Colombia based Tecnoglass (NYSE: TGLS) is the second largest glass fabricator serving the U.S. and the #1 architectural glass transformation company in Latin America. Shares have moved from the single digit level in 2021 to $46.46 as of yesterday’s close as the company has continued to produce strong financial results and growth.

OVERVIEW:

- Tecnoglass Inc. is a leading producer of architectural glass, windows, and associated aluminum products serving the multi-family, single-family and commercial end markets. Located in Barranquilla, Colombia, the Company’s 4.1 million square foot, vertically-integrated and state-of-the-art manufacturing complex provides efficient access to over 1,000 global customers, with the U.S. accounting for more than 90% of revenues.

- PRODUCTS:

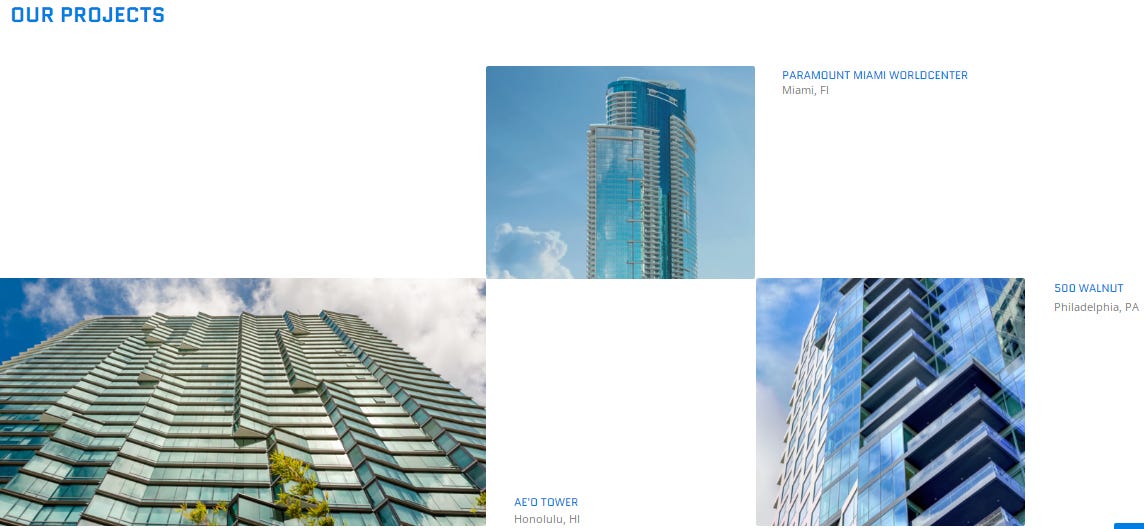

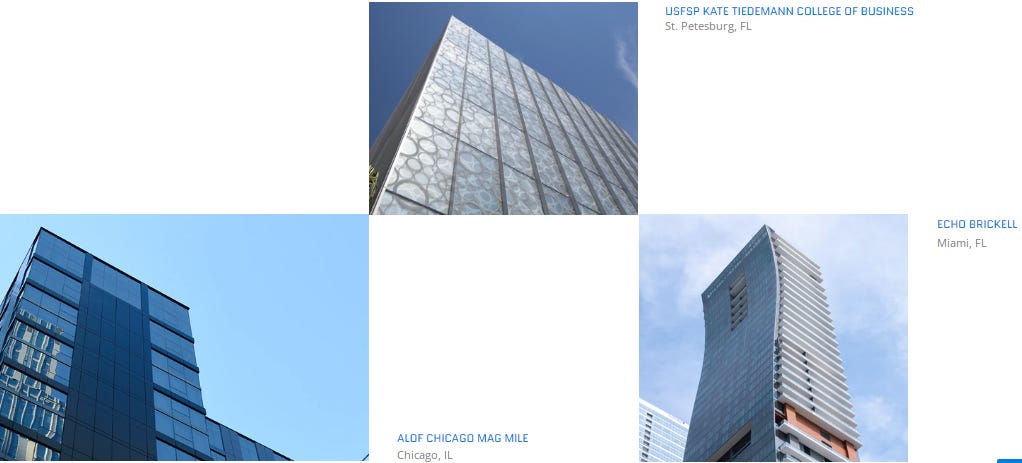

- Tecnoglass’ tailored, high-end products are found on some of the world’s most distinctive properties, including One Thousand Museum (Miami), Paramount (Miami), Salesforce Tower (San Francisco), Via 57 West (NY), Hub50House (Boston), Aeropuerto Internacional El Dorado (Bogotá), One Plaza (Medellín), Pabellon de Cristal (Barranquilla).

- Full Project Gallery

- Tecnoglass Corporate Video (Youtube) 3:00 Minutes

- Tecnoglass: The Future of the Glass-Making Industry (Youtube) 11:09 Minutes

- Is Tecnoglass, Inc. (TGLS), a buy? A candid Interview with President of Alutions, and Legal Representative of Tecnoglass, Rodolfo Espinosa, reveals an answer to this pressing question.

