With mounting geopolitical conflicts or uncertainties in Eastern Europe, the Middle East and North Asia, it’s worth taking some time to take a look at the Colombia ETF and all of its holdings (some of which might be a better way to gain exposure to the country) as the country is far removed from these other conflicts:

Global X MSCI Colombia ETF (NYSEARCA: GXG)

- P/E: 5.03 / Yield: 6.75% (Yahoo! Finance)

However, Colombia does have it’s share of country specific concerns or risks.

Our June 20th post noted how Latin American politics always seems like a never ending seesaw battle between the right and the left. Countries will become investor and free market friendly under a right leaning government only for a little while. Then a Left leaning government will take power and the country will lurch back towards statism.

Nevertheless, Brazil’s Lula has surprised the market by not being as bad as expected (he is also checked by a right leaning Congress). It’s Colombia under the recently elected (and former communist guerrilla) Petro that has investors more concerned.

Our October 3rd post noted a podcast where a fund manager explained how investors always hope a moderate centralist right candidate will emerge from elections. But he also explained why this may not matter much. For example: Bolsonaro may have said controversial things; but he allowed his finance minister to manage the economy, the Central bank remained independent, etc. Lula has also appointed a pragmatic rather than a political finance minister. In other words, what ultimately matters are fiscally responsible policies and the central bank being free to do its job as that will remove or lower country risk premiums.

However and earlier this year, Colombia’s Petro removed the majority of his cabinet – including the orthodox Finance Minister who was the last point of trust and stability from the market’s perspective (Colombia’s President Replaces Market-Friendly Finance Minister in Cabinet Reshuffle). This could be a sign that Petro will act more radical going forward – including targeting the country’s energy and mining sectors (but oil and coal exports are also major sources of government revenue…):

- Explorers in Colombia keep spending amid Petro government’s leftist rhetoric (The Northern Miner) October 2023

- Petro’s Plan To End Oil Exploration Threatens Colombia’s Energy Security (OilPrice.com) August 2023

- Colombia names leftist engineer as new mining minister (Mining.com) July 2023

On the other hand, Ecuador has just replaced a leftist President with a conservative one (an heir to a banana fortune) who has promised to be tough on violent crime and cocaine trafficking.

In other words, the Latin American left-right pendulum is swinging away from the left in Ecuador just as it is swinging towards the left in Colombia. But unless the country becomes another Venezuela, the pendulum in Colombia will eventually swing back again.

