or Price Distortion? (S&P Dow Jones)

- Invesco Manager: Brazil a “Sinkhole of Corruption Still Searching for a Bottom” (Forbes)

- Brazil’s Grievous Manufacturing Collapse (The Emerging Markets Investor)

- Lowe’s Companies Said to be Looking for Acquisitions in Brazil (Bloomberg)

- Brazil’s Middle Class Feels Recession Pains (CNN Money)