- Tecnoglass Reports Record First Quarter 2023 Results May 2023 / Tecnoglass (TGLS) Investor Presentation May 2023 (PDF File)

- Total Revenues Up 50.6% to $202.6 Million

- Strong Results Driven by Organic Growth in Both Multifamily/Commercial and Single-Family Residential Businesses, Up 59% and 40%, Respectively

- Record Gross Margin of 53.2%, Up 830 Basis Points Year-Over-Year

- Net Income of $48.4 Million, or $1.01 Per Diluted Share

- Adjusted Net Income of $51.5 Million, or $1.08 Per Diluted Share

- Adjusted EBITDA Up 89% Year-Over-Year to $85.8 Million, Representing 42.4% of Total Revenues

- Record Cash Flow From Operations of $43.1 Million and Free Cash Flow of $27.5 Million

- Backlog Growth Accelerates, Expanding 19% Year-Over-Year to $776 Million

- Facility Investments Remain on Track to Increase Operational Capacity to ~$950 Million in Revenues by the end of the Second Quarter of 2023

- Raises Full Year 2023 Growth Outlook for Adjusted EBITDA to a range of $315 Million to $3 35 Million on Total Revenues of $810 Million to $850 Million, Bolstered by Record Invoicing in March and April

- José Manuel Daes, Chief Executive Officer of Tecnoglass, commented: “Our strong momentum continued into 2023 with record first quarter results. We generated year-over-year growth in all of our key operating metrics, resulting in record first quarter revenues, gross profit, Adjusted EBITDA1, operating cash flow and free cash flow. This performance further builds upon our established track record of achieving strong financial performance and returns for shareholders, derived from a multi-year effort to fortify our architectural glass platform through sound investments in strategic automation and capacity enhancements. Our continued expanding backlog resulted in a third straight quarter of approximately 60% year-over-year growth in multifamily/commercial revenues. We were also particularly pleased with the continued rapid growth of our single-family residential products. The shorter cash cycle in our single-family residential business, along with our prudent working capital management, also helped us generate our 13th consecutive quarter of strong cash flow. Achieving these results amid a challenging macro-economic backdrop further validates our growth strategy and our structural competitive advantages. Overall, I am proud of the efforts of all of our team members and as we look to the balance of the year, we believe we have all of the tools in place to execute against our multi-faceted growth strategy to further cement our position as an industry leader in the architectural glass market.”

- Tecnoglass Reports Record First Quarter 2023 Results (Youtube) 9:00 Minutes

- Tecnoglass Announces Long Term Strategic Partnership with Wells Fargo to Offer Enhanced Financing Solutions to Customers and Drive Incremental Sales April 2023

- Santiago Giraldo, Chief Financial Officer, stated, “Tecnoglass is committed to providing its customers with the best possible experience, and this partnership with Wells Fargo is just one way that we are working to do so. We are excited to make Wells Fargo’s attractive financing options accessible to help make high-quality window upgrades a reality for property owners. We are rapidly expanding our product lines, opening show rooms and entering new geographic markets to fuel the expansion of our single-family residential business. This financing program complements those efforts and we look forward to our continued success as a premier U.S. provider of windows and architectural glass.”

- Interview: After Reporting Record 2022 Results Tecnoglass CFO Santiago Giraldo Explains The Company’s Growth (Youtube) 26 Minutes (Note: The link includes a transcript)

- P/E (Google Finance): 12.10 / Forward P/E (Finviz): 10.35 / Forward P/E (Yahoo! Finance): 7.54

- Dividend Yield (Google Finance): 0.77% / Dividend Yield (Finviz): 0.77% / Forward Dividend & Yield (Yahoo! Finance): 0.78%

1 YEAR CHART:

LONG TERM CHART:

ADDITIONAL RESOURCES:

- Website

- Investor Relations

- Tecnoglass Corporate Video (Youtube) 3:00 Minutes

- Tecnoglass: The Future of the Glass-Making Industry (Youtube) 11:09 Minutes

- Tecnoglass Reports Record First Quarter 2023 Results May 2023

- Tecnoglass (TGLS) Investor Presentation May 2023 (PDF File)

- Tecnoglass Reports Record First Quarter 2023 Results (Youtube) 9:00 Minutes

- Tecnoglass Announces Long Term Strategic Partnership with Wells Fargo to Offer Enhanced Financing Solutions to Customers and Drive Incremental Sales April 2023

- Interview: After Reporting Record 2022 Results Tecnoglass CFO Santiago Giraldo Explains The Company’s Growth (Youtube) 26 Minutes (Note: The link includes a transcript)

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Similar Posts:

- Gran Tierra Energy (NYSE: GTE): Still Has Plenty of Exploration Opportunities in Colombia and Ecuador

- GeoPark Ltd (NYSE: GPRK): Positioned for a Latin American Oil Boom

- Global X MSCI Colombia ETF Holdings (September 2023)

- Frontera Energy (TSE: FEC / FRA: 3PY3 / OTCMKTS: FECCF): Hit By Colombia Unrest But Sees Coming Profitability and Operational Improvements

- Disorderly Venezuela Default on an Argentina scale is Almost Inevitable (FT)

- Why Could Moody’s Downgrade Colombia’s Credit Rating? (AméricaEconomía)

- Political Reckonings Loom in Pivotal Elections Across Latin America (WPR)

- Latin America: Where to Find Growth in 2019? (Pictet AM)

- Emerging Markets: Why Politics Matter in 2018 (Hermes)

- Mercado Libre CFO Talks E-commerce Markets, Fintech Services, Crypto, Outlook (Yahoo! Finance)

- Latin America Slow Descent into Interventionism (Daniel Lacalle)

- Mexico and Colombia Join ‘Fragile Five’ Emerging Markets (FT)

- Analysis: Chile’s Sliding Peso Reflects Tough Battle vs Rampaging Dollar (Reuters)

- Colombia’s Economy May Yet Catch Up to the Hype (Bloomberg)

- Exchange Rate Predictability in Emerging Markets (Amundi AM)