Calgary based Gran Tierra Energy (TSX: GTE / NYSE: GTE / LSE: GTE) is an independent international exploration and production company with onshore oil production focused in Colombia and Ecuador. Recent earnings and concerns about risk in Colombia have sent share prices downward, but the Company has plenty of long term development opportunities and is focused on using technology to get every last drop of oil.

The WSJ also recently mentioned the stock in an article (As Oil Giants Retreat Globally, Smaller Players Rush In) about how the oil majors are still developing a handful of big oil and gas fields in Latin America. But increasingly, it is smaller, little-known oil firms who are moving into risky lesser explored regions and getting the fossil fuels out of the ground. These smaller oil players have lower costs and can quickly recoup their investment before the next oil price downturn.

OVERVIEW:

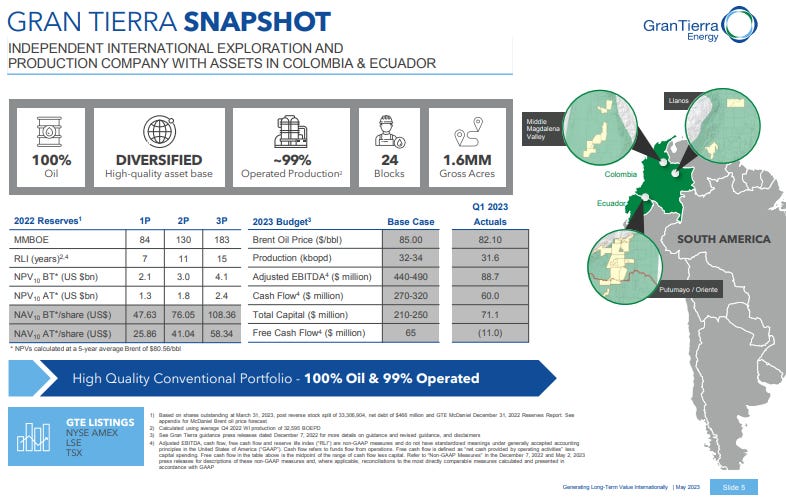

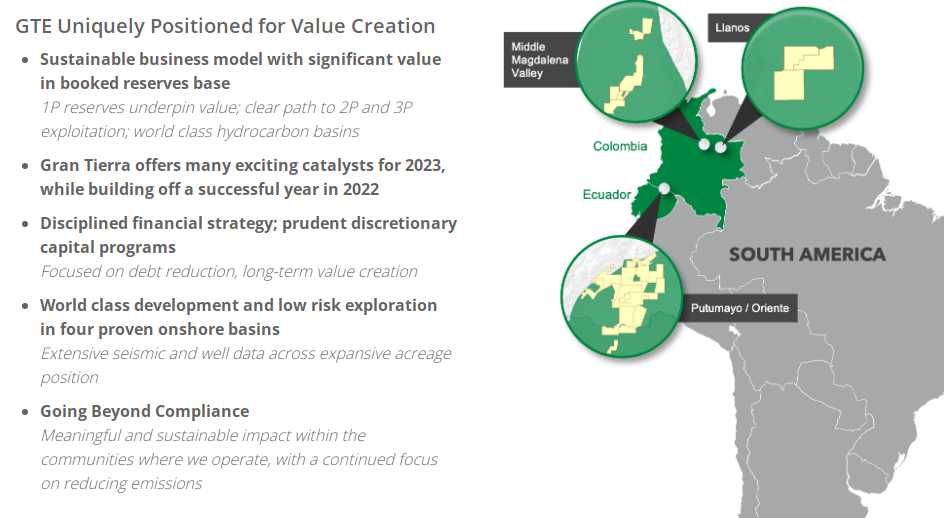

- Colombia represents 99% of production with oil reserves and production mainly located in the Middle Magdalena Valley (“MMV”) and Putumayo Basin. In MMV, their largest field is the Acordionero Field, where they produce approximately 17° API oil, which represented 52% of total Company production in 2022. The Putumayo production is approximately 27° API for Chaza Block and 18° API for Suroriente Block, which represented 25% and 14% respectively of total Company production in 2022.

- Gran Tierra Energy: Corporate video (Youtube) 2 Minutes (April 2023)

- Acordionero Field (Youtube) 2:48 Minutes

RECENT FINANCIALS / NEWS:

- Gran Tierra Energy Inc. Completes Reverse Stock Split May 2023

- As a result of the reverse stock split, every ten (10) of the Company’s issued shares of common stock were automatically combined into one issued share of common stock, without any change to the par value per share. This reduced the number of issued and outstanding shares of common stock from approximately 333.0 million shares to approximately 33.3 million shares.