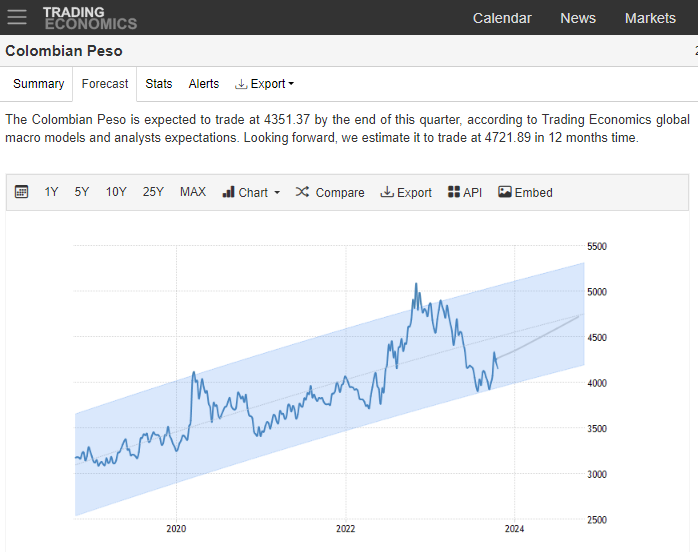

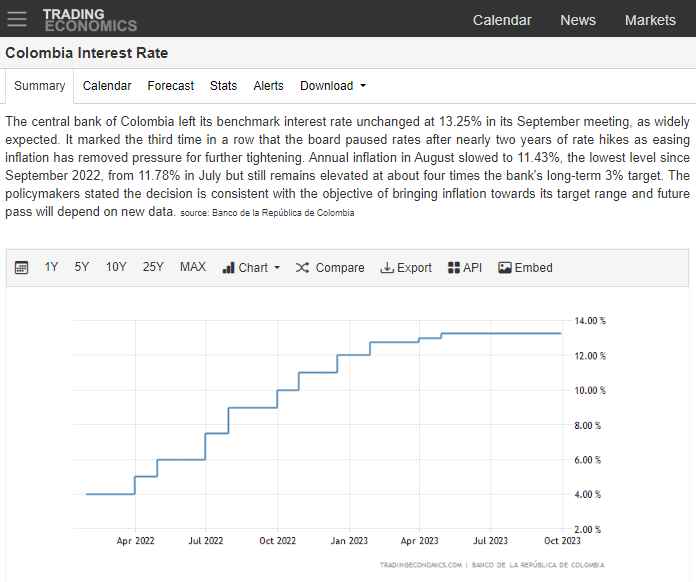

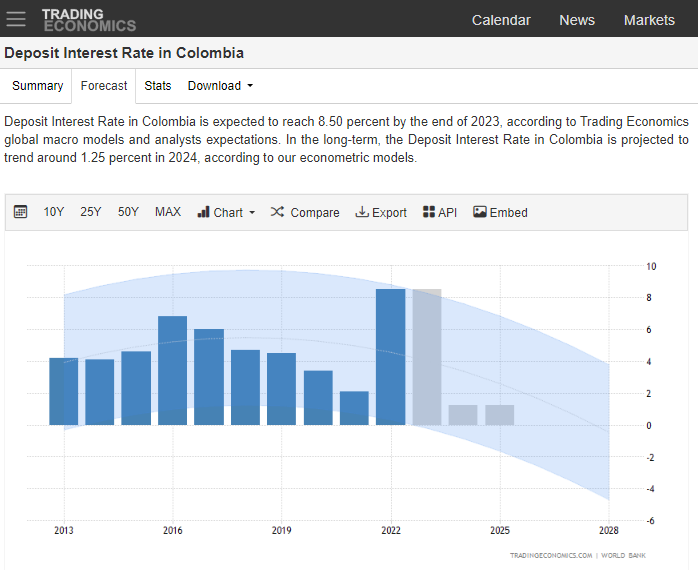

With that said, here is a look at some key Colombian economic data:

Here is a look at the more recent performance of the Colombia ETF covering the COVID period (the charts are linked back to Yahoo! Finance):

And the long term performance chart:

Investors looking at the Colombia ETF should be aware of a couple of potential issues:

- The ETF is heavily invested in financials, energy and utilities – sectors that could all be targeted by left-leaning Petro.

- Several of the holdings are actually cross holdings e.g. subsidiaries or they are controlled by the ETF’s other holdings. Investors will need to examine the shareholding structure of each entity closely.

- Several of the holdings appear to have significant if not most of their exposure to other Latin American countries or the USA. Again, investors will need to look at each stock more closely to determine where revenues, earnings, and risk are coming from.

With the above in mind, I would not go so far as to say the ETF is flawed and it does offer good exposure to Latin America. However, investors looking for more direct or (for that matter) less exposure to Colombia might be better off owning some of the individual stock holdings – some of which do trade on USA stock exchanges.

We also have a Colombia ADRs on our website with more Colombian stocks and investing resources while here are some other Colombian focused stocks we have covered in the past:

- Frontera Energy (TSE: FEC / FRA: 3PY3 / OTCMKTS: FECCF): Hit By Colombia Unrest But Sees Coming Profitability and Operational Improvements

- Gran Tierra Energy (NYSE: GTE): Still Has Plenty of Exploration Opportunities in Colombia and Ecuador

- GeoPark Ltd (NYSE: GPRK): Positioned for a Latin American Oil Boom

- Tecnoglass (NYSE: TGLS): An Architectural Glass Stock With an Unbreakable Recent Performance

To make your life easier, this post includes:

- A quick description of the stock holding (as of the end of September) with links to the IR page and stock quote(s) on Yahoo! Finance or Finviz (for US Listings).

- A link to any Wikipedia page (for what it might be worth…)

- Forward or trailing P/E and dividend yields linked back to the Yahoo! Finance statistics page.

- The latest long term technical chart linked back to Yahoo! Finance.

And as always, this post is provided for informational purposes only (and to make your life easier by providing you with relevant information, links, and charts). It does not constitute investment advice and/or a recommendation…

Banco Davivienda SA

Banco Davivienda SA (BVC: PFDAVVNDA.CL) is a regional bank leader that operates in six countries (Colombia, Panama, Costa Rica, El Salvador, Honduras, and the United States). With over 50 years of experience in the Colombian market, Davivienda offers a wide range of financial services to individuals, SMEs, and corporate customers. The bank currently serves over 22.7 million customers through a network of 672 branches and more than 2,812 ATMs.