- Gran Tierra Energy Inc. Announces First Quarter 2023 Results and Quarterly Report on Form 10-Q (Quarterly Period Ended March 31, 2023) (PDF File)

- First Quarter 2023 Total Average Production of 31,611 BOPD, Up 8% from One Year Ago

- Second Quarter-To-Date 2023(1) Total Average Production of Approximately 32,400 BOPD

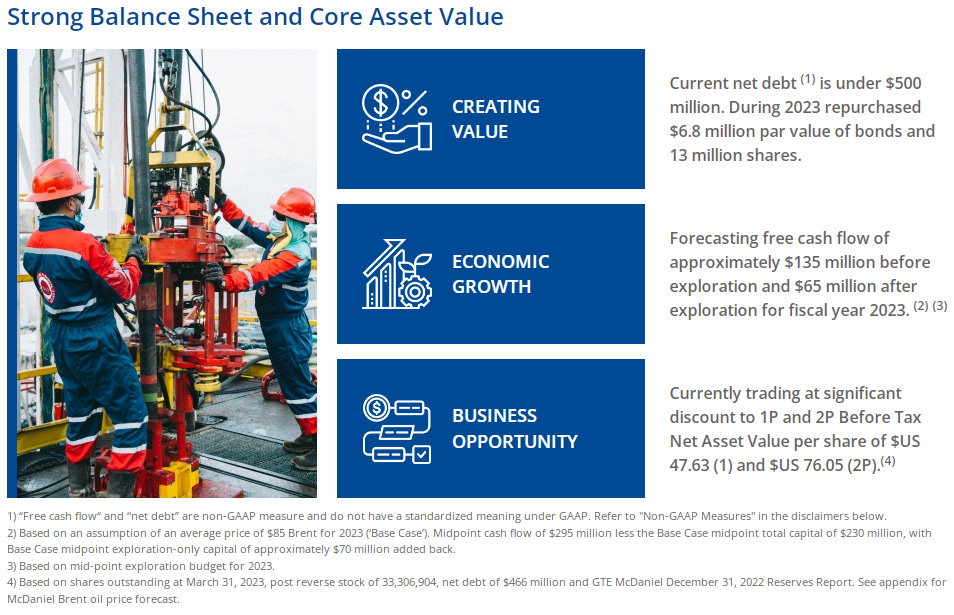

- Net Loss of $10 Million, Net Income of $115 Million Over Last 12 Months

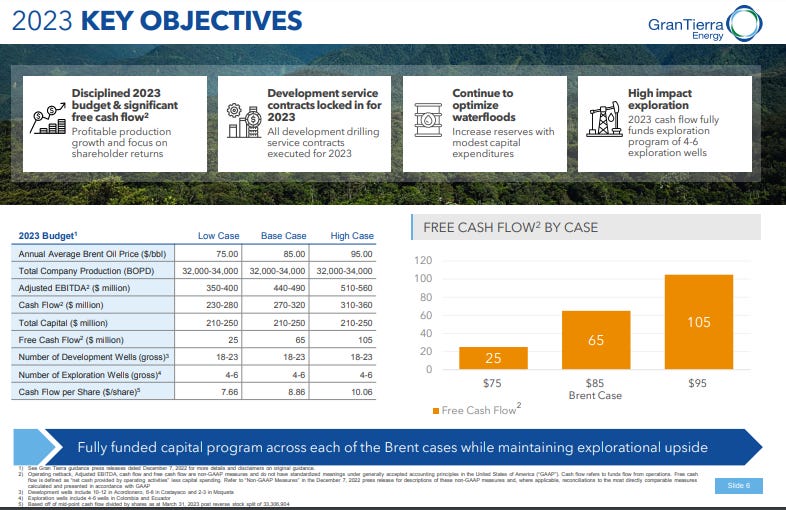

- Adjusted EBITDA(2) of $89 Million, $459 Million Over Last 12 Months

- Funds Flow from Operations(2) of $60 Million, $339 Million Over Last 12 Months

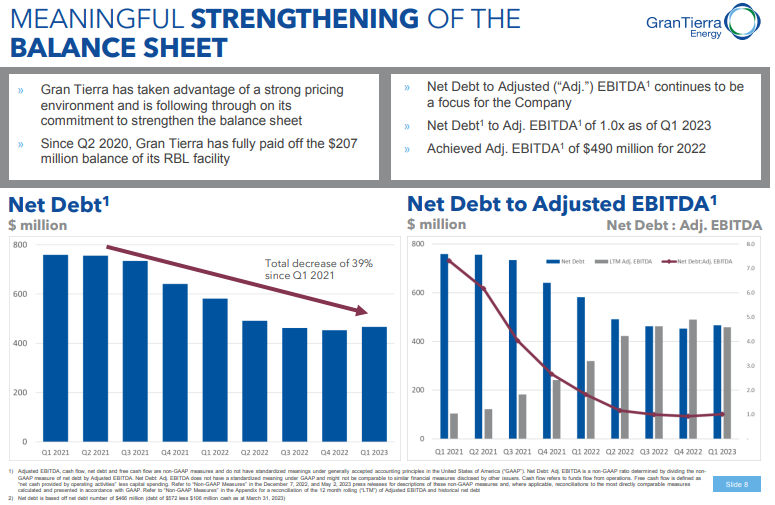

- Cash Balance of $106 Million and Net Debt(2) of $466 Million, as of March 31, 2023

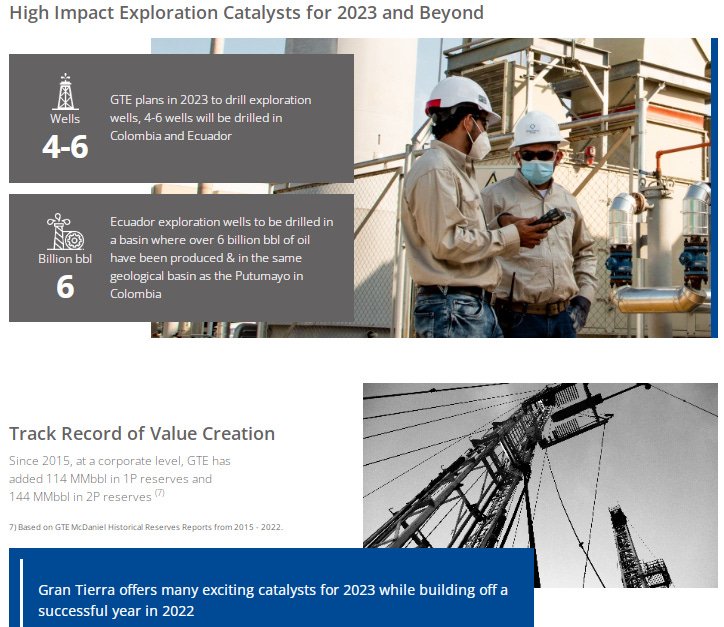

- Colombia Development Campaign Progressing with 14 Wells Drilled in the Quarter and Another 4 Wells Drilled Second Quarter-To-Date 2023(1)

- Gary Guidry, President and Chief Executive Officer of Gran Tierra: “…We are very pleased with our recently announced agreement with Ecopetrol, the national oil company of Colombia, by which Gran Tierra and Ecopetrol renegotiated the agreement for the Suroriente Block in the Putumayo Basin, which was scheduled to end in mid-2024. This agreement provides an opportunity to add significant value, as well as economic life, to Suroriente by continuing its duration for 20 years. The additional term of the agreement allows long-term investment in infrastructure and work programs to enhance oil recovery efficiency in existing fields, and appraisal drilling to potentially prolong the life of the fields. We are also excited to recommence exploration drilling during second half 2023.”

- Gran Tierra in Colombia for long haul, says CEO (Bnamericas) February 2023

- “We have a great portfolio of exploration land and plenty of work in front of us over the next three to five years,” Guidry told investors during a quarterly earnings call.

- “We also have some very exciting lands in Ecuador, in terms of exploration. We realize there have been some [Colombian government] announcements. We get that, but they will not have an impact on our five-year plan.”

- “We have very strict criteria in what we invest in globally,” he said. “We are looking at opportunities in Africa and the Middle East, where we believe we can expand our value portfolio and mitigate risk. We are very happy with exploration in Colombia, but we are looking at opportunities in other basins.”

- Gran Tierra tests polymer injection process to enhance oil recovery at Acordionero (Youtube) 18:04 (November 2022)

- The enhanced recovery process, which involves injecting polymer into the waterflood patterns, is being implemented at its Acordionero project in Colombia as a pilot project.

- “The single most important thing about enhanced recovery and that mindset of, ‘We’re not just going to produce fields on primary production and be happy with a low- to medium-recovery factor.’ It’s much easier to spend the money on the technical effort to get every last drop out of each field,” Guidry explained.

- 00:00 Intro

- 00:49 Why Colombia and Ecuador

- 02:15 Colombia’s fiscal stability

- 03:04 One thing about Ecuador

- 03:45 Gran Tierra’s major oil fields

- 05:16 Enhanced oil recovery: waterflooding

- 09:13 Gran Tierra’s projects in Ecuador

- 10:28 Gran Tierra’s financials

- 12:40 Why investors should consider Gran Tierra

- 15:16 Geopolitcal pressures on the oil and gas industry

- Colombian $4 billion tax reform becomes law, duties on oil and coal hiked (Reuters) November 2022

- The new law states that oil companies will be taxed an additional 5% when international prices are between $67.3 and $75 per barrel. That then becomes an additional 10% when prices are between $75 and $82.2 per barrel and then 15% if they climb any higher.

- Coal companies will face similar extra charges when prices exceed certain thresholds. Oil and mining companies will also not be able to deduct the value of royalties from income taxes.

RECENT STOCK ANALYSIS:

- Gran Tierra Energy’s Latest Numbers Disappoint But It Remains A Buy (Seeking Alpha) May 2023

- Disappointing First Quarter 2023 results spark deep sell-off.

- Geopolitical and commodity price risks weighing on outlook.

- Gran Tierra is heavily undervalued due to overblown perception of risk.

- The main reasons for that disappointingly poor bottom-line result are myriad, key being a sharp decline in revenue from oil sales, which fell 17% year over year to $144 million.

KEY RATIOS:

- P/E (Google Finance): 17.10 / Forward P/E (Finviz): 16.06 / Forward P/E (Yahoo! Finance): 2.31

- Dividend Yield (Google Finance): n/a / Dividend (Finviz): n/a / Forward Dividend & Yield (Yahoo! Finance): n/a

1 YEAR CHART:

LONG TERM CHART:

ADDITIONAL RESOURCES:

- Website

- Investor Relations

- Wikipedia

- Company Snapshot

- Why Invest in Gran Tierra?

- Corporate Presentation (May 2023) (PDF File)

- Gran Tierra Energy: Corporate video (Youtube) 2 Minutes (April 2023)

- Acordionero Field (Youtube) 2:48 Minutes

- Gran Tierra tests polymer injection process to enhance oil recovery at Acordionero (Youtube) 18:04 (November 2022)

- Gran Tierra Energy Inc. Completes Reverse Stock Split May 2023

- Gran Tierra Energy Inc. Announces First Quarter 2023 Results and Quarterly Report on Form 10-Q (Quarterly Period Ended March 31, 2023) (PDF File)

- Gran Tierra Energy’s Latest Numbers Disappoint But It Remains A Buy (Seeking Alpha) May 2023

- Gran Tierra in Colombia for long haul, says CEO (Bnamericas) February 2023

- Colombian $4 billion tax reform becomes law, duties on oil and coal hiked (Reuters) November 2022

- As Oil Giants Retreat Globally, Smaller Players Rush In (WSJ) May 2023

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Similar Posts:

- GeoPark Ltd (NYSE: GPRK): Positioned for a Latin American Oil Boom

- Frontera Energy (TSE: FEC / FRA: 3PY3 / OTCMKTS: FECCF): Hit By Colombia Unrest But Sees Coming Profitability and Operational Improvements

- Is There Progress Fighting Latin American Corruption? (Economist)

- Frontier Case Study: Ecuador’s Path to Economic Sustainability (PGIM Fixed Income)

- Global X MSCI Colombia ETF Holdings (September 2023)

- Tecnoglass (NYSE: TGLS): An Architectural Glass Stock With an Unbreakable Recent Performance

- The World’s Biggest Sovereign Debt Defaults (CNBC)

- Analysis: Colombia’s Extractive Industries Watching Election Warily (Reuters)

- The Odebrecht Corruption Scandal Shakes Up Colombia’s Presidential Vote (WPR)

- Colombia’s Economy May Yet Catch Up to the Hype (Bloomberg)

- Latin America Slow Descent into Interventionism (Daniel Lacalle)

- Mexico and Colombia Join ‘Fragile Five’ Emerging Markets (FT)

- Why Could Moody’s Downgrade Colombia’s Credit Rating? (AméricaEconomía)

- Why Venezuela Can’t Be Like Colombia (RealClear World)

- Latin American Political Turmoil is Roiling These Markets (Bloomberg)