Davivienda has been in business for over 50 years. Formerly incorporated as Corporación de Ahorro y Vivienda in 1972 in Colombia, Davivienda is going through a steady and strong expansion process since 2005. Currently, it is part of Grupo Bolivar and it is the third-largest bank in Colombia by assets and profits.

- Wikipedia

- Forward P/E: 3.21 / Forward Annual Dividend Yield: 6.14% (Yahoo! Finance)

Bancolombia

Bancolombia (NYSE: CIB / BVC: PFBCOLOM) was founded in 1875 and was the first Colombian financial institution listed on the NYSE. It provides banking products and services in Colombia, Panama, Puerto Rico, El Salvador, Bermuda, and Guatemala. The company operates through nine segments: Banking Colombia, Banking Panama, Banking El Salvador, Banking Guatemala, Trust, Investment Banking, Brokerage, International Banking, and All Other.

- Wikipedia

- Forward P/E: / Forward Annual Dividend Yield: (Yahoo! Finance)

- Forward P/E: 4.92 / Forward Annual Dividend Yield: 13.11% (Yahoo! Finance)

Brookfield Renewable Corp

Brookfield Renewable operates one of the world’s largest publicly traded platforms for renewable power and decarbonization solutions. Their diversified portfolio consists of hydroelectric, wind, solar, distributed energy and sustainable solutions across five continents. Investors can access its portfolio either through Brookfield Renewable Partners L.P. (NYSE: BEP), a Bermuda -based limited partnership, or Brookfield Renewable Corporation (NYSE: BEPC), a Canadian corporation. BEPC was created to provide investors with greater flexibility in how they access BEP’s globally diversified portfolio of high-quality renewable power assets. Class A shares of BEPC are structured to provide an economic return equivalent to BEP units through a traditional corporate structure. Each BEPC Class A share has same distribution as a BEP unit, and is exchangeable, at the shareholders option, for one BEP unit.

Brookfield Renewable has operations in more than 30 countries on five continents. Brookfield owns and manages critical infrastructure in Brazil, Chile, Colombia and Peru, including natural gas pipelines, power transmission lines, railways, toll roads and data infrastructure. Their renewable energy assets generate 5.2 GW of installed capacity, and we own a growing solar portfolio. Their private equity portfolio is diverse, including water sanitation, fleet management and residential real estate development. And their real estate portfolio includes high-quality offices, retail and logistics parks.

- Wikipedia (Brookfield Renewable Partners L.P.)

- Forward P/E: 12.95 / Forward Annual Dividend Yield: 5.89% (Yahoo! Finance)

To read more, please visit this article on Substack

Similar Posts:

- Colombia’s Economy May Yet Catch Up to the Hype (Bloomberg)

- Analysis: Colombia’s Extractive Industries Watching Election Warily (Reuters)

- Gran Tierra Energy (NYSE: GTE): Still Has Plenty of Exploration Opportunities in Colombia and Ecuador

- Why Could Moody’s Downgrade Colombia’s Credit Rating? (AméricaEconomía)

- GeoPark Ltd (NYSE: GPRK): Positioned for a Latin American Oil Boom

- Frontera Energy (TSE: FEC / FRA: 3PY3 / OTCMKTS: FECCF): Hit By Colombia Unrest But Sees Coming Profitability and Operational Improvements

- Analysis – Colombia’s First Leftist Leader Gustavo Petro Targets Inequality; Investors on Edge (Reuters)

- Colombians Look to Miami as Gustavo Petro’s Election Sparks Capital Flight Fears (Financial Times)

- How the Colombia Election Could Change Latin America (Financial Times)

- Tecnoglass (NYSE: TGLS): An Architectural Glass Stock With an Unbreakable Recent Performance

- Populist Outsider Shakes up Colombia’s Presidential Election (Financial Times)

- Latin America’s Pink Wave Faces Investor Skepticism (The Emerging Markets Investor)

- Why Venezuela Can’t Be Like Colombia (RealClear World)

- Latin America: Where to Find Growth in 2019? (Pictet AM)

- Mercado Libre CFO Talks E-commerce Markets, Fintech Services, Crypto, Outlook (Yahoo! Finance)